Answered step by step

Verified Expert Solution

Question

1 Approved Answer

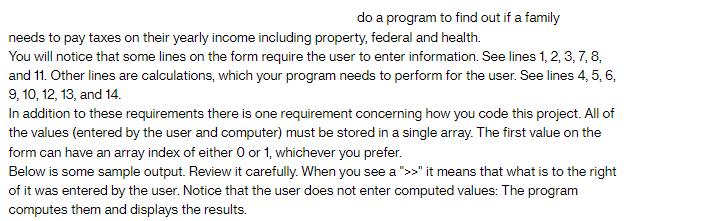

do a program to find out if a family needs to pay taxes on their yearly income including property, federal and health. You will

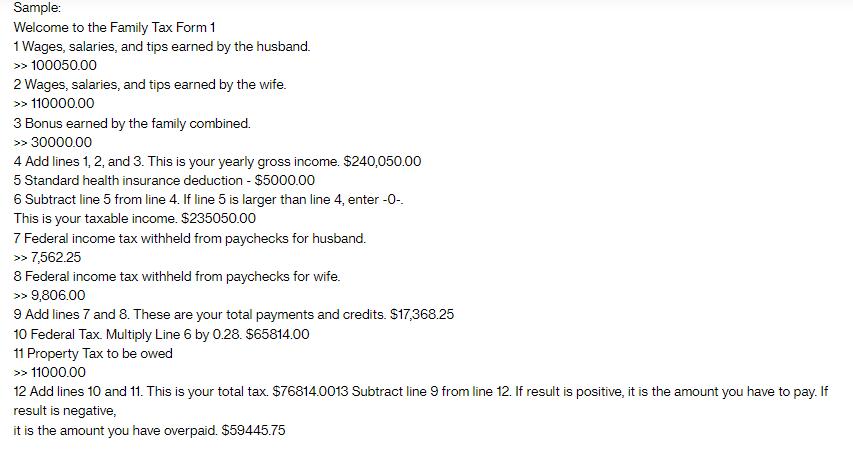

do a program to find out if a family needs to pay taxes on their yearly income including property, federal and health. You will notice that some lines on the form require the user to enter information. See lines 1, 2, 3, 7, 8, and 11. Other lines are calculations, which your program needs to perform for the user. See lines 4, 5, 6, 9, 10, 12, 13, and 14. In addition to these requirements there is one requirement concerning how you code this project. All of the values (entered by the user and computer) must be stored in a single array. The first value on the form can have an array index of either 0 or 1, whichever you prefer. Below is some sample output. Review it carefully. When you see a ">>" it means that what is to the right of it was entered by the user. Notice that the user does not enter computed values: The program computes them and displays the results. Sample: Welcome to the Family Tax Form 1 1 Wages, salaries, and tips earned by the husband. >> 100050.00 2 Wages, salaries, and tips earned by the wife. >> 110000.00 3 Bonus earned by the family combined. >> 30000.00 4 Add lines 1, 2, and 3. This is your yearly gross income. $240,050.00 5 Standard health insurance deduction - $5000.00 6 Subtract line 5 from line 4. If line 5 is larger than line 4, enter -O-. This is your taxable income. $235050.00 7 Federal income tax withheld from paychecks for husband. >> 7,562.25 8 Federal income tax withheld from paychecks for wife. >> 9,806.00 9 Add lines 7 and 8. These are your total payments and credits. $17,368.25 10 Federal Tax. Multiply Line 6 by 0.28. $65814.00 11 Property Tax to be owed >> 11000.00 12 Add lines 10 and 11. This is your total tax. $76814.0013 Subtract line 9 from line 12. If result is positive, it i the amount you have to pay. If result is negative, it is the amount you have overpaid. $59445.75

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Python program that calculates taxes based on the given requirements and stores the values in a sing...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started