Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all the questions otherwise I'll report and downvote, Do not copy from chegg and do the question correctly otherwise I'll downvote Each insurer should

Do all the questions otherwise I'll report and downvote, Do not copy from chegg and do the question correctly otherwise I'll downvote

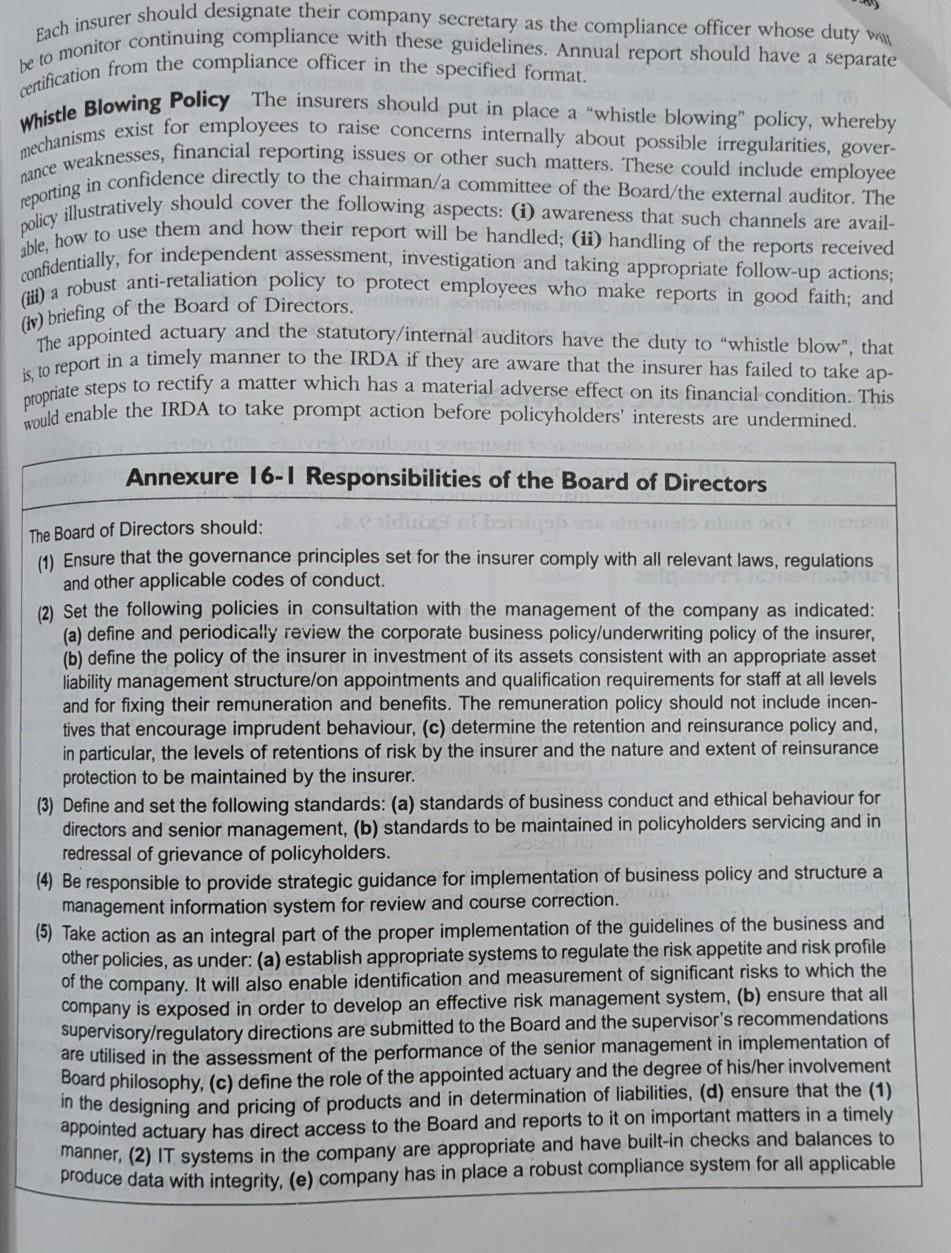

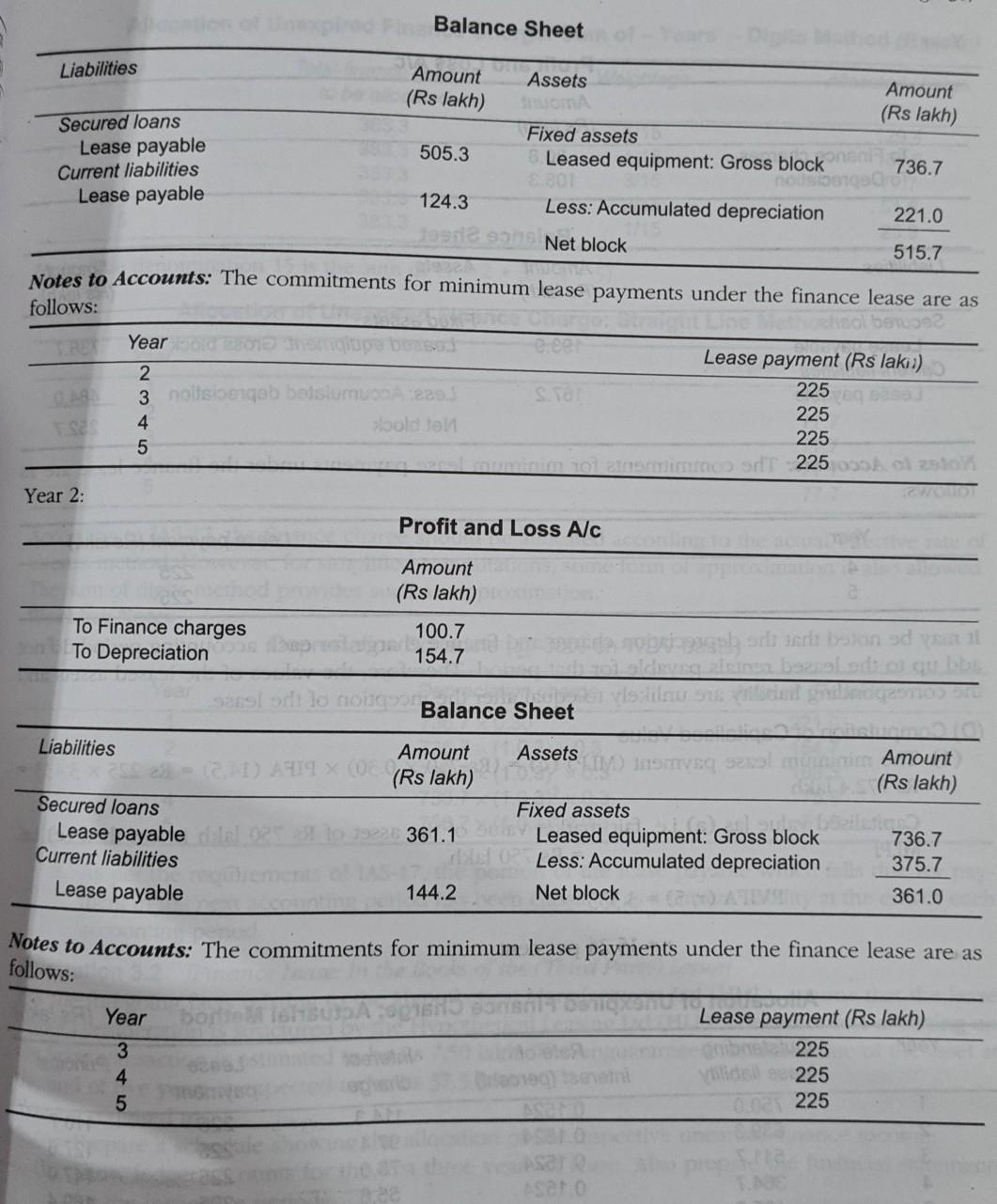

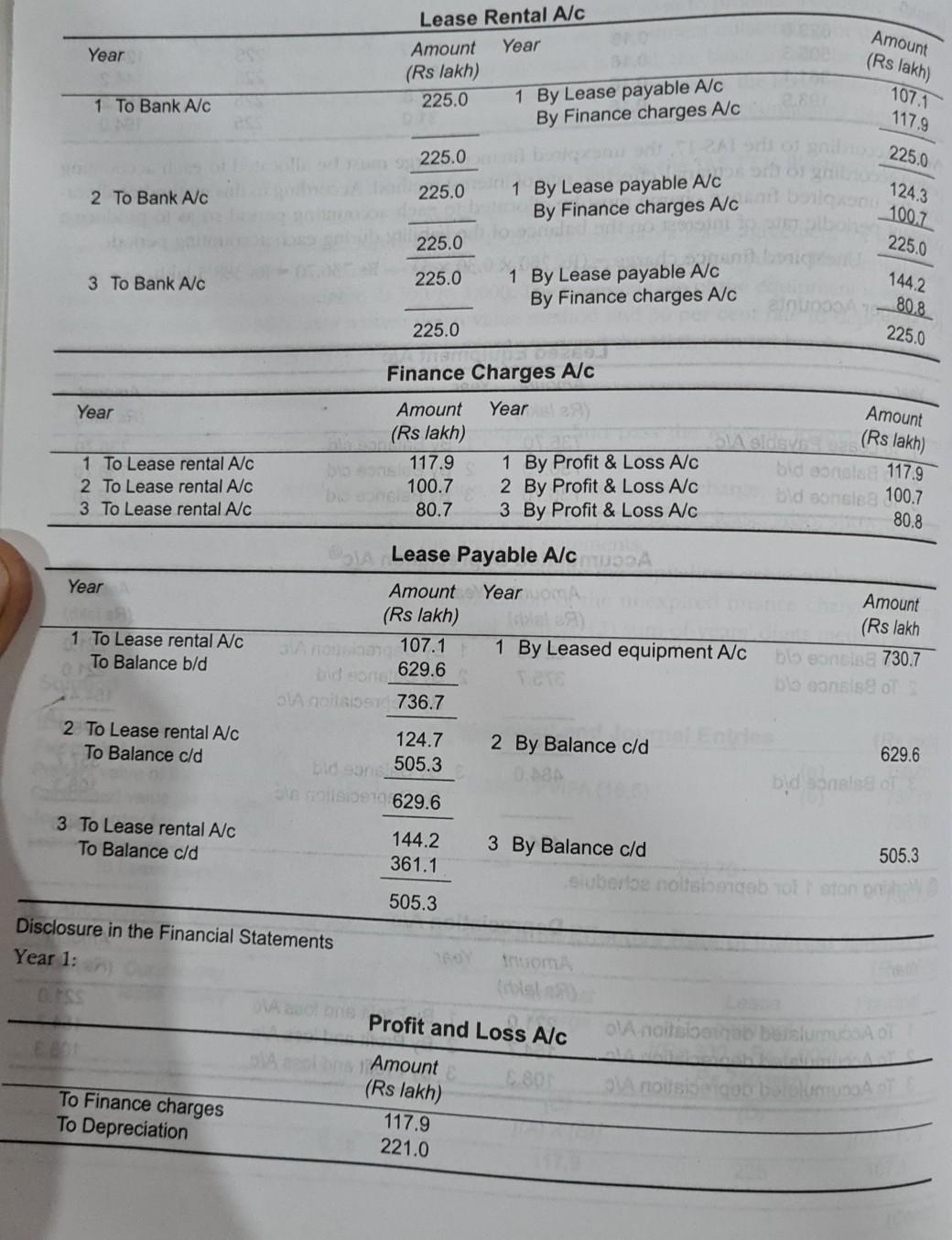

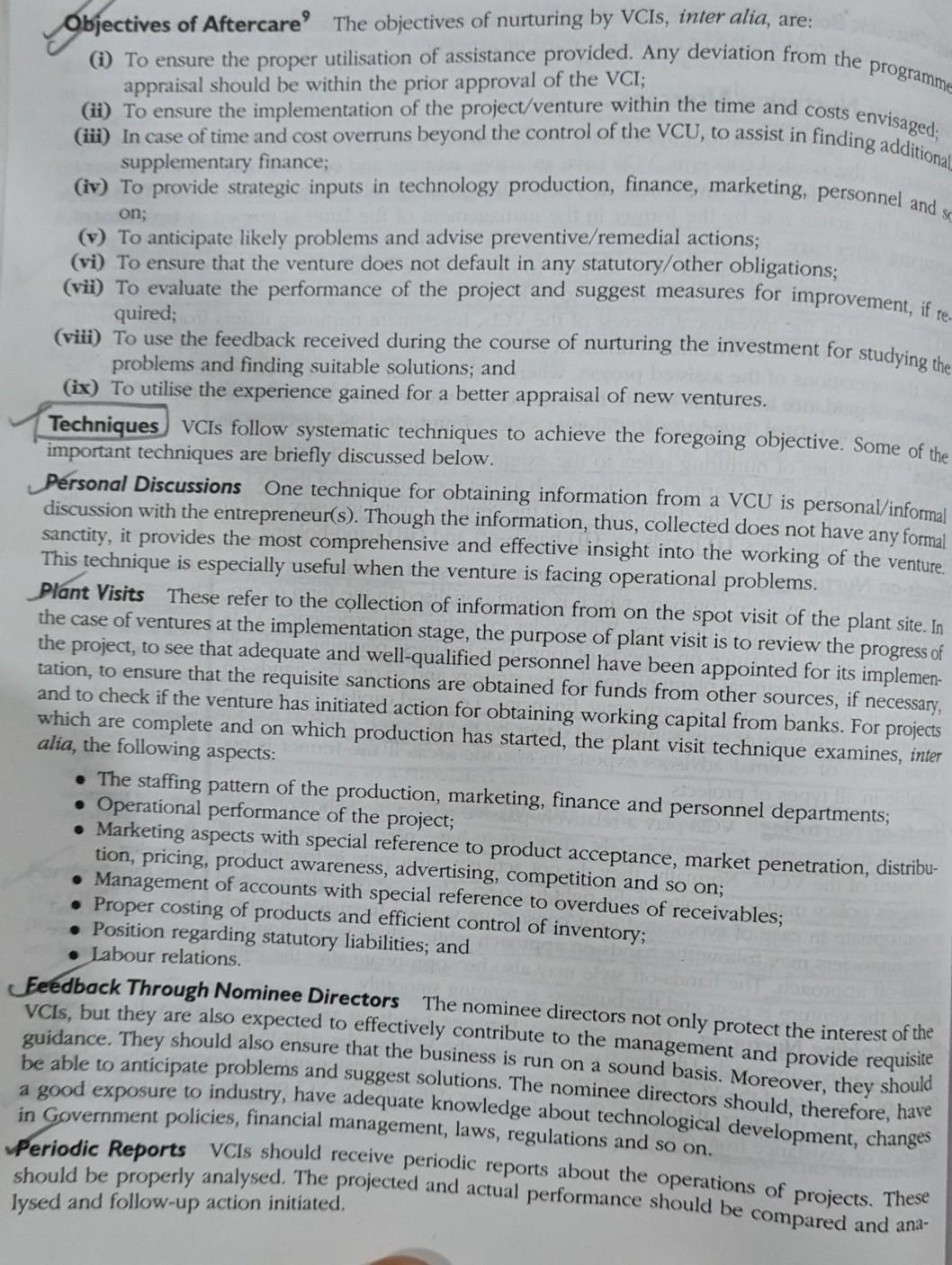

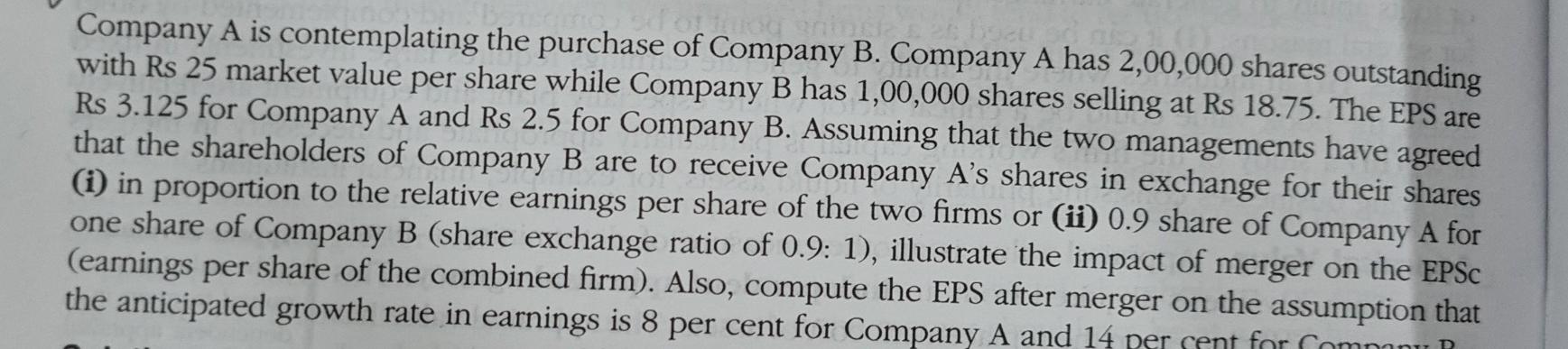

Each insurer should designate their company secretary as the compliance officer whose duty i certification from the compliance officer in the specified format. be to monitor continuing compliance with these guidelines. Annual report should have a separate Whistle Blowing Policy The insurers should put in place a "whistle blowing" policy, whereby mechanisms exist for employees to raise concerns internally about possible irregularities, gover- nance weaknesses, financial reporting issues or other such matters. These could include employee reporting in confidence directly to the chairman/a committee of the Board/the external auditor. The policy illustratively should cover the following aspects: (i) awareness that such channels are avail- able, how to use them and how their report will be handled; (ii) handling of the reports received confidentially, for independent assessment, investigation and taking appropriate follow-up actions; (iii) a robust anti-retaliation policy to protect employees who make reports in good faith; and (iv) briefing of the Board of Directors. a propriate steps to rectify a matter which has a material adverse effect on its financial condition. This The appointed actuary and the statutory/internal auditors have the duty to "whistle blow", that prould enable the IRDA to take prompt action before policyholders' interests are undermined. Annexure 16-1 Responsibilities of the Board of Directors The Board of Directors should: (1) Ensure that the governance principles set for the insurer comply with all relevant laws, regulations and other applicable codes of conduct. (2) Set the following policies in consultation with the management of the company as indicated: (a) define and periodically review the corporate business policy/underwriting policy of the insurer, (b) define the policy of the insurer in investment of its assets consistent with an appropriate asset liability management structurelon appointments and qualification requirements for staff at all levels and for fixing their remuneration and benefits. The remuneration policy should not include incen- tives that encourage imprudent behaviour, (c) determine the retention and reinsurance policy and, in particular, the levels of retentions of risk by the insurer and the nature and extent of reinsurance protection to be maintained by the insurer. (3) Define and set the following standards: (a) standards of business conduct and ethical behaviour for directors and senior management, (b) standards to be maintained in policyholders servicing and in redressal of grievance of policyholders. (4) Be responsible to provide strategic guidance for implementation of business policy and structure a management information system for review and course correction. (5) Take action as an integral part of the proper implementation of the guidelines of the business and other policies, as under: (a) establish appropriate systems to regulate the risk appetite and risk profile of the company. It will also enable identification and measurement of significant risks to which the company is exposed in order to develop an effective risk management system, (b) ensure that all supervisory/regulatory directions are submitted to the Board and the supervisor's recommendations are utilised in the assessment of the performance of the senior management in implementation of Board philosophy, (c) define the role of the appointed actuary and the degree of his/her involvement in the designing and pricing of products and in determination of liabilities, (d) ensure that the (1) appointed actuary has direct access to the Board and reports to it on important matters in a timely manner, (2) IT systems in the company are appropriate and have built-in checks and balances to produce data with integrity, (e) company has in place a robust compliance system for all applicable Balance Sheet Liabilities Amount Assets Amount (Rs lakh) (Rs lakh) Secured loans Fixed assets Lease payable 505.3 Leased equipment: Gross block 736.7 Current liabilities S30 nosos Lease payable 124.3 Less: Accumulated depreciation 221.0 Net block 515.7 Notes to Accounts: The commitments for minimum lease payments under the finance lease are as follows: Bobo Year Slobo Lease payment (Rs laki:) 2 So 225 3 nolls oorgeb bedsomu 2205 EOS 225 4 old to 225 5 mino 225 35 Year 2: Profit and Loss Alc Amount (Rs lakh) To Finance charges To Depreciation 100.7 154.7 berlari bolon adat ang lo no Balance Sheet Liabilities 9 X (Rs lakh) Amount (Rs lakh) Secured loans Lease payable Current liabilities Lease payable Amount Assets Assets Fixed assets 361.1 S Leased equipment: Gross block Less: Accumulated depreciation 144.2 Net block 736.7 375.7 361.0 Notes to Accounts: The commitments for minimum lease payments under the finance lease are as follows: Year 3 4 5 Lease payment (Rs lakh) 225 225 225 sero Year Lease Rental A/C Amount Year (Rs lakh) 225.0 1 By Lease payable A/C By Finance charges Alc Amount (Rs lakh) 107.1 117.9 1 To Bank A/C 225.0 225.0 2 To Bank A/C 225.0 1 By Lease payable Alc By Finance charges Alc 124.3 100,7 225.0 225.0 3 To Bank A/C 225.0 1 By Lease payable A/C By Finance charges A/C 144.2 80.8 225.0 225.0 Year Finance Charges Alc Amount Year (Rs lakh) A sve 117.9 1 By Profit & Loss A/C bid onsla 117.9 100.7 2 By Profit & Loss A/ cbid sonsisa 100.7 80.7 3 By Profit & Loss A/C 80.8 Amount (Rs lakh) 1 To Lease rental A/C 2 To Lease rental A/C 3 To Lease rental A/C Year Lease Payable A/C SA Amount Year (Rs lakh) A 107.1 1 By Leased equipment Alc 1 To Lease rental A/C To Balance bld Amount (Rs lakh bonis 730.7 boonsis bidone 629.6 Ang 736.7 2 To Lease rental Alc To Balance c/d 124.7 505.3 2 By Balance cld 629.6 bid Solar ABD09629.6 3 To Lease rental A/C To Balance cld 144.2 361.1 3 By Balance cld sluborse noltsbondebolton 505.3 505.3 Disclosure in the Financial Statements Year 1: Profit and Loss A/C A noite beslu NOUS To Finance charges To Depreciation Amount (Rs lakh) 117.9 221.0 Objectives of Aftercare' The objectives of nurturing by VCls, inter alia, are: (i) To ensure the proper utilisation of assistance provided. Any deviation from the programme (i) To ensure the implementation of the project/venture within the time and costs envisaged; appraisal should be within the prior approval of the VCI; (iii) In case of time and cost overruns beyond the control of the VCU, to assist in finding additional finance; (iv) To provide strategic inputs in technology production, finance, marketing, personnel and so on; (v) To anticipate likely problems and advise preventive/remedial actions; (vi) To ensure that the venture does not default in any statutory/other obligations; (vii) To evaluate the performance of the project and suggest measures for improvement , if te quired; (viii) To use the feedback received during the course of nurturing the investment for studying the problems and finding suitable solutions; and (ix) To utilise the experience gained for a better appraisal of new ventures. Techniques VCis follow systematic techniques to achieve the foregoing objective. Some of the important techniques are briefly discussed below. Personal Discussions One technique for obtaining information from a VCU is personal/informal discussion with the entrepreneur(s). Though the information, thus, collected does not have any formal sanctity, it provides the most comprehensive and effective insight into the working of the venture. This technique is especially useful when the venture is facing operational problems. Plant Visits These refer to the collection of information from on the spot visit of the plant site. In the case of ventures at the implementation stage, the purpose of plant visit is to review the progress of the project, to see that adequate and well-qualified personnel have been appointed for its implemen- tation, to ensure that the requisite sanctions are obtained for funds from other sources, if necessary, and to check if the venture has initiated action for obtaining working capital from banks. For projects which are complete and on which production has started, the plant visit technique examines, inter alia, the following aspects: The staffing pattern of the production, marketing, finance and personnel departments; Operational performance of the project; Marketing aspects with special reference to product acceptance, market penetration, distribu- tion, pricing, product awareness, advertising, competition and so on; Management of accounts with special reference to overdues of receivables; Proper costing of products and efficient control of inventory; Position regarding statutory liabilities; and Labour relations. Feedback Through Nominee Directors The nominee directors not only protect the interest of the VCLs, but they are also expected to effectively contribute to the management and provide requisite guidance. They should also ensure that the business is run on a sound basis. Moreover, they should be able to anticipate problems and suggest solutions. The nominee directors should, therefore, have a good exposure to industry, have adequate knowledge about technological development, changes in Government policies, financial management, laws, regulations and so on. Periodic Reports Vcis should receive periodic reports about the operations of projects. These should be properly analysed. The projected and actual performance should be compared and ana- lysed and follow-up action initiated. Company A is contemplating the purchase of Company B. Company A has 2,00,000 shares outstanding with Rs 25 market value per share while Company B has 1,00,000 shares selling at Rs 18.75. The EPS are Rs 3.125 for Company A and Rs 2.5 for Company B. Assuming that the two managements have agreed that the shareholders of Company B are to receive Company A's shares in exchange for their shares (i) in proportion to the relative earnings per share of the two firms or () 0.9 share of Company A for one share of Company B (share exchange ratio of 0.9: 1), illustrate the impact of merger on the EPSc (earnings per share of the combined firm). Also, compute the EPS after merger on the assumption that the anticipated growth rate in earnings is 8 per cent for Company A and 14 per sent for romnou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started