Do Higgins, Chapter 9, #16. In this problem, you have access to some financial information for Harley-Davidson and some comparables.

Estimate the stock price implied by each multiple, assuming that the proper multiple to apply to Harley-Davidson is the average of the comps multiples. You should come up with five different stock prices here. Compare Harley-Davidsons growth to that of its comparables. What does this imply about the stock price estimates)? Why are the stock prices implied by the sales-based multiples so much smaller than the prices based on other multiples?

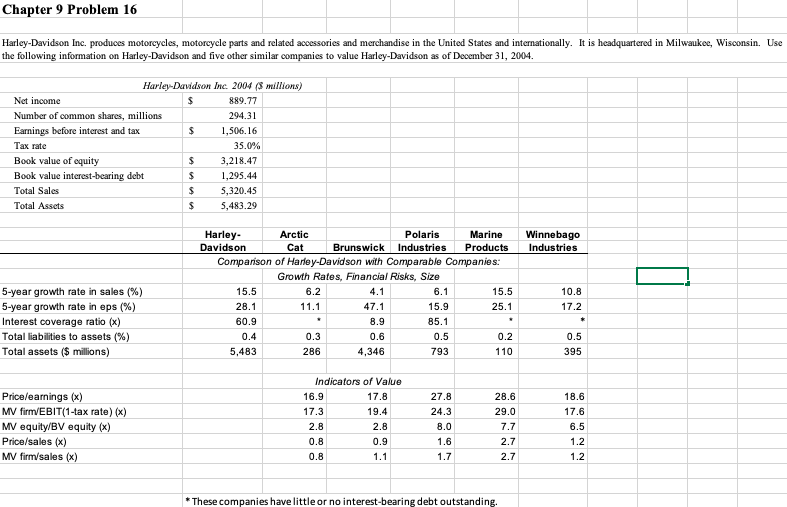

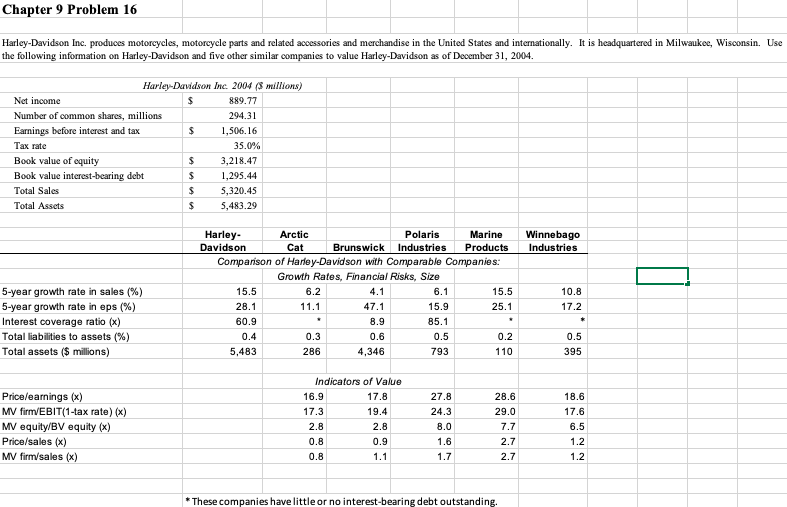

Chapter 9 Problem 16 Harley-Davidson Inc. produces motorcycles, motorcycle parts and related accessories and merchandise in the United States and internationally. It is headquartered in Milwaukec, Wisconsin. Use the following information on Harley-Davidson and five other similar companies to value Harley-Davidson as of December 31,2004. Harley-Davidson Inc. 2004 (3 millions) Companison of Harley-Davidson with Comparable Companies: 5-year growth rate in sales (%) 5 -year growth rate in eps (\%) Interest coverage ratio (x) Total liabilities to assets (\%) Total assets (\$ millions) Growth Rates, Financial Risks, Size \begin{tabular}{|l|r|r|r|r|r|r|} \hline & \multicolumn{2}{|c|}{ Indicators of Value } \\ \hline Price/earnings (x) & 16.9 & 17.8 & 27.8 & 28.6 & 18.6 \\ \hline MV firm/EBIT (1 tax rate )(x) & 17.3 & 19.4 & 24.3 & 29.0 & 17.6 \\ \hline MV equity/BV equity (x) & 2.8 & 2.8 & 8.0 & 7.7 & 1.7 \\ \hline Price/sales (x) & 0.8 & 0.9 & 1.6 & 2.7 & 1.2 \\ \hline MV firm/sales (x) & 0.8 & 1.1 & 1.7 & 2.7 & 1.2 \\ \hline \end{tabular} * These companies have little or no interest-bearing debt outstanding. Chapter 9 Problem 16 Harley-Davidson Inc. produces motorcycles, motorcycle parts and related accessories and merchandise in the United States and internationally. It is headquartered in Milwaukec, Wisconsin. Use the following information on Harley-Davidson and five other similar companies to value Harley-Davidson as of December 31,2004. Harley-Davidson Inc. 2004 (3 millions) Companison of Harley-Davidson with Comparable Companies: 5-year growth rate in sales (%) 5 -year growth rate in eps (\%) Interest coverage ratio (x) Total liabilities to assets (\%) Total assets (\$ millions) Growth Rates, Financial Risks, Size \begin{tabular}{|l|r|r|r|r|r|r|} \hline & \multicolumn{2}{|c|}{ Indicators of Value } \\ \hline Price/earnings (x) & 16.9 & 17.8 & 27.8 & 28.6 & 18.6 \\ \hline MV firm/EBIT (1 tax rate )(x) & 17.3 & 19.4 & 24.3 & 29.0 & 17.6 \\ \hline MV equity/BV equity (x) & 2.8 & 2.8 & 8.0 & 7.7 & 1.7 \\ \hline Price/sales (x) & 0.8 & 0.9 & 1.6 & 2.7 & 1.2 \\ \hline MV firm/sales (x) & 0.8 & 1.1 & 1.7 & 2.7 & 1.2 \\ \hline \end{tabular} * These companies have little or no interest-bearing debt outstanding