Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all the following steps. Anything that doesn't fit in the category can go into capital 5. A. Hoysted is a sign painter and truck

Do all the following steps. Anything that doesn't fit in the category can go into "capital"

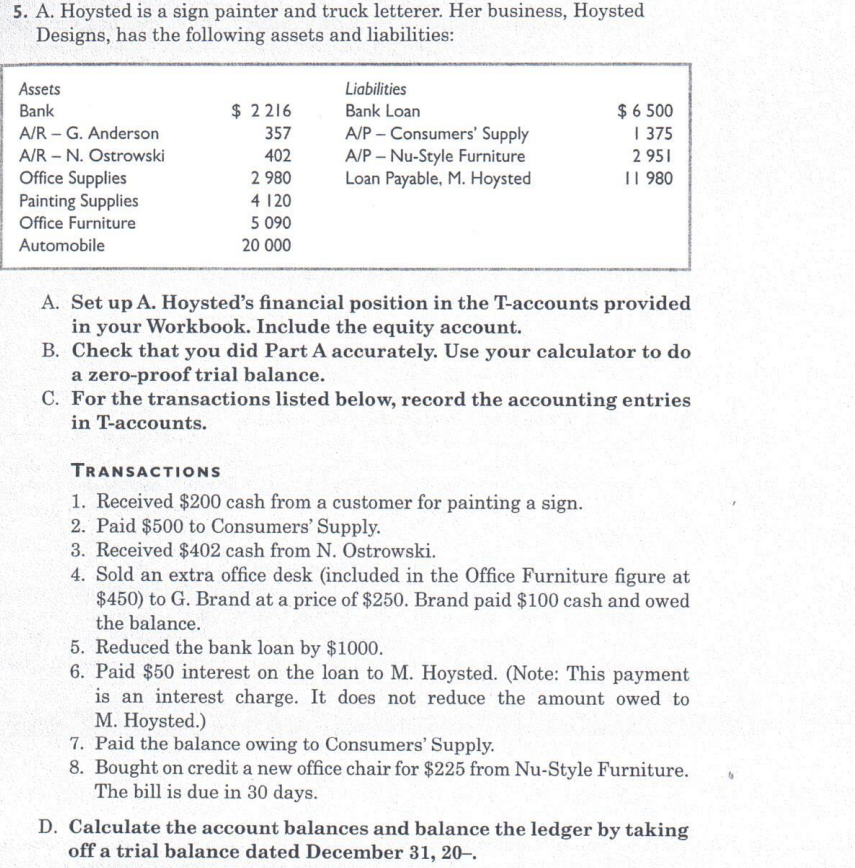

5. A. Hoysted is a sign painter and truck letterer. Her business, Hoysted Designs, has the following assets and liabilities: A. Set up A. Hoysted's financial position in the T-accounts provided in your Workbook. Include the equity account. B. Check that you did Part A accurately. Use your calculator to do a zero-proof trial balance. C. For the transactions listed below, record the accounting entries in T-accounts. TRANSACTIONS 1. Received $200 cash from a customer for painting a sign. 2. Paid $500 to Consumers' Supply. 3. Received $402 cash from N. Ostrowski. 4. Sold an extra office desk (included in the Office Furniture figure at $450) to G. Brand at a price of $250. Brand paid $100 cash and owed the balance. 5. Reduced the bank loan by $1000. 6. Paid $50 interest on the loan to M. Hoysted. (Note: This payment is an interest charge. It does not reduce the amount owed to M. Hoysted.) 7. Paid the balance owing to Consumers' Supply. 8. Bought on credit a new office chair for $225 from Nu-Style Furniture. The bill is due in 30 days. D. Calculate the account balances and balance the ledger by taking off a trial balance dated December 31, 20

5. A. Hoysted is a sign painter and truck letterer. Her business, Hoysted Designs, has the following assets and liabilities: A. Set up A. Hoysted's financial position in the T-accounts provided in your Workbook. Include the equity account. B. Check that you did Part A accurately. Use your calculator to do a zero-proof trial balance. C. For the transactions listed below, record the accounting entries in T-accounts. TRANSACTIONS 1. Received $200 cash from a customer for painting a sign. 2. Paid $500 to Consumers' Supply. 3. Received $402 cash from N. Ostrowski. 4. Sold an extra office desk (included in the Office Furniture figure at $450) to G. Brand at a price of $250. Brand paid $100 cash and owed the balance. 5. Reduced the bank loan by $1000. 6. Paid $50 interest on the loan to M. Hoysted. (Note: This payment is an interest charge. It does not reduce the amount owed to M. Hoysted.) 7. Paid the balance owing to Consumers' Supply. 8. Bought on credit a new office chair for $225 from Nu-Style Furniture. The bill is due in 30 days. D. Calculate the account balances and balance the ledger by taking off a trial balance dated December 31, 20 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started