Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do carefully ASAP otherwise I will report she hatt a Foreign corporate income tax rate b U.S. corporate income tax rate c Foreign dividend withholding

do carefully ASAP otherwise I will report

she hatt

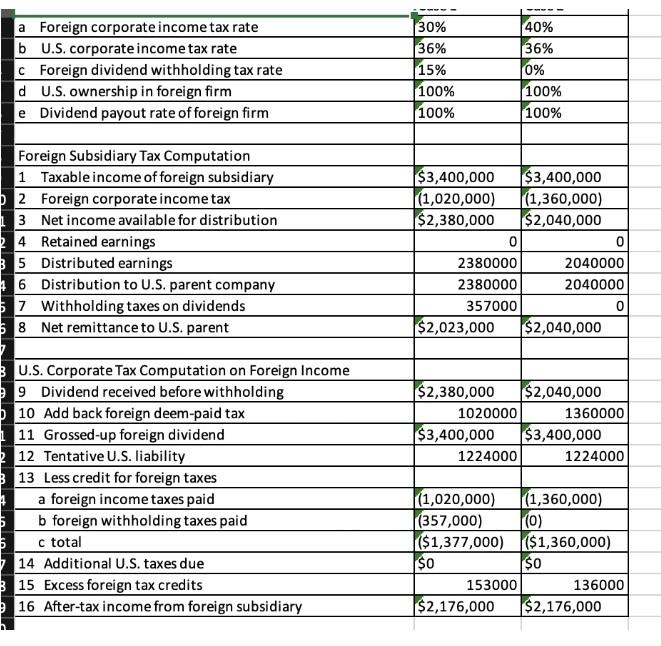

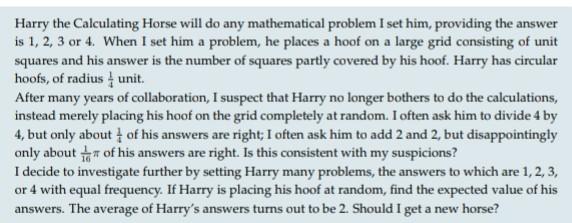

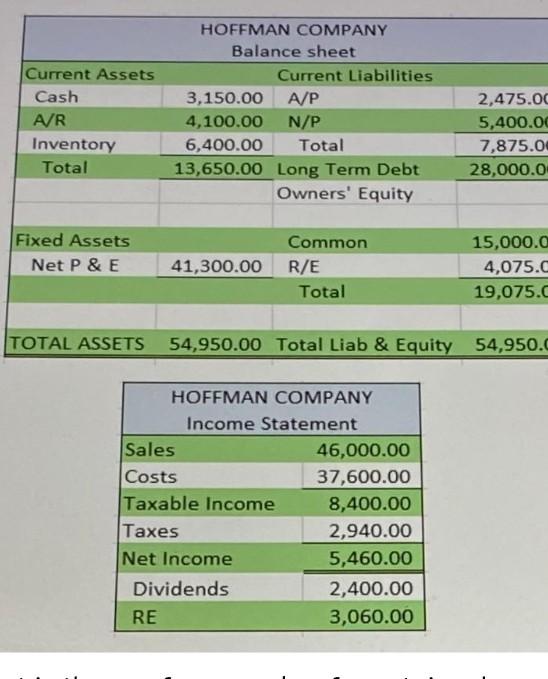

a Foreign corporate income tax rate b U.S. corporate income tax rate c Foreign dividend withholding tax rate d U.S. ownership in foreign firm e Dividend payout rate of foreign firm 30% 36% 15% 100% 100% 40% 36% 0% 100% 100% Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 4 Retained earnings B5 Distributed earnings 6 Distribution to U.S. parent company 7 Withholding taxes on dividends 8 Net remittance to U.S. parent $3,400,000 $3,400,000 (1,020,000) (1,360,000) $2,380,000 $2,040,000 0 0 2380000 2040000 2380000 2040000 357000 0 $2,023,000 $2,040,000 $2,380,000 $2,040,000 1020000 1360000 $3,400,000 $3,400,000 1224000 1224000 U.S. Corporate Tax Computation on Foreign Income 9 Dividend received before withholding 10 Add back foreign deem-paid tax 11 Grossed-up foreign dividend 12 Tentative U.S. liability 13 Less credit for foreign taxes a foreign income taxes paid b foreign withholding taxes paid c total 14 Additional U.S. taxes due 15 Excess foreign tax credits 16 After-tax income from foreign subsidiary (1,020,000) (1,360,000) (357,000) (0) ($1,377,000) ($1,360,000) $0 $0 153000 136000 $2,176,000 $2,176,000 Harry the Calculating Horse will do any mathematical problem I set him, providing the answer is 1, 2, 3 or 4. When I set him a problem, he places a hoof on a large grid consisting of unit squares and his answer is the number of squares partly covered by his hoof. Harry has circular hoofs, of radius unit After many years of collaboration, I suspect that Harry no longer bothers to do the calculations, instead merely placing his hoof on the grid completely at random. I often ask him to divide 4 by 4, but only about of his answers are right; I often ask him to add 2 and 2, but disappointingly only about of his answers are right. Is this consistent with my suspicions? I decide to investigate further by setting Harry many problems, the answers to which are 1, 2, 3, or 4 with equal frequency. If Harry is placing his hoof at random, find the expected value of his answers. The average of Harry's answers turns out to be 2. Should I get a new horse? Current Assets Cash AVR Inventory Total HOFFMAN COMPANY Balance sheet Current Liabilities 3,150.00 A/P 4,100.00 N/P 6,400.00 Total 13,650.00 Long Term Debt Owners' Equity 2,475.00 5,400.0 7,875.00 28,000.0 Fixed Assets Net P & E 41,300.00 Common R/E Total 15,000.0 4,075.C 19,075.C TOTAL ASSETS 54,950.00 Total Liab & Equity 54,950. HOFFMAN COMPANY Income Statement Sales 46,000.00 Costs 37,600.00 Taxable Income 8,400.00 Taxes 2,940.00 Net Income 5,460.00 Dividends 2,400.00 RE 3,060.00 a Foreign corporate income tax rate b U.S. corporate income tax rate c Foreign dividend withholding tax rate d U.S. ownership in foreign firm e Dividend payout rate of foreign firm 30% 36% 15% 100% 100% 40% 36% 0% 100% 100% Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 4 Retained earnings B5 Distributed earnings 6 Distribution to U.S. parent company 7 Withholding taxes on dividends 8 Net remittance to U.S. parent $3,400,000 $3,400,000 (1,020,000) (1,360,000) $2,380,000 $2,040,000 0 0 2380000 2040000 2380000 2040000 357000 0 $2,023,000 $2,040,000 $2,380,000 $2,040,000 1020000 1360000 $3,400,000 $3,400,000 1224000 1224000 U.S. Corporate Tax Computation on Foreign Income 9 Dividend received before withholding 10 Add back foreign deem-paid tax 11 Grossed-up foreign dividend 12 Tentative U.S. liability 13 Less credit for foreign taxes a foreign income taxes paid b foreign withholding taxes paid c total 14 Additional U.S. taxes due 15 Excess foreign tax credits 16 After-tax income from foreign subsidiary (1,020,000) (1,360,000) (357,000) (0) ($1,377,000) ($1,360,000) $0 $0 153000 136000 $2,176,000 $2,176,000 Harry the Calculating Horse will do any mathematical problem I set him, providing the answer is 1, 2, 3 or 4. When I set him a problem, he places a hoof on a large grid consisting of unit squares and his answer is the number of squares partly covered by his hoof. Harry has circular hoofs, of radius unit After many years of collaboration, I suspect that Harry no longer bothers to do the calculations, instead merely placing his hoof on the grid completely at random. I often ask him to divide 4 by 4, but only about of his answers are right; I often ask him to add 2 and 2, but disappointingly only about of his answers are right. Is this consistent with my suspicions? I decide to investigate further by setting Harry many problems, the answers to which are 1, 2, 3, or 4 with equal frequency. If Harry is placing his hoof at random, find the expected value of his answers. The average of Harry's answers turns out to be 2. Should I get a new horse? Current Assets Cash AVR Inventory Total HOFFMAN COMPANY Balance sheet Current Liabilities 3,150.00 A/P 4,100.00 N/P 6,400.00 Total 13,650.00 Long Term Debt Owners' Equity 2,475.00 5,400.0 7,875.00 28,000.0 Fixed Assets Net P & E 41,300.00 Common R/E Total 15,000.0 4,075.C 19,075.C TOTAL ASSETS 54,950.00 Total Liab & Equity 54,950. HOFFMAN COMPANY Income Statement Sales 46,000.00 Costs 37,600.00 Taxable Income 8,400.00 Taxes 2,940.00 Net Income 5,460.00 Dividends 2,400.00 RE 3,060.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started