Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do high level financial analysis and further breakdown cost for the given project. Senior managers now want to see some high level financial analysis for

do "high level financial analysis" and "further breakdown cost" for the given project.

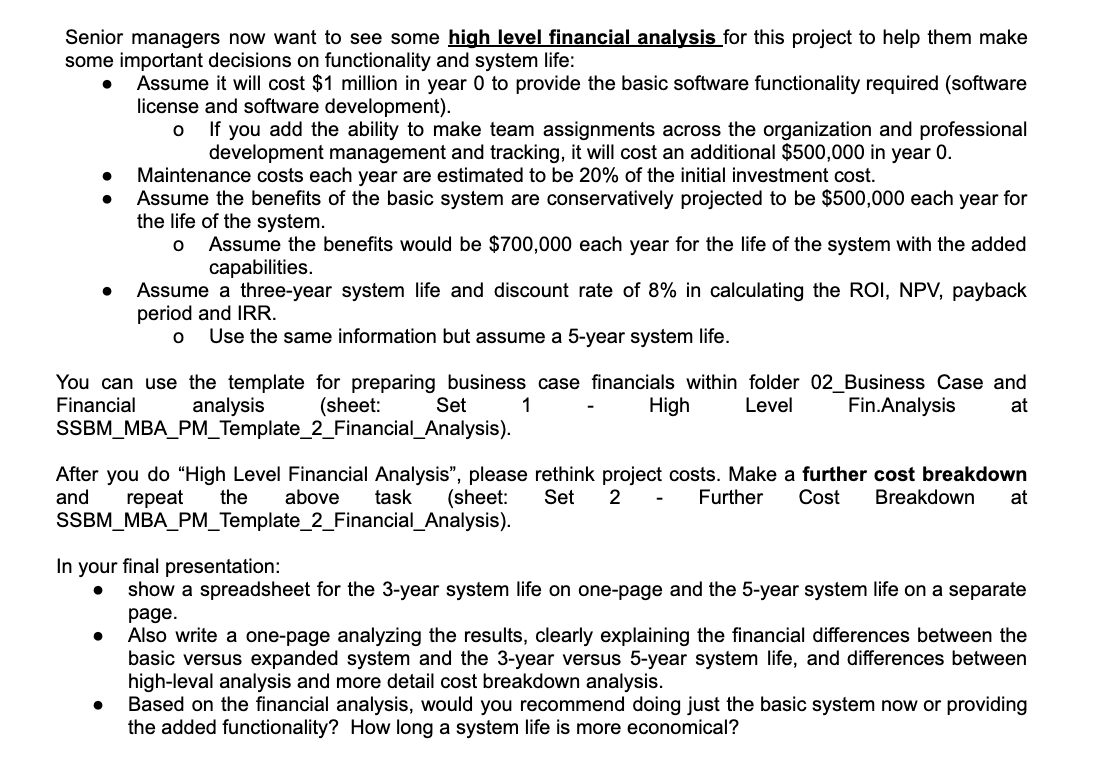

Senior managers now want to see some high level financial analysis for this project to help them make some important decisions on functionality and system life:

Assume it will cost $ million in year to provide the basic software functionality required software license and software development

o If you add the ability to make team assignments across the organization and professional development management and tracking, it will cost an additional $ in year

Maintenance costs each year are estimated to be of the initial investment cost.

Assume the benefits of the basic system are conservatively projected to be $ each year for

the life of the system.

o Assume the benefits would be $ each year for the life of the system with the added capabilities.

Assume a threeyear system life and discount rate of in calculating the ROI, NPV payback period and IRR.

o Use the same information but assume a year system life.

In your final presentation:

show a spreadsheet for the year system life on onepage and the year system life on a separate

page.

Also write a onepage analyzing the results, clearly explaining the financial differences between the

basic versus expanded system and the year versus year system life, and differences between

highleval analysis and more detail cost breakdown analysis.

Based on the financial analysis, would you recommend doing just the basic system now or providing

the added functionality? How long a system life is more economical?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started