do all questions

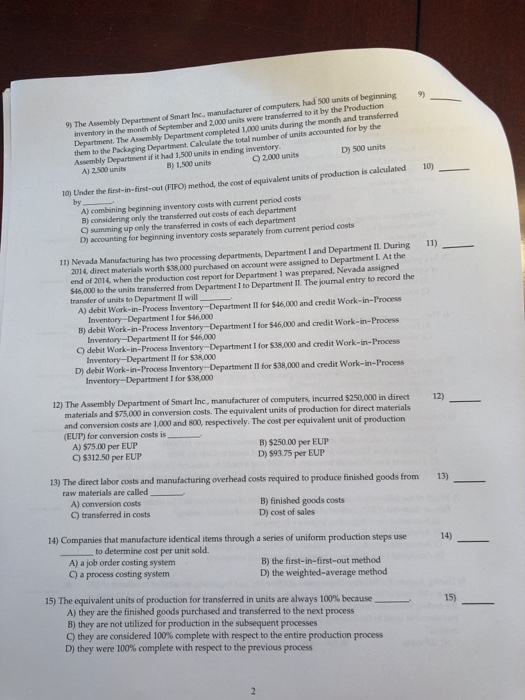

9) inventory in the month of September and 2,000 units were transferred to it by the Production Department The Assembly Department completed 1,00 units during the month and transferred them to the Packaging Department. Calculate the total number of units accounted for by the Assembly Department if it had 1,500 units in ending inventory 9) The Assembly Department of Smart Inc, manufacturer of computers, had 500 units of beginning 9 D) 500 units ) 2000 units A) 2,500 units B) 1,500 units 10) o) Under the first-in-first-out (FIFO) method, the cost of equivalent units of production is calculated by A) combining beginning inventory costs with current period costs B) considering only the transferred out costs of each department ) summing up only the transferred in costs of each department D) accounting for beginning inventory costs separately from current period costs 11) Nevada Manufacturing has two processing departments, Department I and Department II. During 11) 2014 direct materials worth $38,000 purchased on account were assigned to Department L. At the end of 2014, when the production cost repoet for Department 1 was prepared, Nevada assigned $16,000 to the units transferred from Department I to Department II. The journal entry to record the transfer of units to Department II will A) debit Work-in-Process Inventory-Department II for $46,000 and credit Work-in-Process I for $46,000 and credit Work-in-Process C) debit Work-in-Process Inventory-Department I for $38,000 and credit Work-in-Process D) debit Work-in-Process Inventory-Department II for $38,000 and credit Work-in-Process Inventory-Department I for $46,000 Inventory-Department II for $46,000 Inventory-Department II for $38,000 Inventory-Department I for $38,000 B) debit Work-in-Process 12) The Assembly Department of Smart Inc, manufacturer of computers, incurred $250,000 in direct 12) materials and $75,000 in conversion costs production for direct ma The equivalent units of and conversion costs are 1,000 and 800, respectively. The cost per equivalent unit of production (EUP) for conversion costs is A) 575.00 per EUP C $312.50 per EUP B) $250.00 per EUP D) $9375 per EUP 13) The direct labor costs and manufacturing overhead costs required to produce finished goods from 13) raw materials are called A) conversion costs O) transferred in costs B) finished goods costs D) cost of sales 14) Companies that manufacture identical items through a series of uniform production steps use 14) to determine cost per unit sold A) a job order costing system C) a process costing system B) the first-in-first-out method D) the weighted-average method 15) The equivalent units of production for transferred in units are always 100% because- 15) A) they are the finished goods purchased and transferred to the next process B) they are not utilized for production in the subsequent processes C) they are considered 100% complete with respect to the entire production process D) they were 100% complete with respect to the previous process