Answered step by step

Verified Expert Solution

Question

1 Approved Answer

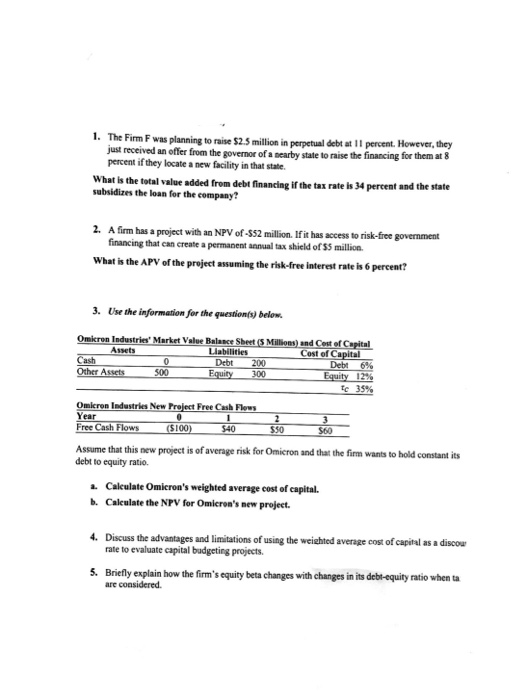

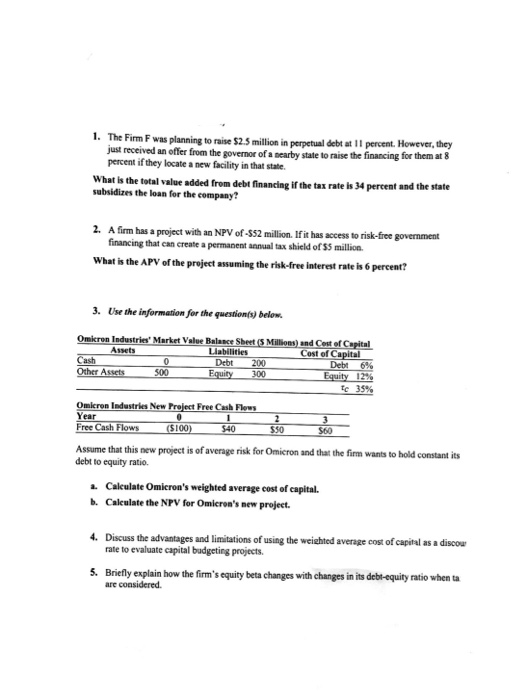

DO ALL PROBLEMS SHOW EACH STEP FOR FULL CREDIT 1. The Firm just received an offer from the governor of a searby state to raise

DO ALL PROBLEMS SHOW EACH STEP FOR FULL CREDIT

1. The Firm just received an offer from the governor of a searby state to raise the percent if they locate F was planning to raise $2.5 million in perpetual debt at 1 percent. However, they financing for them at 8 a new facility in that state What is the total value added from debt financing if the tax rate is 34 percent and the state subsidizes the loan for the company? 2. A fim has a project with an NPV of -S52 million. Ifit has access to risk-free government financing that can create a permanent annual tax shield of S5 million What is the APV of the project assuming the risk-free interest rate is 6 percent? 3. Use the information for the questionts) below. Industries, Market Value Balance Sbeet S Million'Ind car of Capital Liabilities Cost of C ash Debt 200 Debt Omicron lndustries New Year ree Cash Free Cash Flows $50 Assume that this new project is of average risk for Omieron and that the firm wants to hold constant its debt to equity ratio. a Caleulate Omicron's weighted average cost of capital b. Caleulate the NPV for Omicron's mew projeet . Discuss the advantages and limitations of using the weighted average cost of capital as a discou rate to evaluate capital budgeting projects 5. Briefly explain how the firm's equity beta changes with changes in its debi-equity ratio when ta are considered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started