Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do #31: Budgets for Cash Collections from Sales and Cash Payments for Purchases. HINT: Prepare Part A only. Use the suggested format in the text

Do #31: Budgets for Cash Collections from Sales and Cash Payments for Purchases.

- HINT: Prepare Part A only. Use the suggested format in the text (i.e. Cash Budget sample in Figure 9.11 for "Cash Budget for Jerry's Ice Cream").

i have posted both the questions , please select the values from that

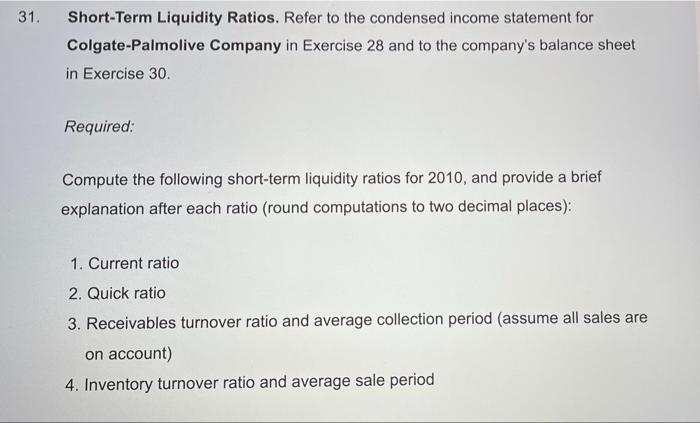

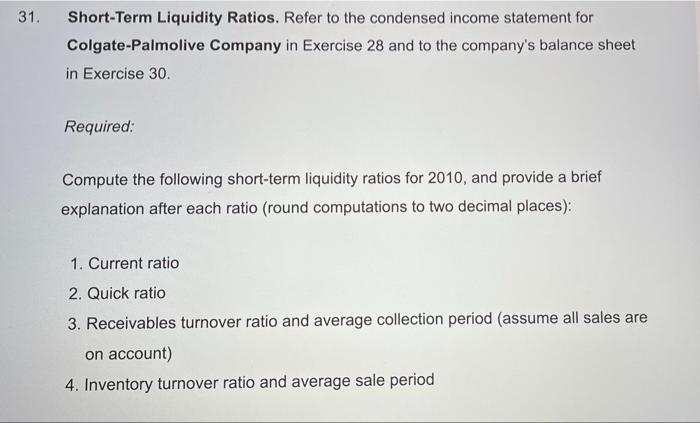

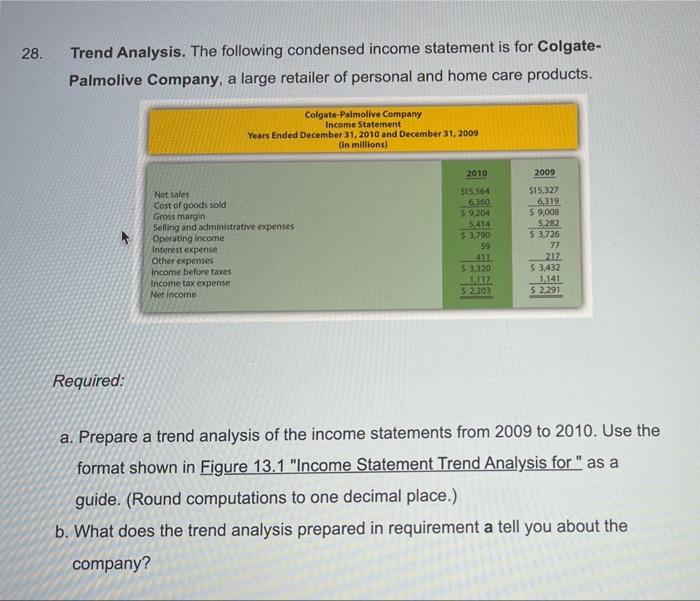

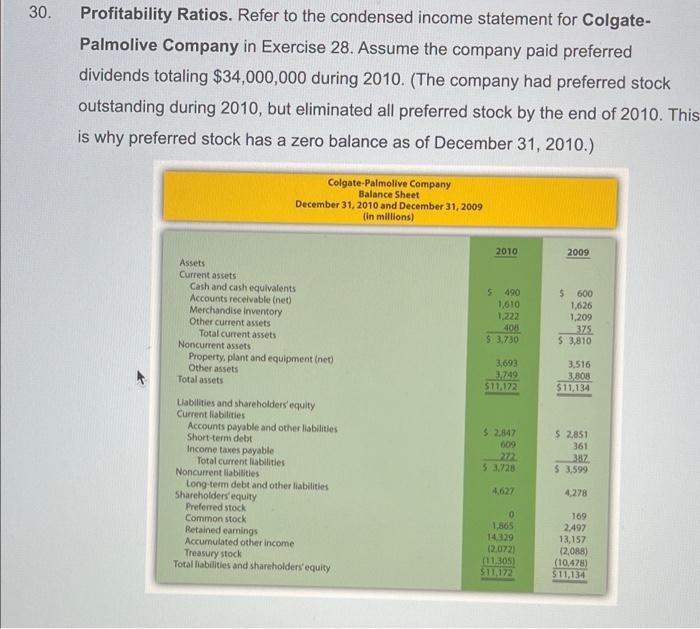

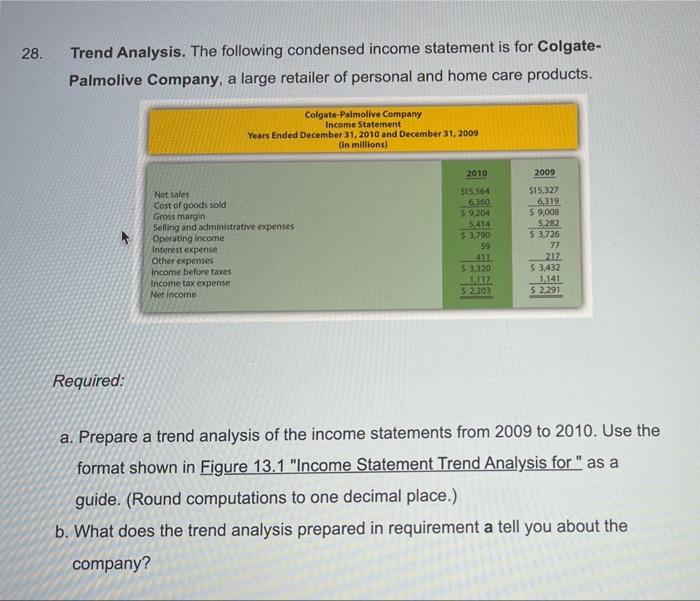

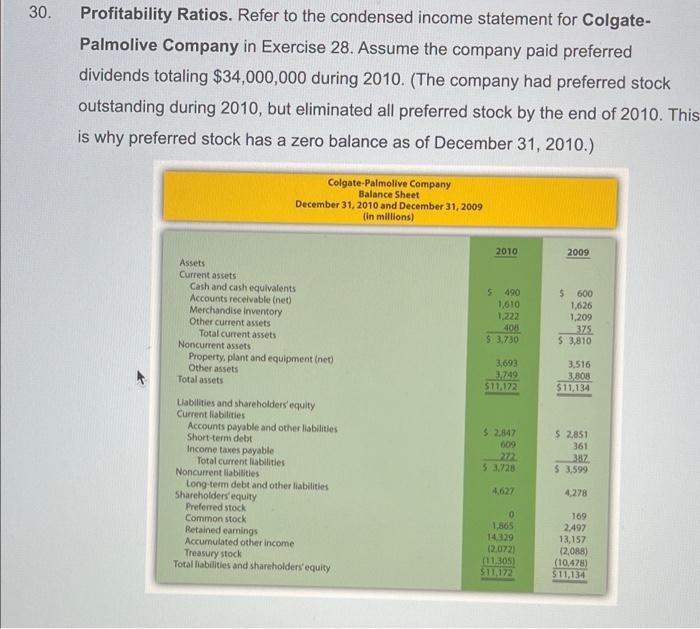

31. Short-Term Liquidity Ratios. Refer to the condensed income statement for Colgate-Palmolive Company in Exercise 28 and to the company's balance sheet in Exercise 30. Required: Compute the following short-term liquidity ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places): 1. Current ratio 2. Quick ratio 3. Receivables turnover ratio and average collection period (assume all sales are on account) 4. Inventory turnover ratio and average sale period 28. Trend Analysis. The following condensed income statement is for Colgate- Palmolive Company, a large retailer of personal and home care products. Colgate-Palmolive Company Income Statement Years Ended December 31, 2010 and December 31, 2009 (in millions) 2010 2009 Net sales Cost of goods sold Gross margin Selling and administrative expenses Operating income Interest expense Other expenses Income before taxes Income tax expense Net income $15.564 6360 $ 9,204 5414 $ 3,790 59 411 $ 3,320 1117 5 2203 $15,327 6,319 59,008 5282 $ 3,726 77 217 $ 3,432 1.141 $ 2.291 Required: a. Prepare a trend analysis of the income statements from 2009 to 2010. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.) b. What does the trend analysis prepared in requirement a tell you about the company? 30. Profitability Ratios. Refer to the condensed income statement for Colgate- Palmolive Company in Exercise 28. Assume the company paid preferred dividends totaling $34,000,000 during 2010. (The company had preferred stock outstanding during 2010, but eliminated all preferred stock by the end of 2010. This is why preferred stock has a zero balance as of December 31, 2010.) Colgate-Palmolive Company Balance Sheet December 31, 2010 and December 31, 2009 (in millions) 2010 2009 Assets Current assets Cash and cash equivalents Accounts receivable (net) Merchandise Inventory Other current assets Total current assets Noncurrent assets Property, plant and equipment (net) Other assets Total assets 5490 1,610 1.222 403 $ 3.730 $ 600 1,626 1,209 375 $ 3,810 3,693 3.749 511.172 3,516 3,808 $11,134 $ 2,847 609 2772 5 1.728 $ 2,851 361 387 5 3.599 Liabilities and shareholders' equity Current liabilities Accounts payable and other liabilities Short-term debt Income taxes payable Total current liabilities Noncurrent liabilities Long-term debt and other liabilities Shareholders' equity Preferred stock Common stock Retained earnings Accumulated other income Treasury stock Total liabilities and shareholders' equity 4.627 4.278 0 1.865 14.329 (2,0721 01.305) $11,172 169 2.497 13,157 (2,088) (10,478) $11,134 thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started