Do all at he same time

Do all at he same time

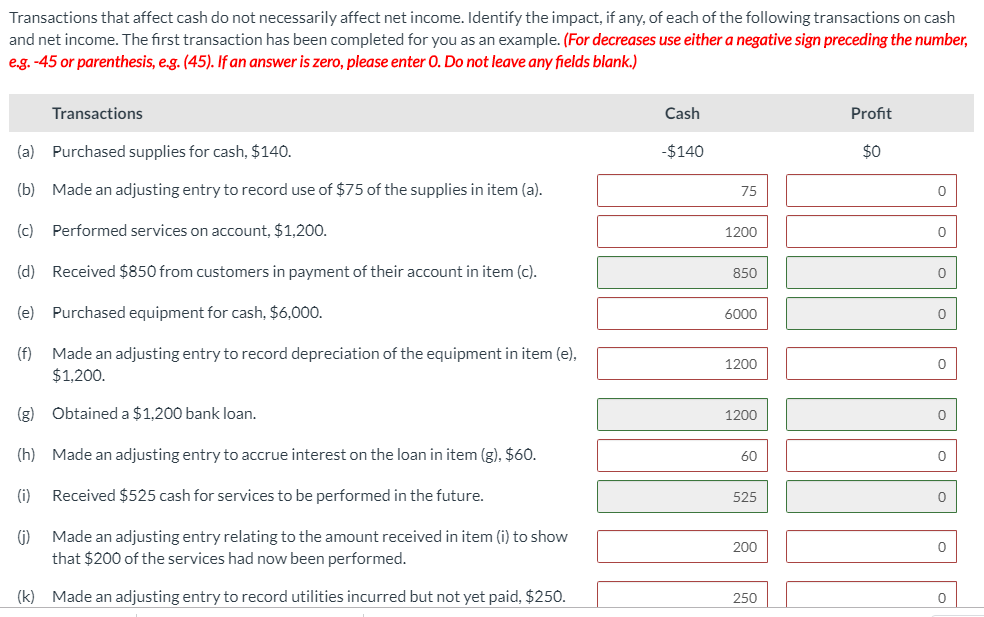

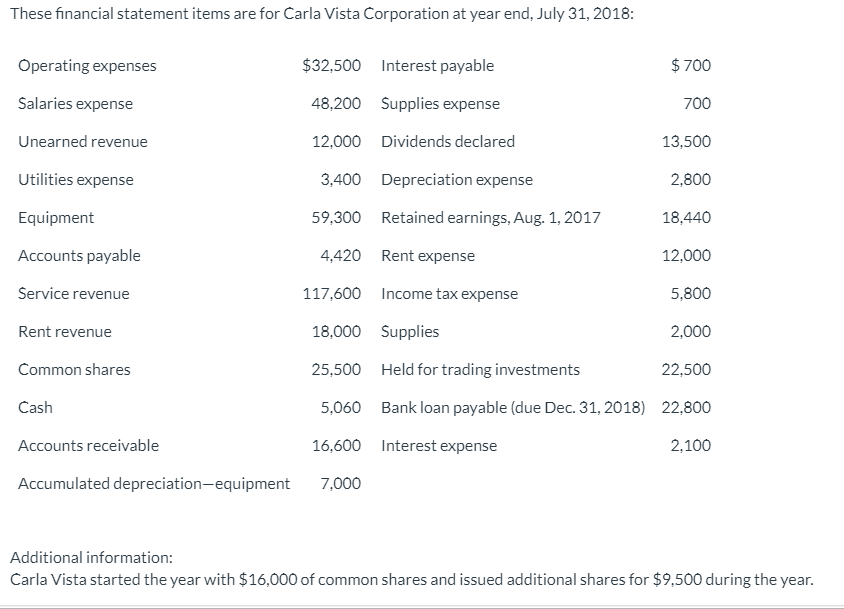

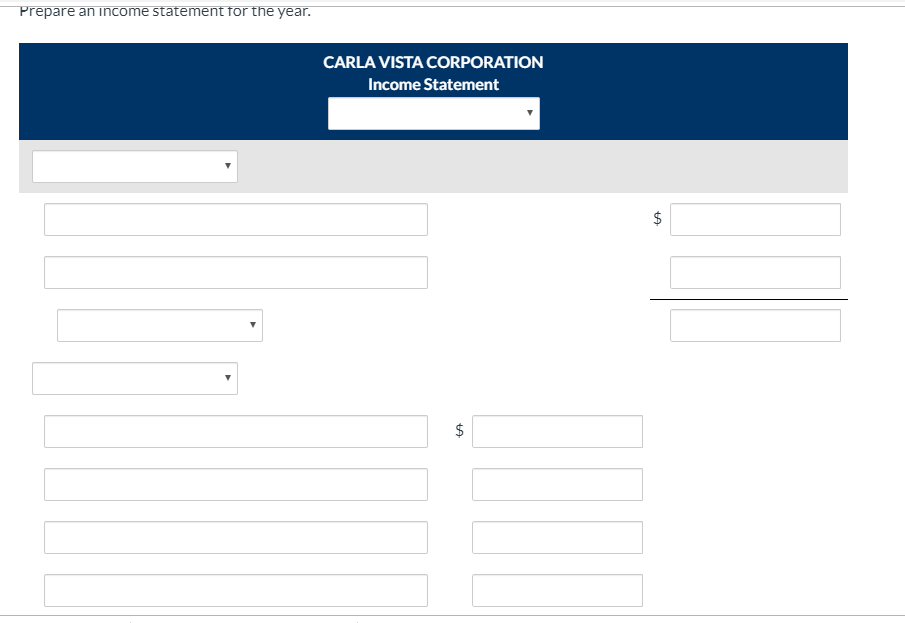

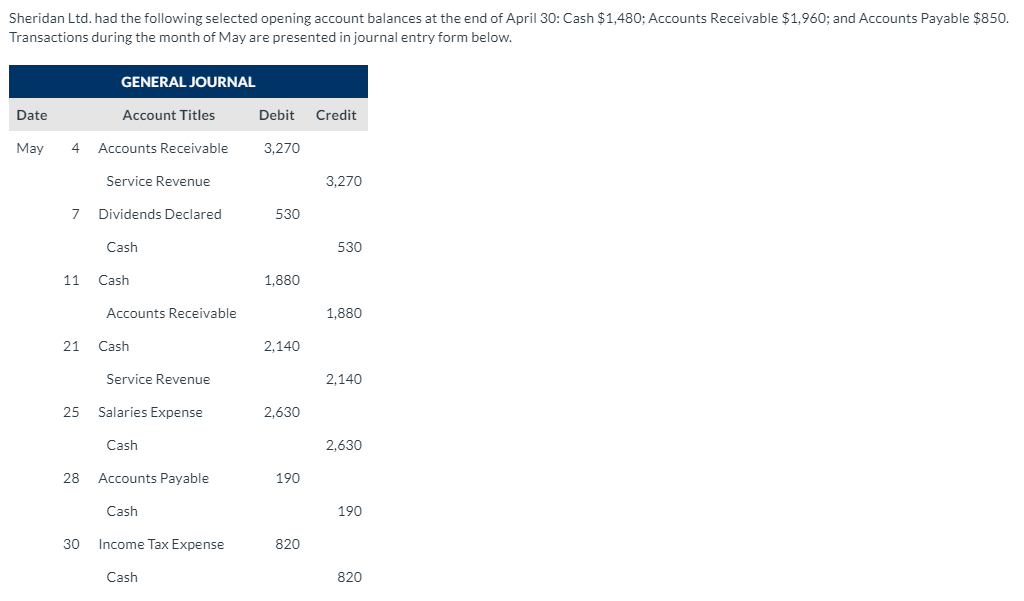

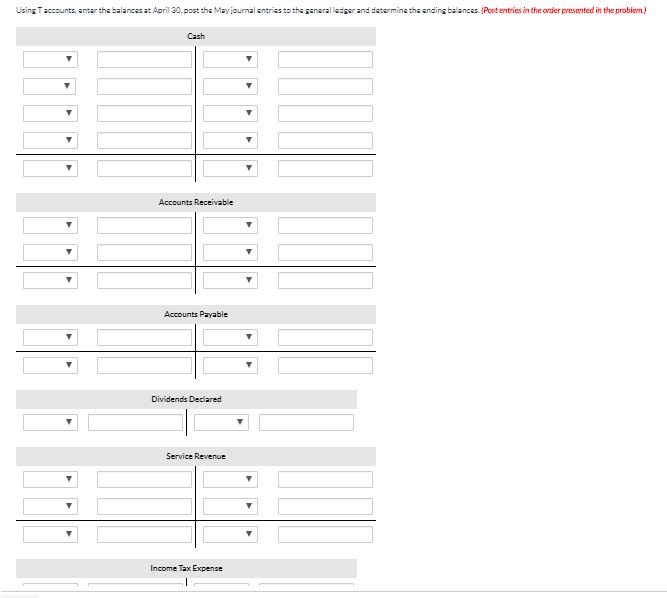

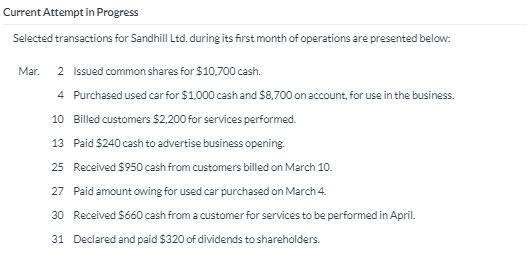

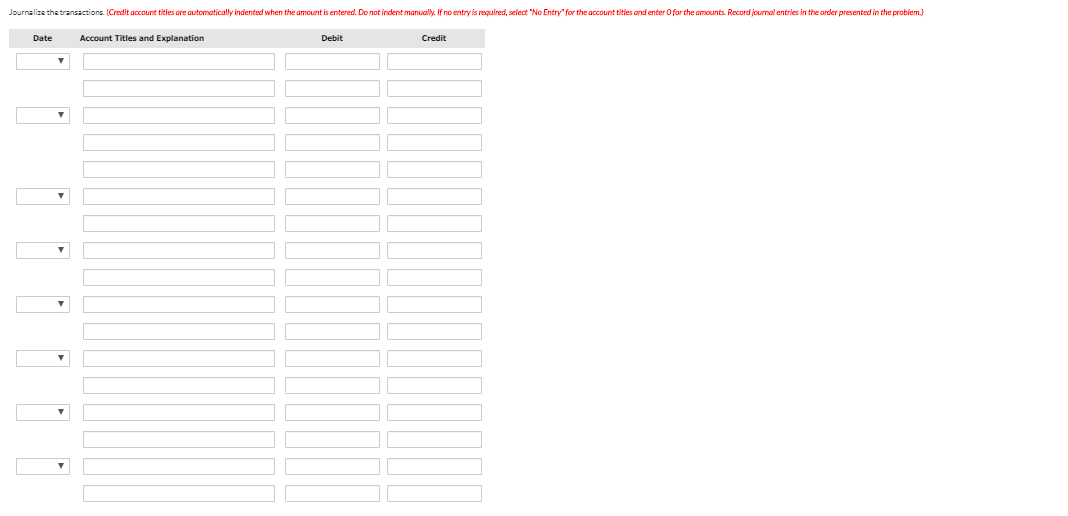

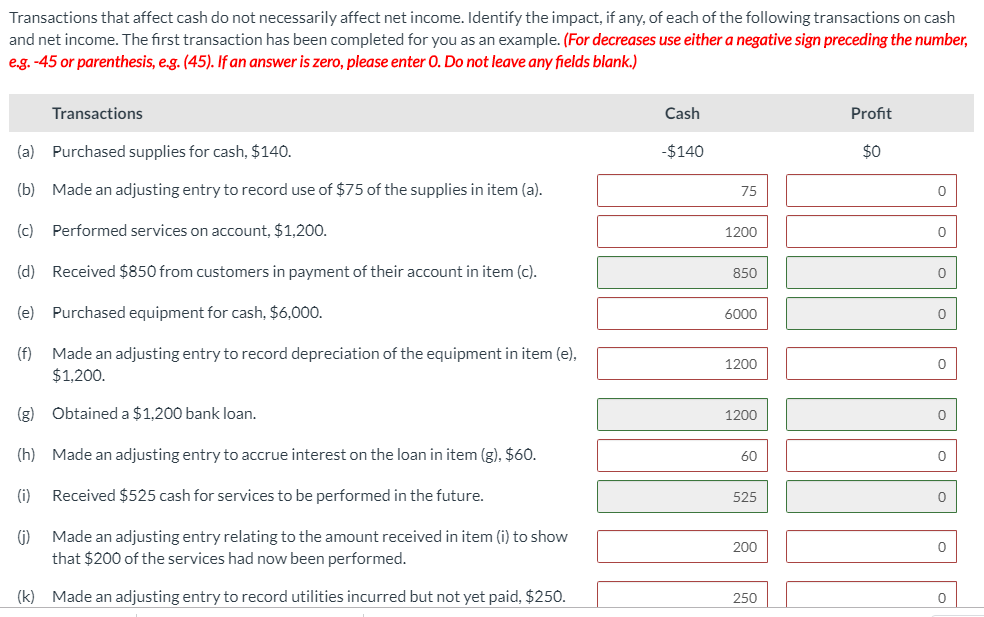

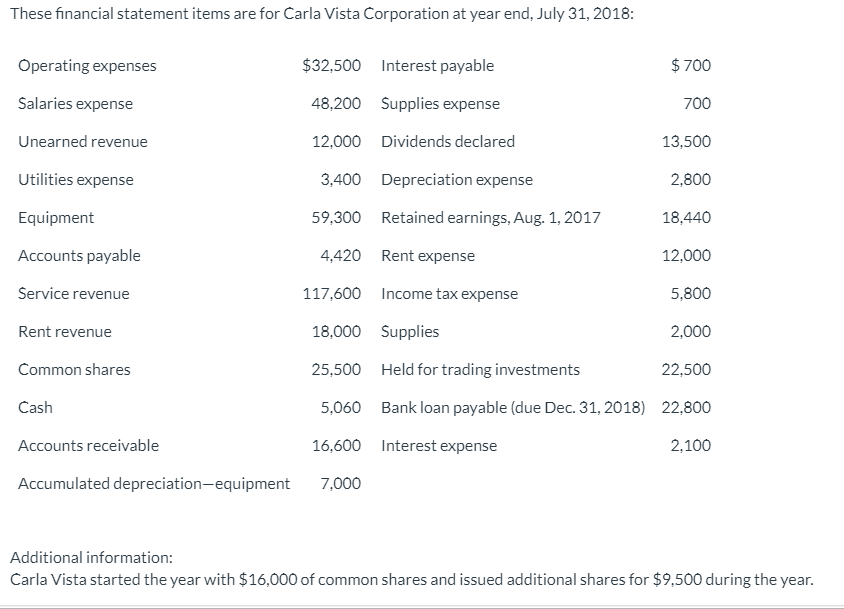

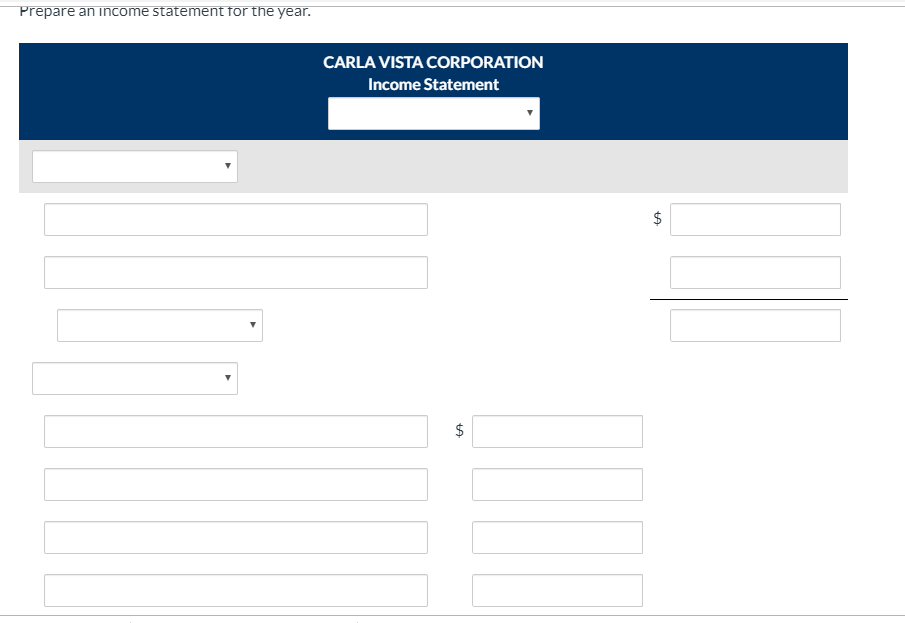

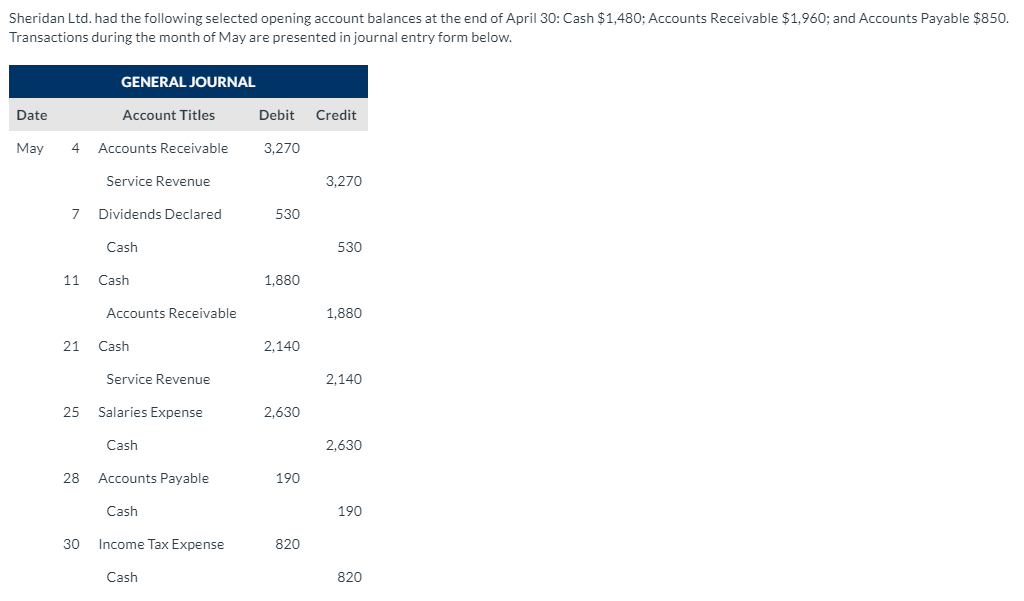

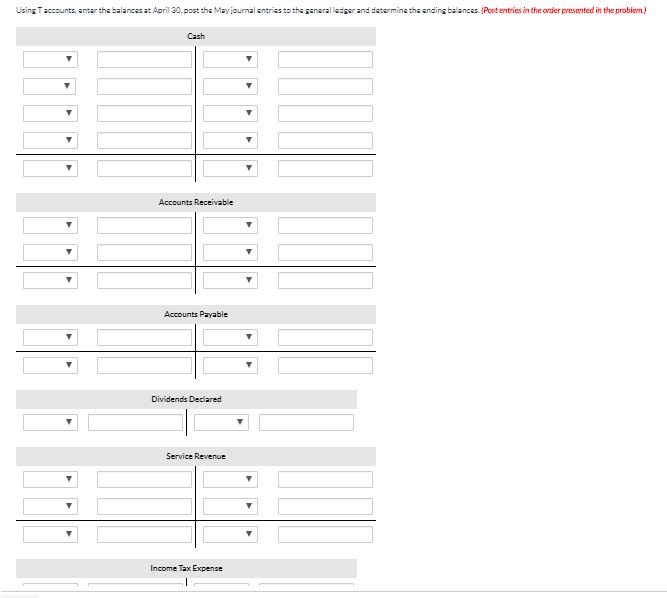

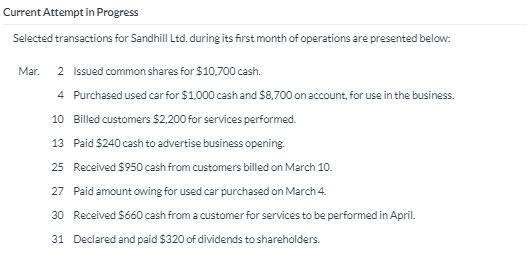

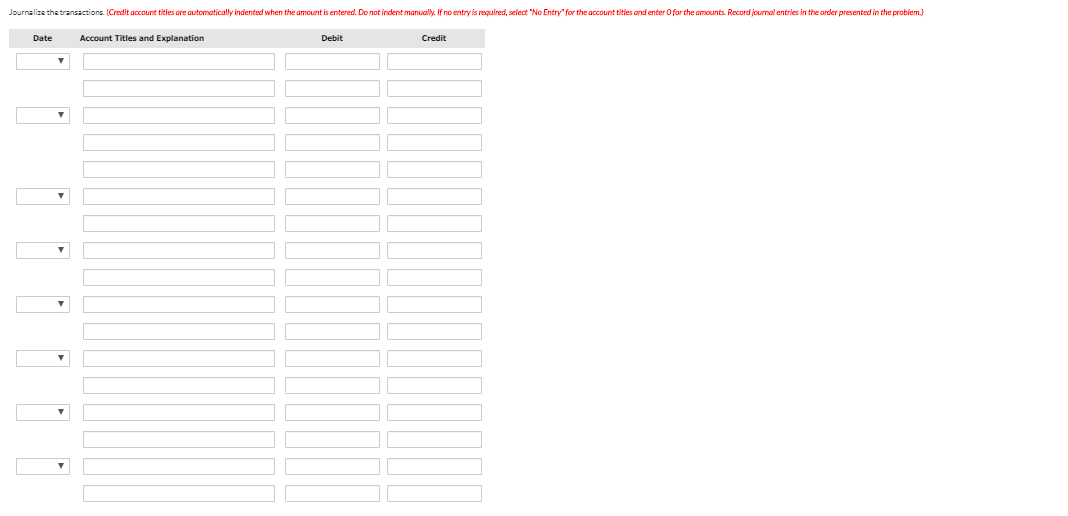

Transactions that affect cash do not necessarily affect net income. Identify the impact, if any, of each of the following transactions on cash and net income. The first transaction has been completed for you as an example. (For decreases use either a negative sign preceding the number, e.g.-45 or parenthesis, e.g. (45). If an answer is zero, please enter 0. Do not leave any fields blank.) Transactions Cash Profit (a) Purchased supplies for cash, $140. -$140 $0 (b) Made an adjusting entry to record use of $75 of the supplies in item (a). (c) Performed services on account, $1,200. 1200 (d) Received $850 from customers in payment of their account in item (c). 850 (e) Purchased equipment for cash, $6,000. 6000 (f) Made an adjusting entry to record depreciation of the equipment in item (e), $1,200. 1200 (g) Obtained a $1.200 bank loan. 1200 (h) Made an adjusting entry to accrue interest on the loan in item (g), $60. 60 (i) Received $525 cash for services to be performed in the future. 525 (0) Made an adjusting entry relating to the amount received in item (i) to show that $200 of the services had now been performed. 200 (k) Made an adjusting entry to record utilities incurred but not yet paid, $250. 250 These financial statement items are for Carla Vista Corporation at year end, July 31, 2018: Operating expenses $32,500 Interest payable $ 700 Salaries expense 48,200 Supplies expense 700 Unearned revenue 12,000 Dividends declared 13,500 Utilities expense 3,400 Depreciation expense 2,800 Equipment 59,300 Retained earnings, Aug. 1, 2017 18,440 Accounts payable 4.420 Rent expense 12,000 Service revenue 117,600 Income tax expense 5,800 Rent revenue 18,000 Supplies 2,000 Common shares 25,500 Held for trading investments 22,500 Cash 5,060 Bank loan payable (due Dec. 31, 2018) 22,800 Interest expense 2,100 Accounts receivable 16,600 Accumulated depreciation-equipment 7,000 Additional information: Carla Vista started the year with $16,000 of common shares and issued additional shares for $9,500 during the year. Prepare an income statement for the year. CARLA VISTA CORPORATION Income Statement Sheridan Ltd. had the following selected opening account balances at the end of April 30: Cash $1,480; Accounts Receivable $1,960; and Accounts Payable $850. Transactions during the month of May are presented in journal entry form below. GENERAL JOURNAL Date Account Titles Debit Credit May 4 Accounts Receivable 3,270 Service Revenue 3,270 7 Dividends Declared 530 Cash 530 11 Cash 1,880 Accounts Receivable 1,880 21 Cash 2,140 Service Revenue 2,140 25 Salaries Expense 2,630 Cash 2,630 28 Accounts Payable 190 Cash 190 30 Income Tax Expense 820 Cash 820 Using accounts, enter the balances at April 30, post the Mayjournal entries to the general ledger and determine the ending balances. (Post entries in the order presented in the problem Accounts Payable Dividends Declared Service Revenue Income Tax Expense Current Attempt in Progress Selected transactions for Sandhill Ltd. during its first month of operations are presented below: Mar. 2 Issued common shares for $10,700 cash. 4 Purchased used car for $1.000 cash and $8,700 on account for use in the business. 10 Billed customers $2,200 for services performed. 13 Paid $240 cash to advertise business opening. 25 Received $950 cash from customers billed on March 10. 27 Paid amount owing for used car purchased on March 4. 30 Received $660 cash from a customer for services to be performed in April. 31 Declared and paid $320 of dividends to shareholders. Journalize the transactions. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit

Do all at he same time

Do all at he same time