Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do help me for this ques what information do you need sir/madam ? QUESTION 3 (TOTAL: 20 MARKS) (a) For financial year ended 31 October

Do help me for this ques

what information do you need sir/madam ?

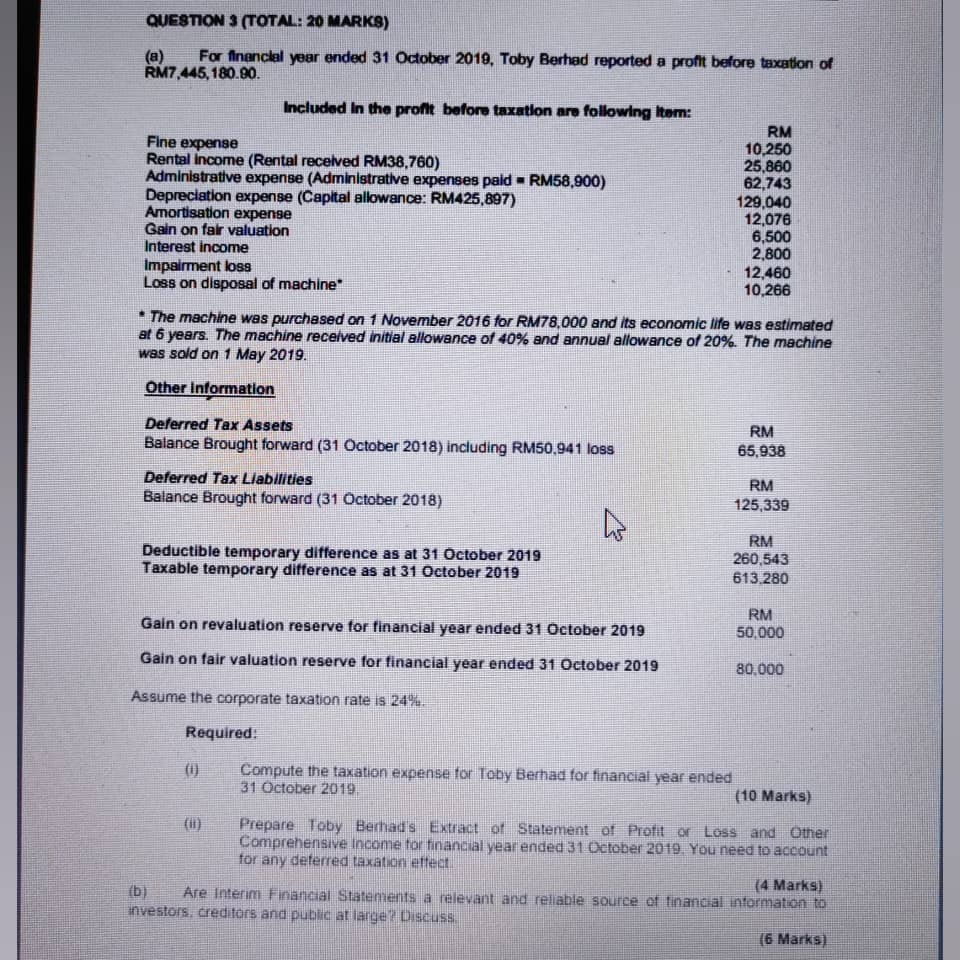

QUESTION 3 (TOTAL: 20 MARKS) (a) For financial year ended 31 October 2019, Toby Berhad reported a profit before taxation of RM7,445, 180.90. Included in the profit before taxation are following Item: Fine expense Rental income (Rental received RM38,760) Administrative expense (Administrative expenses paid = RM58,900) Depreciation expense (Capital allowance: RM425,897) Amortisation expense Gain on fair valuation Interest income Impairment loss Loss on disposal of machine RM 10.250 25,860 62,743 129,040 12,076 6,500 2,800 12,460 10,266 The machine was purchased on 1 November 2016 for RM78,000 and its economic life was estimated at 6 years. The machine received initial allowance of 40% and annual allowance of 20%. The machine was sold on 1 May 2019. Other Information Deferred Tax Assets Balance Brought forward (31 October 2018) including RM50,941 loss RM 65,938 Deferred Tax Llabilities Balance Brought forward (31 October 2018) RM 125,339 Deductible temporary difference as at 31 October 2019 Taxable temporary difference as at 31 October 2019 RM 260,543 613.280 Gain on revaluation reserve for financial year ended 31 October 2019 RM 50.000 Gain on fair valuation reserve for financial year ended 31 October 2019 80.000 Assume the corporate taxation rate is 24%. Required: (0) Compute the taxation expense for Toby Berhad for financial year ended 31 October 2019 (10 Marks) Prepare Toby Berhads Extract of Statement of Profit or Loss and Other Comprehensive income for financial year ended 31 October 2019. You need to account for any deferred taxation effect (4 Marks) ib Are Interim Financial Statements a relevant and reliable source of financial information to investors. creditors and public at large? Discuss (6 Marks) QUESTION 3 (TOTAL: 20 MARKS) (a) For financial year ended 31 October 2019, Toby Berhad reported a profit before taxation of RM7,445, 180.90. Included in the profit before taxation are following Item: Fine expense Rental income (Rental received RM38,760) Administrative expense (Administrative expenses paid = RM58,900) Depreciation expense (Capital allowance: RM425,897) Amortisation expense Gain on fair valuation Interest income Impairment loss Loss on disposal of machine RM 10.250 25,860 62,743 129,040 12,076 6,500 2,800 12,460 10,266 The machine was purchased on 1 November 2016 for RM78,000 and its economic life was estimated at 6 years. The machine received initial allowance of 40% and annual allowance of 20%. The machine was sold on 1 May 2019. Other Information Deferred Tax Assets Balance Brought forward (31 October 2018) including RM50,941 loss RM 65,938 Deferred Tax Llabilities Balance Brought forward (31 October 2018) RM 125,339 Deductible temporary difference as at 31 October 2019 Taxable temporary difference as at 31 October 2019 RM 260,543 613.280 Gain on revaluation reserve for financial year ended 31 October 2019 RM 50.000 Gain on fair valuation reserve for financial year ended 31 October 2019 80.000 Assume the corporate taxation rate is 24%. Required: (0) Compute the taxation expense for Toby Berhad for financial year ended 31 October 2019 (10 Marks) Prepare Toby Berhads Extract of Statement of Profit or Loss and Other Comprehensive income for financial year ended 31 October 2019. You need to account for any deferred taxation effect (4 Marks) ib Are Interim Financial Statements a relevant and reliable source of financial information to investors. creditors and public at large? Discuss (6 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started