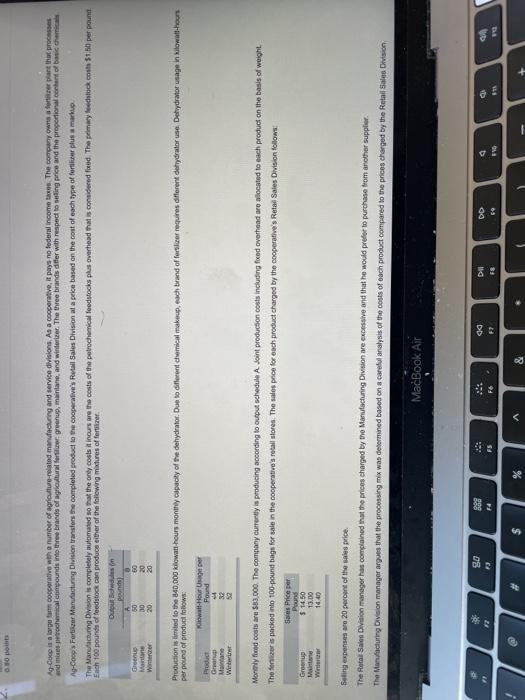

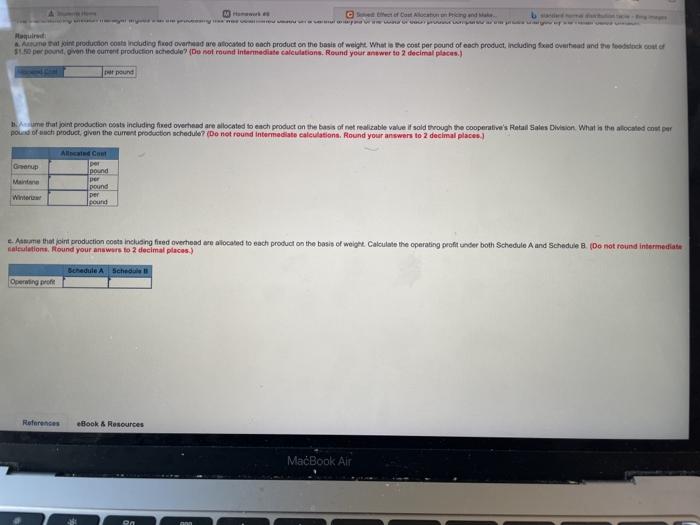

DO Ag Cuco is a large amooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fer plant that processes and petrochemical compounds into the brand of agricultural for greanup, mainan and wintertzer. The three brands differ with respect to sing price and the proportional cochant of basic chemicals Ag-Coco Fortier Manufacturing Division transfers the completed product to the cooperative's Retail Sales Division at a peke based on the cost of each type of forcer plus a markup The Manufacturing Division is completely automated so that the only costs inours are the costs of the petrochemical feedstocks plus overhead that is considered fored. The primary feedstock costa $150 per point Each 100 pounds of feedstock can produce either of the following mixtures of fertizer Greene Maitane Wanderer A 50 30 20. 50 20 20 Production is torted to the 840,000 kilowatt-hours monthly capacity of the dehydrator. Due to different chemical makeup, each brand of forseer requires different dehydrator use Dehydrator usage in kilowatt-hours per pound of product follows: Flow-Hour User Product Gr Mainan Winter Pound 4 32 52 Mormly feed coats are 589.000. The company currently in producing according to output schedule A Joint production costs including fixed overhead are allocated to each product on the basis of weight The foor is packed into 100 pound bags for sale in the cooperatives retail stores. The sales price for each product charged by the cooperative's Retal Sales Division follows: Group Mane Wir Sales Price per Pound $ 14,50 13.00 14.40 Seling expenses are 20 percent of the sales price The Retail Sales Division manager has complained that the prices charged by the Manufacturing Division are excessive and that he would prefer to purchase trom another supplier The Manufacturing Division manager argues that the processing mix was determined based on a careful analysis of the costs of each product compared to the prices charged by the Retail Sales Division MacBook Air 80 F2 12 DD Di F8 - F6 . 50 FYD $ % A & Mw Controle Required una in production costa nouding fired over and are focated to each product on the basis of weight What is the cost per pound of each product, including focadowhead and the cost of 11. perunt, over the current production schedule? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Het pound Asume that point production costs including fed overhead are located to each product on the basis of root realizable value if sold through the cooperative's Retail Sales Division. What is the located coup pound of each product, given the current production schedule? (Do not round Intermediate calculations. Round your answers to 2 decimal places Grup Main por pound per pound per pound Winter Anname that joint production costs including fired overhead are allocated to each product on the basis of weight Calculate the operating profit under both Schedule A and Schedule B. Do not round intermediate alculations. Round your answers to 2 decimal places) Behedule A Schedule Opening References eBook & Resources MacBook Air DO Ag Cuco is a large amooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fer plant that processes and petrochemical compounds into the brand of agricultural for greanup, mainan and wintertzer. The three brands differ with respect to sing price and the proportional cochant of basic chemicals Ag-Coco Fortier Manufacturing Division transfers the completed product to the cooperative's Retail Sales Division at a peke based on the cost of each type of forcer plus a markup The Manufacturing Division is completely automated so that the only costs inours are the costs of the petrochemical feedstocks plus overhead that is considered fored. The primary feedstock costa $150 per point Each 100 pounds of feedstock can produce either of the following mixtures of fertizer Greene Maitane Wanderer A 50 30 20. 50 20 20 Production is torted to the 840,000 kilowatt-hours monthly capacity of the dehydrator. Due to different chemical makeup, each brand of forseer requires different dehydrator use Dehydrator usage in kilowatt-hours per pound of product follows: Flow-Hour User Product Gr Mainan Winter Pound 4 32 52 Mormly feed coats are 589.000. The company currently in producing according to output schedule A Joint production costs including fixed overhead are allocated to each product on the basis of weight The foor is packed into 100 pound bags for sale in the cooperatives retail stores. The sales price for each product charged by the cooperative's Retal Sales Division follows: Group Mane Wir Sales Price per Pound $ 14,50 13.00 14.40 Seling expenses are 20 percent of the sales price The Retail Sales Division manager has complained that the prices charged by the Manufacturing Division are excessive and that he would prefer to purchase trom another supplier The Manufacturing Division manager argues that the processing mix was determined based on a careful analysis of the costs of each product compared to the prices charged by the Retail Sales Division MacBook Air 80 F2 12 DD Di F8 - F6 . 50 FYD $ % A & Mw Controle Required una in production costa nouding fired over and are focated to each product on the basis of weight What is the cost per pound of each product, including focadowhead and the cost of 11. perunt, over the current production schedule? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Het pound Asume that point production costs including fed overhead are located to each product on the basis of root realizable value if sold through the cooperative's Retail Sales Division. What is the located coup pound of each product, given the current production schedule? (Do not round Intermediate calculations. Round your answers to 2 decimal places Grup Main por pound per pound per pound Winter Anname that joint production costs including fired overhead are allocated to each product on the basis of weight Calculate the operating profit under both Schedule A and Schedule B. Do not round intermediate alculations. Round your answers to 2 decimal places) Behedule A Schedule Opening References eBook & Resources MacBook Air