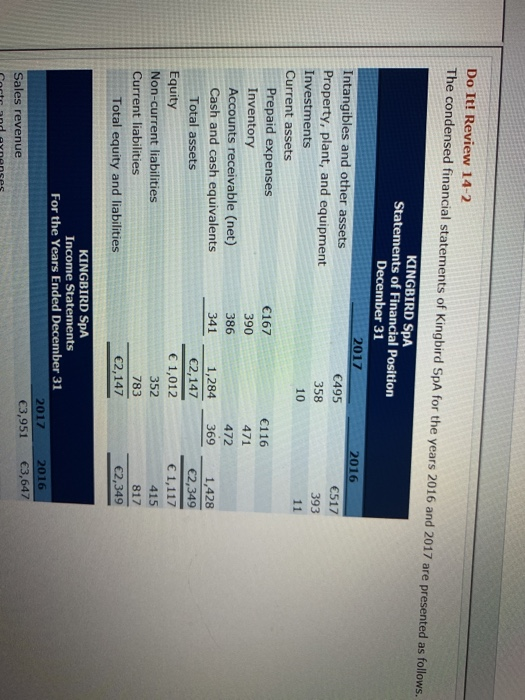

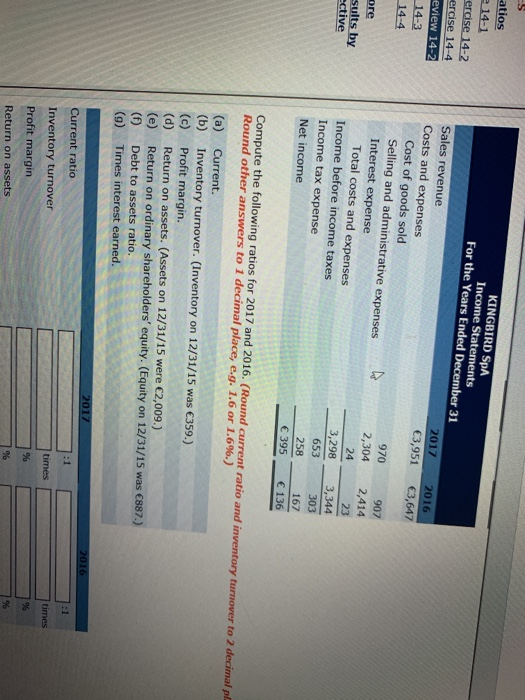

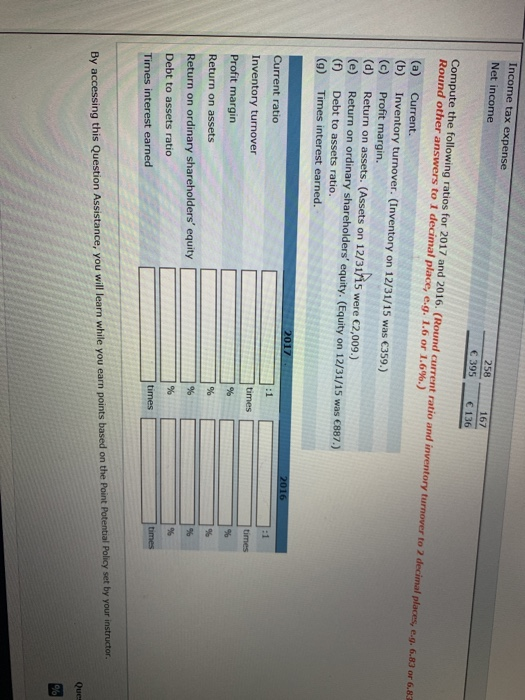

Do It! Review 14-2 The condensed financial statements of Kingbird SpA for the years 2016 and 2017 are presented as follows. KINGBIRD SPA Statements of Financial Position December 31 2017 2016 Intangibles and other assets 495 Property, plant, and equipment 517 358 393 Investments 11 Current assets Prepaid expenses 167 116 Inventory 390 471 Accounts receivable (net) 386 472 Cash and cash equivalents 341 1,284 369 1,428 Total assets 2,147 2,349 Equity 1,012 1,117 Non-current liabilities 415 Current liabilities 783 Total equity and liabilities 2,147 2,349 10 352 817 KINGBIRD SpA Income Statements For the Years Ended December 31 2017 3,951 2016 3,647 Sales revenue and Vaneme cios 14-1 rcise 14-2 rcise 14-4 view 14-2 14-3 14-4 2016 3,647 KINGBIRD SpA Income Statements For the Years Ended December 31 2017 Sales revenue 3,951 Costs and expenses Cost of goods sold 970 Selling and administrative expenses 2,304 Interest expense Total costs and expenses 3,298 Income before income taxes Income tax expense 258 Net income 395 24 are sults by ctive 907 2,414 23 3,344 303 167 136 653 Compute the following ratios for 2017 and 2016. (Round current ratio and inventory turnover to 2 decimal pl Round other answers to 1 decimal place, e.g. 1.6 or 1.696.) (a) (b) (c) (d) (e) (1) (9) Current Inventory turnover. (Inventory on 12/31/15 was 359.) Profit margin. Return on assets. (Assets on 12/31/15 were 2,009.) Return on ordinary shareholders' equity. (Equity on 12/31/15 was 887.) Debt to assets ratio. Times interest earned. 2016 2017 times times Current ratio Inventory turnover Profit margin Income tax expense Net income 395 167 136 Compute the following ratios for 2017 and 2016. (Round current ratio and inventory turnover to 2 decimal places. 6.3 or 6.8 Round other answers to I decimal place, e.g. 1.6 or 1.6%.) (a) (b) (c) (d) (e) (1) (9) Current Inventory turnover. (Inventory on 12/31/15 was 359.) Profit margin. Return on assets. (Assets on 12/31/15 were 2,009.) Return on ordinary shareholders' equity. (Equity on 12/31/15 was 887.) Debt to assets ratio. Times interest earned. 2017 Current ratio Inventory turnover Profit margin Return on assets Return on ordinary shareholders' equity Debt to assets ratio Times interest earned By accessing this Question Assistance, you will learn while you earn points based on the Point Potential policy set by your instructor Que