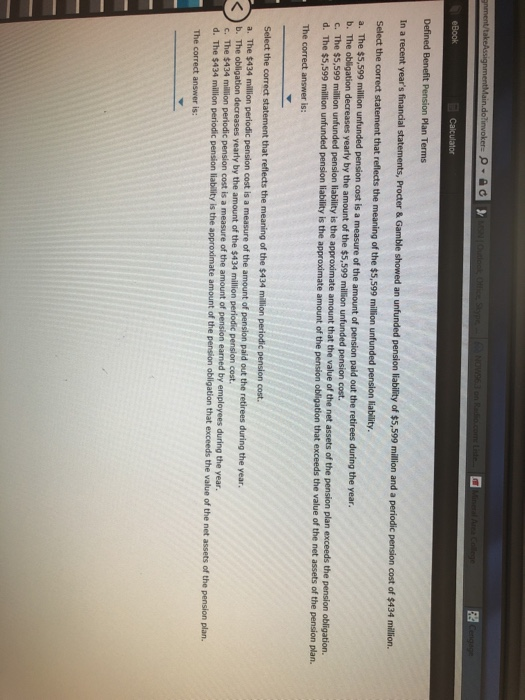

do Calculator Defined Benefit Pension Plan Terms Procter & Gamble showed an unfunded pension lability of $5,599 million and a periodic pension cost of $434 million. the $5,599 million unfunded pension liability Select the correct statement that reflects the meaning of a. The $5,599 million unfunded c. The $5,599 million unfunded pension liability is the approximate amount that the value of cost is a measure of the amount of pension paid out the retirees during the year pension cost. is the e approximate amount that the value of the net assets of the pension plan exceeds the pension obligation approximate amount of the pension obligation that exceeds the value of the net assets of the pension plan. d. The $5,599 million unfunded pension liability is the The correct answer is: Select the correct statement that reflects the meaning of the $434 million periodic pension cost. is a measure of the amount of pension paid out the retirees during the year. a. The $434 million periodic pension cost b. The obligation decreases yearly by the amount of the $434 million periodic pension cost e of the amount of pension eaned by employees during the year. iability is the approximate amount of the pension obligation that exceeds the value of the net assets of the pension plan. d. The $434 million periodic The correct answer is: do Calculator Defined Benefit Pension Plan Terms Procter & Gamble showed an unfunded pension lability of $5,599 million and a periodic pension cost of $434 million. the $5,599 million unfunded pension liability Select the correct statement that reflects the meaning of a. The $5,599 million unfunded c. The $5,599 million unfunded pension liability is the approximate amount that the value of cost is a measure of the amount of pension paid out the retirees during the year pension cost. is the e approximate amount that the value of the net assets of the pension plan exceeds the pension obligation approximate amount of the pension obligation that exceeds the value of the net assets of the pension plan. d. The $5,599 million unfunded pension liability is the The correct answer is: Select the correct statement that reflects the meaning of the $434 million periodic pension cost. is a measure of the amount of pension paid out the retirees during the year. a. The $434 million periodic pension cost b. The obligation decreases yearly by the amount of the $434 million periodic pension cost e of the amount of pension eaned by employees during the year. iability is the approximate amount of the pension obligation that exceeds the value of the net assets of the pension plan. d. The $434 million periodic The correct answer is