Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do help me in this question what information do you need sir/madam ? QUESTION 4 (TOTAL: 20 MARKS) Discuss the Impact to THREE users of

Do help me in this question

what information do you need sir/madam ?

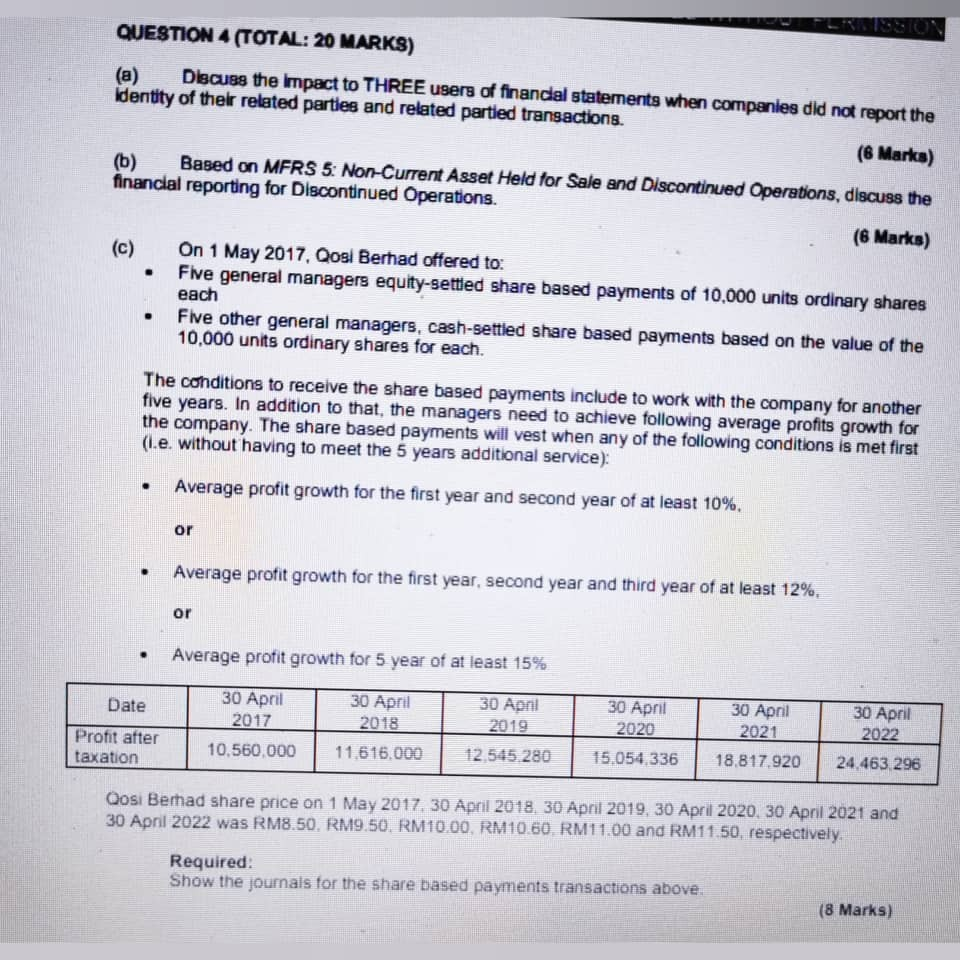

QUESTION 4 (TOTAL: 20 MARKS) Discuss the Impact to THREE users of financial statements when companies did not report the identity of their related parties and related partied transactions. (6 Marks) . (b) Based on MFRS 5: Non-Current Asset Held for Sale and Discontinued Operations, discuss the financial reporting for Discontinued Operations. (6 Marks) (c) On 1 May 2017, Qosi Bernad offered to: Five general managers equity-settied share based payments of 10,000 units ordinary shares each Five other general managers, cash-settled share based payments based on the value of the 10,000 units ordinary shares for each. The conditions to receive the share based payments include to work with the company for another five years. In addition to that, the managers need to achieve following average profits growth for the company. The share based payments will vest when any of the following conditions is met first (I.e. without having to meet the 5 years additional service): . Average profit growth for the first year and second year of at least 10%, or . Average profit growth for the first year, second year and third year of at least 12%. or . Average profit growth for 5 year of at least 15% Date 30 April 2017 10.560,000 30 April 2018 30 April 2019 30 April 2020 30 April 2021 Profit after taxation 30 April 2022 24.463 296 11.616.000 12.545.280 15.054.336 18,817.920 Qosi Berhad share price on 1 May 2017 30 April 2018 30 April 2019, 30 April 2020, 30 April 2021 and 30 April 2022 was RM8.50 RM9.50. RM10.00 RM10.60. RM11.00 and RM11.50, respectively. Required Show the journals for the share based payments transactions above. (8 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started