Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do free cash flows exhibit different features across various stages of a firms development, and why? Explain briefly A comparative balance sheet for Alpha Company,

Do free cash flows exhibit different features across various stages of a firms development, and why? Explain briefly

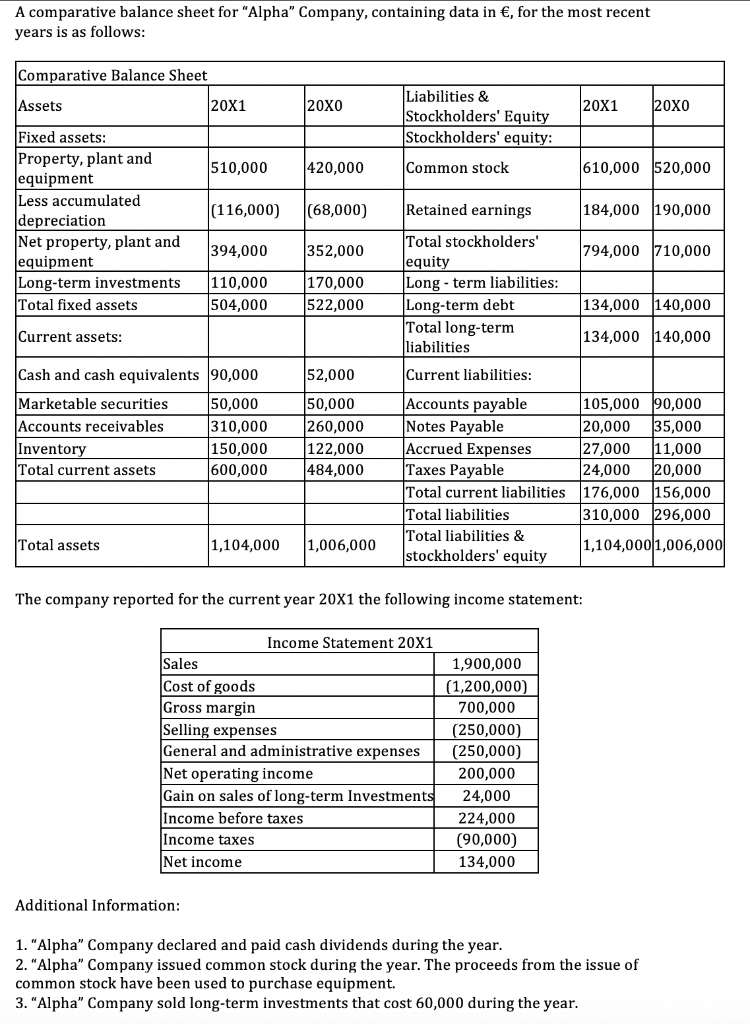

A comparative balance sheet for "Alpha" Company, containing data in , for the most recent years is as follows: Comparative Balance Sheet Assets 20X1 20x0 20X1 20x0 Liabilities & Stockholders' Equity Stockholders' equity: 510,000 420,000 Common stock 610,000 $20,000 (116,000) (68,000) Retained earnings 184,000 190,000 Fixed assets: Property, plant and Jequipment Less accumulated depreciation Net property, plant and equipment Long-term investments Total fixed assets 394,000 352,000 794,000 710,000 110,000 504,000 170,000 522,000 Total stockholders' equity Long-term liabilities: Long-term debt Total long-term liabilities 134,000 140,000 Current assets: 134,000 140,000 52,000 Current liabilities: Cash and cash equivalents 90,000 Marketable securities 50,000 Accounts receivables 310,000 Inventory 150,000 Total current assets 600,000 50,000 260,000 122,000 484,000 Accounts payable 105,000 90,000 Notes Payable 20,000 35,000 Accrued Expenses 27,000 11,000 Taxes Payable 24,000 20,000 Total current liabilities 176,000 156,000 Total liabilities 310,000 296,000 Total liabilities & 1,104,000 1,006,000 stockholders' equity Total assets 1,104,000 1,006,000 The company reported for the current year 20X1 the following income statement: Income Statement 20X1 Sales 1,900,000 Cost of goods (1,200,000) Gross margin 700,000 Selling expenses (250,000) General and administrative expenses (250,000) Net operating income 200,000 Gain on sales of long-term Investments 24,000 Income before taxes 224,000 Income taxes (90,000) Net income 134,000 Additional Information: 1. "Alpha" Company declared and paid cash dividends during the year. 2. "Alpha" Company issued common stock during the year. The proceeds from the issue of common stock have been used to purchase equipment. 3. "Alpha" Company sold long-term investments that cost 60,000 during the year. A comparative balance sheet for "Alpha" Company, containing data in , for the most recent years is as follows: Comparative Balance Sheet Assets 20X1 20x0 20X1 20x0 Liabilities & Stockholders' Equity Stockholders' equity: 510,000 420,000 Common stock 610,000 $20,000 (116,000) (68,000) Retained earnings 184,000 190,000 Fixed assets: Property, plant and Jequipment Less accumulated depreciation Net property, plant and equipment Long-term investments Total fixed assets 394,000 352,000 794,000 710,000 110,000 504,000 170,000 522,000 Total stockholders' equity Long-term liabilities: Long-term debt Total long-term liabilities 134,000 140,000 Current assets: 134,000 140,000 52,000 Current liabilities: Cash and cash equivalents 90,000 Marketable securities 50,000 Accounts receivables 310,000 Inventory 150,000 Total current assets 600,000 50,000 260,000 122,000 484,000 Accounts payable 105,000 90,000 Notes Payable 20,000 35,000 Accrued Expenses 27,000 11,000 Taxes Payable 24,000 20,000 Total current liabilities 176,000 156,000 Total liabilities 310,000 296,000 Total liabilities & 1,104,000 1,006,000 stockholders' equity Total assets 1,104,000 1,006,000 The company reported for the current year 20X1 the following income statement: Income Statement 20X1 Sales 1,900,000 Cost of goods (1,200,000) Gross margin 700,000 Selling expenses (250,000) General and administrative expenses (250,000) Net operating income 200,000 Gain on sales of long-term Investments 24,000 Income before taxes 224,000 Income taxes (90,000) Net income 134,000 Additional Information: 1. "Alpha" Company declared and paid cash dividends during the year. 2. "Alpha" Company issued common stock during the year. The proceeds from the issue of common stock have been used to purchase equipment. 3. "Alpha" Company sold long-term investments that cost 60,000 during the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started