Answered step by step

Verified Expert Solution

Question

1 Approved Answer

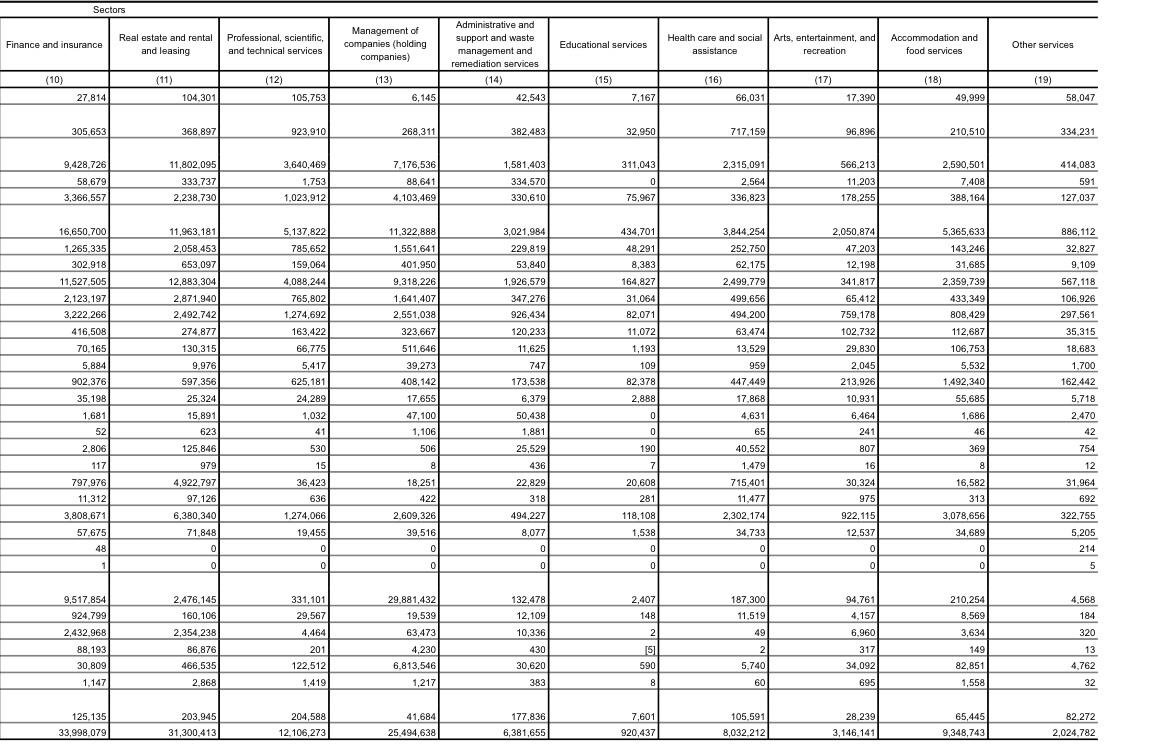

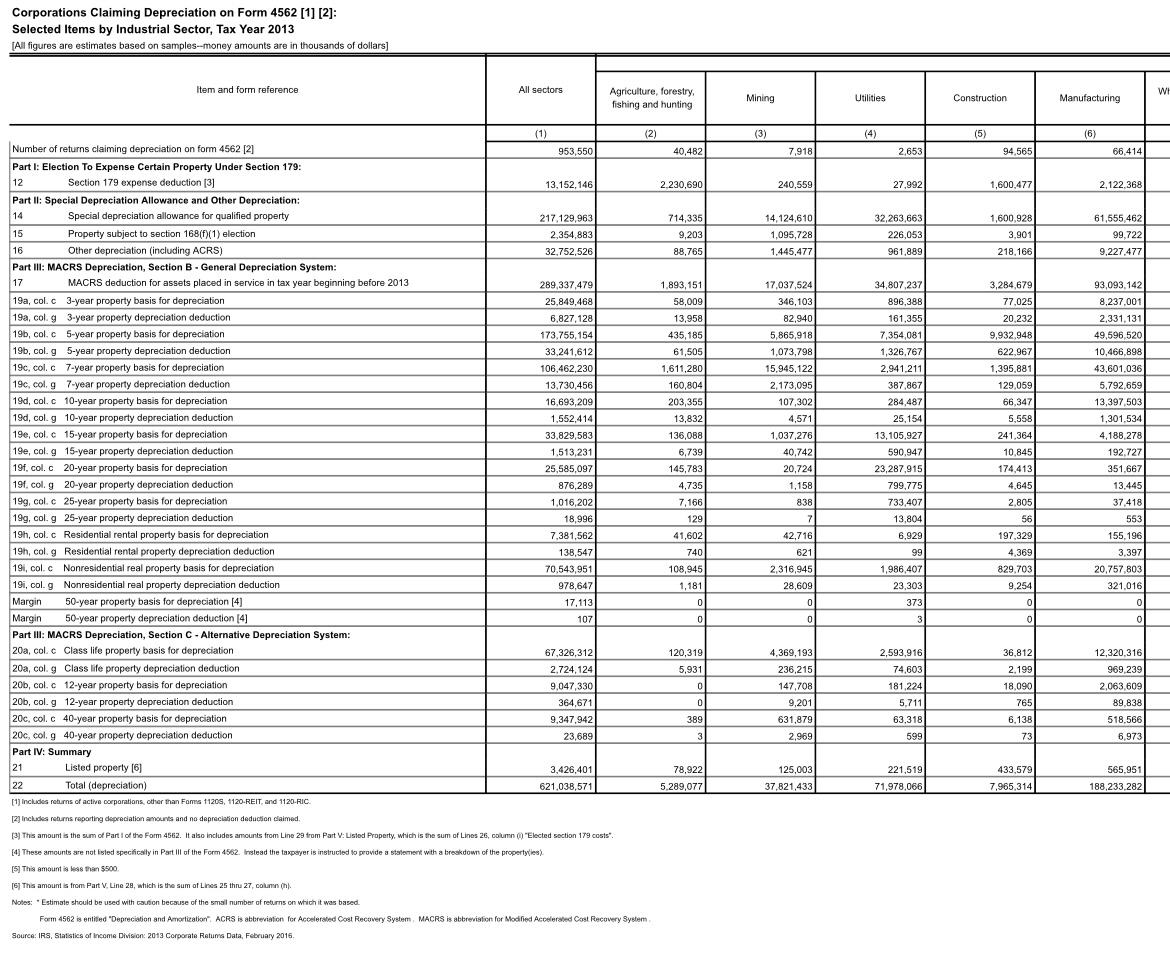

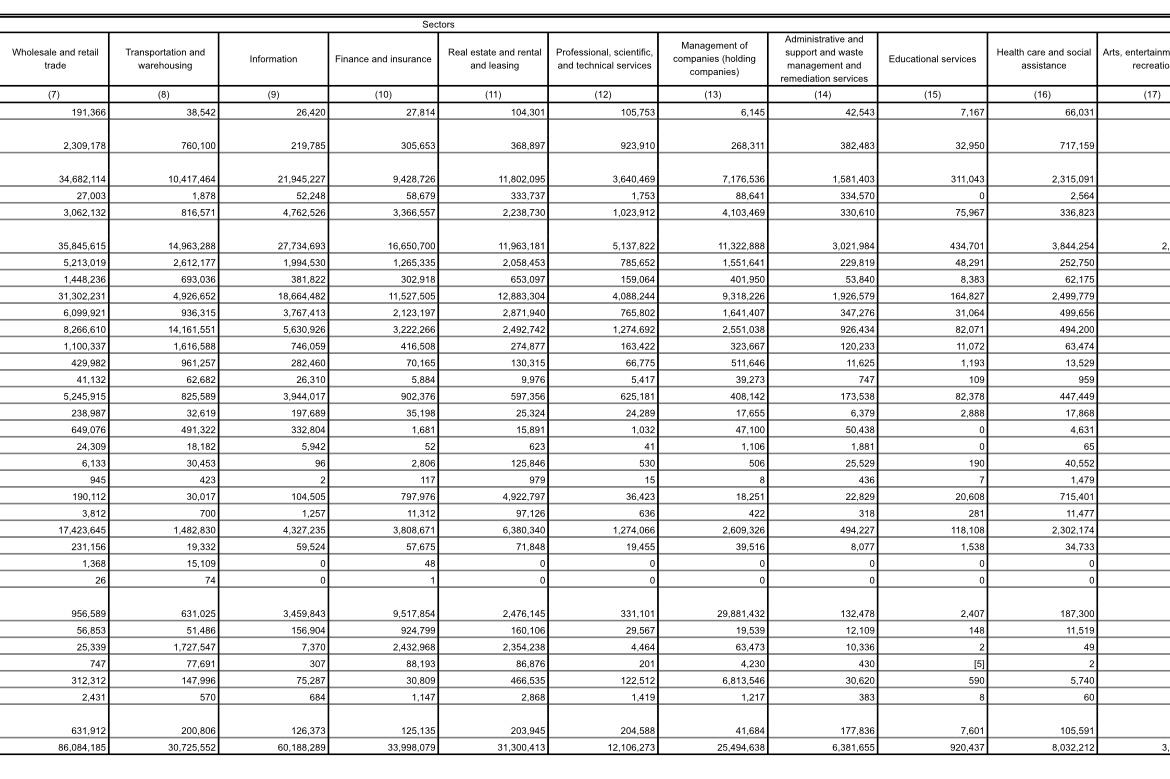

Do depreciation deductions vary by entity type or by industry? Go to the IRS Tax Statistics page (irs.gov/statistics), and review the Excel spreadsheets containing data

Do depreciation deductions vary by entity type or by industry? Go to the IRS Tax Statistics page (irs.gov/statistics), and review the Excel spreadsheets containing data for corporations, partnerships, and nonfarm proprietorships by sector or industry. You can find these in the Business Tax Statistics section of the IRS site.

Evaluate the depreciation deductions by sector (19 sectors are identified in the IRS spreadsheets) and by entity using Excel. E-mail the spreadsheet to your instructor along with a brief summary of your findings.

Sectors Finance and insurance Real estate and rental and leasing Professional, scientific, and technical services Management of companies (holding companies) Educational services Health care and social Arts, entertainment, and assistance recreation Accommodation and food services Other services Administrative and support and waste management and remediation services (14) 42,543 (10) (11) (12) (13) (15) (16) (17) (18) (19) 27,814 104,301 105,753 6,145 7.167 66.031 17,390 49,999 58,047 305,653 368.897 923,910 268,311 382,483 32,950 717.159 96.896 210,510 334 231 11,802,095 311,043 414.083 9,428.726 58.679 3,366.557 3.640,469 1,753 1,023,912 7,176,536 88,641 333.737 2,238.730 1,581,403 334.570 330,610 0 2,315.091 2.564 336.823 566,2131 11.203 178,255 2.590.501 7,408 388,164 591 127,037 4,103,4691 75,967 16,650.700 434,701 11,322,888 1,551,641 3,844,254 252.750 5,365,633 143,246 401,950 62.175 31,685 1,265,335 302,918 11,527,505 2,123,197 3,222 266 416,508 70.165 11,963,181 2,058,453 653,097 12,883,304 2.871.940 2.492.742 274.877 130,315 5,137,822 785,652 159,064 4,088,244 765,802 1.274,692 3,021,984 229,819 53,840 1,926,579 347,276 926,434 120.233 48,291 8,383 164,827 31,064 82,071 9.318,226 1,641,407 2,551,038 323,667 511,646 39,273 408,142 2.499.779 499,656 494 200 63,474 2,050,874 47.203 12.198 341,817 65,412 759,178 102.732 2,359,739 433,349 808,429 886,112 32.827 9.109 567,118 106,926 297,561 35,315 18,683 1,700 162.442 5.718 163,422 66,775 11.072 5.884 9.976 597,356 11,625 747 173,538 5,417 625,181 24,289 1,193 109 82,378 13,529 959 447.449 902.376 35.198 25.324 6,379 2,888 29.830 2.045 213.926 10.931 6,464 241 807 0 1,681 52 17,655 47,100 1,106 506 1,032 41 0 50,438 1,881 25,529 436 15,891 623 125.846 979 4,922.797 97.126 112,687 106,753 5,532 1,492,340 55,685 1,686 46 369 8 16,582 313 2,806 117 190 7 8 16 530 15 36,423 636 22.829 797.976 11.312 3,808,671 20,608 281 17,868 4,631 65 40.552 1,479 715,401 11.477 2,302,174 34.733 g 0 0 30,324 975 2.470 42 754 12 31,964 692 322.755 5,205 214 5 318 18,251 422 2.609,326 39,516 0 6,380.340 1274.066 494,227 57.675 71,848 0 19,455 0 8,077 0 118,108 1,538 0 922, 115 12.537 0 3,078,656 34,689 0 48 1 0 0 0 0 0 0 2,407 2,476,145 160,106 2,354 238 132,478 12,109 187,300 11,519 4,568 184 148 9,517,854 924.799 2,432.968 88,193 30,809 1,147 331, 101 29,567 4,464 201 122,512 49 29,881,432 19,539 63,473 4,230 6,813,546 1,217 94.761 4.157 6.960 317 10,336 430 30,620 86,876 466,535 2,868 210,254 8,569 3,634 149 82,851 2 151 590 8 2 5,740 320 13 4,762 34.092 695 1.419 383 60 1,558 32 28.239 125.135 33,998.079 203.945 31,300,413 204,588 12.106,273 41,684 25.494,638 177,836 6,381,655 7,601 920,437 105.591 8,032.212 65,445 9,348,743 82 272 2.024.782 3,146,141 Corporations Claiming Depreciation on Form 4562 [1] [2]: Selected Items by Industrial Sector, Tax Year 2013 All figures are estimates based on samples--money amounts are in thousands of dollars) Item and form reference All sectors WI Agriculture, forestry fishing and hunting Mining Utilities Construction Manufacturing (3) (4) (5) (6) 7,918 2,653 94,565 66.414 240,559 27,992 1,600.477 2,122.368 14,124,610 1,095,728 32,263,663 226,053 961,889 1,600,928 3.901 61,555,462 99.722 1,445,477 218,166 9,227.477 17,037,524 346,103 82,940 93,093,142 8,237,001 2,331,131 49,596.520 34,807,237 896.388 161,355 7,354 081 1,326,767 2,941.211 387,867 284,487 25,154 3,284,679 77,025 20.232 9,932,948 622,967 1,395,881 129,059 66,347 5,558 5,865,918 1,073,798 15,945,122 2,173,095 107,302 10,466,898 1.611,280 43,601,036 5,792,659 13,397 503 1,301,534 4,188,278 192,727 351,667 13,105,927 590,947 23,287,915 799,775 733,407 241,364 10,845 174,413 4,645 13.445 (1) (2) Number of returns claiming depreciation on form 4562 [2] [2 953,550 40,482 Part I: Election To Expense Certain Property Under Section 179: 12 Section 179 expense deduction (3) 13,152,146 2.230,690 Part II: Special Depreciation Allowance and Other Depreciation: 14 Special depreciation allowance for qualified property 217.129,963 714,335 15 Property subject to section 168(f(1) election 2,354,883 9,203 16 Other depreciation (including ACRS) 32,752,526 88,765 Part III: MACRS Depreciation, Section B - General Depreciation System: 17 MACRS deduction for assets placed in service in tax year beginning before 2013 289,337,479 1.893,151 19a, colc 3-year property basis for depreciation 25,849,468 58,009 19a, colg 3-year property depreciation deduction 6,827, 128 13,958 19b, col. c 5-year property basis for depreciation Preciom 173.755,154 435,185 19b, col. g 5-year property depreciation deduction 33,241,612 61,505 19c, col. c 7-year property basis for depreciation 106,462,230 19c, col. g 7-year property depreciation deduction 13.730,456 160,804 19d, col. c 10-year property basis for depreciation 16,693,209 203,355 19d, col. 10-year property depreciation deduction 1,552,414 13,832 19e, col. 15-year property basis for depreciation 33,829,583 136,088 19e, col. g 15-year property depreciation deduction 1.513,231 6,739 19f. col. 20-year property basis for depreciation 25,585,097 145,783 191. col. g 20-year property depreciation deduction 876,289 4,735 199, col. c 25-year property basis for depreciation 1,016,202 7,166 19g, col.g 25-year property depreciation deduction 18.996 129 19h, col.c Residential rental property basis for depreciation 7,381,562 41,602 19h, colg Residential rental property depreciation deduction 138,547 740 191, col. c Nonresidential real property basis for depreciation 70,543,951 108,945 191, col.g Nonresidential real property depreciation deduction 978,647 1,181 Margin 50-year property basis for depreciation (4) 17,113 0 Margin 50-year property depreciation deduction (4) 107 0 Part III: MACRS Depreciation, Section C - Alternative Depreciation System: 20a, col. Class life property basis for depreciation 67,326,312 120,319 20a, col. g Class life property depreciation deduction 2.724,124 5,931 20b, col. c 12-year property basis for depreciation 9.047,330 0 20b, col.g 12-year property depreciation deduction 364,671 0 20c, col. c 40-year property basis for depreciation . 9.347,942 389 20c, col. g 40-year property depreciation deduction 23,689 3 Part IV: Summary 21 Listed property (6] 3.426.401 78,922 22 Total (depreciation) 621,038,571 5.289,077 [1] Includes returns of active corporations, other than Foms 11205, 1120-REIT, and 1120-RIC [2] Includes reurs reporting depreciation amounts and no depreciation deduction claimed. (3) This amount is the sum of Part 1 of the Form 4662. It also includes amounts from Line 29 from Part V: Listed Property, which is the sum of Lines 26, column() Elected section 179 costs". [4] These amounts are not listed specifically in Part Ill of the Form 4562. Irislead the taxpayer is instructed to provide a statement with a breakdown of the properties) [5] This amount is less than $500 [6] This amount is from Part V. Line 28, which is the sum of Lines 25 thru 27,column (h) Notes: "Estimate should be used with caution because of the small number of returns on which it was based Form 4562 is entitled "Depreciation and Amortization" ACRS is abbreviation for Accelerated Cost Recovery System MACRS is abbreviation for Modified Accelerated Cost Recovery System Source: IRS, Statistics of Income Division 2013 Corporate Retuma Data, February 2016 4,571 1,037,276 40,742 20,724 1,158 838 7 42,716 621 2,316,945 28,609 2,805 56 197,329 37,418 553 155, 196 3.397 13,804 6,929 99 1,986,407 23,303 373 4,369 829.703 20.757,803 321.016 9,254 0 0 0 0 3 0 0 4,369,193 236,215 147,708 9,201 631.879 2,593,916 74,603 181,224 36,812 2.199 18,090 765 12,320,316 969 239 2,063,609 89.838 518.566 6,973 5.711 63,318 599 6,138 73 2.969 565.951 125,003 37.821,433 221,519 71,978.066 433,579 7.965,314 188,233.282 Sectors Wholesale and retail trade Transportation and warehousing Information Finance and insurance Real estate and rental and leasing Professional, scientific, and technical services Management of companies (holding companies) Educational services Health care and social Arts, entertainm assistance recreatio Administrative and support and waste management and remediation services (14) 42,543 (7) (8) (9) (10) (11) (12) (13) (15) (16) (17) 191,366 38,542 26,420 27,814 104,301 105.753 6.145 7.167 66,031 2,309,178 760,100 219,785 305,653 368,897 923.910 268,311 382,483 32,950 717,159 21.945,227 311,043 34 682,114 27,003 10,417,464 1,878 816,571 52,248 9,428,726 58,679 3,366,557 11,802,095 333.737 2,238.730 3,640,469 1.753 1.023.912 7,176,536 88.641 4.103.469 1,581,403 334.5701 330.6101 0 2,315,091 2,564 336.823 3.062,132 4,762,526 75,967 2 35,845,615 5.213,019 1,448,236 16,650,700 1.265,335 11,963,181 2,058.453 27,734,693 1.994,530 381,822 18,664,482 3,767,413 11,322,888 1,551,641 401,950 434,701 48,291 8,383 302,918 31,302,231 14.963,288 2,612,177 693,036 4.926,652 936,315 14,161,551 1,616,588 961,257 62,682 5,137,822 785 652 159,064 4,088.244 765,802 1,274,692 163,422 6,099,921 8,266,610 1,100,337 429,982 41.132 653,097 12,883,304 2,871,940 2,492,742 274,877 130,315 9,976 164,827 31,064 82,071 11,072 5,630,926 746,059 282,460 26,310 3,944,017 197,689 332,804 3,844,254 252.750 62,175 2,499,779 499,656 494,200 63,474 13,529 3,021,984 229,819 53,840 1.926,579 347,276 926,434 120,233 11,625 747 173,538 6,379 50,438 9,318,226 1,641,407 2,551,038 323,667 511,646 39,273 408,142 17,655 47.100 959 11,527,505 2,123,197 3,222,266 416,508 70,165 5,884 902,376 35,198 1,681 52 2,806 117 797.976 11.312 66.775 5.417 625.181 24 289 1,032 1,193 109 82,378 2,888 5,245,915 238,987 649,076 24,309 6,133 945 597.356 25.324 15,891 623 447,449 17,868 4,631 0 0 5,942 825,589 32,619 491,322 18,182 30,453 423 30,017 700 41 530 96 21 104,505 1.881 25,529 436 1,106 506 8 18.251 422 125.846 979 4,922.797 97,1261 6,380 340 15 36,423 190 7 20,608 281 65 40,552 1,479 715,401 11.477 190,112 3,812 636 1,257 4,327,235 59,524 22,829 318 494,227 8,077 3,808,671 57,675 1.274,066 19.455 2,609,326 39,516 71,848 17.423,645 231,156 1,368 26 1.482,830 19,332 15,109 74 118,108 1,538 0 0 2,302,174 34,733 0 0 0 0 0 0 0 48 1 0 0 0 0 0 956,589 132,478 2,476,145 160.106 2,407 148 56,853 25,339 747 631,025 51,486 1,727,547 77,691 331.101 29.567 4,464 12,109 10,336 187,300 11,519 49 2 3,459,843 156,904 7,370 307 75,287 684 9,517,854 924,799 2,432 968 88,193 30,809 1.147 2,354.238 86,876 29,881,432 19,539 63,473 4,230 6,813,546 1,217 201 430 2 [5] 590 30,620 312,312 2,431 147.996 570 466,535 2.868 122,512 1,419 5,740 60 383 8 8 631,912 125,135 203.945 41,684 177,836 7,601 105.591 200,806 30.725,552 126,373 60,188,289 204,588 12,106,273 86,084, 185 , 33,998,079 31,300,413 25,494,638 6,381,655 920,437 8,032.212 3. Sectors Finance and insurance Real estate and rental and leasing Professional, scientific, and technical services Management of companies (holding companies) Educational services Health care and social Arts, entertainment, and assistance recreation Accommodation and food services Other services Administrative and support and waste management and remediation services (14) 42,543 (10) (11) (12) (13) (15) (16) (17) (18) (19) 27,814 104,301 105,753 6,145 7.167 66.031 17,390 49,999 58,047 305,653 368.897 923,910 268,311 382,483 32,950 717.159 96.896 210,510 334 231 11,802,095 311,043 414.083 9,428.726 58.679 3,366.557 3.640,469 1,753 1,023,912 7,176,536 88,641 333.737 2,238.730 1,581,403 334.570 330,610 0 2,315.091 2.564 336.823 566,2131 11.203 178,255 2.590.501 7,408 388,164 591 127,037 4,103,4691 75,967 16,650.700 434,701 11,322,888 1,551,641 3,844,254 252.750 5,365,633 143,246 401,950 62.175 31,685 1,265,335 302,918 11,527,505 2,123,197 3,222 266 416,508 70.165 11,963,181 2,058,453 653,097 12,883,304 2.871.940 2.492.742 274.877 130,315 5,137,822 785,652 159,064 4,088,244 765,802 1.274,692 3,021,984 229,819 53,840 1,926,579 347,276 926,434 120.233 48,291 8,383 164,827 31,064 82,071 9.318,226 1,641,407 2,551,038 323,667 511,646 39,273 408,142 2.499.779 499,656 494 200 63,474 2,050,874 47.203 12.198 341,817 65,412 759,178 102.732 2,359,739 433,349 808,429 886,112 32.827 9.109 567,118 106,926 297,561 35,315 18,683 1,700 162.442 5.718 163,422 66,775 11.072 5.884 9.976 597,356 11,625 747 173,538 5,417 625,181 24,289 1,193 109 82,378 13,529 959 447.449 902.376 35.198 25.324 6,379 2,888 29.830 2.045 213.926 10.931 6,464 241 807 0 1,681 52 17,655 47,100 1,106 506 1,032 41 0 50,438 1,881 25,529 436 15,891 623 125.846 979 4,922.797 97.126 112,687 106,753 5,532 1,492,340 55,685 1,686 46 369 8 16,582 313 2,806 117 190 7 8 16 530 15 36,423 636 22.829 797.976 11.312 3,808,671 20,608 281 17,868 4,631 65 40.552 1,479 715,401 11.477 2,302,174 34.733 g 0 0 30,324 975 2.470 42 754 12 31,964 692 322.755 5,205 214 5 318 18,251 422 2.609,326 39,516 0 6,380.340 1274.066 494,227 57.675 71,848 0 19,455 0 8,077 0 118,108 1,538 0 922, 115 12.537 0 3,078,656 34,689 0 48 1 0 0 0 0 0 0 2,407 2,476,145 160,106 2,354 238 132,478 12,109 187,300 11,519 4,568 184 148 9,517,854 924.799 2,432.968 88,193 30,809 1,147 331, 101 29,567 4,464 201 122,512 49 29,881,432 19,539 63,473 4,230 6,813,546 1,217 94.761 4.157 6.960 317 10,336 430 30,620 86,876 466,535 2,868 210,254 8,569 3,634 149 82,851 2 151 590 8 2 5,740 320 13 4,762 34.092 695 1.419 383 60 1,558 32 28.239 125.135 33,998.079 203.945 31,300,413 204,588 12.106,273 41,684 25.494,638 177,836 6,381,655 7,601 920,437 105.591 8,032.212 65,445 9,348,743 82 272 2.024.782 3,146,141 Corporations Claiming Depreciation on Form 4562 [1] [2]: Selected Items by Industrial Sector, Tax Year 2013 All figures are estimates based on samples--money amounts are in thousands of dollars) Item and form reference All sectors WI Agriculture, forestry fishing and hunting Mining Utilities Construction Manufacturing (3) (4) (5) (6) 7,918 2,653 94,565 66.414 240,559 27,992 1,600.477 2,122.368 14,124,610 1,095,728 32,263,663 226,053 961,889 1,600,928 3.901 61,555,462 99.722 1,445,477 218,166 9,227.477 17,037,524 346,103 82,940 93,093,142 8,237,001 2,331,131 49,596.520 34,807,237 896.388 161,355 7,354 081 1,326,767 2,941.211 387,867 284,487 25,154 3,284,679 77,025 20.232 9,932,948 622,967 1,395,881 129,059 66,347 5,558 5,865,918 1,073,798 15,945,122 2,173,095 107,302 10,466,898 1.611,280 43,601,036 5,792,659 13,397 503 1,301,534 4,188,278 192,727 351,667 13,105,927 590,947 23,287,915 799,775 733,407 241,364 10,845 174,413 4,645 13.445 (1) (2) Number of returns claiming depreciation on form 4562 [2] [2 953,550 40,482 Part I: Election To Expense Certain Property Under Section 179: 12 Section 179 expense deduction (3) 13,152,146 2.230,690 Part II: Special Depreciation Allowance and Other Depreciation: 14 Special depreciation allowance for qualified property 217.129,963 714,335 15 Property subject to section 168(f(1) election 2,354,883 9,203 16 Other depreciation (including ACRS) 32,752,526 88,765 Part III: MACRS Depreciation, Section B - General Depreciation System: 17 MACRS deduction for assets placed in service in tax year beginning before 2013 289,337,479 1.893,151 19a, colc 3-year property basis for depreciation 25,849,468 58,009 19a, colg 3-year property depreciation deduction 6,827, 128 13,958 19b, col. c 5-year property basis for depreciation Preciom 173.755,154 435,185 19b, col. g 5-year property depreciation deduction 33,241,612 61,505 19c, col. c 7-year property basis for depreciation 106,462,230 19c, col. g 7-year property depreciation deduction 13.730,456 160,804 19d, col. c 10-year property basis for depreciation 16,693,209 203,355 19d, col. 10-year property depreciation deduction 1,552,414 13,832 19e, col. 15-year property basis for depreciation 33,829,583 136,088 19e, col. g 15-year property depreciation deduction 1.513,231 6,739 19f. col. 20-year property basis for depreciation 25,585,097 145,783 191. col. g 20-year property depreciation deduction 876,289 4,735 199, col. c 25-year property basis for depreciation 1,016,202 7,166 19g, col.g 25-year property depreciation deduction 18.996 129 19h, col.c Residential rental property basis for depreciation 7,381,562 41,602 19h, colg Residential rental property depreciation deduction 138,547 740 191, col. c Nonresidential real property basis for depreciation 70,543,951 108,945 191, col.g Nonresidential real property depreciation deduction 978,647 1,181 Margin 50-year property basis for depreciation (4) 17,113 0 Margin 50-year property depreciation deduction (4) 107 0 Part III: MACRS Depreciation, Section C - Alternative Depreciation System: 20a, col. Class life property basis for depreciation 67,326,312 120,319 20a, col. g Class life property depreciation deduction 2.724,124 5,931 20b, col. c 12-year property basis for depreciation 9.047,330 0 20b, col.g 12-year property depreciation deduction 364,671 0 20c, col. c 40-year property basis for depreciation . 9.347,942 389 20c, col. g 40-year property depreciation deduction 23,689 3 Part IV: Summary 21 Listed property (6] 3.426.401 78,922 22 Total (depreciation) 621,038,571 5.289,077 [1] Includes returns of active corporations, other than Foms 11205, 1120-REIT, and 1120-RIC [2] Includes reurs reporting depreciation amounts and no depreciation deduction claimed. (3) This amount is the sum of Part 1 of the Form 4662. It also includes amounts from Line 29 from Part V: Listed Property, which is the sum of Lines 26, column() Elected section 179 costs". [4] These amounts are not listed specifically in Part Ill of the Form 4562. Irislead the taxpayer is instructed to provide a statement with a breakdown of the properties) [5] This amount is less than $500 [6] This amount is from Part V. Line 28, which is the sum of Lines 25 thru 27,column (h) Notes: "Estimate should be used with caution because of the small number of returns on which it was based Form 4562 is entitled "Depreciation and Amortization" ACRS is abbreviation for Accelerated Cost Recovery System MACRS is abbreviation for Modified Accelerated Cost Recovery System Source: IRS, Statistics of Income Division 2013 Corporate Retuma Data, February 2016 4,571 1,037,276 40,742 20,724 1,158 838 7 42,716 621 2,316,945 28,609 2,805 56 197,329 37,418 553 155, 196 3.397 13,804 6,929 99 1,986,407 23,303 373 4,369 829.703 20.757,803 321.016 9,254 0 0 0 0 3 0 0 4,369,193 236,215 147,708 9,201 631.879 2,593,916 74,603 181,224 36,812 2.199 18,090 765 12,320,316 969 239 2,063,609 89.838 518.566 6,973 5.711 63,318 599 6,138 73 2.969 565.951 125,003 37.821,433 221,519 71,978.066 433,579 7.965,314 188,233.282 Sectors Wholesale and retail trade Transportation and warehousing Information Finance and insurance Real estate and rental and leasing Professional, scientific, and technical services Management of companies (holding companies) Educational services Health care and social Arts, entertainm assistance recreatio Administrative and support and waste management and remediation services (14) 42,543 (7) (8) (9) (10) (11) (12) (13) (15) (16) (17) 191,366 38,542 26,420 27,814 104,301 105.753 6.145 7.167 66,031 2,309,178 760,100 219,785 305,653 368,897 923.910 268,311 382,483 32,950 717,159 21.945,227 311,043 34 682,114 27,003 10,417,464 1,878 816,571 52,248 9,428,726 58,679 3,366,557 11,802,095 333.737 2,238.730 3,640,469 1.753 1.023.912 7,176,536 88.641 4.103.469 1,581,403 334.5701 330.6101 0 2,315,091 2,564 336.823 3.062,132 4,762,526 75,967 2 35,845,615 5.213,019 1,448,236 16,650,700 1.265,335 11,963,181 2,058.453 27,734,693 1.994,530 381,822 18,664,482 3,767,413 11,322,888 1,551,641 401,950 434,701 48,291 8,383 302,918 31,302,231 14.963,288 2,612,177 693,036 4.926,652 936,315 14,161,551 1,616,588 961,257 62,682 5,137,822 785 652 159,064 4,088.244 765,802 1,274,692 163,422 6,099,921 8,266,610 1,100,337 429,982 41.132 653,097 12,883,304 2,871,940 2,492,742 274,877 130,315 9,976 164,827 31,064 82,071 11,072 5,630,926 746,059 282,460 26,310 3,944,017 197,689 332,804 3,844,254 252.750 62,175 2,499,779 499,656 494,200 63,474 13,529 3,021,984 229,819 53,840 1.926,579 347,276 926,434 120,233 11,625 747 173,538 6,379 50,438 9,318,226 1,641,407 2,551,038 323,667 511,646 39,273 408,142 17,655 47.100 959 11,527,505 2,123,197 3,222,266 416,508 70,165 5,884 902,376 35,198 1,681 52 2,806 117 797.976 11.312 66.775 5.417 625.181 24 289 1,032 1,193 109 82,378 2,888 5,245,915 238,987 649,076 24,309 6,133 945 597.356 25.324 15,891 623 447,449 17,868 4,631 0 0 5,942 825,589 32,619 491,322 18,182 30,453 423 30,017 700 41 530 96 21 104,505 1.881 25,529 436 1,106 506 8 18.251 422 125.846 979 4,922.797 97,1261 6,380 340 15 36,423 190 7 20,608 281 65 40,552 1,479 715,401 11.477 190,112 3,812 636 1,257 4,327,235 59,524 22,829 318 494,227 8,077 3,808,671 57,675 1.274,066 19.455 2,609,326 39,516 71,848 17.423,645 231,156 1,368 26 1.482,830 19,332 15,109 74 118,108 1,538 0 0 2,302,174 34,733 0 0 0 0 0 0 0 48 1 0 0 0 0 0 956,589 132,478 2,476,145 160.106 2,407 148 56,853 25,339 747 631,025 51,486 1,727,547 77,691 331.101 29.567 4,464 12,109 10,336 187,300 11,519 49 2 3,459,843 156,904 7,370 307 75,287 684 9,517,854 924,799 2,432 968 88,193 30,809 1.147 2,354.238 86,876 29,881,432 19,539 63,473 4,230 6,813,546 1,217 201 430 2 [5] 590 30,620 312,312 2,431 147.996 570 466,535 2.868 122,512 1,419 5,740 60 383 8 8 631,912 125,135 203.945 41,684 177,836 7,601 105.591 200,806 30.725,552 126,373 60,188,289 204,588 12,106,273 86,084, 185 , 33,998,079 31,300,413 25,494,638 6,381,655 920,437 8,032.212 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started