Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do help me in this question what information do you need sir/madam ? QUESTION & (TOTAL: 20 MARKS) On 1 August 2017. Grend Corporation, a

do help me in this question

what information do you need sir/madam ?

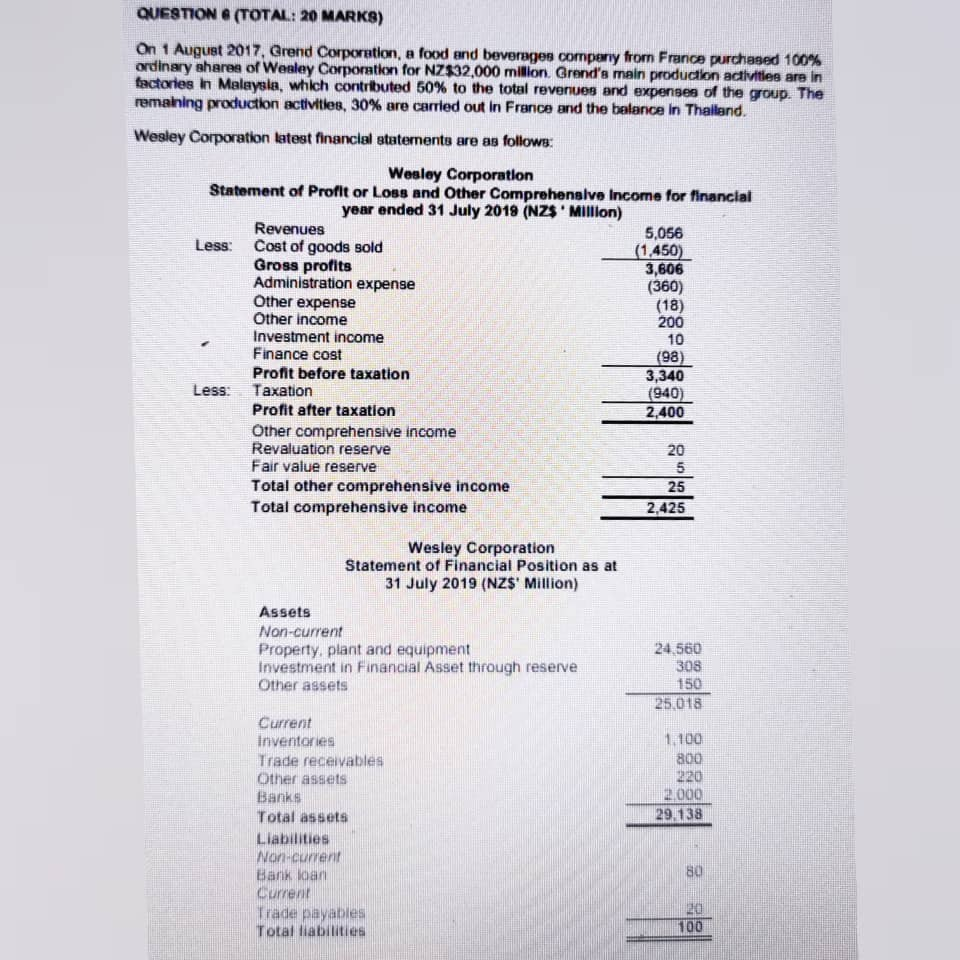

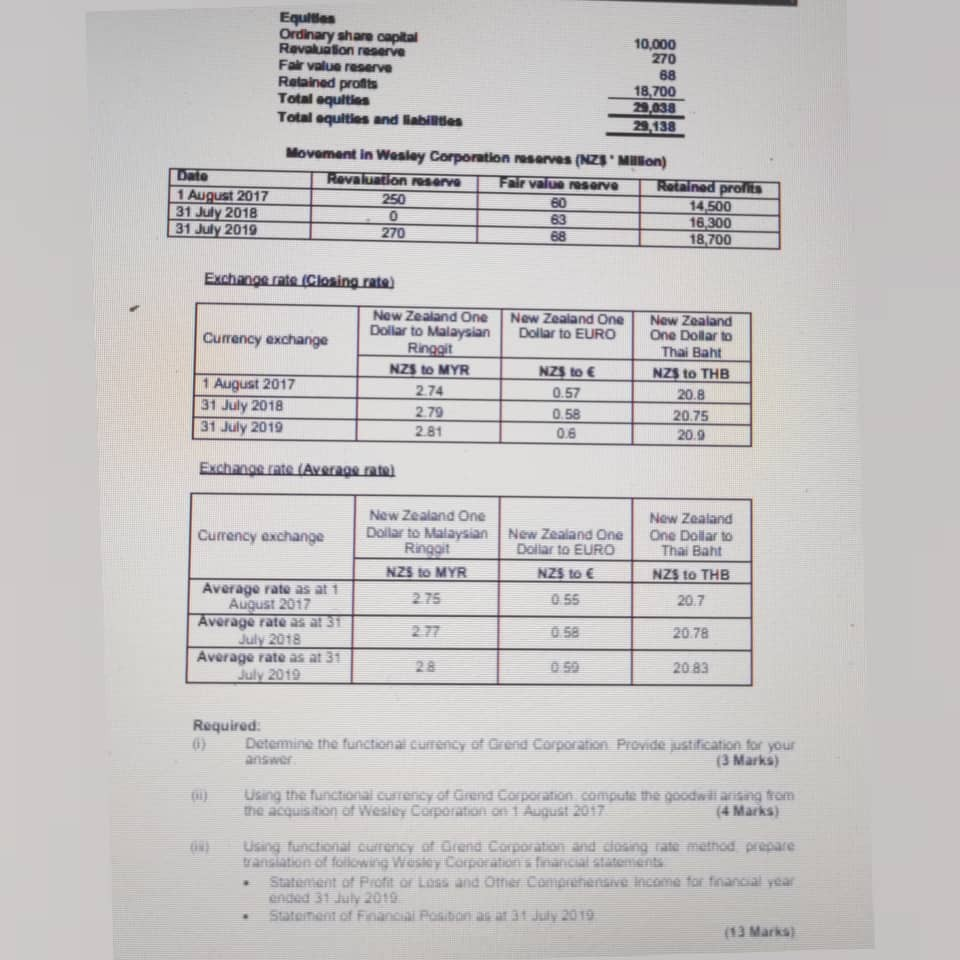

QUESTION & (TOTAL: 20 MARKS) On 1 August 2017. Grend Corporation, a food and beverages company from France purchased 100% ordinary shares of Wesley Corporation for NZ$32,000 million. Grend's main production activities are in factories in Malaysia, which contributed 50% to the total revenues and expenses of the group. The remaining production activities, 30% are carried out in France and the balance in Thailand, Wesley Corporation latest financial statements are as follows: Wesley Corporation Statement of Profit or Loss and Other Comprehensive Income for financial year ended 31 July 2019 (NZ$ ' Million) Revenues 5,056 Less: Cost of goods sold (1.450) Gross profits 3,606 Administration expense (360) Other expense (18) Other income 200 Investment income 10 Finance cost (98) Profit before taxation 3,340 Less: Taxation (940) Profit after taxation 2,400 Other comprehensive income Revaluation reserve Fair value reserve 5 Total other comprehensive income 25 Total comprehensive income 2,425 20 Wesley Corporation Statement of Financial Position as at 31 July 2019 (NZ$' Million) Assets Non-current Property, plant and equipment Investment in Financial Asset through reserve Other assets 24.560 308 150 25.018 1.100 800 220 2.000 29.138 Current Inventories Trade receivables Other assets Banks Total assets Liabilities Noncurrent Bank loan Current Trade payables Total liabilities 80 100 Equities Ordinary share capital Revolution reserve Fair value reserve Retained profits Total equities Total equities and liabilities 10,000 270 88 18.700 29,038 23,138 Dato 1 August 2017 31 July 2018 31 July 2019 Movement in Wesley Corporation reserves (NZS Million) Revaluation reserve Fair value reserve Retained profits 250 60 14,500 63 16,300 270 68 18.700 Exchange rate (Closing rate) New Zealand One Dollar to EURO Currency exchange New Zealand One Dollar to Malaysian Ringot NZS to MYR 2.74 2.79 2.81 1 August 2017 31 July 2018 31 July 2019 NZS to 0.57 0.58 0.6 New Zealand One Dollar to Thai Baht NZS to THB 20.8 20.75 20.9 Exchange rate (Average rate Currency exchange New Zealand One Dollar to Malaysian Ringgit NZS to MYR 275 New Zealand One Dollar to EURO NZS to 0.55 New Zealand One Dollar to Thai Baht NZS 10 THB 20.7 Average rate as ati August 2017 Average rate as at 31 July 2018 Average rate as at 31 July 2019 27 20.78 20 83 Required: Determine the functional currency of Grend Corporation Pronde ustification for your (3 Marks) Using the function currency of Grand Corporation compute the good ng tom the acquisition of Wesley Corporation on 1 Audus 2017 (4 Marks) Uang funciona cuireng of diend Corporation and diasing tate mathed progre translation of following Wastey Cortefinancial statements Stato it at Profit of Lass und Omer Conte income for that year Statement of Financial President July 20 B (13 Marks) QUESTION & (TOTAL: 20 MARKS) On 1 August 2017. Grend Corporation, a food and beverages company from France purchased 100% ordinary shares of Wesley Corporation for NZ$32,000 million. Grend's main production activities are in factories in Malaysia, which contributed 50% to the total revenues and expenses of the group. The remaining production activities, 30% are carried out in France and the balance in Thailand, Wesley Corporation latest financial statements are as follows: Wesley Corporation Statement of Profit or Loss and Other Comprehensive Income for financial year ended 31 July 2019 (NZ$ ' Million) Revenues 5,056 Less: Cost of goods sold (1.450) Gross profits 3,606 Administration expense (360) Other expense (18) Other income 200 Investment income 10 Finance cost (98) Profit before taxation 3,340 Less: Taxation (940) Profit after taxation 2,400 Other comprehensive income Revaluation reserve Fair value reserve 5 Total other comprehensive income 25 Total comprehensive income 2,425 20 Wesley Corporation Statement of Financial Position as at 31 July 2019 (NZ$' Million) Assets Non-current Property, plant and equipment Investment in Financial Asset through reserve Other assets 24.560 308 150 25.018 1.100 800 220 2.000 29.138 Current Inventories Trade receivables Other assets Banks Total assets Liabilities Noncurrent Bank loan Current Trade payables Total liabilities 80 100 Equities Ordinary share capital Revolution reserve Fair value reserve Retained profits Total equities Total equities and liabilities 10,000 270 88 18.700 29,038 23,138 Dato 1 August 2017 31 July 2018 31 July 2019 Movement in Wesley Corporation reserves (NZS Million) Revaluation reserve Fair value reserve Retained profits 250 60 14,500 63 16,300 270 68 18.700 Exchange rate (Closing rate) New Zealand One Dollar to EURO Currency exchange New Zealand One Dollar to Malaysian Ringot NZS to MYR 2.74 2.79 2.81 1 August 2017 31 July 2018 31 July 2019 NZS to 0.57 0.58 0.6 New Zealand One Dollar to Thai Baht NZS to THB 20.8 20.75 20.9 Exchange rate (Average rate Currency exchange New Zealand One Dollar to Malaysian Ringgit NZS to MYR 275 New Zealand One Dollar to EURO NZS to 0.55 New Zealand One Dollar to Thai Baht NZS 10 THB 20.7 Average rate as ati August 2017 Average rate as at 31 July 2018 Average rate as at 31 July 2019 27 20.78 20 83 Required: Determine the functional currency of Grend Corporation Pronde ustification for your (3 Marks) Using the function currency of Grand Corporation compute the good ng tom the acquisition of Wesley Corporation on 1 Audus 2017 (4 Marks) Uang funciona cuireng of diend Corporation and diasing tate mathed progre translation of following Wastey Cortefinancial statements Stato it at Profit of Lass und Omer Conte income for that year Statement of Financial President July 20 B (13 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started