Answered step by step

Verified Expert Solution

Question

1 Approved Answer

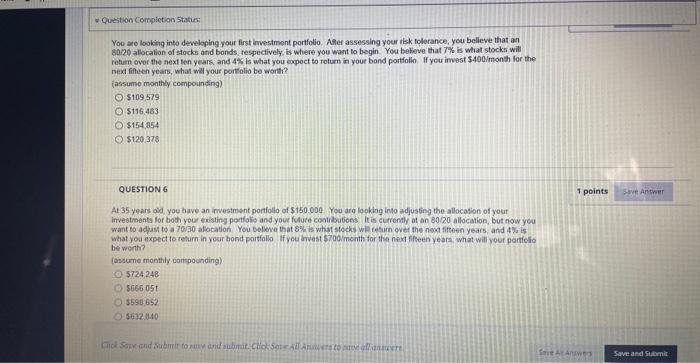

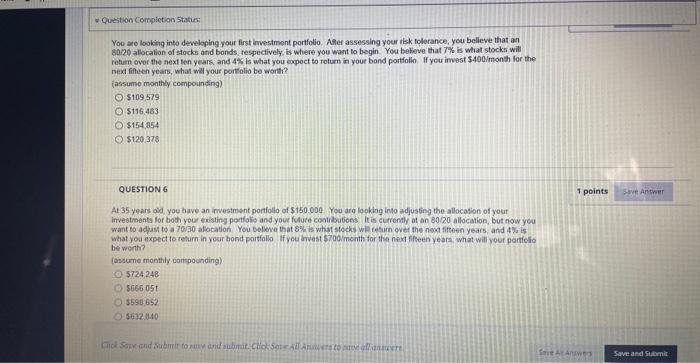

do both if possible You aro looking into developing your first imestment portfolio. Aller assessing your tisk tolerance, you believe that an ban20 alloration of

do both if possible

You aro looking into developing your first imestment portfolio. Aller assessing your tisk tolerance, you believe that an ban20 alloration of stocks and bonds, tespecively, is where you want to begin. You belkeve that T\% is what stocks wili retuen over the next ten years. and 4% is what you expoct to relum in your bond portfolio. If you imvest \$400/mont for the next fitteen years, what will your portinlio be worth? (assume monthly compounding) $109,579$116,483$154,854$120,378 QUESTION 6 At 35 years old you have an mestment portiolio of $150.000. You aro looking into adjusting the allocation of yout investroents for both your existing portolls and your fulure contibutions it is currently at an b0D0 allocation, but now you what you expect to return in your bond portfolio if you brvest $700 imonth for thee next fifeen years, what will your porticlo be werth? (assume monthly compounding) $724,248 $66505t 5590,652 36312.040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started