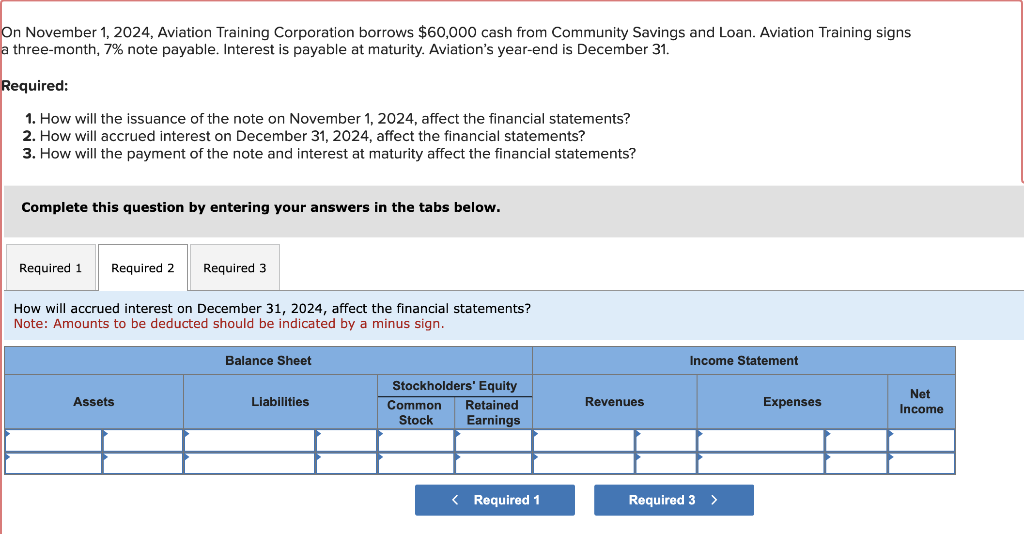

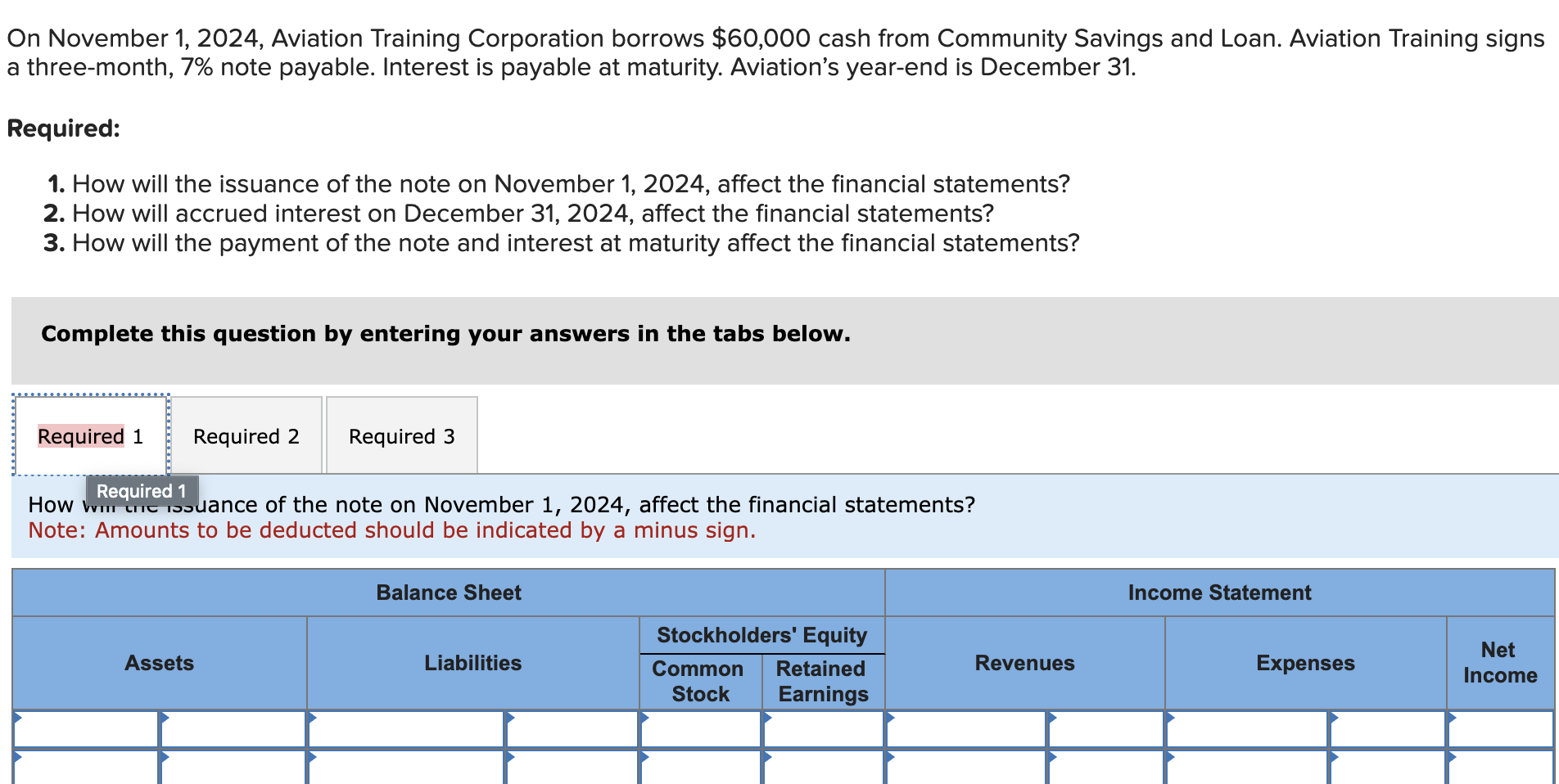

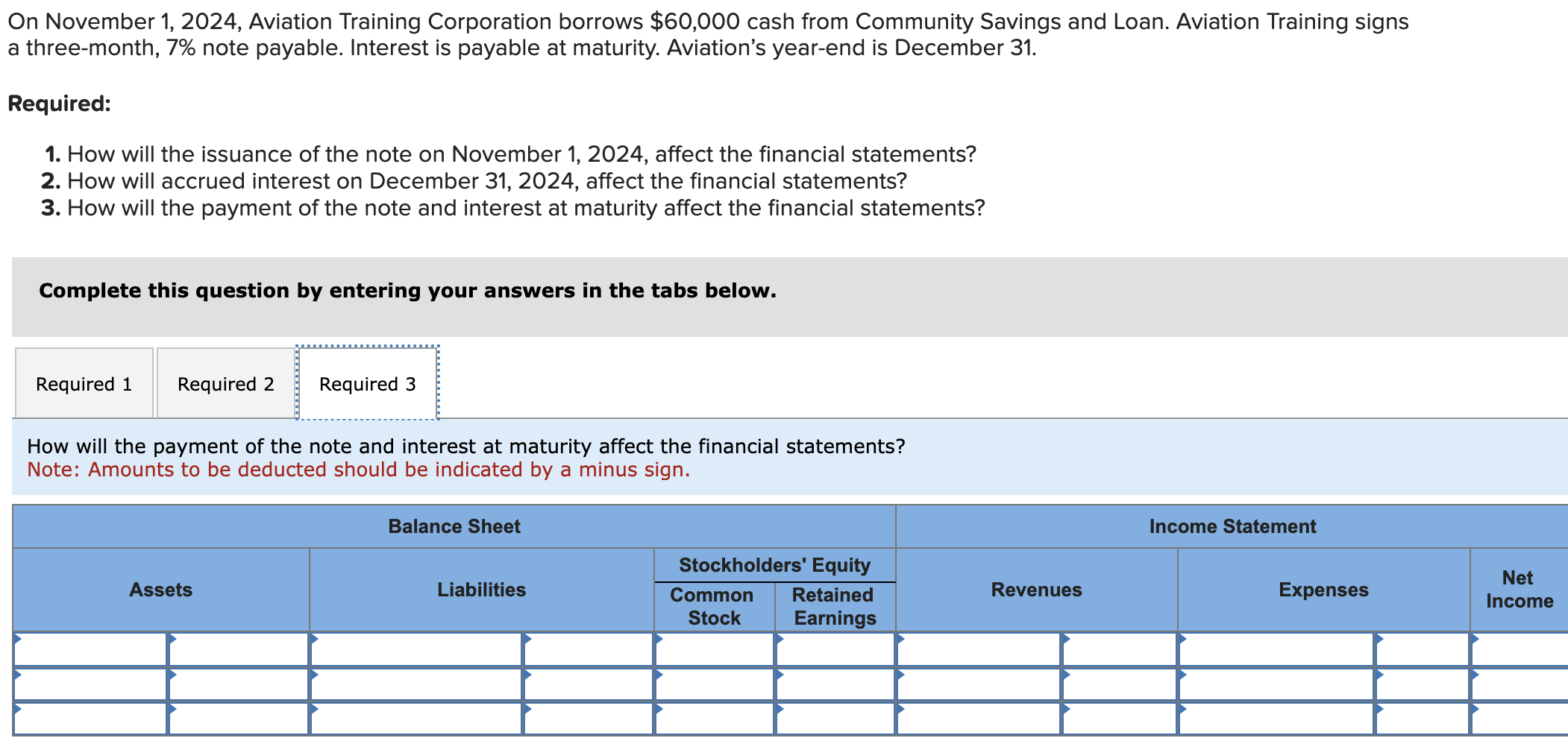

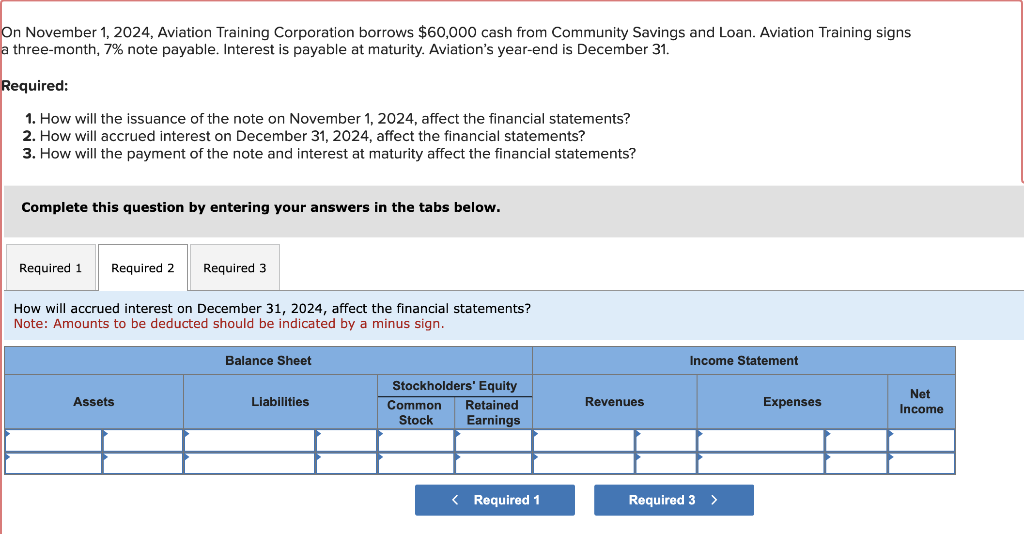

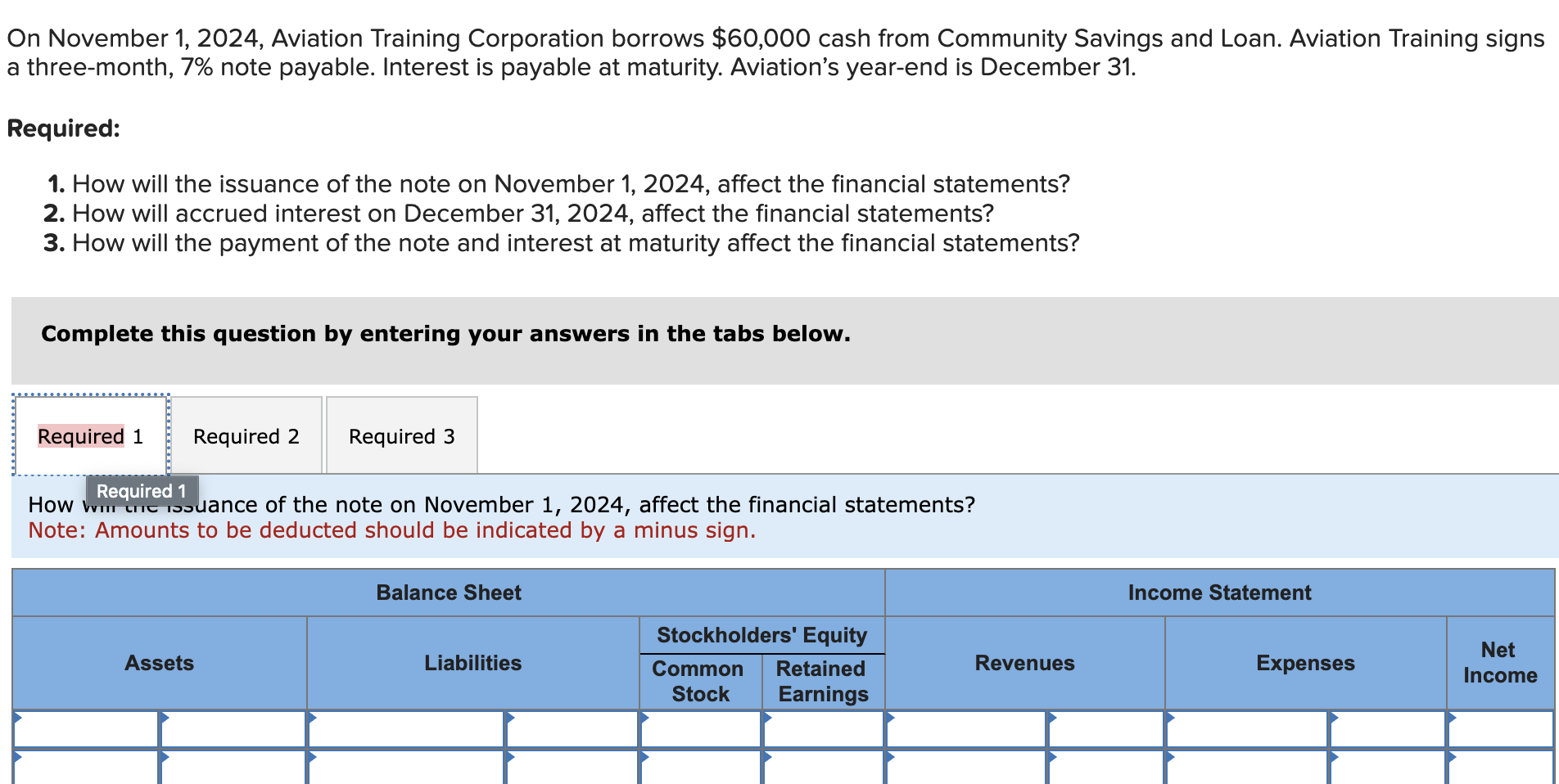

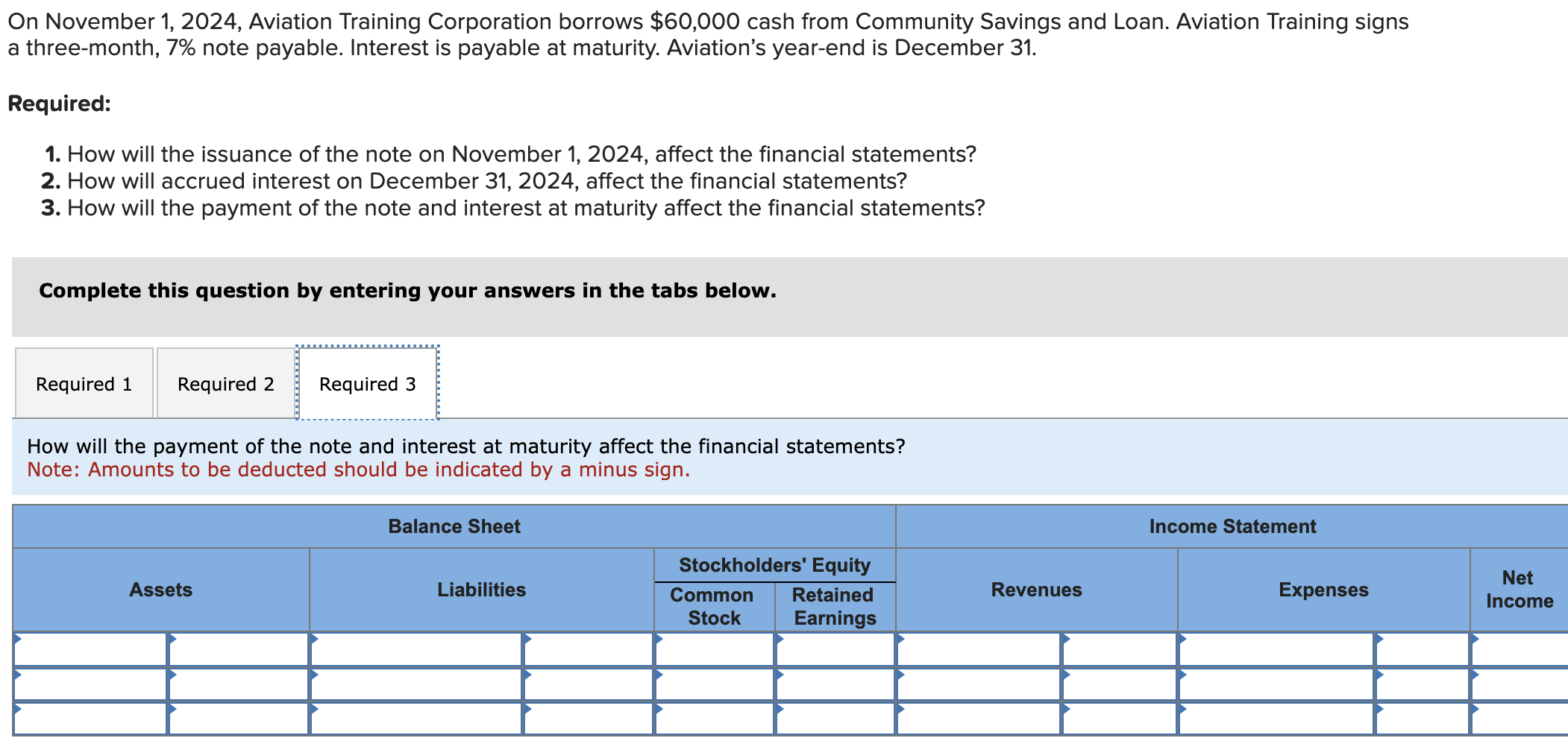

Dn November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31,2024 , affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How will accrued interest on December 31,2024 , affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. On November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31, 2024, affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How Required 1 How hequire isouance of the note on November 1, 2024, affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. On November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31,2024 , affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How will the payment of the note and interest at maturity affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. Dn November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31,2024 , affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How will accrued interest on December 31,2024 , affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. On November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31, 2024, affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How Required 1 How hequire isouance of the note on November 1, 2024, affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. On November 1,2024 , Aviation Training Corporation borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation's year-end is December 31. Required: 1. How will the issuance of the note on November 1,2024 , affect the financial statements? 2. How will accrued interest on December 31,2024 , affect the financial statements? 3. How will the payment of the note and interest at maturity affect the financial statements? Complete this question by entering your answers in the tabs below. How will the payment of the note and interest at maturity affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign