Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do E6-11, please! Replace Part C with these questions, c. Assume that the LIFO reserve last year (2013) was $1,219. What would Cost of Goods

Do E6-11, please! Replace Part C with these questions,

c. Assume that the LIFO reserve last year (2013) was $1,219. What would Cost of Goods Sold be for 2014 under FIFO?

d. Assume sales are $24,178. Compute the Gross Profit % using LIFO and FIFO.

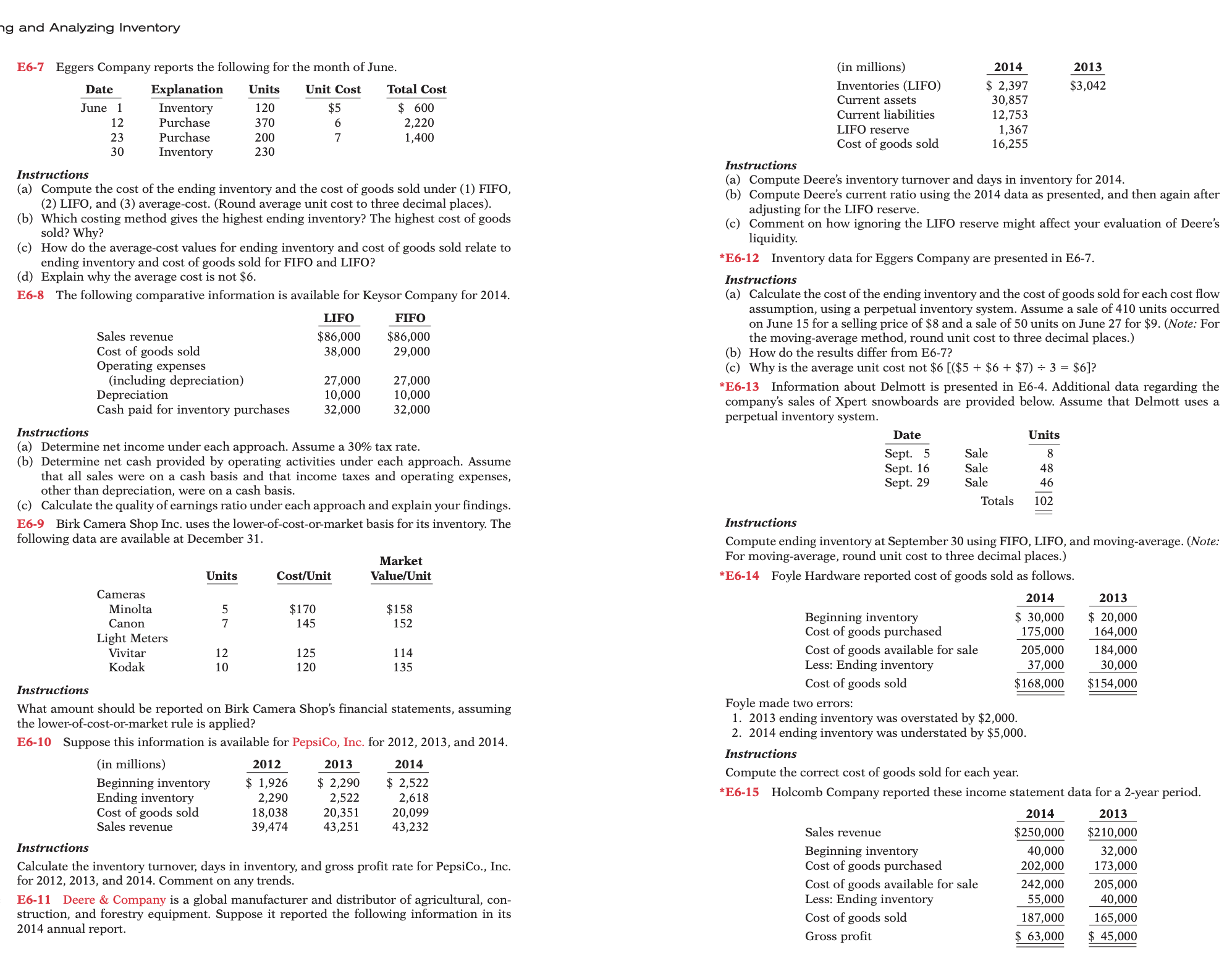

ing and Analyzing Inventory E6-7 Eggers Company reports the following for the month of June. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average-cost. (Round average unit cost to three decimal places). (b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why? (c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO? (d) Explain why the average cost is not $6. E6-8 The following comparative information is available for Keysor Company for 2014. Instructions (a) Determine net income under each approach. Assume a 30% tax rate. (b) Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. (c) Calculate the quality of earnings ratio under each approach and explain your findings. E6-9 Birk Camera Shop Inc. uses the lower-of-cost-or-market basis for its inventory. The following data are available at December 31. Instructions What amount should be reported on Birk Camera Shop's financial statements, assuming the lower-of-cost-or-market rule is applied? E6-10 Suppose this information is available for PepsiCo, Inc. for 2012, 2013, and 2014. Instructions Calculate the inventory turnover, days in inventory, and gross profit rate for PepsiCo., Inc. for 2012, 2013, and 2014. Comment on any trends. E6-11 Deere \& Company is a global manufacturer and distributor of agricultural, construction, and forestry equipment. Suppose it reported the following information in its 2014 annual report. Instructions (a) Compute Deere's inventory turnover and days in inventory for 2014. (b) Compute Deere's current ratio using the 2014 data as presented, and then again after adjusting for the LIFO reserve. (c) Comment on how ignoring the LIFO reserve might affect your evaluation of Deere's liquidity. *E6-12 Inventory data for Eggers Company are presented in E6-7. Instructions (a) Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. Assume a sale of 410 units occurred on June 15 for a selling price of $8 and a sale of 50 units on June 27 for \$9. (Note: For the moving-average method, round unit cost to three decimal places.) (b) How do the results differ from E6-7? (c) Why is the average unit cost not $6[($5+$6+$7)3=$6] ? *E6-13 Information about Delmott is presented in E6-4. Additional data regarding the company's sales of Xpert snowboards are provided below. Assume that Delmott uses a perpetual inventory system. Instructions Compute ending inventory at September 30 using FIFO, LIFO, and moving-average. (Note: For moving-average, round unit cost to three decimal places.) *E6-14 Foyle Hardware reported cost of goods sold as follows. Foyle made two errors: 1. 2013 ending inventory was overstated by $2,000. 2. 2014 ending inventory was understated by $5,000. Instructions Compute the correct cost of goods sold for each year. *E6-15 Holcomb Company reported these income statement data for a 2-year periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started