Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do all the steps. I am including a problem and an example. do all the steps that the example problem have. Example question What is

do all the steps. I am including a problem and an example. do all the steps that the example problem have.

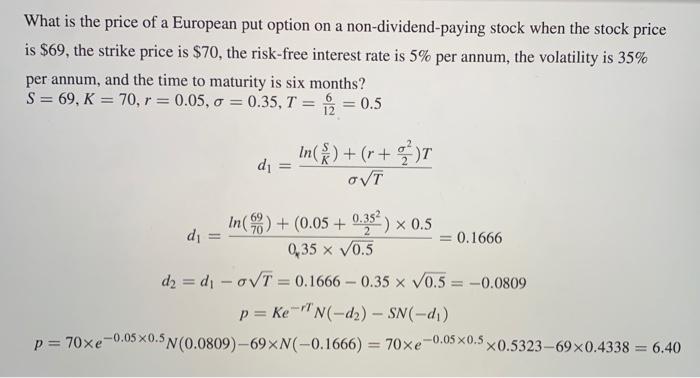

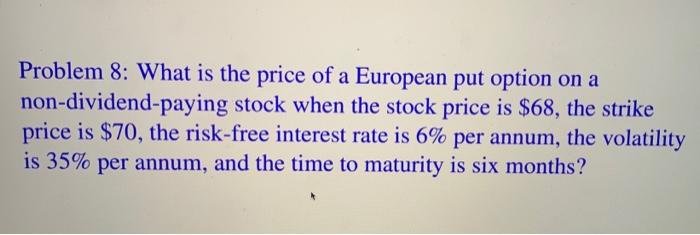

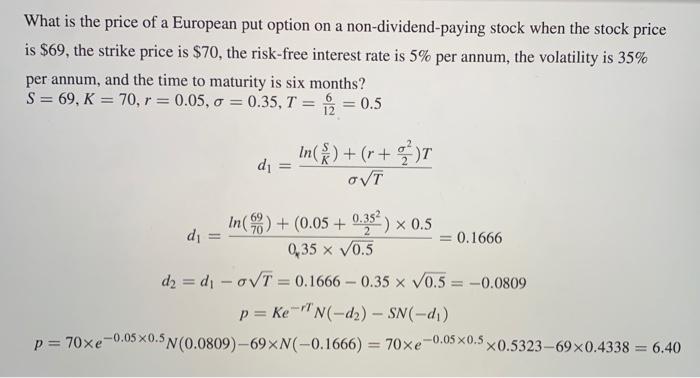

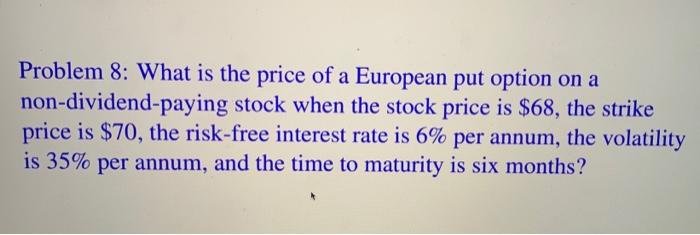

What is the price of a European put option on a non-dividend paying stock when the stock price is $69, the strike price is $70, the risk-free interest rate is 5% per annum, the volatility is 35% per annum, and the time to maturity is six months? S = 69, K = 70, r = 0.05, 0 = 0.35, T = = 0.5 12 di In() +(r+ (r+) NT In ) + (0.05 + 0.352) x 0.5 di = = 0.1666 0,35 x 10.5 d2 = di-ovt = 0.1666 -0.35 x 70.5 -0.0809 p= Ke-"N(-d2) - SN(-d.) (0.0809) -69%N-0.1666) = = 70xe ,-0.05x0.5 x0.5323-69x0.4338 = 6.40 P = 70xe-0.05x0.5 Problem 8: What is the price of a European put option on a non-dividend-paying stock when the stock price is $68, the strike price is $70, the risk-free interest rate is 6% per annum, the volatility is 35% per annum, and the time to maturity is six months Example

question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started