do all the test and let me know if you need more information

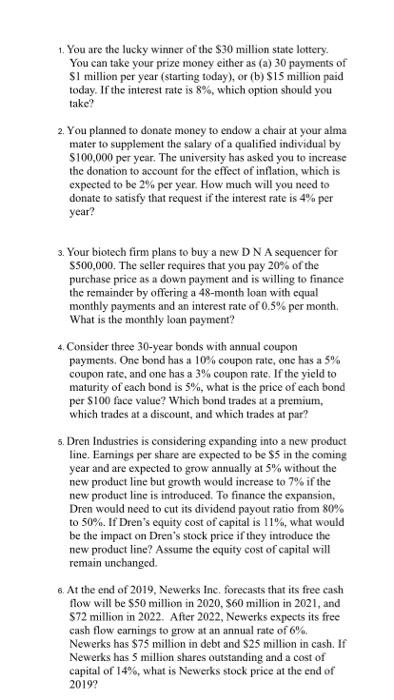

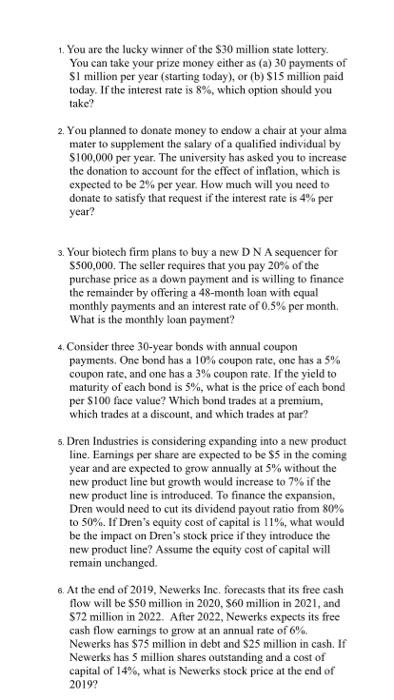

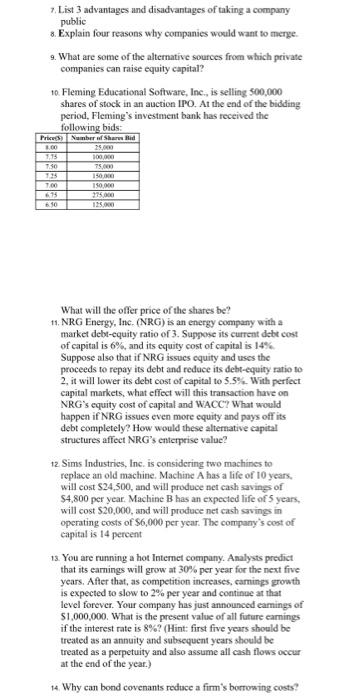

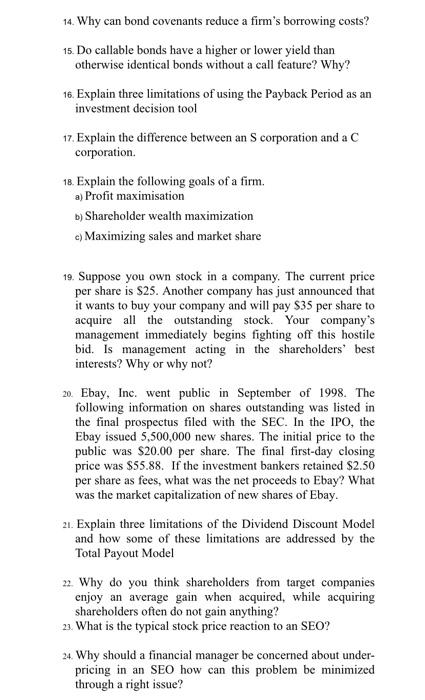

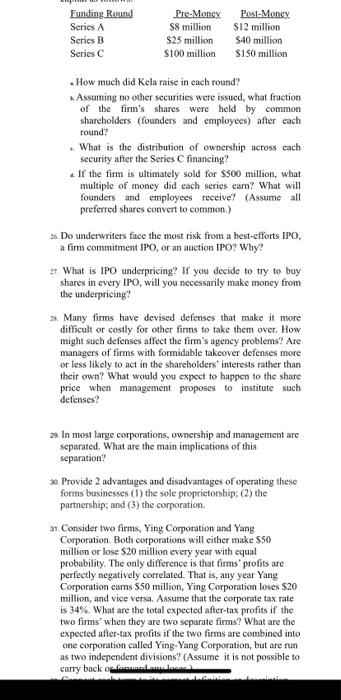

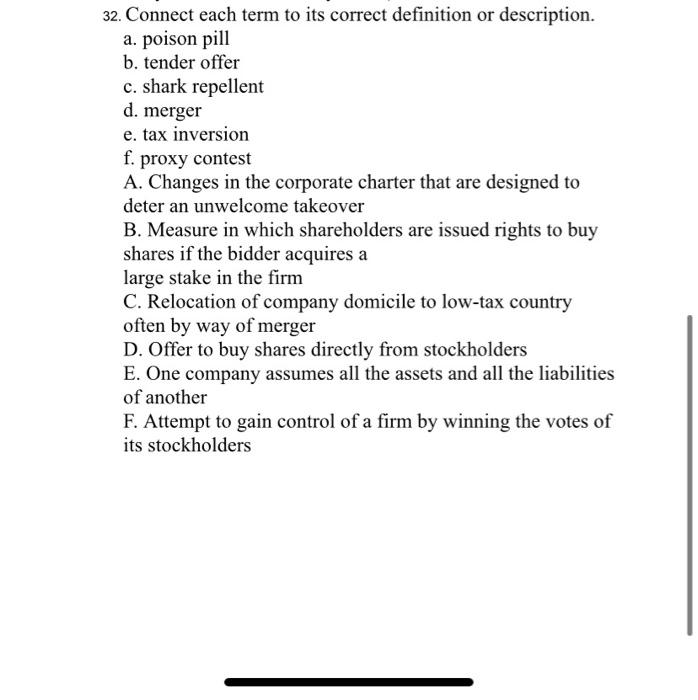

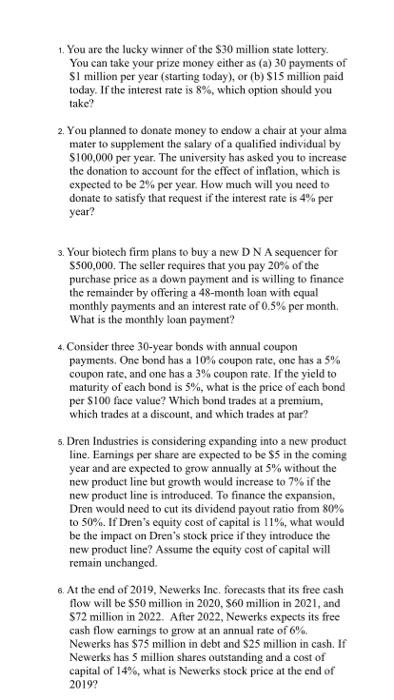

1. You are the lucky winner of the $30 million state lottery. You can take your prize money either as (a) 30 payments of $1 million per year (starting today), or (b) S15 million paid today. If the interest rate is 8%, which option should you take? 2. You planned to donate money to endow a chair at your alma mater to supplement the salary of a qualified individual by $100,000 per year. The university has asked you to increase the donation to account for the effect of inflation, which is expected to be 2% per year. How much will you need to donate to satisfy that request if the interest rate is 4% per year? 3. Your biotech firm plans to buy a new DNA sequencer for $500,000. The seller requires that you pay 20% of the purchase price as a down payment and is willing to finance the remainder by offering a 48-month loan with equal monthly payments and an interest rate of 0.5% per month, What is the monthly loan payment? 4. Consider three 30-year bonds with annual coupon payments. One bond has a 10% coupon rate, one has a 5% coupon rate, and one has a 3% coupon rate. If the yield to maturity of each bond is 5%, what is the price of each bond per $100 face value? Which bond trades at a premium, which trades at a discount, and which trades at par? 5. Dren Industries is considering expanding into a new product line. Earnings per share are expected to be $5 in the coming year and are expected to grow annually at 5% without the new product line but growth would increase to 7% if the new product line is introduced. To finance the expansion, Dren would need to cut its dividend payout ratio from 80% to 50%. If Dren's equity cost of capital is 11%, what would be the impact on Dren's stock price if they introduce the new product line? Assume the equity cost of capital will remain unchanged. 6. At the end of 2019, Newerks Inc. forecasts that its free cash flow will be $50 million in 2020, 560 million in 2021, and 572 million in 2022. After 2022, Newerks expects its free cash flow earnings to grow at an annual rate of 6% Newerks has $75 million in debt and S25 million in cash. If Newerks has 5 million shares outstanding and a cost of capital of 14%, what is Newerks stock price at the end of 2019? 7. List 3 advantages and disadvantages of taking a company public 8. Explain four reasons why companies would want to merge 9. What are some of the alternative sources from which private companies can raise equity capital? 10. Fleming Educational Software, Inc., is selling 500,000 shares of stock in an auction IPO. At the end of the bidding period, Fleming's investment bank has received the following bids: Price Number of Shared 15.00 100.000 75 300 9.15 730 735 700 675 50 150.000 275.000 125.000 What will the offer price of the shares be? 11. NRG Energy, Inc. (NRG) is an energy company with a market debt-equity ratio of 3. Suppose its current debt cost of capital is 6%, and its equity cost of capital is 14% Suppose also that if NRG issues cquity and uses the proceeds to repay its debt and reduce its debt-equity ratio to 2. it will lower its debt cost of capital to 3.5%. With perfect capital markets, what effect will this transaction have on NRG's equity cost of capital and WACC? What would happen if NRG issues even more equity and pays off its debt completely? How would these alternative capital structures affect NRG's enterprise value? 12 Sims Industries, Inc. is considering two machines to replace an old machine. Machine A has a life of 10 years, will cost $24,500, and will produce net cash savings of $4,800 per year. Machine B has an expected life of 5 years, will cost $20,000, and will produce net cash savings in operating costs of S6,000 per year. The company's cost of capital is 14 percent 13. You are running a hot Internet company. Analysts predict that its earnings will grow at 30% per year for the next five years. After that, as competition increases, camnings growth is expected to slow to 2% per year and continue at that level forever. Your company has just announced earnings of $1,000,000. What is the present value of all future earnings if the interest rate is 8%? (Hint: first five years should be treated as an annuity and subsequent years should be treated as a perpetuity and also assume all cash flows occur at the end of the year.) 14. Why can bond covenants reduce a firm's borrowing costs! 14. Why can bond covenants reduce a firm's borrowing costs? 15. Do callable bonds have a higher or lower yield than otherwise identical bonds without a call feature? Why? 16. Explain three limitations of using the Payback Period as an investment decision tool 17. Explain the difference between an Scorporation and a C corporation. 18. Explain the following goals of a firm. a) Profit maximisation b) Shareholder wealth maximization c) Maximizing sales and market share 19. Suppose you own stock in a company. The current price per share is $25. Another company has just announced that it wants to buy your company and will pay $35 per share to acquire all the outstanding stock. Your company's management immediately begins fighting off this hostile bid. Is management acting in the shareholders' best interests? Why or why not? 20. Ebay, Inc. went public in September of 1998. The following information on shares outstanding was listed in the final prospectus filed with the SEC. In the IPO, the Ebay issued 5,500,000 new shares. The initial price to the public was $20.00 per share. The final first-day closing price was $55.88. If the investment bankers retained $2.50 per share as fees, what was the net proceeds to Ebay? What was the market capitalization of new shares of Ebay. 2. Explain three limitations of the Dividend Discount Model and how some of these limitations are addressed by the Total Payout Model 22. Why do you think shareholders from target companies cnjoy an average gain when acquired, while acquiring shareholders often do not gain anything? 23. What is the typical stock price reaction to an SEO? 24. Why should a financial manager be concerned about under- pricing in an SEO how can this problem be minimized through a right issue? Funding Round Series A Series B Series C Pre-Money $8 million $25 million $100 million Post-Money $12 million S40 million $150 million . How much did Kela raise in cach round? Assuming no other securities were issued, what fraction of the firm's shares were held by common shareholders (founders and employees) after each round? What is the distribution of ownership across each security after the Series financing? . If the firm is ultimately sold for $500 million, what multiple of money did each series carn? What will founders and employees receive? (Assume all preferred shares convert to common.) 26. Do underwriters face the most risk from a best-efforts IPO. a firm commitment IPO, or an auction IPO? Why? 2. What is IPO underpricing? If you decide to try to buy shares in every IPO, will you necessarily make money from the underpricing? ** Many firms have devised defenses that make it more difficult or costly for other firms to take them over. How might such defenses affect the firm's agency problems? Are managers of firms with formidable takeover defenses more or less likely to act in the shareholders' interests rather than their own? What would you expect to happen to the share price when management proposes to institute such defenses? ze. In most large corporations, ownership and management are separated. What are the main implications of this separation? Provide 2 advantages and disadvantages of operating these forms businesses (1) the sole proprietorship (2) the partnership: and (3) the corporation. 31. Consider two firms, Ying Corporation and Yang Corporation. Both corporations will either make 550 million or lose S20 million every year with equal probability. The only difference is that firms profits are perfectly negatively correlated. That is, any year Yang Corporation earns 550 million, Ying Corporation loses $20 million, and vice versa. Assume that the corporate tax rate is 34%. What are the total expected after-tax profits if the two firms' when they are two separate firms? What are the expected after-tax profits if the two firms are combined into one corporation called Ying-Yang Corporation, but are run as two independent divisions? (Assume it is not possible to carry back on 32. Connect each term to its correct definition or description. a. poison pill b. tender offer c. shark repellent d. merger e. tax inversion f. proxy contest A. Changes in the corporate charter that are designed to deter an unwelcome takeover B. Measure in which shareholders are issued rights to buy shares if the bidder acquires a large stake in the firm C. Relocation of company domicile to low-tax country often by way of merger D. Offer to buy shares directly from stockholders E. One company assumes all the assets and all the liabilities of another F. Attempt to gain control of a firm by winning the votes of its stockholders