Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dn Assume that a parent company acquired a subsidiary on January 1, 2022. The purchase Q1: Equity Method Acquisition and Consolidating Entries with impairment

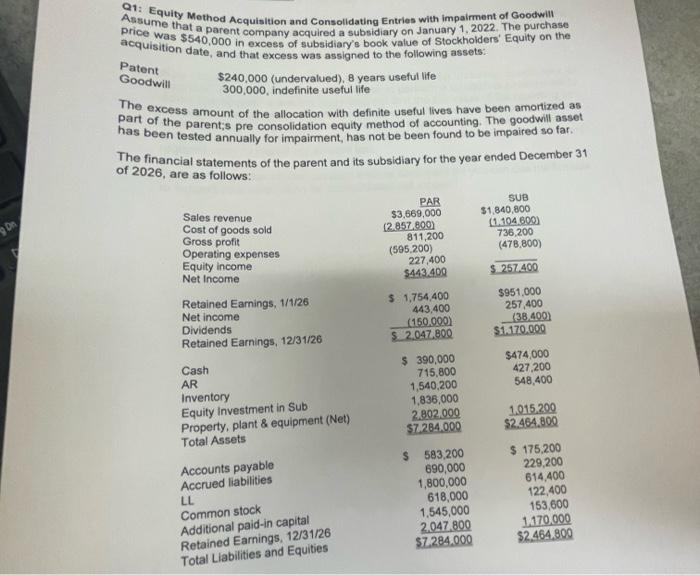

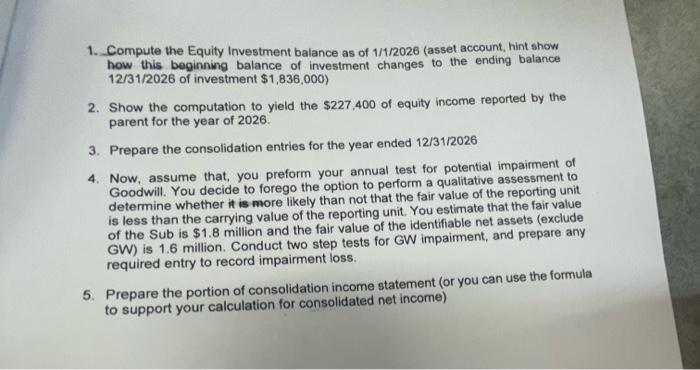

Dn Assume that a parent company acquired a subsidiary on January 1, 2022. The purchase Q1: Equity Method Acquisition and Consolidating Entries with impairment of Goodwill price was $540,000 in excess of subsidiary's book value of Stockholders' Equity on the acquisition date, and that excess was assigned to the following assets: Patent Goodwill $240,000 (undervalued), 8 years useful life 300,000, indefinite useful life The excess amount of the allocation with definite useful lives have been amortized as has been tested annually for impairment, has not be been found to be impaired so far. The financial statements of the parent and its subsidiary for the year ended December 31 of 2026, are as follows: Sales revenue Cost of goods sold Gross profit Operating expenses Equity income Net Income Retained Earnings, 1/1/26 Net income Dividends Retained Earnings, 12/31/26 Cash AR Inventory Equity Investment in Sub Property, plant & equipment (Net) Total Assets Accounts payable Accrued liabilities LL Common stock Additional paid-in capital Retained Earnings, 12/31/26 Total Liabilities and Equities PAR $3,669,000 (2.857.800) 811,200 (595,200) 227,400 $443.400 $ 1,754,400 443,400 (150.000) $ 2.047.800 $ 390,000 715,800 1,540,200 1,836,000 2.802.000 $7.284.000 $ 583,200 690,000 1,800,000 618,000 1,545,000 2,047,800 $7.284.000 SUB $1,840,800 (1.104.600) 736,200 (478,800) $ 257.400 $951,000 257,400 (38.400) $1.170.000 $474,000 427,200 548,400 1.015.200 $2.464.800 $ 175,200 229,200 614,400 122,400 153,600 1.170.000 $2,464.800 1. Compute the Equity Investment balance as of 1/1/2026 (asset account, hint show how this beginning balance of investment changes to the ending balance 12/31/2026 of investment $1,836,000) 2. Show the computation to yield the $227,400 of equity income reported by the parent for the year of 2026. 3. Prepare the consolidation entries for the year ended 12/31/2026 4. Now, assume that, you preform your annual test for potential impairment of Goodwill. You decide to forego the option to perform a qualitative assessment to determine whether it is more likely than not that the fair value of the reporting unit is less than the carrying value of the reporting unit. You estimate that the fair value of the Sub is $1.8 million and the fair value of the identifiable net assets (exclude GW) is 1.6 million. Conduct two step tests for GW impairment, and prepare any required entry to record impairment loss. 5. Prepare the portion of consolidation income statement (or you can use the formula to support your calculation for consolidated net income)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The Equity Investment balance as of 112026 is calculated as follows Equity Investment balance as of 112026 Purchase price of subsidiary Share of subsidiarys net income Dividends received Purchase pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started