Question: spreadsheet template: The Poughkeepsie Development Corporation (PDC) is trying to complete its investment plans for the next five years. Currently PDC has $4.9 million available

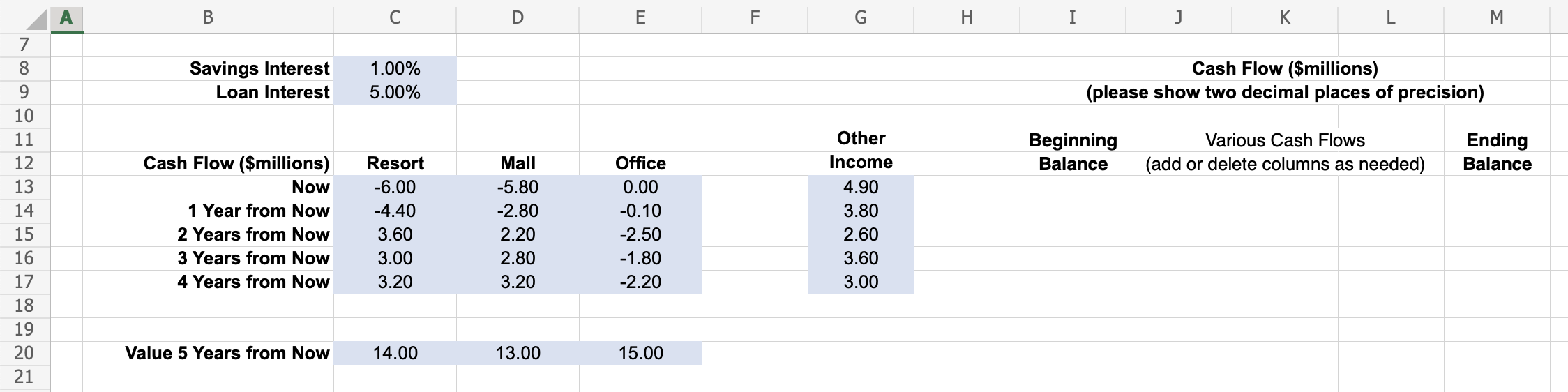

spreadsheet template:

spreadsheet template:

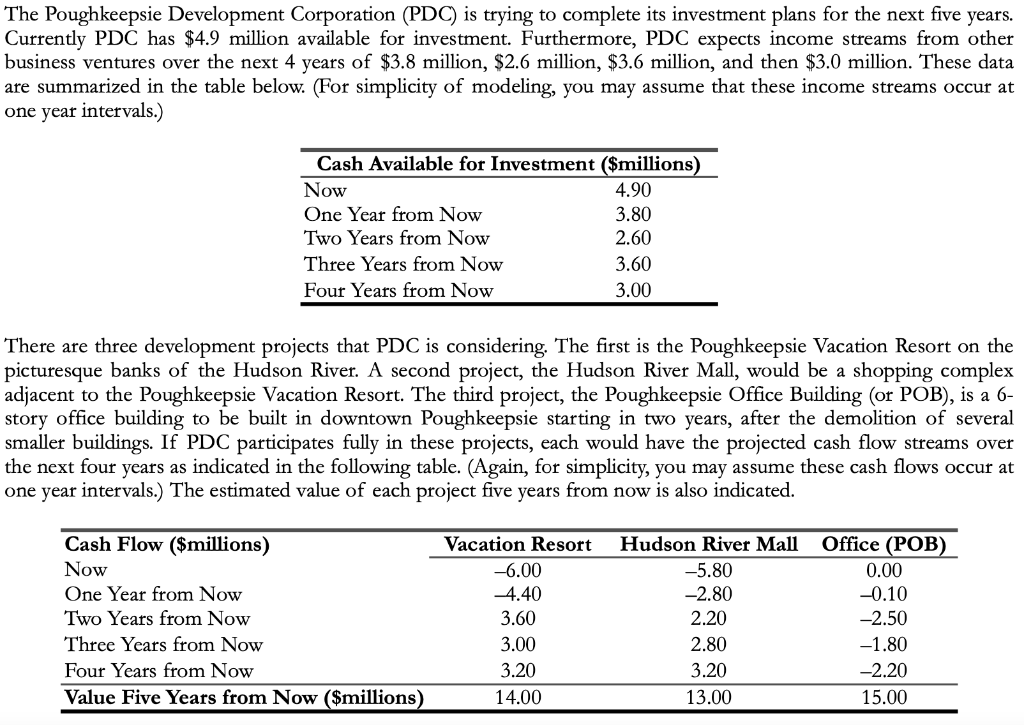

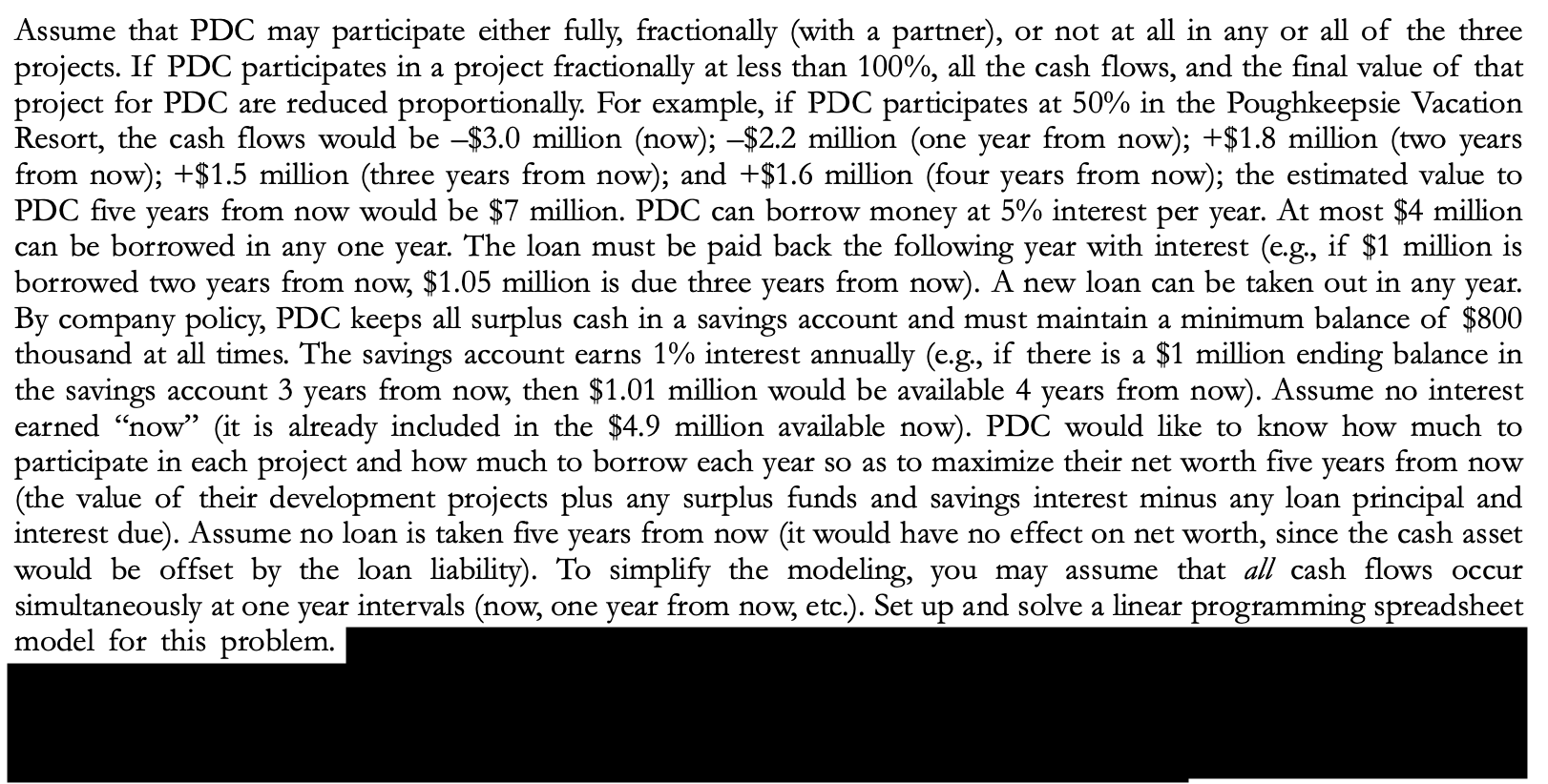

The Poughkeepsie Development Corporation (PDC) is trying to complete its investment plans for the next five years. Currently PDC has $4.9 million available for investment. Furthermore, PDC expects income streams from other business ventures over the next 4 years of $3.8 million, $2.6 million, $3.6 million, and then $3.0 million. These data are summarized in the table below. (For simplicity of modeling, you may assume that these income streams occur at one year intervals.) Cash Available for Investment ($millions) Now 4.90 One Year from Now 3.80 Two Years from Now 2.60 Three Years from Now Four Years from Now 3.60 3.00 There are three development projects that PDC is considering. The first is the Poughkeepsie Vacation Resort on the picturesque banks of the Hudson River. A second project, the Hudson River Mall, would be a shopping complex adjacent to the Poughkeepsie Vacation Resort. The third project, the Poughkeepsie Office Building (or POB), is a 6- story office building to be built in downtown Poughkeepsie starting in two years, after the demolition of several smaller buildings. If PDC participates fully in these projects, each would have the projected cash flow streams over the next four years as indicated in the following table. (Again, for simplicity, you may assume these cash flows occur at one year intervals.) The estimated value of each project five years from now is also indicated. Cash Flow ($millions) Vacation Resort Hudson River Mall Office (POB) Now One Year from Now -6.00 -5.80 0.00 -4.40 -2.80 -0.10 Two Years from Now 3.60 2.20 -2.50 Three Years from Now 3.00 2.80 -1.80 Four Years from Now 3.20 3.20 -2.20 Value Five Years from Now ($millions) 14.00 13.00 15.00

Step by Step Solution

There are 3 Steps involved in it

I have calculated the cash flows for each project under the assu... View full answer

Get step-by-step solutions from verified subject matter experts