Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all the questions otherwise I'll downvote and report. Don't try to copy from chegg and do the question correctly otherwise I'll downvote. Accounting/Reporting Framework

Do all the questions otherwise I'll downvote and report. Don't try to copy from chegg and do the question correctly otherwise I'll downvote.

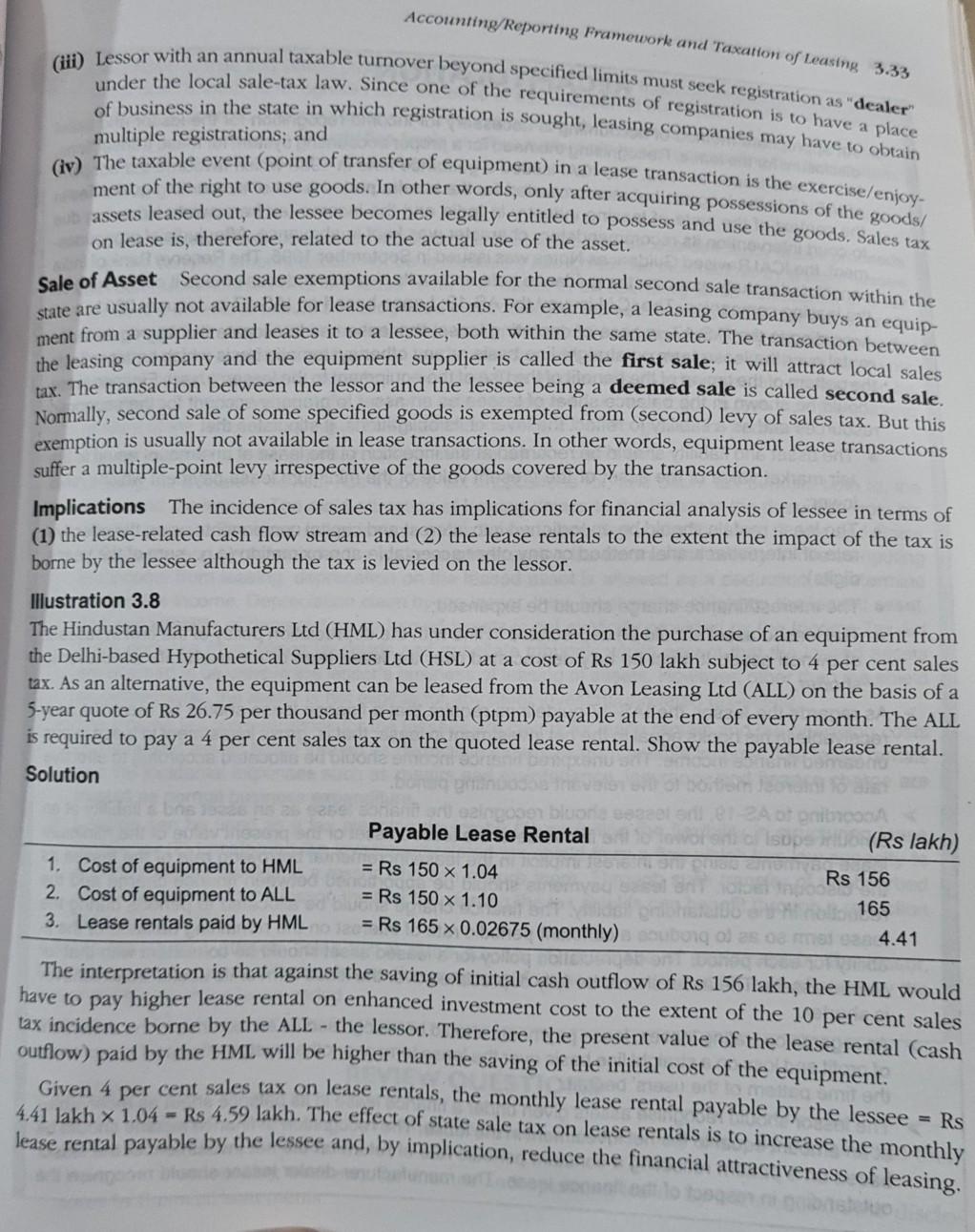

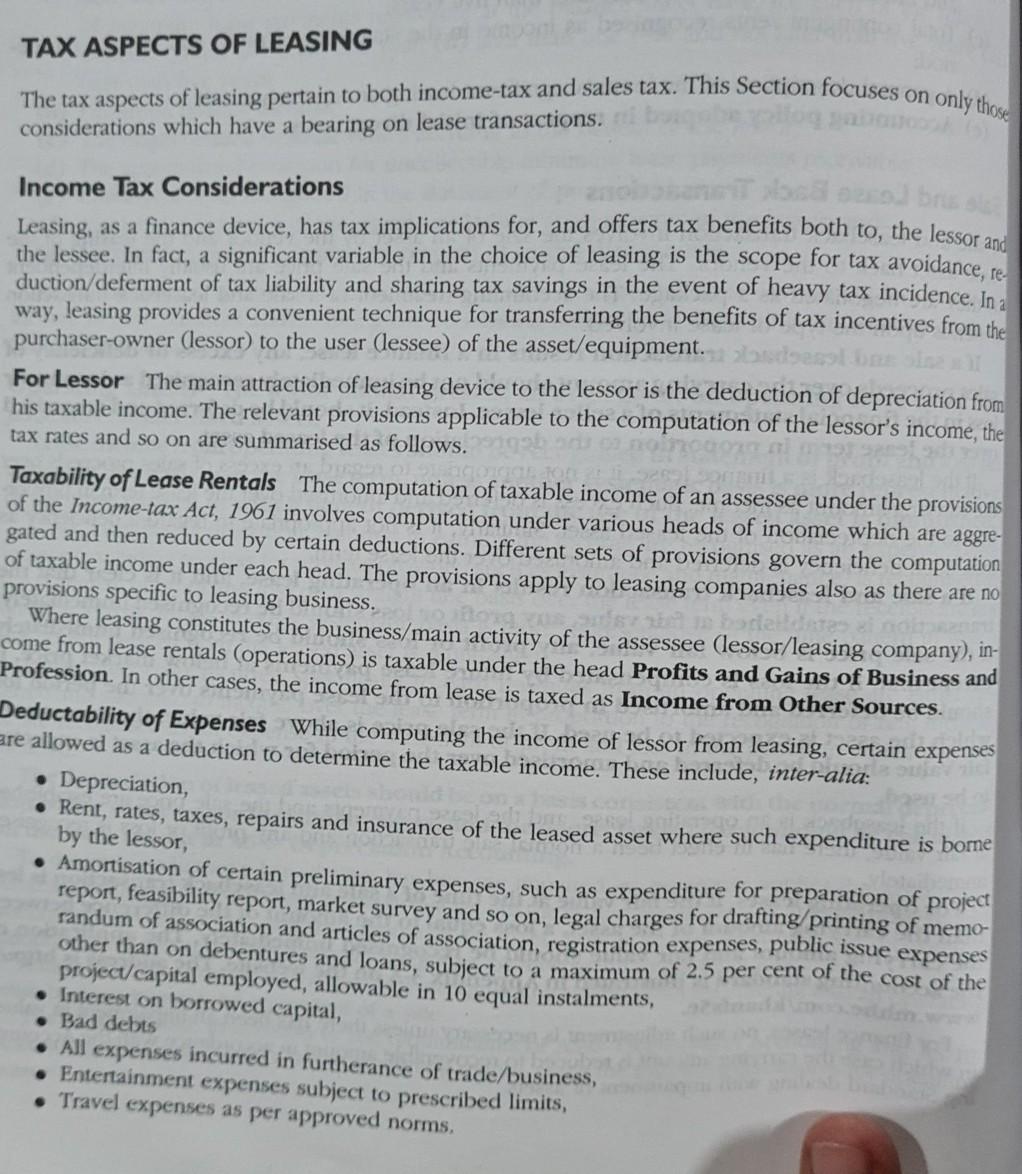

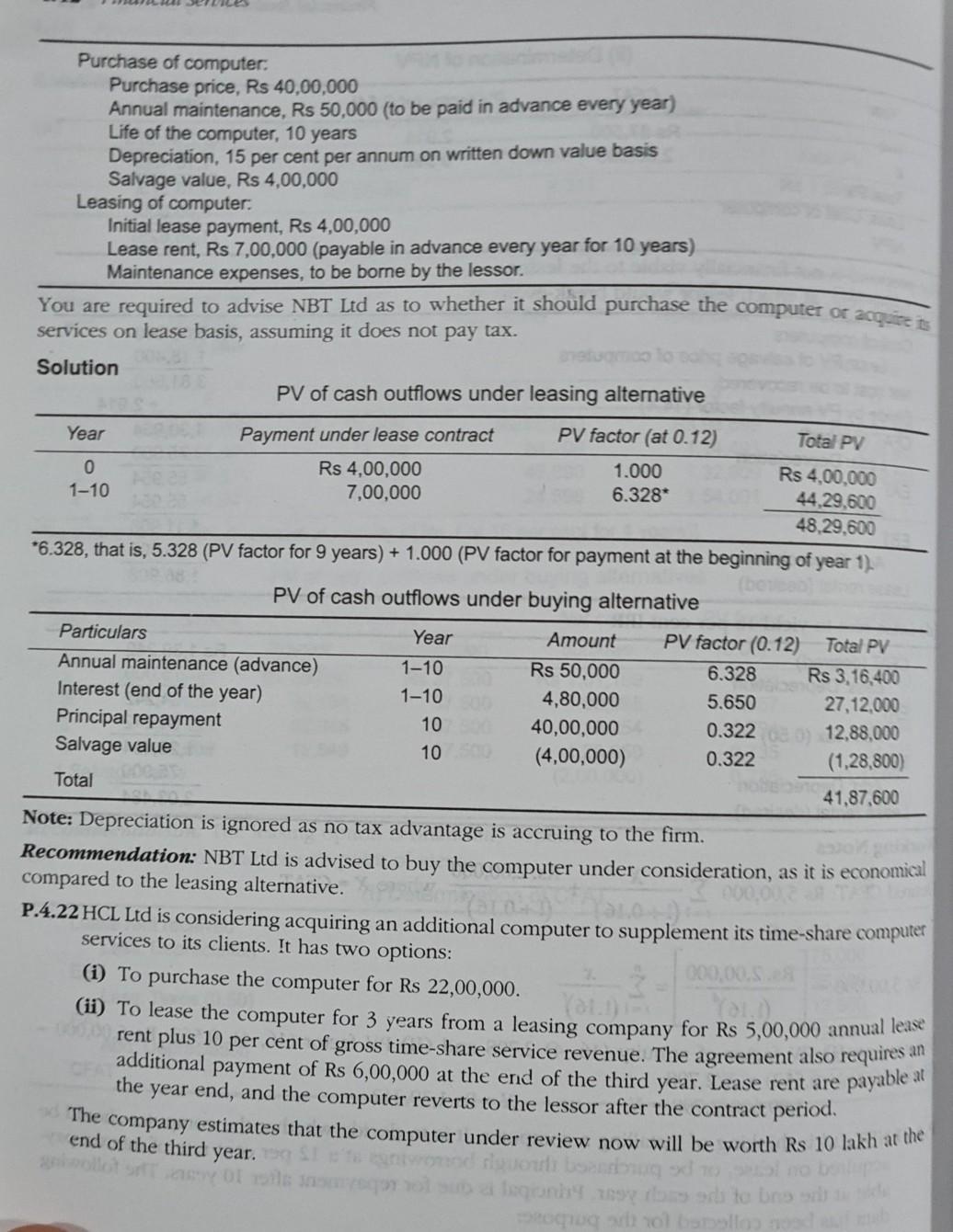

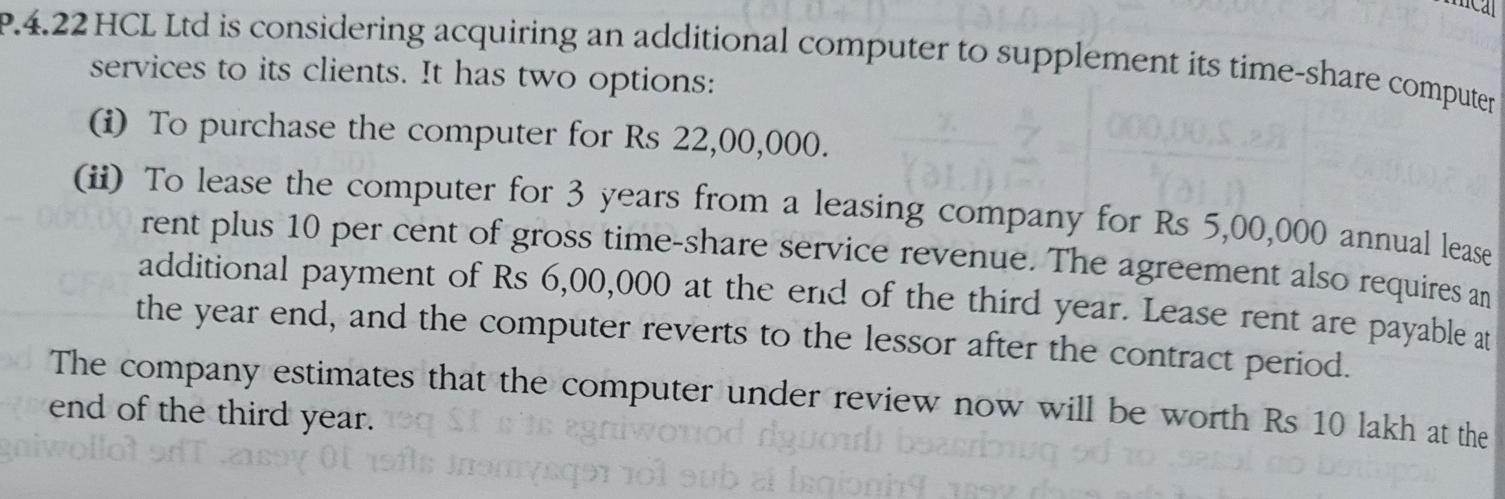

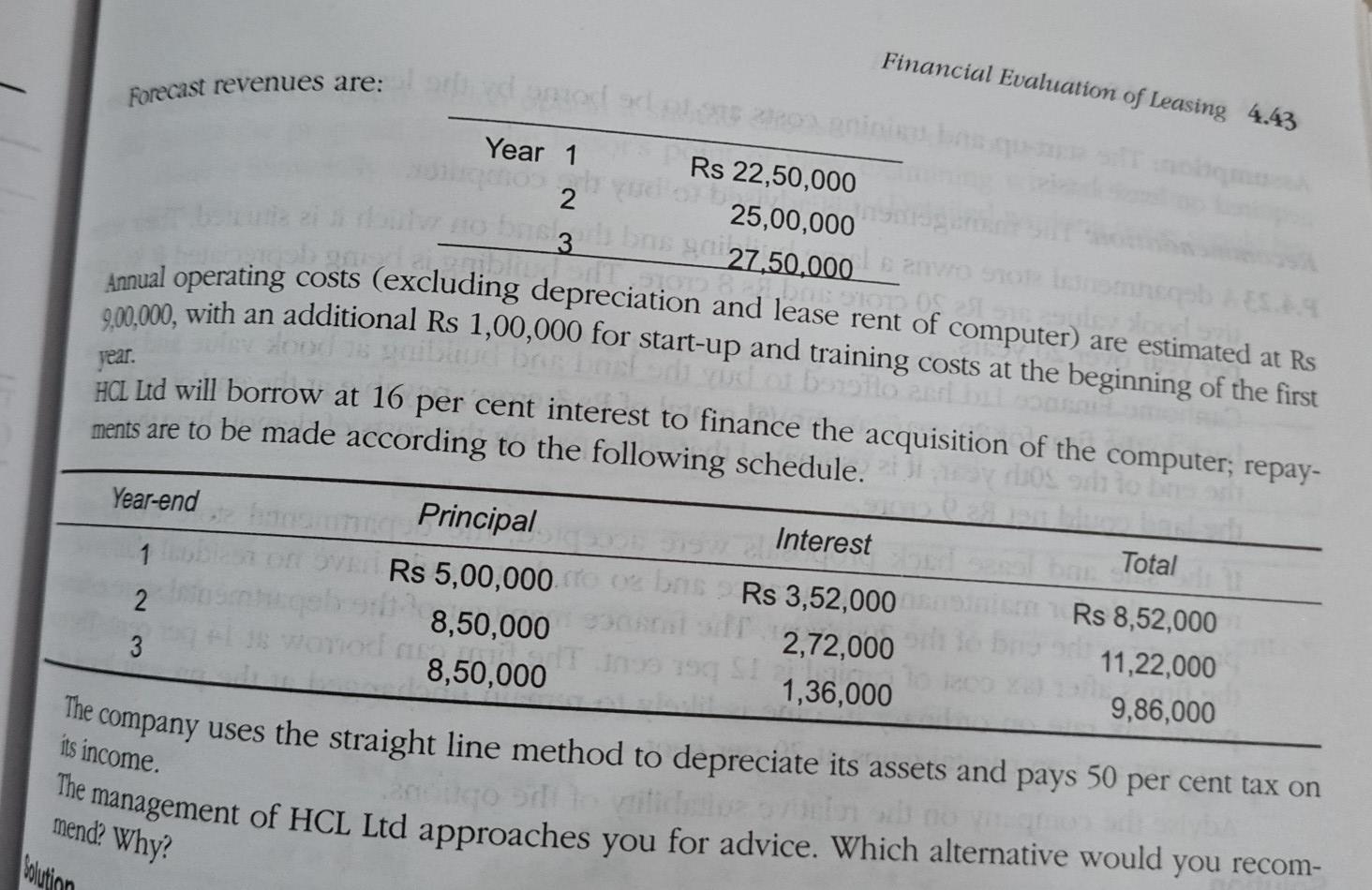

Accounting/Reporting Framework and Taxation of Leasing 3.33 (iii) Lessor with an annual taxable turnover beyond specified limits must seek registration as "dealer" under the local sale-tax law. Since one of the requirements of registration is to have a place of business in the state in which registration is sought, leasing companies may have to obtain multiple registrations; and (v) The taxable event (point of transfer of equipment in a lease transaction is the exercise/enjoy- ment of the right to use goods. In other words, only after acquiring possessions of the goods, assets leased out, the lessee becomes legally entitled to possess and use the goods, Sales tax on lease is, therefore, related to the actual use of the asset. Sale of Asset Second sale exemptions available for the normal second sale transaction within the State are usually not available for lease transactions. For example, a leasing company buys an equip ment from a supplier and leases it to a lessee, both within the same state. The transaction between the leasing company and the equipment supplier is called the first sale; it will attract local sales tax. The transaction between the lessor and the lessee being a deemed sale is called second sale. Normally, second sale of some specified goods is exempted from (second) levy of sales tax. But this exemption is usually not available in lease transactions. In other words, equipment lease transactions suffer a multiple-point levy irrespective of the goods covered by the transaction. Implications The incidence of sales tax has implications for financial analysis of lessee in terms of (1) the lease-related cash flow stream and (2) the lease rentals to the extent the impact of the tax is borne by the lessee although the tax is levied on the lessor. Illustration 3.8 The Hindustan Manufacturers Ltd (HML) has under consideration the purchase of an equipment from the Delhi-based Hypothetical Suppliers Ltd (HSL) at a cost of Rs 150 lakh subject to 4 per cent sales tax. As an alternative, the equipment can be leased from the Avon Leasing Ltd (ALL) on the basis of a 5-year quote of Rs 26.75 per thousand per month (ptpm) payable at the end of every month. The ALL is required to pay a 4 per cent sales tax on the quoted lease rental. Show the payable lease rental. Solution Payable Lease Rental (Rs lakh) 1. Cost of equipment to HML = Rs 150 x 1.04 Rs 156 2. Cost of equipment to ALL = Rs 150 x 1.10 165 3. Lease rentals paid by HML = Rs 165 x 0.02675 (monthly) 4.41 The interpretation is that against the saving of initial cash outflow of Rs 156 lakh, the HML would have to pay higher lease rental on enhanced investment cost to the extent of the 10 per cent sales tax incidence borne by the ALL - the lessor. Therefore, the present value of the lease rental (cash outflow) paid by the HML will be higher than the saving of the initial cost of the equipment. Given 4 per cent sales tax on lease rentals, the monthly lease rental payable by the lessee = Rs 4.41 lakh x 1.04 = Rs 4.59 lakh. The effect of state sale tax on lease rentals is to increase the monthly lease rental payable by the lessee and, by implication, reduce the financial attractiveness of leasing. TAX ASPECTS OF LEASING The tax aspects of leasing pertain to both income-tax and sales tax. This Section focuses on only those considerations which have a bearing on lease transactions. Income Tax Considerations Leasing, as a finance device, has tax implications for, and offers tax benefits both to, the lessor and the lessee. In fact, a significant variable in the choice of leasing is the scope for tax avoidance, re duction/deferment of tax liability and sharing tax savings in the event of heavy tax incidence. In a way, leasing provides a convenient technique for transferring the benefits of tax incentives from the purchaser-owner (lessor) to the user (lessee) of the asset/equipment For Lessor The main attraction of leasing device to the lessor is the deduction of depreciation from his taxable income. The relevant provisions applicable to the computation of the lessor's income, the tax rates and so on are summarised as follows. TO Taxability of Lease Rentals The computation of taxable income of an assessee under the provisions of the Income-tax Act, 1961 involves computation under various heads of income which are aggre- gated and then reduced by certain deductions. Different sets of provisions govern the computation of taxable income under each head. The provisions apply to leasing companies also as there are no provisions specific to leasing business. Where leasing constitutes the business/main activity of the assessee (lessor/leasing company), in- come from lease rentals (operations) is taxable under the head Profits and Gains of Business and Profession. In other cases, the income from lease is taxed as Income from Other Sources. Deductability of Expenses While computing the income of lessor from leasing, certain expenses are allowed as a deduction to determine the taxable income. These include, inter-alia: Depreciation, Rent, rates, taxes, repairs and insurance of the leased asset where such expenditure is borne by the lessor, Amortisation of certain preliminary expenses, such as expenditure for preparation of project report, feasibility report, market survey and so on, legal charges for drafting/printing of memo- randum of association and articles of association, registration expenses, public issue expenses other than on debentures and loans, subject to a maximum of 2.5 per cent of the cost of the project/capital employed, allowable in 10 equal instalments, Interest on borrowed capital, Bad debts All expenses incurred in furtherance of trade/business, Entertainment expenses subject to prescribed limits, Travel expenses as per approved norms, Purchase of computer, Purchase price, Rs 40,00,000 Annual maintenance, Rs 50,000 (to be paid in advance every year) Life of the computer, 10 years Depreciation, 15 per cent per annum on written down value basis Salvage value, Rs 4,00,000 Leasing of computer Initial lease payment, Rs 4,00,000 Lease rent, Rs 7,00,000 (payable in advance every year for 10 years) Maintenance expenses, to be borne by the lessor. You are required to advise NBT Ltd as to whether it should purchase the computer or acquiz services on lease basis, assuming it does not pay tax. Solution PV of cash outflows under leasing alternative Year Payment under lease contract PV factor (at 0.12) Total PV 0 Rs 4,00,000 1.000 Rs 4,00,000 1-10 7,00,000 6.328* 44.29,600 48,29,600 *6.328, that is, 5.328 (PV factor for 9 years) + 1.000 (PV factor for payment at the beginning of year 1) PV of cash outflows under buying alternative Particulars Year Amount PV factor (0.12) Total PV Annual maintenance (advance) 1-10 Rs 50,000 6.328 Rs 3,16,400 Interest (end of the year) 1-10 4,80,000 5.650 27,12.000 Principal repayment 10 40,00,000 0.322 30 12,88,000 Salvage value 10 (4,00,000) 0.322 (1,28,800) Total 41,87,600 Note: Depreciation is ignored as no tax advantage is accruing to the firm. Recommendation: NBT Ltd is advised to buy the computer under consideration, as it is economical compared to the leasing alternative. P.4.22 HCL Ltd is considering acquiring an additional computer to supplement its time-share computer services to its clients. It has two options: 000.00 (i) To purchase the computer for Rs 22,00,000. (ii) To lease the computer for 3 years from a leasing company for Rs 5,00,000 annual lease rent plus 10 per cent of gross time-share service revenue. The agreement also requires an additional payment of Rs 6,00,000 at the end of the third year. Lease rent are payable at the year end, and the computer reverts to the lessor after the contract period. The company estimates that the computer under review now will be worth Rs 10 lakh at the end of the third year. luule sony bog od to be pomogaol batalla P.4.22 HCL Ltd is considering acquiring an additional computer to supplement its time-share computer services to its clients. It has two options: (i) To purchase the computer for Rs 22,00,000. () To lease the computer for 3 years from a leasing company for Rs 5,00,000 annual lease rent plus 10 per cent of gross time-share service revenue. The agreement also requires an additional payment of Rs 6,00,000 at the end of the third year. Lease rent are payable at the year end, and the computer reverts to the lessor after the contract period. The company estimates that the computer under review now will be worth Rs 10 lakh at the end of the third year. egriworod dyuo gaivollotora Oltils in Pr701 aub a legion Financial Evaluation of Leasing 4.43 Forecast revenues are: 2 odontod 20 Year 1 Rs 22,50,000 25,00,000 27,50.000 250 BOSTO Annual operating costs (excluding depreciation and lease rent of computer) are estimated at Rs 900,000, with an additional Rs 1,00,000 for start-up and training costs at the beginning of the first HCI Ltd will borrow at 16 per cent interest to finance the acquisition of the computer; repay- Y LOS to ments are to be made according to the following schedule. Year-end Interest 1 Total 2 Principal Rs 5,00,000 8,50,000 8,50,000 3 Rs 3,52,000 2,72,000 1,36,000 Rs 8,52,000 11,22,000 9,86,000 The company uses the straight line method to depreciate its assets and pays 50 per cent tax on its income. The management of HCL Ltd approaches you for advice. Which alternative would you recom- mend? Why? Solution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started