Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do it in Excel please You have the following time series of prices. You need to quickly calculate the VaR of this portfolio. Reminder: Take

Do it in Excel please

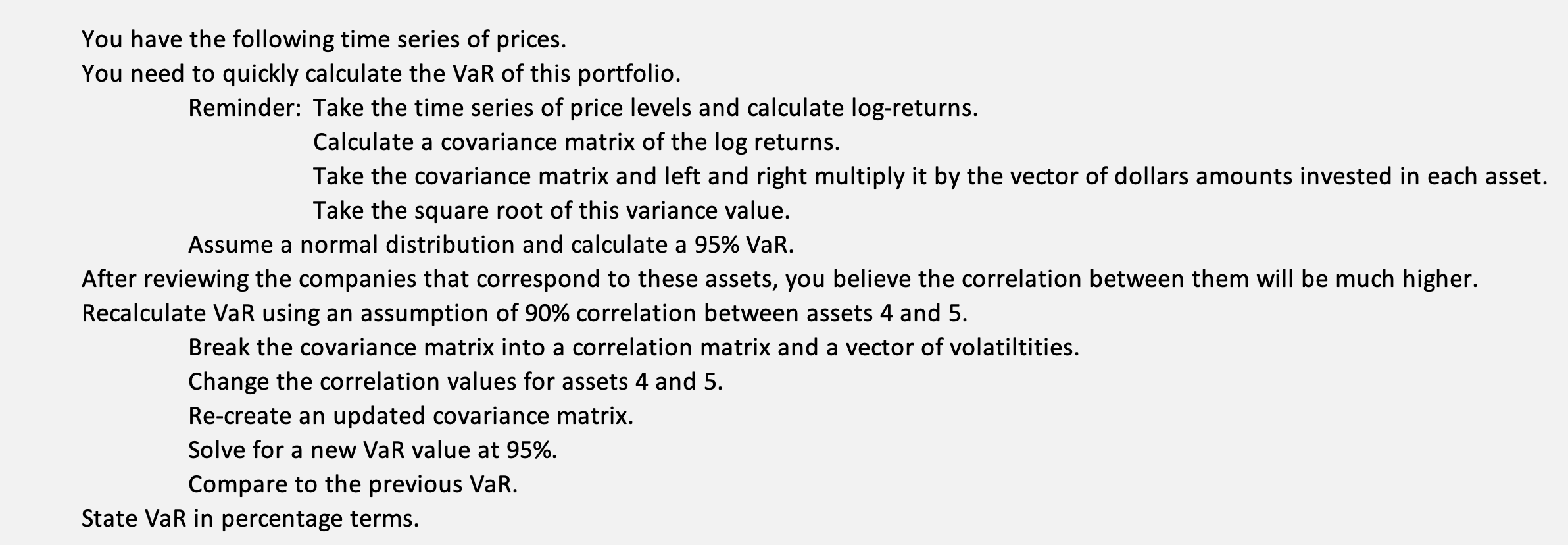

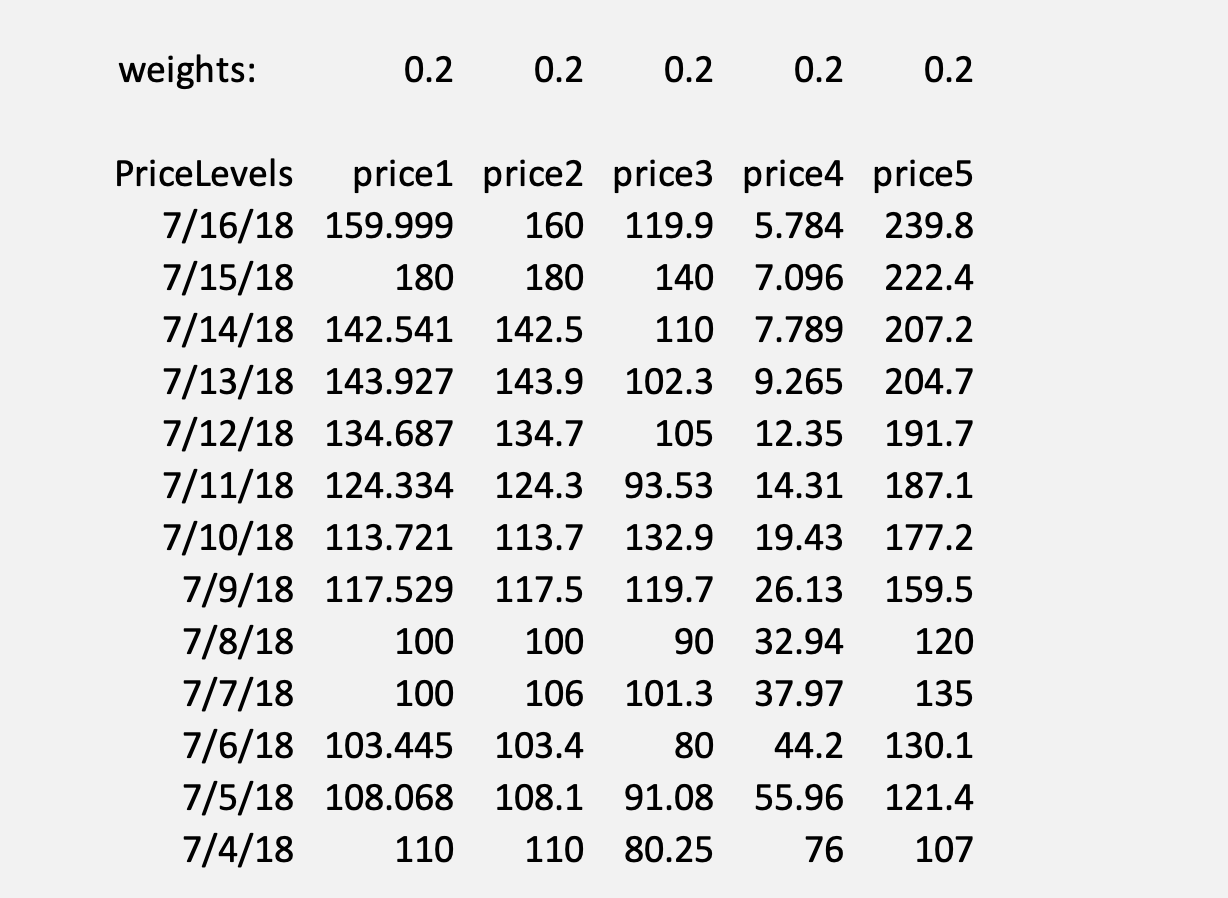

You have the following time series of prices. You need to quickly calculate the VaR of this portfolio. Reminder: Take the time series of price levels and calculate log-returns. Calculate a covariance matrix of the log returns. Take the covariance matrix and left and right multiply it by the vector of dollars amounts invested in each asset. Take the square root of this variance value. Assume a normal distribution and calculate a 95% VaR. After reviewing the companies that correspond to these assets, you believe the correlation between them will be much higher. Recalculate VaR using an assumption of 90% correlation between assets 4 and 5 . Break the covariance matrix into a correlation matrix and a vector of volatiltities. Change the correlation values for assets 4 and 5 . Re-create an updated covariance matrix. Solve for a new VaR value at 95%. Compare to the previous VaR. State VaR in percentage terms. \begin{tabular}{rrrrrr} weights: & 0.2 & 0.2 & 0.2 & 0.2 & 0.2 \\ & & & & & \\ Pricelevels & price1 & price2 & price3 & price4 & price5 \\ 7/16/18 & 159.999 & 160 & 119.9 & 5.784 & 239.8 \\ 7/15/18 & 180 & 180 & 140 & 7.096 & 222.4 \\ 7/14/18 & 142.541 & 142.5 & 110 & 7.789 & 207.2 \\ 7/13/18 & 143.927 & 143.9 & 102.3 & 9.265 & 204.7 \\ 7/12/18 & 134.687 & 134.7 & 105 & 12.35 & 191.7 \\ 7/11/18 & 124.334 & 124.3 & 93.53 & 14.31 & 187.1 \\ 7/10/18 & 113.721 & 113.7 & 132.9 & 19.43 & 177.2 \\ 7/9/18 & 117.529 & 117.5 & 119.7 & 26.13 & 159.5 \\ 7/8/18 & 100 & 100 & 90 & 32.94 & 120 \\ 7/7/18 & 100 & 106 & 101.3 & 37.97 & 135 \\ 7/6/18 & 103.445 & 103.4 & 80 & 44.2 & 130.1 \\ 7/5/18 & 108.068 & 108.1 & 91.08 & 55.96 & 121.4 \\ 7/4/18 & 110 & 110 & 80.25 & 76 & 107 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started