do excel work

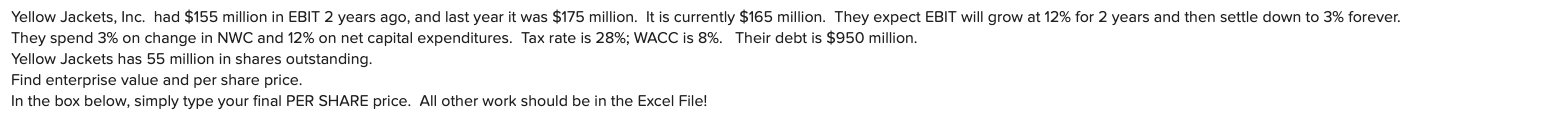

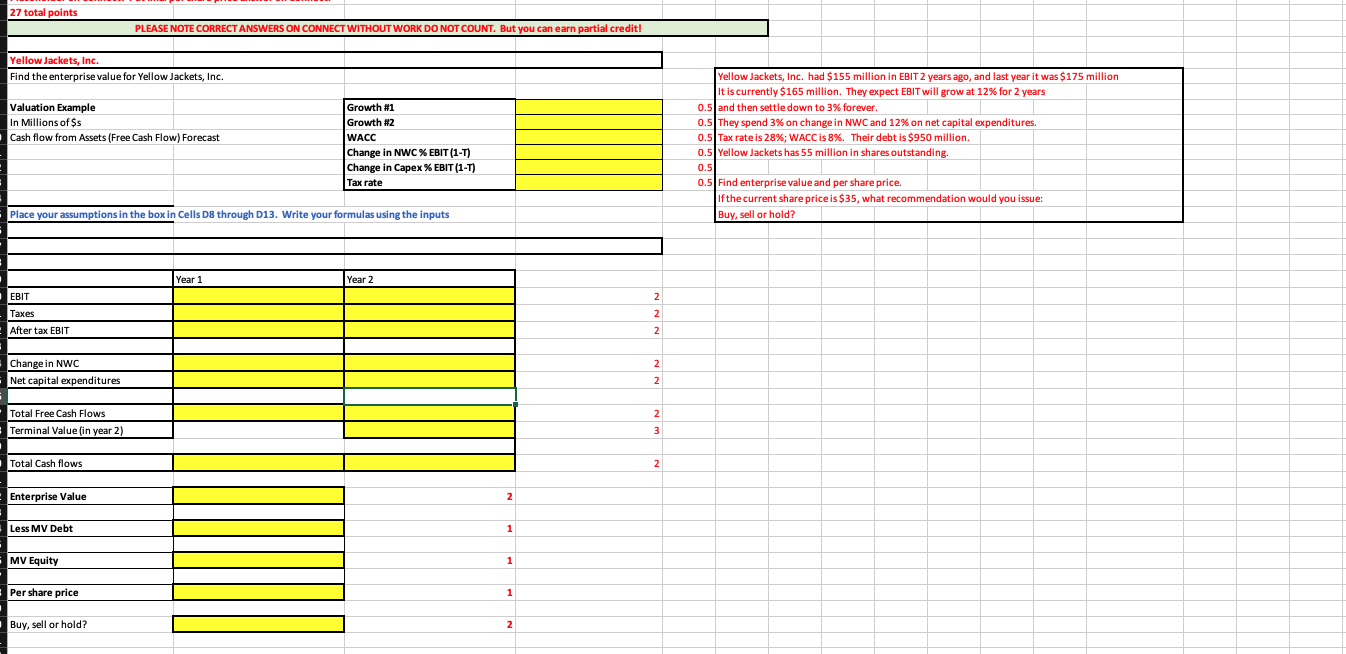

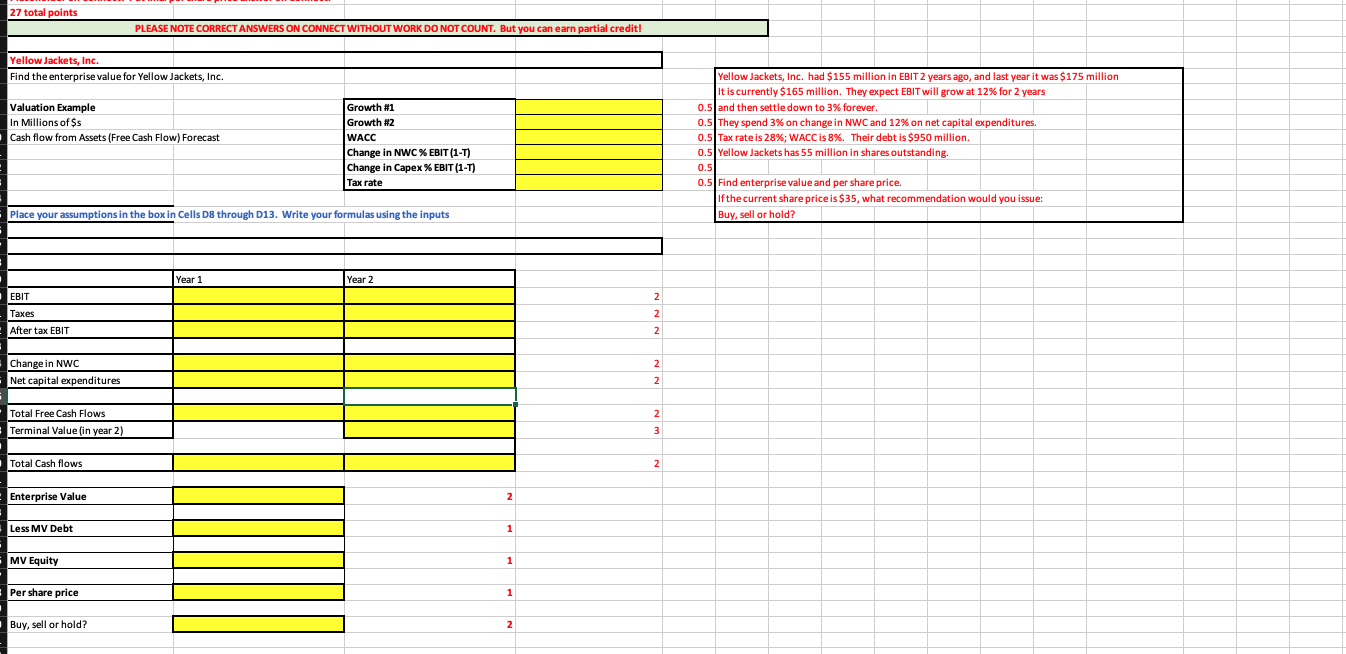

Yellow Jackets, Inc. had $155 million in EBIT 2 years ago, and last year it was $175 million. It is currently $165 million. They expect EBIT will grow at 12% for 2 years and then settle down to 3% forever. They spend 3% on change in NWC and 12% on net capital expenditures. Tax rate is 28%; WACC is 8%. Their debt is $950 million. Yellow Jackets has 55 million in shares outstanding. Find enterprise value and per share price. In the box below, simply type your final PER SHARE price. All other work should be in the Excel File! 27 total points PLEASE NOTE CORRECT ANSWERS ON CONNECT WITHOUT WORK DO NOT COUNT. But you can earn partial credit! Yellow Jackets, Inc. Find the enterprise value for Yellow Jackets, Inc. Valuation Example In Millions of $s Cash flow from Assets (Free Cash Flow) Forecast Growth #1 Growth 2 WACC Change in NWC%EBIT (1-1) Change in Capex % EBIT (1-T) Tax rate Yellow Jackets, Inc. had $155 million in EBIT 2 years ago, and last year it was $175 million It is currently $165 million. They expect EBIT will grow at 12% for 2 years 0.5 and then settle down to 3% forever. 0.5 They spend 3% on change in NWC and 12% on net capital expenditures. 0.5 Tax rate is 28%; WACC is 8%. Their debt is $950 million. 0.5 Yellow Jackets has 55 million in shares outstanding. 0.5 0.5 Find enterprise value and per share price. If the current share price is $35, what recommendation would you issue: Buy, sell or hold? Place your assumptions in the box in Cells D8 through D13. Write your formulas using the inputs Year 1 Year 2 EBIT Taxes After tax EBIT 2 2 2 2 Change in NWC Net capital expenditures 2 2 Total Free Cash Flows Terminal Value (in year 2) 3 Total Cash flows 2 Enterprise Value Less MV Debt MV Equity Per share price Buy, sell or hold? Yellow Jackets, Inc. had $155 million in EBIT 2 years ago, and last year it was $175 million. It is currently $165 million. They expect EBIT will grow at 12% for 2 years and then settle down to 3% forever. They spend 3% on change in NWC and 12% on net capital expenditures. Tax rate is 28%; WACC is 8%. Their debt is $950 million. Yellow Jackets has 55 million in shares outstanding. Find enterprise value and per share price. In the box below, simply type your final PER SHARE price. All other work should be in the Excel File! 27 total points PLEASE NOTE CORRECT ANSWERS ON CONNECT WITHOUT WORK DO NOT COUNT. But you can earn partial credit! Yellow Jackets, Inc. Find the enterprise value for Yellow Jackets, Inc. Valuation Example In Millions of $s Cash flow from Assets (Free Cash Flow) Forecast Growth #1 Growth 2 WACC Change in NWC%EBIT (1-1) Change in Capex % EBIT (1-T) Tax rate Yellow Jackets, Inc. had $155 million in EBIT 2 years ago, and last year it was $175 million It is currently $165 million. They expect EBIT will grow at 12% for 2 years 0.5 and then settle down to 3% forever. 0.5 They spend 3% on change in NWC and 12% on net capital expenditures. 0.5 Tax rate is 28%; WACC is 8%. Their debt is $950 million. 0.5 Yellow Jackets has 55 million in shares outstanding. 0.5 0.5 Find enterprise value and per share price. If the current share price is $35, what recommendation would you issue: Buy, sell or hold? Place your assumptions in the box in Cells D8 through D13. Write your formulas using the inputs Year 1 Year 2 EBIT Taxes After tax EBIT 2 2 2 2 Change in NWC Net capital expenditures 2 2 Total Free Cash Flows Terminal Value (in year 2) 3 Total Cash flows 2 Enterprise Value Less MV Debt MV Equity Per share price Buy, sell or hold