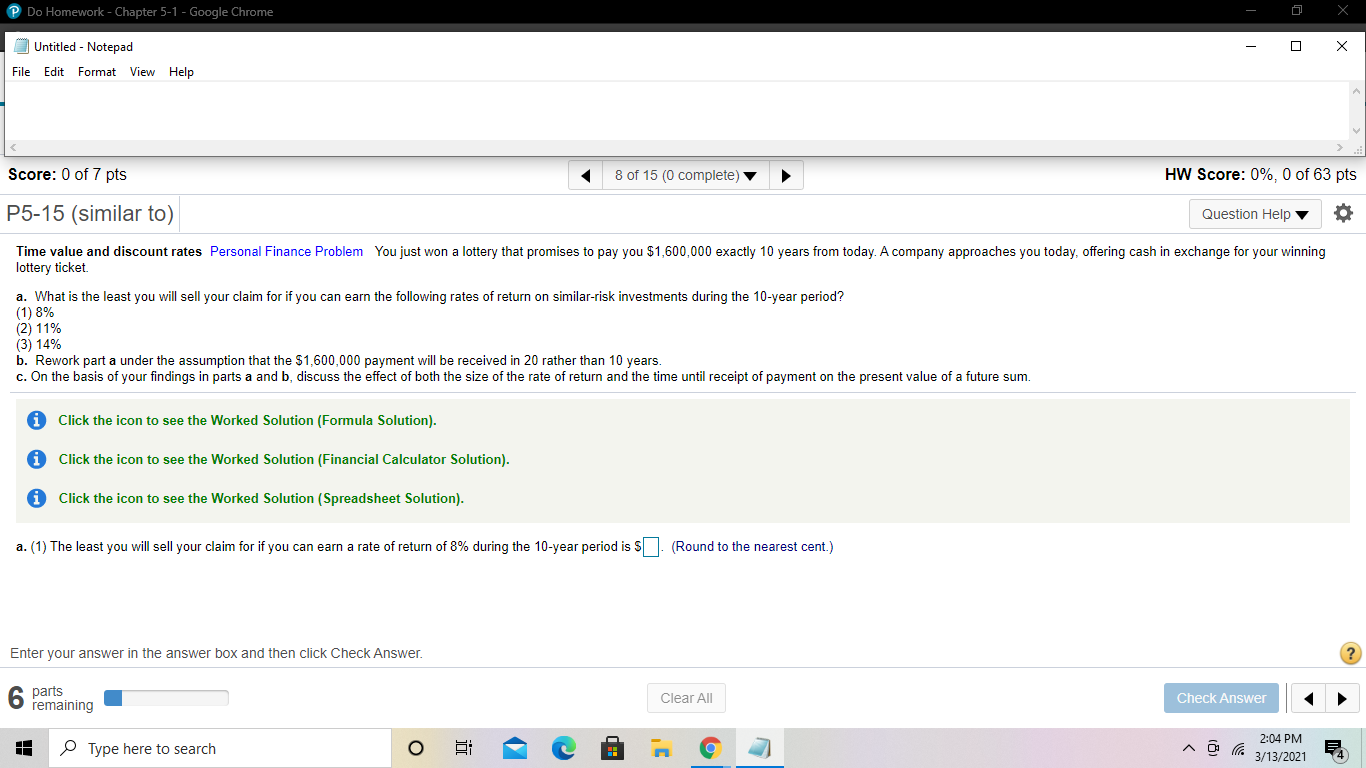

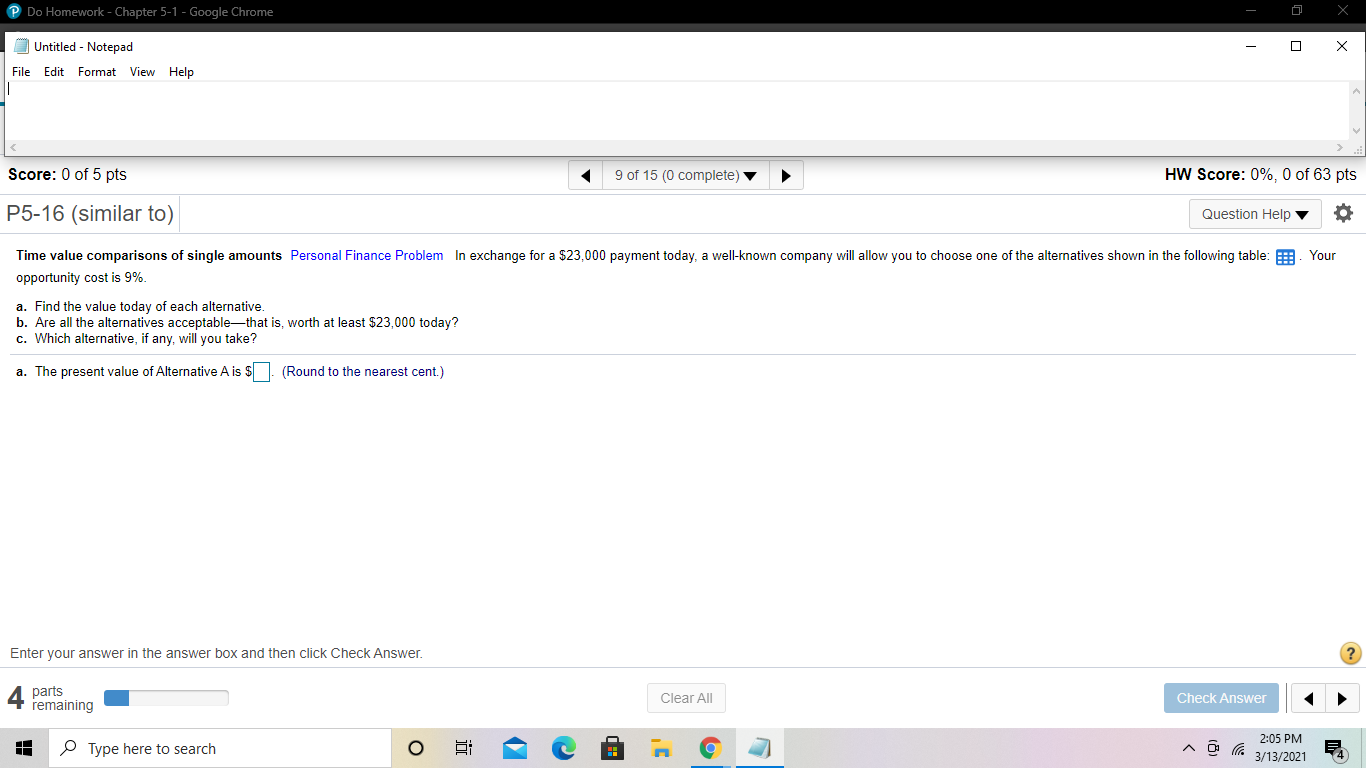

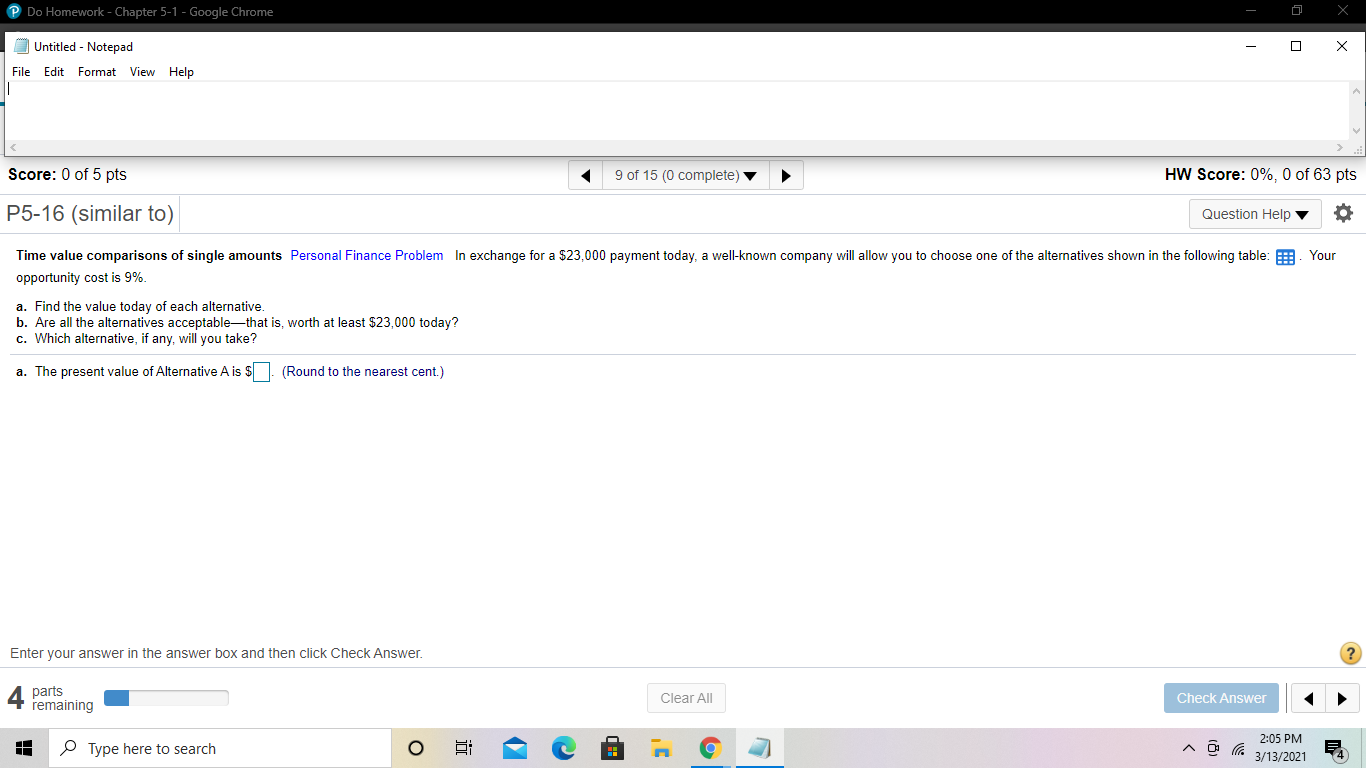

Do Homework - Chapter 5-1 - Google Chrome o Untitled - Notepad File Edit Format View Help Score: 0 of 7 pts 8 of 15 (0 complete) HW Score: 0%, 0 of 63 pts P5-15 (similar to) Question Help Time value and discount rates Personal Finance Problem You just won a lottery that promises to pay you $1,600,000 exactly 10 years from today. A company approaches you today, offering cash in exchange for your winning lottery ticket a. What is the least you will sell your claim for if you can earn the following rates of return on similar-risk investments during the 10-year period? (1) 8% (2) 11% (3) 14% b. Rework part a under the assumption that the $1,600,000 payment will be received in 20 rather than 10 years. c. On the basis of your findings in parts a and b, discuss the effect of both the size of the rate of return and the time until receipt of payment on the present value of a future sum. Click the icon to see the worked Solution (Formula Solution). i Click the icon to see the Worked Solution (Financial Calculator Solution). i Click the icon to see the Worked Solution (Spreadsheet Solution). a. (1) The least you will sell your claim for if you can earn a rate of return of 8% during the 10-year period is $. (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. parts Clear All Check Answer remaining Type here to search I e 2:04 PM 3/13/2021 Do Homework - Chapter 5-1 - Google Chrome o Untitled - Notepad File Edit Format View Help Score: 0 of 5 pts 9 of 15 (0 complete) HW Score: 0%, 0 of 63 pts P5-16 (similar to) Question Help Time value comparisons of single amounts Personal Finance Problem in exchange for a $23,000 payment today, a well-known company will allow you to choose one of the alternatives shown in the following table: Your opportunity cost is 9% a. Find the value today of each alternative b. Are all the alternatives acceptablethat is, worth at least $23,000 today? c. Which alternative, if any, will you take? a. The present value of Alternative A is $. (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. parts remaining Clear All Check Answer O Type here to search e 2:05 PM 3/13/2021