Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all of them, otherwise leave it for other tutoor, no need for explanation just give the correct answer 1 1 point There are many

Do all of them, otherwise leave it for other tutoor, no need for explanation just give the correct answer

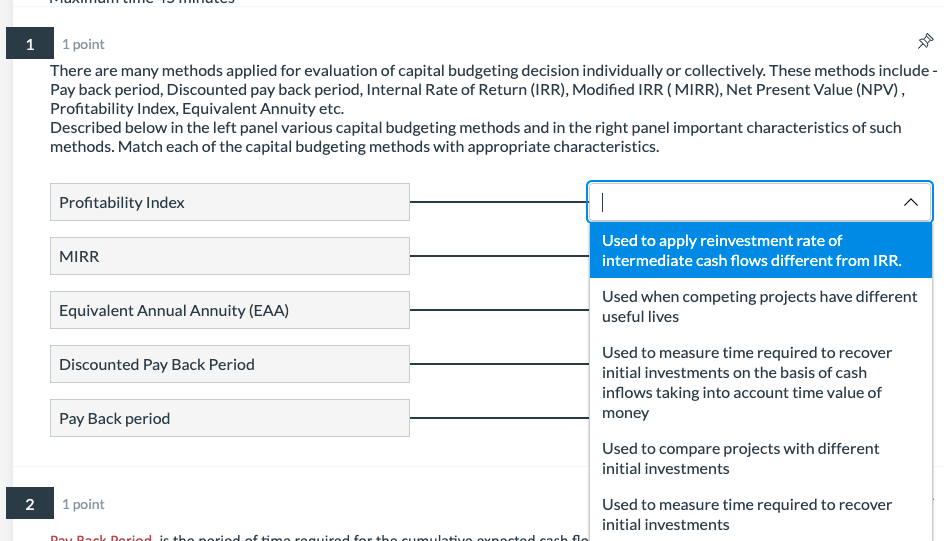

1 1 point There are many methods applied for evaluation of capital budgeting decision individually or collectively. These methods include- Pay back period, Discounted pay back period, Internal Rate of Return (IRR), Modified IRR (MIRR), Net Present Value (NPV), Profitability Index, Equivalent Annuity etc. Described below in the left panel various capital budgeting methods and in the right panel important characteristics of such methods. Match each of the capital budgeting methods with appropriate characteristics. Profitability Index MIRR Equivalent Annual Annuity (EAA) Discounted Pay Back Period Used to apply reinvestment rate of intermediate cash flows different from IRR. Used when competing projects have different useful lives Used to measure time required to recover initial investments on the basis of cash inflows taking into account time value of money Used to compare projects with different initial investments Pay Back period N 1 point Used to measure time required to recover initial investments DVD Dariadithanariad of himorired for the cumulative vertederStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started