Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all questions otherwise I'll downvote, do not copy from chegg and do it correctly otherwise I'll downvote and report. ctivities/Procedures 14.39 securities are format

Do all questions otherwise I'll downvote, do not copy from chegg and do it correctly otherwise I'll downvote and report.

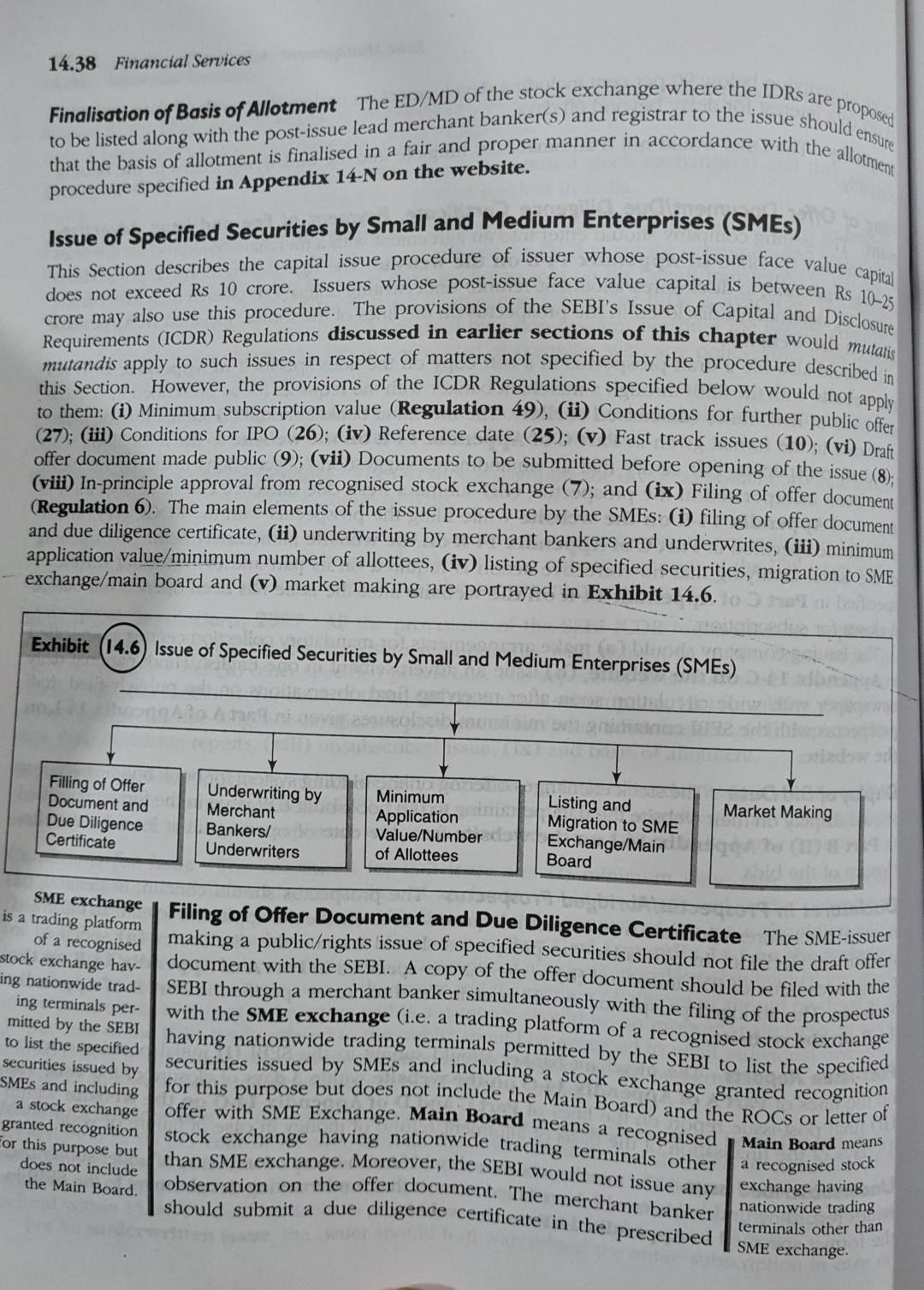

ctivities/Procedures 14.39 securities are format including the specified addition confirmation along with the offer document to the SEBI in Form H of Appendix 14-E on the website. The offer document should be displayed from the date of filing on the website of the SEBI/issuer/merchant banker/the SME exchange where the proposed to be listed. Underwriting by Merchant Bankers/Underwriters The entire issue (and not restricted to the minimum subscription level) should be underwritten. At least 15 per cent of the issue size should be underwritten by the merchant banker(s) on his/their own account(s). The issuer in consultation with the merchant banker may appoint SEBI-registered underwriters. The merchant banker may enter into an agreement with a nominated investor indicating the number of securities which they agree to subscribe at issue price in case of undersubscription. A nominated investor means a QIB/private equity fund (i.e. a fund registered with any regulatory authority or a fund established by any person registered with any regulatory authority) who enters into an agreement with the merchant banker to robcribe to the issue in case of undersubscription or to receive/deliver the securities in the market making process. The merchant banker would fulfil the underwriting obligation in case of failure of other underwritersominated investors to fulfil their underwriting/subscription obligations. The underwritersominated investors cannot subscribe to the issue in any manner other than fulfilling their obligations under their respective agreements in this regard. All the underwriting/subscription arrangements should be disclosed in the offer document. An undertaking to the effect that the issue has been 100 per cent underwritten along with the list of underwritersominated investors should be filed by the merchant banker with the SEBI one day before the opening of the issue. Minimum Application Value/Number of Allottees The minimum size would be Rs. 1 lakh per application and should be disclosed in the offer document. The minimum number of prospec- tive allottees is 50. shareholders Listing and Migration to SME Exchange/Main Board The specified securities would be listed on SME exchange. Securities of the issuer listed on any other stock exchange would have to migrate on the SME exchange. A listed issuer whose post-issue face value capital is less than Rs. 25 crore may migrate its securities to the SME exchange if its non-promoter shareholders approve it by a special resolution with a two-thirds majority. Similarly, such an issuer may migrate its securities from an SME exchange to the main board. Where the post-issue face value capital of an issuer listed on SME exchange is likely to exceed Rs 25 crore by virtue of further issues of capital by way of rights/ Preferential/bonus issue(s), the issuer should migrate such listed securities to, and seek their listing on, the Main Board. He would be able to make further issues of capital only if (1) the non-promoter approve by a two-thirds majority in a special resolution through postal ballot and (ii) theprinciple approval from the Main Board is obtained for listing of the entire securities. Market Making The merchant banker should ensure compulsory market making through the SME exchange brokers in the manner specified by the SEBI for at least three years from the date of also enter into an agreement with nominated investors for receiving delivering the securities in 1) listing of the securities on the SME exchange or (ii) migration from the main board. He should the market making subject to the SME exchange's prior approval. The details of the market mak- ing arrangement should be disclosed in the offer document. Such securities may be transferred to, date of allotment should be 5 per cent of the securities proposed to be listed. The market maker Of from the concerned nominated investor. The minimum inventory of the market maker on the should buy the entire holding in one lot of a shareholder whose holding is less than the minimum contract size for trading but he cannot sell in lots less than the minimum contract size. Moreover, 14.38 Financial Services Finalisation of Basis of Allotment The ED/MD of the stock exchange where the IDRs are proposed to be listed along with the post-issue lead merchant banker(s) and registrar to the issue should ensure that the basis of allotment is finalised in a fair and proper manner in accordance with the allotment procedure specified in Appendix 14-N on the website. capital Issue of Specified Securities by Small and Medium Enterprises (SMEs) This Section describes the capital issue procedure of issuer whose post-issue face value Issuers whose post-issue face value capital is between Rs 10-25 does not exceed Rs 10 crore. Requirements (ICDR) Regulations discussed in earlier sections of this chapter would mutatis crore may also use this procedure. The provisions of the SEBI's Issue of Capital and Disclosure mutandis apply to such issues in respect of matters not specified by the procedure described in this section. However , the provisions of the ICDR Regulations specified below would not apply to them: (1) Minimum subscription value (Regulation 49), (ii) Conditions for further public offer (27); (iii) Conditions for IPO (26); (iv) Reference date (25); (v) Fast track issues (10); (vi) Draft offer document made public (9); (vii) Documents to be submitted before opening of the issue (8); (viii) In-principle approval from recognised stock exchange (7); and (ix) Filing of offer document (Regulation 6). The main elements of the issue procedure by the SMEs: (i) filing of offer document and due diligence certificate, () underwriting by merchant bankers and underwrites, (iii) minimum application value/minimum number of allottees, (iv) listing of specified securities, migration to SME exchange/main board and (v) market making are portrayed in Exhibit 14.6. Exhibit (14.6) Issue of Specified Securities by Small and Medium Enterprises (SMEs) Filling of Offer Document and Due Diligence Certificate Underwriting by Merchant Bankers/ Underwriters Market Making Minimum Application Value/Number : of Allottees Listing and Migration to SME Exchange/Main Board SME exchange Filing of Offer Document and Due Diligence Certificate The SME-issuer is a trading platform of a recognised making a public/rights issue of specified securities should not file the draft offer stock exchange hav- document with the SEBI. A copy of the offer document should be filed with the ing nationwide trad- SEBI through a merchant banker simultaneously with the filing of the prospectus ing terminals per- with the SME exchange (i.e. a trading platform of a recognised stock exchange mitted by the SEBI securities issued by SMEs and including a stock exchange granted recognition securities issued by SMEs and including for this purpose but does not include the Main Board) and the ROCs or letter of a stock exchange offer with SME Exchange. Main Board means a recognised, Main Board means granted recognition stock exchange having nationwide trading terminals other For this purpose but than SME exchange. Moreover, the SEBI would not issue any does not include observation on the offer document. The merchant banker the Main Board should submit a due diligence certificate in the prescribed SME exchange to list the specified having nationwide trading terminals permitted by the SEBI to list the specified a recognised stock exchange having nationwide trading terminals other than cedures 14.37 company 14-A on the website. under-subscription below 90 per cent including devolvement on underwriters with 60 days and with Fungibility The DIRs would not b automatically fungible into the underlying shares of the issuing 15 per cent interest for delay beyond 60 days. ment The issuing company should enter into an agreement with a merchant banker(s) on the lines Filing of Offer Document/Due Diligence Certificate, Payment of Fee and Issue Advertise- of the format specified in Appendix 14-B on the website. The rights/obligations/responsibilities relating, inter-alia, to disclosures/allotment/refund/ underwriting obligations of each merchant banker should be detemriend/disclosed in the prospectus on the lines of the format specified in Appendix It should also file a draft prospectus in a soft copy on the lines specified in Appendix 14-D on the website with the SEBI through a merchant banker with the requisite fee as prescribed in Compa- mies Issue of IDRs Rules (discussed earlier). The merchant banker should (1) submit due diligence certificate in the format given in Part C of Appendix 14-R on the website to the SEBI along with the draft prospectus, (ii) certify that all amendments/suggestions/observations made by the SEBI have been incorporated in the prospectus, (iii) submit a fresh due diligence certificate specified in Part of Appendix 14-R on the website while filing the prospectus with the ROCs, (iv) furnish a certificate specified in Part C of Appendix 14-R on the website immediately before the opening of the issue, certifying that no corrective action is required on its part and (v) furnish a certificate specified in Part C of Appendix 14-R on the website after the issue has been opened but before i doses for subscription. The issuing company should (a) make arrangements for mandatory collection centres as specified in Appendix 14-C on the website, (b) issue an advertisement in one English/Hindi national daily newspaper with wide circulation soon after receiving final observations on the publicly-filed draft prospectus with the SEBI containing the minimum disclosures given in Part A of Appendix 14-L on the website. Display of Bid Data The stock exchanges offering online bidding system for book building process should display on their website the data pertaining to the book-built IDR issue in the format specified in Part B (I) of Appendix 14-J on the website from the date of opening till at least 3 days after dosure of the bids. Disclosures in Prospectus/Abridged Prospectus The prospectus should contain, in general, all material disclosures which are true/correct/adequate so as to enable the applicants to take an informed investment decision. In particular, the prospectus should contain the disclosures (a) specified in Companies Issue of IDR Rules and (b) in the manner specified in Part A of Appendix 14-R on the website. The abridged prospectus should contain the disclosures specified in Part B of Appendix 3 14-R on the website. Post-issue Reports The merchant banker should submit to the SEBI (i) initial post-issue report on the lines of Part A of Appendix 14-0 on the website within 3 days of closure of the issue and (ii) final post-issue report on the lines of Part C and D of Appendix 14-0 on the website within 15 days of the finalisation of the basis of allotment/refund of money in case of failure of issue. issues regarding underwriters who have failed to meet their underwriting devolvement to the SEBI in the format specified in Appendix 14-P on the website. Undersubscribed Issue The merchant banker should furnish information in case of under-subscribed respect to the IDRs. Any statement by an expert can be circulated/issued/distributed in India/abroad only if his consent to the issue appears on the prospectus. Listing of IDRs The IDRs should be listed on a recognised stock exchange(s) and they can be purchased/possessed/freely transferred by a person resident in India. Procedure for Transfer and Redemption A holder may transfer or may ask the DD to redeem the IRDs. In case of redemption, the DD would request the OCB to get the corresponding underlying shares released in favour of the holder of IDRs for being sold on his behalf/transferred in the book of the issuer in the name of holder of IDRs. Nomination facility for IRDs is available. The issued IDRs may be purchased/possessed and transferred by a non-resident person if the issuing company obtains specific approval from the RBI in this regard or complies with any policy/guidelines issued by the RBI on the subject matter. Continuous Disclosure Requirement Every issuing company should comply with such continuous disclosure requirements as may be specified by the SEBI in this behalf. Distribution of Corporate Benefits The DD should distribute the dividends/other corporate action on the IDRs in proportion to the holdings of IDRS." Penalty Contravention of these rules by the company/any person for which no punishment is vided in the Companies Act would be punishable with fine upto the amount of the IDR issue and a pro- further fine upto Rs 5,000 per day during which the contravention continues. SEBI ICDR Regulations, 2009 All the provisions of the SEBI ICDR regulations are applicable in case of IDRs excepting the (i) disclosure requirements with respect to public/rights issues of specified securities and (ii) other specified provisions. The aspects of IDRs discussed here relate to: (1) eligibility, (ii) conditions for issue of IDRs, (iii) minimum subscription, (iv) fungibility, (vi) filing of draft prospectus/due diligence-certificates/payment of fee/issue advertisement, (vi) display of bid data, (vii) post-issue reports, (viii) unsubscribed issue, (ix) and basis of allotment. Eligibility An issuer of IDRs should also satisfy the following: It (i) is listed in its home country (i.e. the country where it is incorporated/listed), (ii) not prohibited to issue securities by a regulatory body and (iii) has track record of compliance with securities market regulations in its home country. Conditions for Issue The conditions for IDR issue are: (i) minimum issue size, Rs 50 crore, (ii) procedure to be followed by each class of applicant should be mentioned in the prospectus, (iii ) minimum application amount, Rs 20,000, (iv) at least 50 per cent of the issue should be allot- ted to QIBs on proportionate basis as per illustration in Part of Appendix 14-J on the website, (v) balance 50 per cent may be allotted among categories of non-institutional/retail individual investors including employees at the discretion of the issuer and the manner of allocation should be disclosed in the prospectus; allotment to investors within a category should be on proportionate basis; at least 30 per cent of the IDRs being offered to the public should be allocated to retail individual investors and spill over to the extent of under-subscription in this category would be permitted to others, and (vi) there should be only one denomination of the IDR at a time. Minimum Subscription If the issuer does not receive in a non-underwritten issue the minimum subscription of 90 per cent of its offer through the offer document on the date of closure or the subscription level falls below 90 per cent after its closure on account of cheques returned unpaid/ refund within 15 days would be liable to pay 15 per cent interest for the period of delay. For an underwritten issue, the issuerskould forthwith refund the entire subscription in case of 14.1 Explain briefly the common conditions for public and rights issues. 14.2 Discuss the eligibility requirements for public issues. 14.3 Examine the stipulations relating to pricing in public issues. 14.4 What are the provisions relating to promoters contribution in public issues? ctivities/Procedures 14.39 securities are format including the specified addition confirmation along with the offer document to the SEBI in Form H of Appendix 14-E on the website. The offer document should be displayed from the date of filing on the website of the SEBI/issuer/merchant banker/the SME exchange where the proposed to be listed. Underwriting by Merchant Bankers/Underwriters The entire issue (and not restricted to the minimum subscription level) should be underwritten. At least 15 per cent of the issue size should be underwritten by the merchant banker(s) on his/their own account(s). The issuer in consultation with the merchant banker may appoint SEBI-registered underwriters. The merchant banker may enter into an agreement with a nominated investor indicating the number of securities which they agree to subscribe at issue price in case of undersubscription. A nominated investor means a QIB/private equity fund (i.e. a fund registered with any regulatory authority or a fund established by any person registered with any regulatory authority) who enters into an agreement with the merchant banker to robcribe to the issue in case of undersubscription or to receive/deliver the securities in the market making process. The merchant banker would fulfil the underwriting obligation in case of failure of other underwritersominated investors to fulfil their underwriting/subscription obligations. The underwritersominated investors cannot subscribe to the issue in any manner other than fulfilling their obligations under their respective agreements in this regard. All the underwriting/subscription arrangements should be disclosed in the offer document. An undertaking to the effect that the issue has been 100 per cent underwritten along with the list of underwritersominated investors should be filed by the merchant banker with the SEBI one day before the opening of the issue. Minimum Application Value/Number of Allottees The minimum size would be Rs. 1 lakh per application and should be disclosed in the offer document. The minimum number of prospec- tive allottees is 50. shareholders Listing and Migration to SME Exchange/Main Board The specified securities would be listed on SME exchange. Securities of the issuer listed on any other stock exchange would have to migrate on the SME exchange. A listed issuer whose post-issue face value capital is less than Rs. 25 crore may migrate its securities to the SME exchange if its non-promoter shareholders approve it by a special resolution with a two-thirds majority. Similarly, such an issuer may migrate its securities from an SME exchange to the main board. Where the post-issue face value capital of an issuer listed on SME exchange is likely to exceed Rs 25 crore by virtue of further issues of capital by way of rights/ Preferential/bonus issue(s), the issuer should migrate such listed securities to, and seek their listing on, the Main Board. He would be able to make further issues of capital only if (1) the non-promoter approve by a two-thirds majority in a special resolution through postal ballot and (ii) theprinciple approval from the Main Board is obtained for listing of the entire securities. Market Making The merchant banker should ensure compulsory market making through the SME exchange brokers in the manner specified by the SEBI for at least three years from the date of also enter into an agreement with nominated investors for receiving delivering the securities in 1) listing of the securities on the SME exchange or (ii) migration from the main board. He should the market making subject to the SME exchange's prior approval. The details of the market mak- ing arrangement should be disclosed in the offer document. Such securities may be transferred to, date of allotment should be 5 per cent of the securities proposed to be listed. The market maker Of from the concerned nominated investor. The minimum inventory of the market maker on the should buy the entire holding in one lot of a shareholder whose holding is less than the minimum contract size for trading but he cannot sell in lots less than the minimum contract size. Moreover, 14.38 Financial Services Finalisation of Basis of Allotment The ED/MD of the stock exchange where the IDRs are proposed to be listed along with the post-issue lead merchant banker(s) and registrar to the issue should ensure that the basis of allotment is finalised in a fair and proper manner in accordance with the allotment procedure specified in Appendix 14-N on the website. capital Issue of Specified Securities by Small and Medium Enterprises (SMEs) This Section describes the capital issue procedure of issuer whose post-issue face value Issuers whose post-issue face value capital is between Rs 10-25 does not exceed Rs 10 crore. Requirements (ICDR) Regulations discussed in earlier sections of this chapter would mutatis crore may also use this procedure. The provisions of the SEBI's Issue of Capital and Disclosure mutandis apply to such issues in respect of matters not specified by the procedure described in this section. However , the provisions of the ICDR Regulations specified below would not apply to them: (1) Minimum subscription value (Regulation 49), (ii) Conditions for further public offer (27); (iii) Conditions for IPO (26); (iv) Reference date (25); (v) Fast track issues (10); (vi) Draft offer document made public (9); (vii) Documents to be submitted before opening of the issue (8); (viii) In-principle approval from recognised stock exchange (7); and (ix) Filing of offer document (Regulation 6). The main elements of the issue procedure by the SMEs: (i) filing of offer document and due diligence certificate, () underwriting by merchant bankers and underwrites, (iii) minimum application value/minimum number of allottees, (iv) listing of specified securities, migration to SME exchange/main board and (v) market making are portrayed in Exhibit 14.6. Exhibit (14.6) Issue of Specified Securities by Small and Medium Enterprises (SMEs) Filling of Offer Document and Due Diligence Certificate Underwriting by Merchant Bankers/ Underwriters Market Making Minimum Application Value/Number : of Allottees Listing and Migration to SME Exchange/Main Board SME exchange Filing of Offer Document and Due Diligence Certificate The SME-issuer is a trading platform of a recognised making a public/rights issue of specified securities should not file the draft offer stock exchange hav- document with the SEBI. A copy of the offer document should be filed with the ing nationwide trad- SEBI through a merchant banker simultaneously with the filing of the prospectus ing terminals per- with the SME exchange (i.e. a trading platform of a recognised stock exchange mitted by the SEBI securities issued by SMEs and including a stock exchange granted recognition securities issued by SMEs and including for this purpose but does not include the Main Board) and the ROCs or letter of a stock exchange offer with SME Exchange. Main Board means a recognised, Main Board means granted recognition stock exchange having nationwide trading terminals other For this purpose but than SME exchange. Moreover, the SEBI would not issue any does not include observation on the offer document. The merchant banker the Main Board should submit a due diligence certificate in the prescribed SME exchange to list the specified having nationwide trading terminals permitted by the SEBI to list the specified a recognised stock exchange having nationwide trading terminals other than cedures 14.37 company 14-A on the website. under-subscription below 90 per cent including devolvement on underwriters with 60 days and with Fungibility The DIRs would not b automatically fungible into the underlying shares of the issuing 15 per cent interest for delay beyond 60 days. ment The issuing company should enter into an agreement with a merchant banker(s) on the lines Filing of Offer Document/Due Diligence Certificate, Payment of Fee and Issue Advertise- of the format specified in Appendix 14-B on the website. The rights/obligations/responsibilities relating, inter-alia, to disclosures/allotment/refund/ underwriting obligations of each merchant banker should be detemriend/disclosed in the prospectus on the lines of the format specified in Appendix It should also file a draft prospectus in a soft copy on the lines specified in Appendix 14-D on the website with the SEBI through a merchant banker with the requisite fee as prescribed in Compa- mies Issue of IDRs Rules (discussed earlier). The merchant banker should (1) submit due diligence certificate in the format given in Part C of Appendix 14-R on the website to the SEBI along with the draft prospectus, (ii) certify that all amendments/suggestions/observations made by the SEBI have been incorporated in the prospectus, (iii) submit a fresh due diligence certificate specified in Part of Appendix 14-R on the website while filing the prospectus with the ROCs, (iv) furnish a certificate specified in Part C of Appendix 14-R on the website immediately before the opening of the issue, certifying that no corrective action is required on its part and (v) furnish a certificate specified in Part C of Appendix 14-R on the website after the issue has been opened but before i doses for subscription. The issuing company should (a) make arrangements for mandatory collection centres as specified in Appendix 14-C on the website, (b) issue an advertisement in one English/Hindi national daily newspaper with wide circulation soon after receiving final observations on the publicly-filed draft prospectus with the SEBI containing the minimum disclosures given in Part A of Appendix 14-L on the website. Display of Bid Data The stock exchanges offering online bidding system for book building process should display on their website the data pertaining to the book-built IDR issue in the format specified in Part B (I) of Appendix 14-J on the website from the date of opening till at least 3 days after dosure of the bids. Disclosures in Prospectus/Abridged Prospectus The prospectus should contain, in general, all material disclosures which are true/correct/adequate so as to enable the applicants to take an informed investment decision. In particular, the prospectus should contain the disclosures (a) specified in Companies Issue of IDR Rules and (b) in the manner specified in Part A of Appendix 14-R on the website. The abridged prospectus should contain the disclosures specified in Part B of Appendix 3 14-R on the website. Post-issue Reports The merchant banker should submit to the SEBI (i) initial post-issue report on the lines of Part A of Appendix 14-0 on the website within 3 days of closure of the issue and (ii) final post-issue report on the lines of Part C and D of Appendix 14-0 on the website within 15 days of the finalisation of the basis of allotment/refund of money in case of failure of issue. issues regarding underwriters who have failed to meet their underwriting devolvement to the SEBI in the format specified in Appendix 14-P on the website. Undersubscribed Issue The merchant banker should furnish information in case of under-subscribed respect to the IDRs. Any statement by an expert can be circulated/issued/distributed in India/abroad only if his consent to the issue appears on the prospectus. Listing of IDRs The IDRs should be listed on a recognised stock exchange(s) and they can be purchased/possessed/freely transferred by a person resident in India. Procedure for Transfer and Redemption A holder may transfer or may ask the DD to redeem the IRDs. In case of redemption, the DD would request the OCB to get the corresponding underlying shares released in favour of the holder of IDRs for being sold on his behalf/transferred in the book of the issuer in the name of holder of IDRs. Nomination facility for IRDs is available. The issued IDRs may be purchased/possessed and transferred by a non-resident person if the issuing company obtains specific approval from the RBI in this regard or complies with any policy/guidelines issued by the RBI on the subject matter. Continuous Disclosure Requirement Every issuing company should comply with such continuous disclosure requirements as may be specified by the SEBI in this behalf. Distribution of Corporate Benefits The DD should distribute the dividends/other corporate action on the IDRs in proportion to the holdings of IDRS." Penalty Contravention of these rules by the company/any person for which no punishment is vided in the Companies Act would be punishable with fine upto the amount of the IDR issue and a pro- further fine upto Rs 5,000 per day during which the contravention continues. SEBI ICDR Regulations, 2009 All the provisions of the SEBI ICDR regulations are applicable in case of IDRs excepting the (i) disclosure requirements with respect to public/rights issues of specified securities and (ii) other specified provisions. The aspects of IDRs discussed here relate to: (1) eligibility, (ii) conditions for issue of IDRs, (iii) minimum subscription, (iv) fungibility, (vi) filing of draft prospectus/due diligence-certificates/payment of fee/issue advertisement, (vi) display of bid data, (vii) post-issue reports, (viii) unsubscribed issue, (ix) and basis of allotment. Eligibility An issuer of IDRs should also satisfy the following: It (i) is listed in its home country (i.e. the country where it is incorporated/listed), (ii) not prohibited to issue securities by a regulatory body and (iii) has track record of compliance with securities market regulations in its home country. Conditions for Issue The conditions for IDR issue are: (i) minimum issue size, Rs 50 crore, (ii) procedure to be followed by each class of applicant should be mentioned in the prospectus, (iii ) minimum application amount, Rs 20,000, (iv) at least 50 per cent of the issue should be allot- ted to QIBs on proportionate basis as per illustration in Part of Appendix 14-J on the website, (v) balance 50 per cent may be allotted among categories of non-institutional/retail individual investors including employees at the discretion of the issuer and the manner of allocation should be disclosed in the prospectus; allotment to investors within a category should be on proportionate basis; at least 30 per cent of the IDRs being offered to the public should be allocated to retail individual investors and spill over to the extent of under-subscription in this category would be permitted to others, and (vi) there should be only one denomination of the IDR at a time. Minimum Subscription If the issuer does not receive in a non-underwritten issue the minimum subscription of 90 per cent of its offer through the offer document on the date of closure or the subscription level falls below 90 per cent after its closure on account of cheques returned unpaid/ refund within 15 days would be liable to pay 15 per cent interest for the period of delay. For an underwritten issue, the issuerskould forthwith refund the entire subscription in case of 14.1 Explain briefly the common conditions for public and rights issues. 14.2 Discuss the eligibility requirements for public issues. 14.3 Examine the stipulations relating to pricing in public issues. 14.4 What are the provisions relating to promoters contribution in public issues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started