Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do 29 and 30 and i will thumb up QUESTION 29 A borrower takes out a 15 year mortgage loan for $250,000 with an interest

do 29 and 30 and i will thumb up

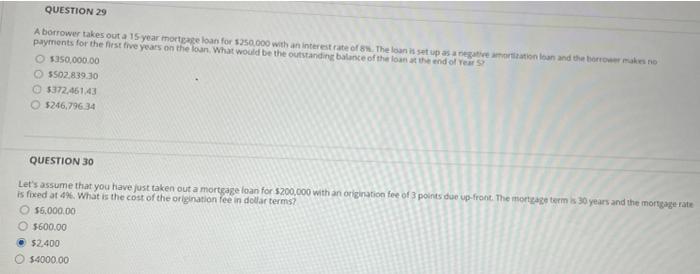

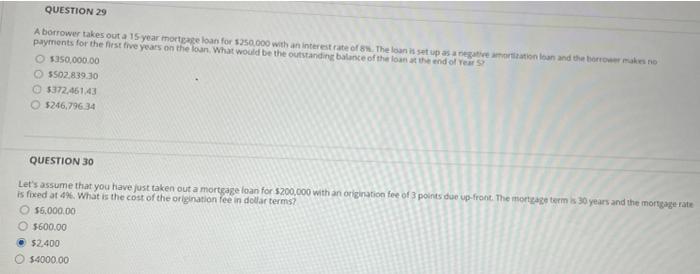

QUESTION 29 A borrower takes out a 15 year mortgage loan for $250,000 with an interest rate of 8. The loan is set up as negative motion loan and the brown payments for the first five years on the loan What would be the outstanding balance of the loan at the end of easy 350,000.00 5502839.30 @ $372.461.43 5246.796.34 QUESTION 30 Let's assume that you have just taken out a mortgage loan for $200.000 with an origination fee of 3 points dae up front. The mortgage terms 30 years and the mortgage rate is fixed at 4%. What is the cost of the origination fee in dollar terms? $6.000.00 5600.00 52,400 54000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started