do internal analysis

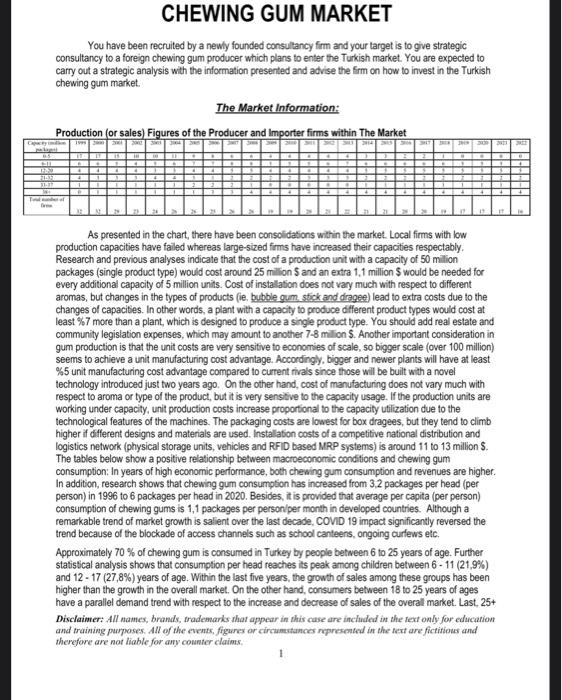

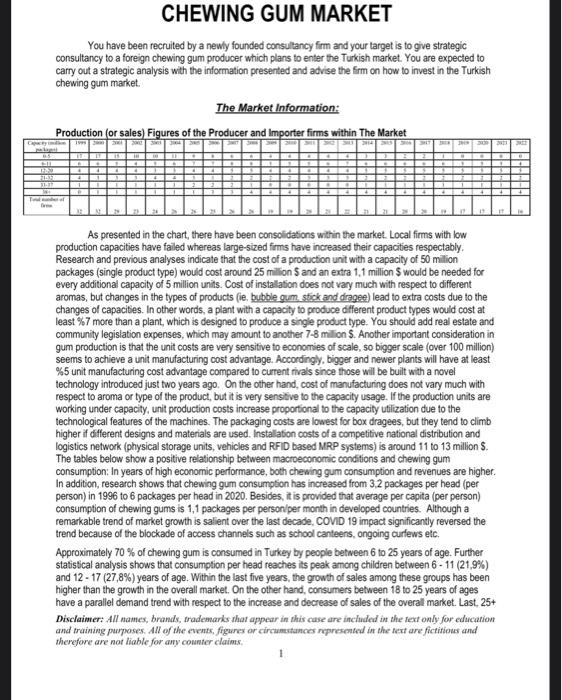

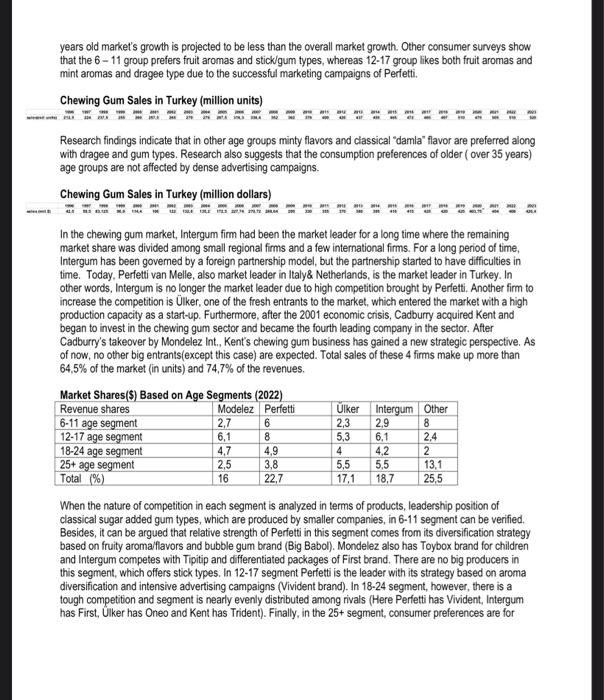

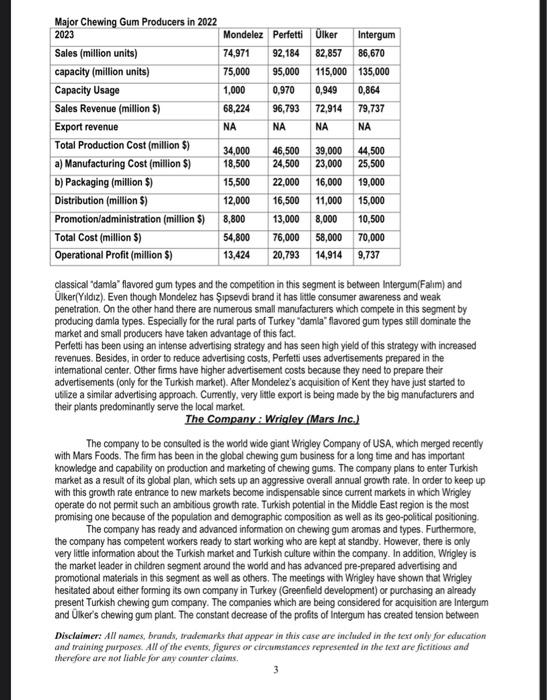

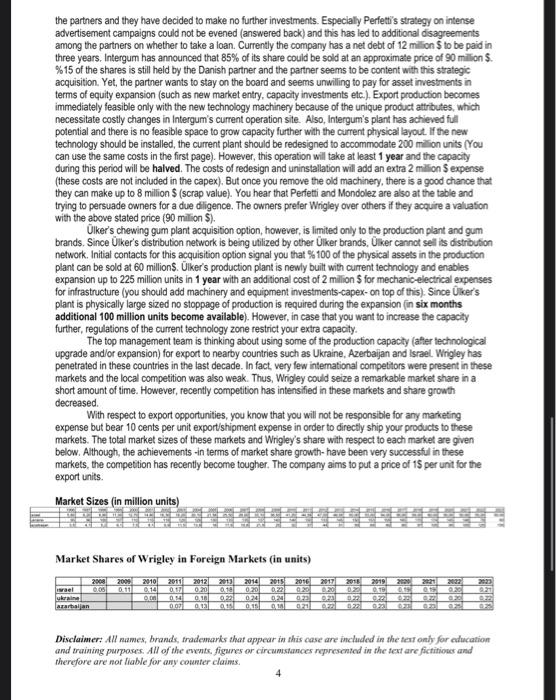

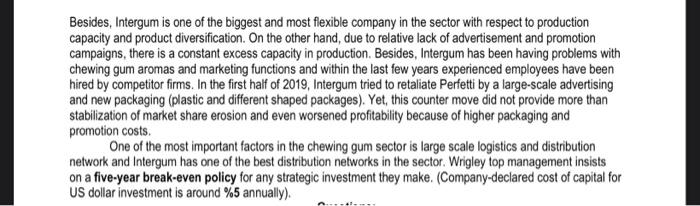

You have been recruited by a newly founded consultancy fim and your target is to give strategic consultancy to a foreign chewing gum producer which plans to enter the Turkish market. You are expected to carry out a strategic analysis with the information presented and advise the firm on how to invest in the Turkish chewing gum market. The Market Information: Production (or sales) Fioures of the Producer and Imborter firms within The Market As presented in the chart, there have been consolidations within the market. Local firms with low production capacities have failed whereas large-sized firms have increased their capacities respectably. Research and previous analyses indicate that the cost of a production unit with a capacity of 50 milion packages (single product type) would cost around 25mililion$ and an extra 1,1 million $ would be needed for every additional capacity of 5 million units. Cost of installation does not vary much with respect to different aromas, but changes in the types of products (ie. bubble gum, stick and dragee) lead to extra costs due to the changes of capacises. In other words, a plant with a capacity to produce different product types would cost at least %7 more than a plant, which is designed to produce a single product type. You should add real estate and community legislation expenses, which may amount to another 7-8 milion $. Another important consideration in gum production is that the unit costs are very sensitive to economies of scale, 50 bigger scale (over 100 million) seems to achieve a unit manufacturing cost advantage. Accordingly, bigger and newer plants will have at least %5 unit manufacturing cost advantage compared to curtent tivals since those will be built with a novel technology introduced just two years ago. On the other hand, cost of manufacturing does not vary much with respect to aroma or type of the product, but it is very sensitive to the capacity usage. If the production units are working under capacity, unit production costs increase proportional to the capacity utilization due to the technological features of the machines. The packaging costs are lowest for box dragees, but they tend to climb higher if different designs and materials are used. Installation costs of a competitive national distribution and logistics network (physical storage units, vehicles and RFID based MRP systems) is around 11 to 13 million \$. The tables below show a positive relationship between macroeconomic conditions and chewing gum consumption: In years of high economic performance, both chewing gum consumption and revenues are higher. In addition, research shows that chewing gum consumption has increased from 3,2 packages per head (per person) in 1996 to 6 packages per head in 2020. Besides, it is provided that average per capita (per person) consumption of chewing gums is 1,1 packages per person/per month in developed countries. Although a remarkable trend of market growth is salient over the last decade, COVID 19 impact significantly reversed the trend because of the blockade of access channels such as school canteens, ongoing curfews etc. Approximately 70% of chewing gum is consumed in Turkey by people between 6 to 25 years of age. Further statistical analysis shows that consumption per head reaches its peak among children between 611 (21,9\%) and 1217(27,8%) years of age. Within the last five years, the growth of sales among these groups has been higher than the growth in the overall market. On the other hand, consumers between 18 to 25 years of ages have a parallel demand trend with respect to the increase and decrease of sales of the overal market. Last, 25+ Disclaimer: All names, brands, trademarks that appear in this case are inchuded in the text only for education and training purposes. All of the events, figures or circumentunces nepresented in the text are fictitious and therefore are not liable for any counter claims. 1 years old market's growth is projected to be less than the overall market growth. Other consumer surveys show that the 6-11 group prefers fruit aromas and stick/gum types, whereas 12-17 group likes both fruit aromas and mint aromas and dragee type due to the successful marketing campaigns of Perfetti. Chewing Gum Sales in Turkey (million units) Research findings indicate that in other age groups minty flavors and classical "damla" flavor are preferred along with dragee and gum types. Research also suggests that the consumption preferences of older (over 35 years) age groups are not affected by dense advertising campaigns. Chewing Gum Sales in Turkey (million dollars) In the chewing gum market, Intergum firm had been the market leader for a long time where the remaining market share was divided among small regional firms and a few international firms. For a long period of time, Intergum has been governed by a foreign partnership model, but the partnership started to have difficulties in time. Today, Perfetti van Melle, also market leader in Italy\& Netherlands, is the market leader in Turkey. In other words, Intergum is no longer the market leader due to high competition brought by Perfetti. Another firm to increase the competition is lker, one of the fresh entrants to the market, which entered the market with a high production capacity as a start-up. Furthermore, after the 2001 economic crisis, Cadburry acquired Kent and began to invest in the chewing gum sector and became the fourth leading company in the sector. After Cadburry's takeover by Mondelez Int., Kent's chewing gum business has gained a new strategic perspective. As of now, no other big entrants(except this case) are expected. Total sales of these 4 firms make up more than 64,5% of the market (in units) and 74,7% of the revenues. When the nature of competition in each segment is analyzed in terms of products, leadership position of classical sugar added gum types, which are produced by smaller companies, in 6-11 segment can be verified. Besides, it can be argued that relative strength of Perfetti in this segment comes from its diversification strategy based on fruity aromaflavors and bubble gum brand (Big Babol). Mondelez also has Toybox brand for children and Intergum competes with Tipitip and differentiated packages of First brand. There are no big producers in this segment, which offers stick types. In 12-17 segment Perfetti is the leader with its strategy based on aroma diversification and intensive advertising campaigns (Vivident brand). In 18-24 segment, however, there is a tough competition and segment is nearly evenly distributed among rivals (Here Perfetti has Vivident, Intergum has First, Ulker has Oneo and Kent has Trident). Finally, in the 25+ segment, consumer preferences are for classical "damla" flavored gum types and the competition in this segment is between Intergum(Falm) and Uliker(Yildiz). Even though Mondelez has Sipsevdi brand it has little consumer awareness and weak penetration. On the other hand there are numerous small manufacturers which compele in this segment by producing damla types. Especially for the rural parts of Turkey "damla" flavored gum types still dominate the market and small producers have taken advantage of this fact. Perfetti has been using an intense advertising strategy and has seen high yield of this strategy with increased revenues. Besides, in order to reduce advertising costs, Perfetti uses advertisements prepared in the intemational center. Other firms have higher advertisement costs because they need to prepare their advertisements (only for the Turkish market). After Mondelez's acquisition of Kent they have just started to utilize a similar advertising approach. Currently, very little export is being made by the big manufacturers and their plants predominantly serve the local market. The Company : Wrigley (Mars Inc.) The company to be consulted is the world wide giant Wrigley Company of USA, which merged recently with Mars Foods. The firm has been in the global chewing gum business for a long time and has important knowledge and capability on production and marketing of chewing gums. The company plans to enter Turkish market as a result of its global plan, which sets up an aggressive overall annual growth rate. In order to keep up with this growth rate entrance to new markets become indispensable since current markets in which Wrigley operate do not permit such an ambitious growth rate. Turkish potential in the Middle East region is the most promising one because of the population and demographic composition as well as its geo-political positioning. The company has ready and advanced information on chewing gum aromas and types. Furthermore, the company has competent workers ready to start working who are kept at standby. However, there is only very little information about the Turkish market and Turkish culture within the company. In addition, Wrigley is the market leader in children segment around the world and has advanced pre-prepared advertising and the partners and they have decided to make no further investments. Especially Perfettis strategy on intense advertisement campaigns could not be evened (answered back) and this has led to additional disagreements among the partners on whether to take a loan. Currently the company has a net debt of 12 million $ to be paid in three years. Intergum has announced that 85% of its share could be sold at an approximate price of 90 milion $. %15 of the shares is still held by the Danish partner and the partner seems to be content with this strategic acquisition. Yet, the partner wants to stay on the board and seems unwilling to pay for asset investments in terms of equity expansion (such as new market entry, capacity investments etc.). Export production becomes immediately feasible only with the new technology machinery because of the unique product attributes, which necessitate costly changes in Intergum's current operation site. Also, Intergum's plant has achieved ful potential and there is no feasible space to grow capacity further with the current physical layout. If the new technology should be installed, the current plant should be redesigned to accommodate 200 milion units (You can use the same costs in the first page). However, this operation will take at least 1 year and the capacily during this period will be halved. The costs of redesign and uninstallation will add an extra 2 milion $ expense (these costs are not included in the capex), But once you remove the old machinery, there is a good chance that they can make up to 8 million \$ (scrap value). You hear that Perfetti and Mondolez are also at the table and trying to persuade owners for a due diligence. The owners prefer Whigley over others if they acquire a valuation with the above stated price ( 90 milion \$). lker's chewing gum plant acquisition option, however, is limited only to the production plant and gum brands. Since Uiker's distribution network is being utilized by other Uliker brands, ker cannot sell is distribution network. Initial contacts for this acquisition option signal you that %100 of the physical assets in the production plant can be sold at 60 million\$. lker's production plant is newly built with current technology and enables expansion up to 225 million units in 1 year with an additional cost of 2 million $ for mechanic-electrical expenses for infrastructure (you should add machinery and equipment investments-capex-on top of this). Since ker's plant is physically large sized no stoppage of production is required during the expansion (in six months additional 100 million units become available). However, in case that you want to increase the capacity further, regulations of the current technology zone restrict your extra capacity. The top management team is thinking about using some of the production capacty (after technological upgrade and/or expansion) for export to nearby countries such as Ukraine, Azerbaijan and israel. Wrigley has penetrated in these countries in the last decade. In fact, very few intemational compettors were present in these markets and the local competition was also weak. Thus, Wrigley could seize a remarkable market share in a short amount of time. However, recently competition has intensified in these markets and share growth decreased. With respect to export opportunities, you know that you will not be responsible for any marketing expense but bear 10 cents per unit export/shipment expense in order to directly ship your products to these markets. The total market sizes of these markets and Wrigley's share with respect to each market are given below. Although, the achievements -in terms of market share growth-have been very successful in these markets, the competition has recently become tougher. The company aims to put a price of 15 per unit for the export units. Market Sizes (in million units) Market Shares of Wrigley in Foreign Markets (in units) Disclaimer: All names, brands, trademaris that appear in this case are included in the tert only for education and training purposes. All of the ewents, figures or circumstances represcoted in the text are fictitioner and therefore are not liable for any conater clains. Besides, Intergum is one of the biggest and most flexible company in the sector with respect to production capacity and product diversification. On the other hand, due to relative lack of advertisement and promotion campaigns, there is a constant excess capacity in production. Besides, Intergum has been having problems with chewing gum aromas and marketing functions and within the last few years experienced employees have been hired by competitor firms. In the first half of 2019, Intergum tried to retaliate Perfetti by a large-scale advertising and new packaging (plastic and different shaped packages). Yet, this counter move did not provide more than stabilization of market share erosion and even worsened profitability because of higher packaging and promotion costs. One of the most important factors in the chewing gum sector is large scale logistics and distribution network and Intergum has one of the best distribution networks in the sector. Wrigley top management insists on a five-year break-even policy for any strategic investment they make. (Company-declared cost of capital for US dollar investment is around %5 annually)