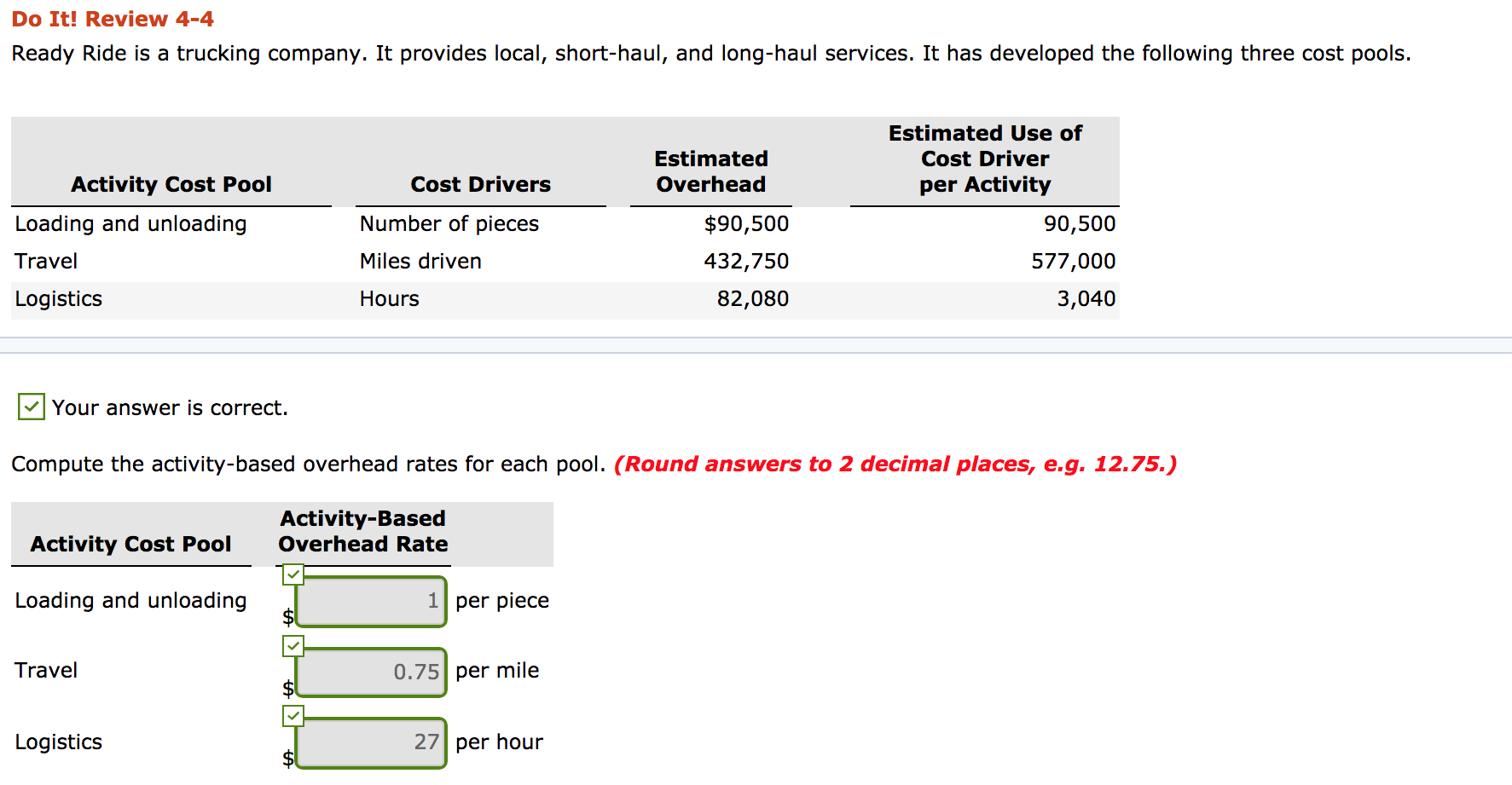

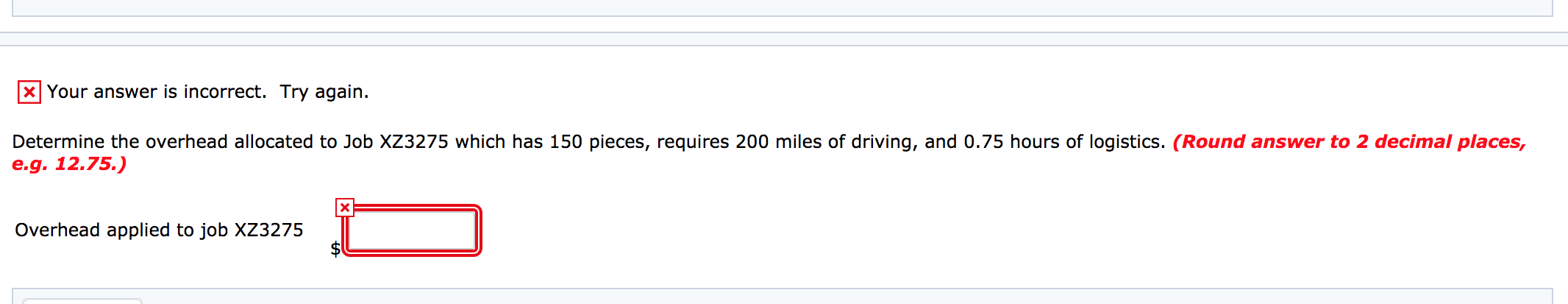

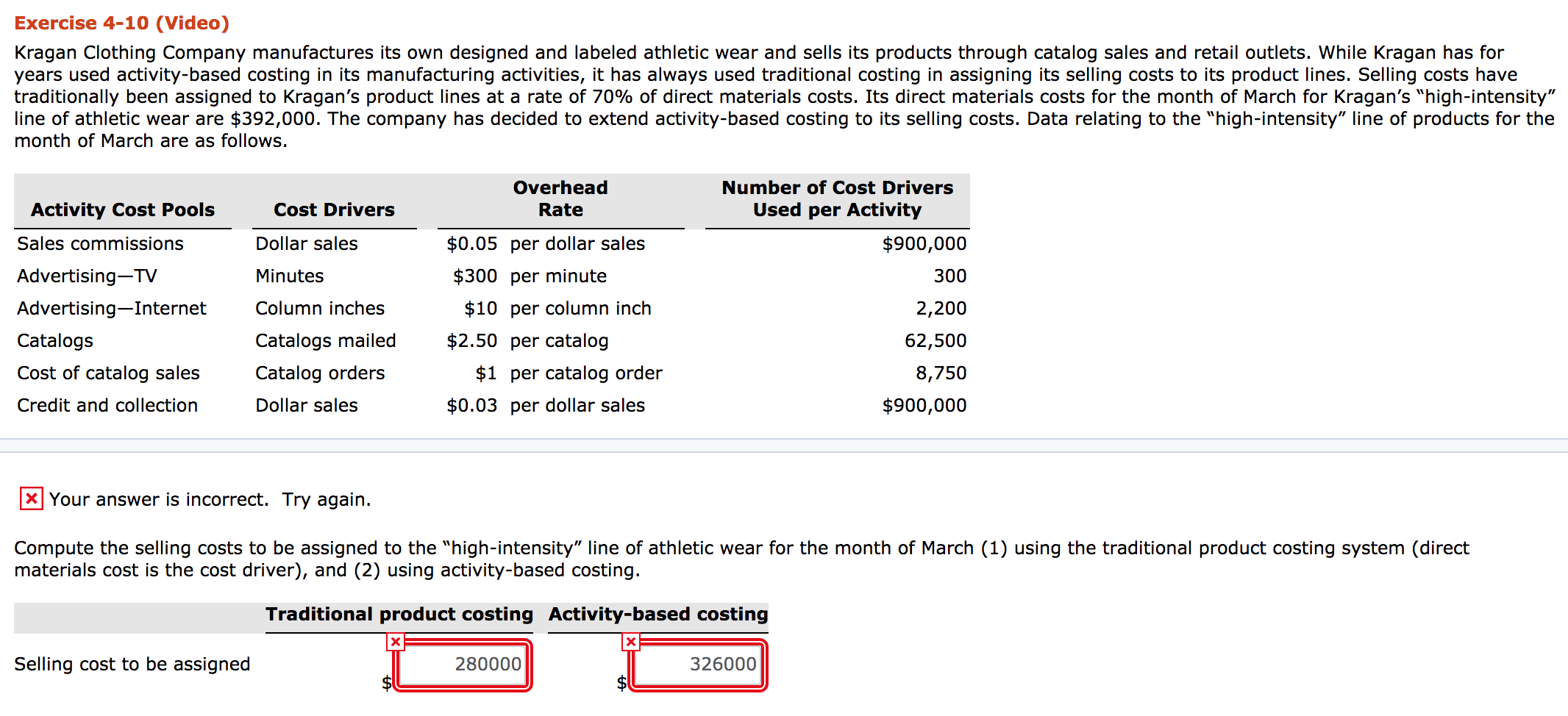

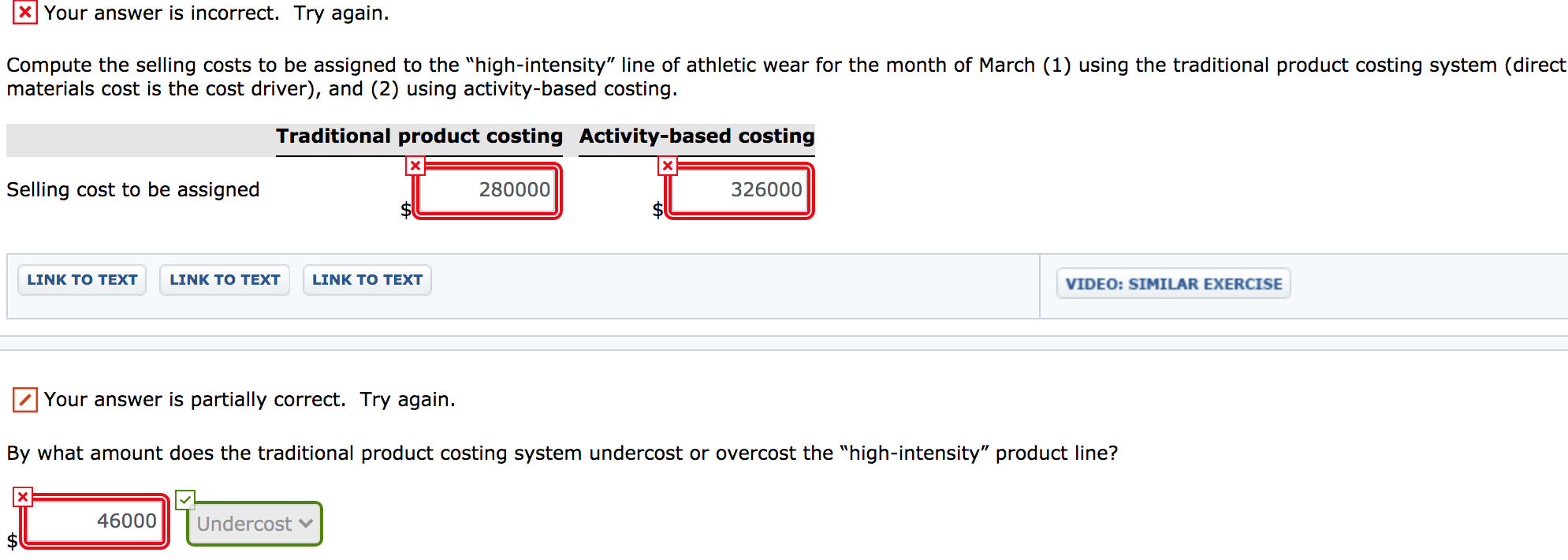

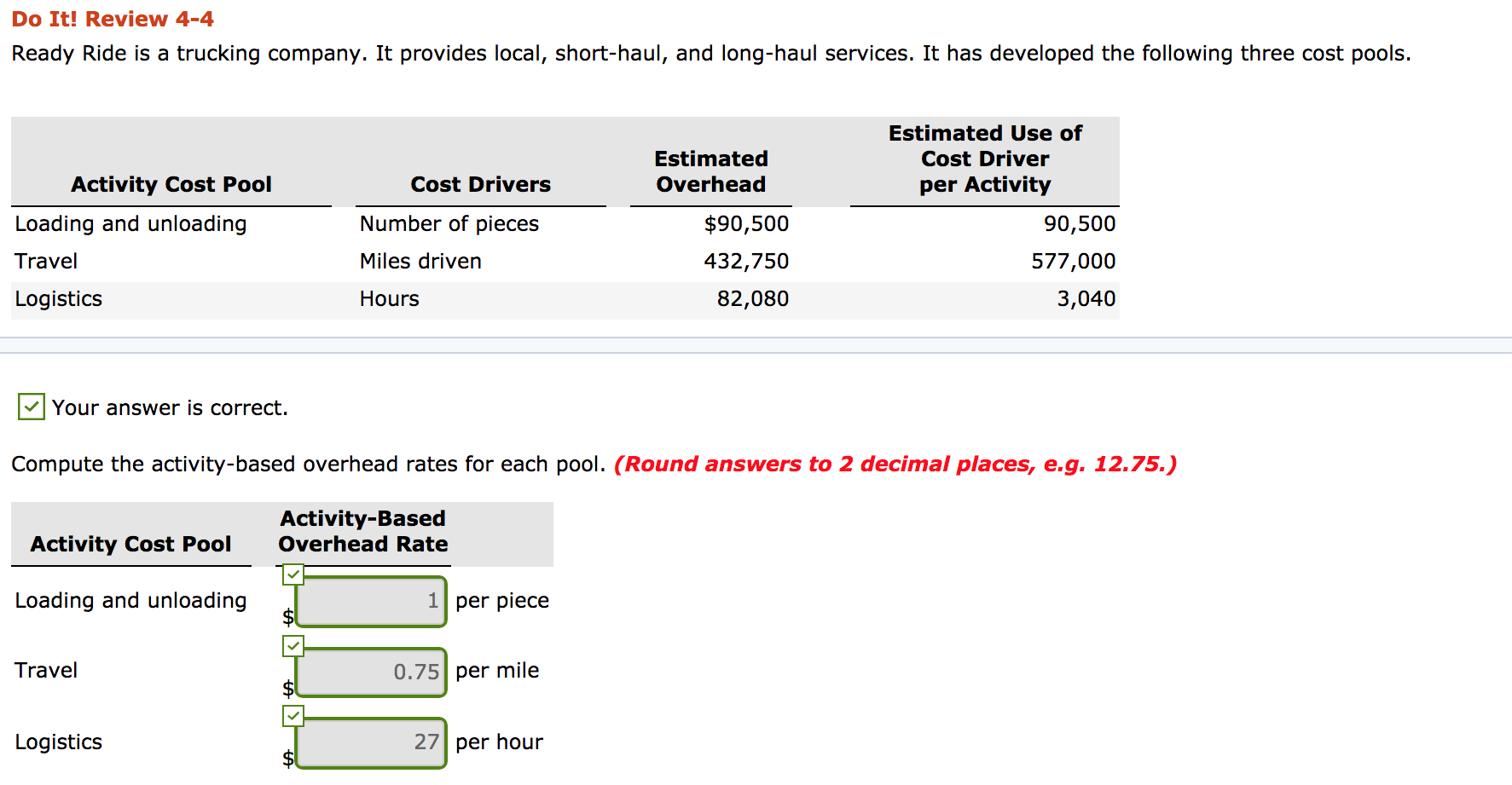

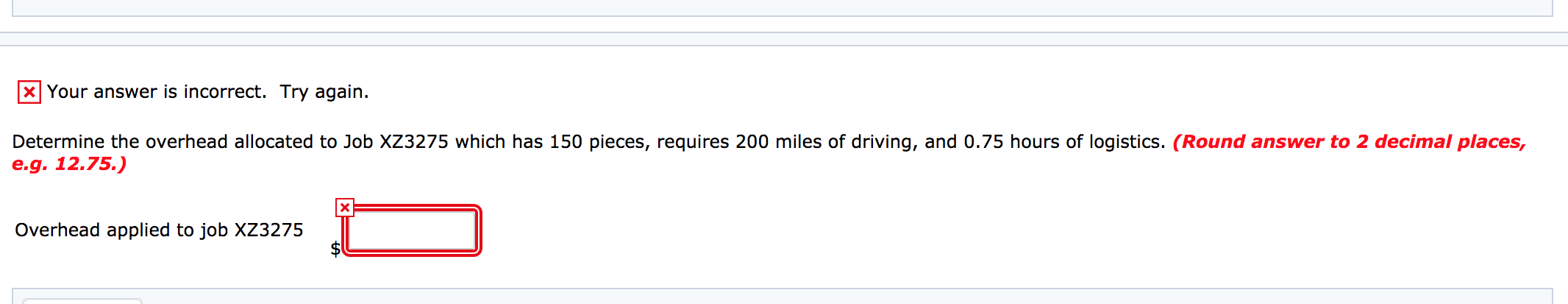

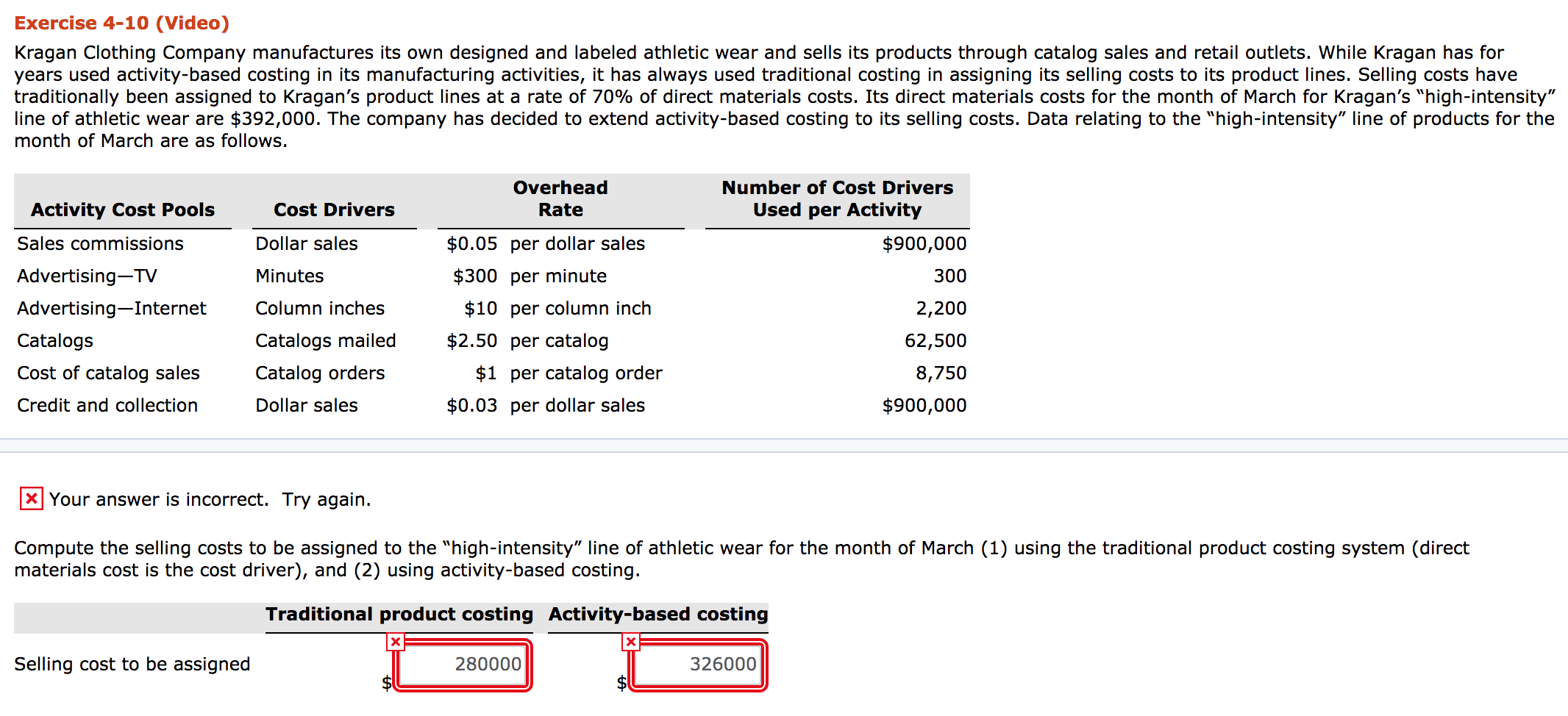

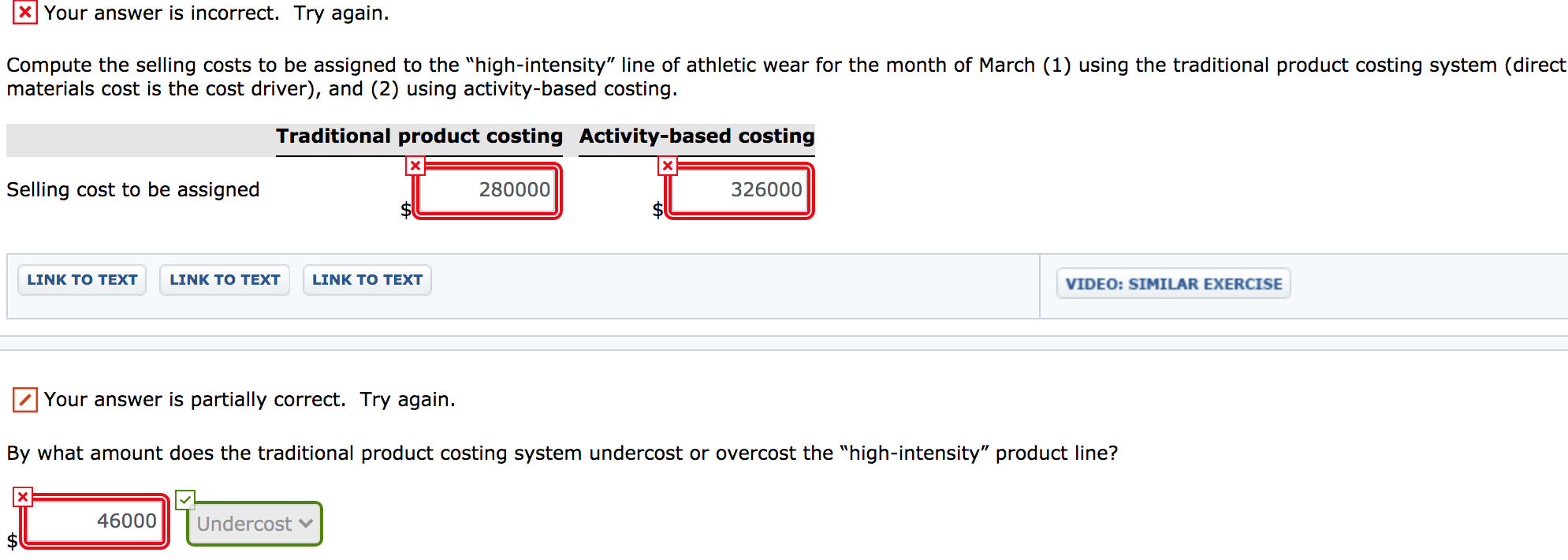

Do It! Review 4-4 Ready Ride is a trucking company. It provides local, short-haul, and long-haul services. It has developed the following three cost pools. Estimated Overhead Cost Drivers Activity Cost Pool Loading and unloading Travel Number of pieces Estimated Use of Cost Driver per Activity 90,500 577,000 3,040 $90,500 432,750 82,080 Miles driven Logistics Hours Your answer is correct. Compute the activity-based overhead rates for each pool. (Round answers to 2 decimal places, e.g. 12.75.) Activity-Based Overhead Rate Activity Cost Pool Loading and unloading 1 per piece Travel 0.75 per mile Logistics 27 per hour * Your answer is incorrect. Try again. Determine the overhead allocated to Job XZ3275 which has 150 pieces, requires 200 miles of driving, and 0.75 hours of logistics. (Round answer to 2 decimal places, e.g. 12.75.) Overhead applied to job XZ3275 Exercise 4-10 (Video) Kragan Clothing Company manufactures its own designed and labeled athletic wear and sells its products through catalog sales and retail outlets. While Kragan has for years used activity-based costing in its manufacturing activities, it has always used traditional costing in assigning its selling costs to its product lines. Selling costs have traditionally been assigned to Kragan's product lines at a rate of 70% of direct materials costs. Its direct materials costs for the month of March for Kragan's "high-intensity line of athletic wear are $392,000. The company has decided to extend activity-based costing to its selling costs. Data relating to the "high-intensity line of products for the month of March are as follows. Overhead Rate Activity Cost Pools Cost Drivers Number of Cost Drivers Used per Activity $900,000 300 Sales commissions Dollar sales Minutes Column inches Advertising-TV Advertising-Internet Catalogs Cost of catalog sales Credit and collection $0.05 per dollar sales $300 per minute $10 per column inch $2.50 per catalog $1 per catalog order $0.03 per dollar sales Catalogs mailed Catalog orders 2,200 62,500 8,750 $900,000 Dollar sales x Your answer is incorrect. Try again. Compute the selling costs to be assigned to the "high-intensity" line of athletic wear for the month of March (1) using the traditional product costing system (direct materials cost is the cost driver), and (2) using activity-based costing. Traditional product costing Activity-based costing X X Selling cost to be assigned 280000 326000 x Your answer is incorrect. Try again. Compute the selling costs to be assigned to the "high-intensity" line of athletic wear for the month of March (1) using the traditional product costing system (direct materials cost is the cost driver), and (2) using activity-based costing. Traditional product costing Activity-based costing X Selling cost to be assigned 280000 326000 LINK TO TEXT LINK TO TEXT LINK TO TEXT VIDEO: SIMILAR EXERCISE Your answer is partially correct. Try again. By what amount does the traditional product costing system undercost or overcost the "high-intensity" product line? 46000 Undercost