Answered step by step

Verified Expert Solution

Question

1 Approved Answer

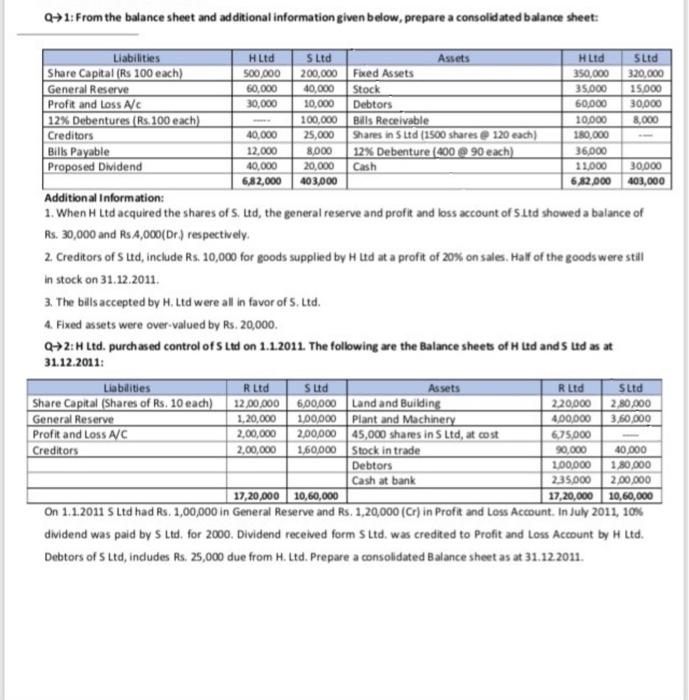

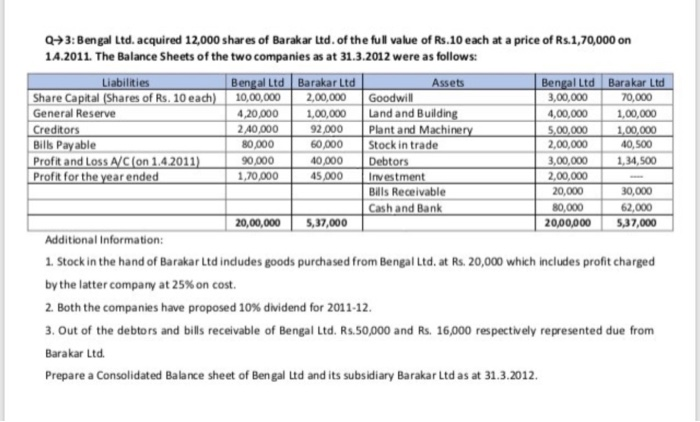

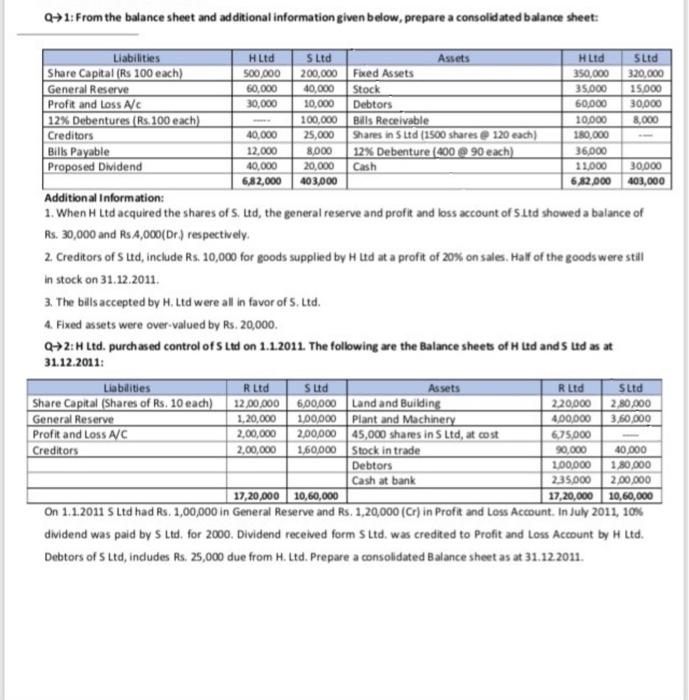

do it uegently please!!!!!!! all parts Q+1: From the balance sheet and additional information given below, prepare a consolidated balance sheet: 8.000 Liabilities HLtd SLtd

do it uegently please!!!!!!!

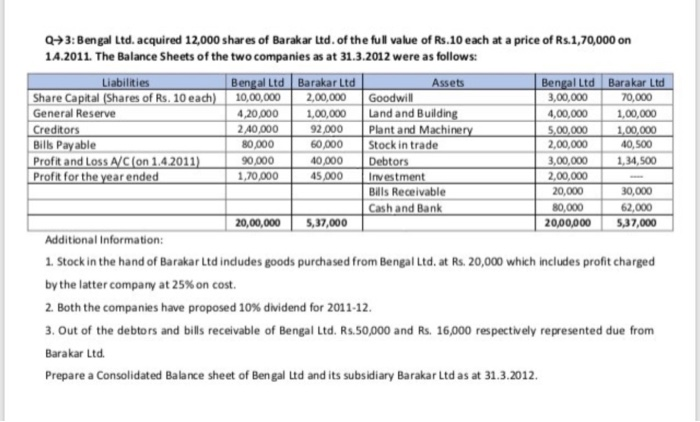

Q+1: From the balance sheet and additional information given below, prepare a consolidated balance sheet: 8.000 Liabilities HLtd SLtd Assets H Ltd SLtd Share Capital (Rs 100 each) 500,000 200,000 Faed Assets 350,000 320,000 General Reserve 60,000 40,000 Stock 35.000 15.000 Profit and Loss Alc 30,000 10,000 Debtors 60,000 30,000 12% Debentures (Rs. 100 each) 100,000 Balls Receivable 10,000 Creditors 40,000 25,000 Shares in S Ltd (1500 shares 120 each) 180,000 Bills Payable 12,000 8,000 12% Debenture (400 @ 90 each) 36,000 Proposed Dividend 40,000 20,000 Cash 11.000 30,000 6,82,000 403,000 6,822.000 403,000 Additional Information: 1. When H Ltd acquired the shares of S. Ltd, the general reserve and profit and loss account of S.Ltd showed a balance of Rs. 30,000 and Rs 4,000(Dr.) respectively. 2. Creditors of S Ltd, include Rs. 10,000 for goods supplied by H Ltd at a profit of 20% on sales. Half of the goods were still in stock on 31.12.2011 3. The bills accepted by H. Ltd were all in favor of S. Ltd. 4. Fixed assets were over-valued by Rs. 20,000. Q+2: Ltd. purchased control of Ltd on 1.1.2011. The following are the Balance sheets of H Ltd ands Ltd as at 31.12.2011 Liabilities R Ltd Sud Assets RLtd SLtd Share Capital (Shares of Rs. 10 each) 12.00.000 6,00,000 Land and Building 2.20,000 280,000 General Reserve 1,20,000 1,00,000 plant and Machinery 4,00,000 3,60.000 Profit and Loss A/C 2,00,000 200,000 45,000 shares in S Ltd, at cost 6.75,000 Creditors 2,00,000 1,60,000 Stock in trade 90,000 40.000 Debtors 100.000 1,80.000 Cash at bank 2,35,000 2,00,000 17,20,000 10,60,000 17,20,000 10,60,000 On 1.1.2011 S Ltd had Rs. 1,00,000 in General Reserve and Rs. 1,20,000 (Cr) in Profit and Loss Account. In July 2011, 10% dividend was paid by S Ltd. for 2000. Dividend received form S Ltd. was credited to profit and Loss Account by H Ltd. Debtors of S Ltd, includes Rs. 25,000 due from H. Ltd. Prepare a consolidated Balance sheet as at 31.12.2011 Q73: Bengal Ltd. acquired 12,000 shares of Barakar Ltd. of the full value of Rs.10 each at a price of Rs.1,70,000 on 14.2011. The Balance Sheets of the two companies as at 31.3.2012 were as follows: Liabilities Bengal Ltd Barakar Ltd Assets Bengal Ltd Barakar Ltd Share Capital (Shares of Rs. 10 each) 10,00,000 2,00,000 Goodwill 3,00,000 70,000 General Reserve 4,20,000 1,00,000 Land and Building 4,00,000 1,00,000 Creditors 240,000 92,000 Plant and Machinery 5,00,000 1,00,000 Bills Payable 80,000 60,000 Stock in trade 2,00,000 40,500 Profit and Loss A/C (on 1.4.2011) 90,000 40,000 Debtors 3,00,000 1,34,500 Profit for the year ended 1,70,000 45,000 Investment 2,00,000 Bills Receivable 20,000 30,000 Cash and Bank 80,000 62,000 20,00,000 5,37,000 20,00,000 5,37,000 Additional Information: 1. Stock in the hand of Barakar Ltd includes goods purchased from Bengal Ltd. at Rs. 20,000 which includes profit charged by the latter company at 25% on cost. 2. Both the companies have proposed 10% dividend for 2011-12. 3. Out of the debtors and bills receivable of Bengal Ltd. Rs.50,000 and Rs. 16,000 respectively represented due from Barakar Ltd Prepare a Consolidated Balance sheet of Bengal Ltd and its subsidiary Barakar Ltd as at 31.3.2012 Q+1: From the balance sheet and additional information given below, prepare a consolidated balance sheet: 8.000 Liabilities HLtd SLtd Assets H Ltd SLtd Share Capital (Rs 100 each) 500,000 200,000 Faed Assets 350,000 320,000 General Reserve 60,000 40,000 Stock 35.000 15.000 Profit and Loss Alc 30,000 10,000 Debtors 60,000 30,000 12% Debentures (Rs. 100 each) 100,000 Balls Receivable 10,000 Creditors 40,000 25,000 Shares in S Ltd (1500 shares 120 each) 180,000 Bills Payable 12,000 8,000 12% Debenture (400 @ 90 each) 36,000 Proposed Dividend 40,000 20,000 Cash 11.000 30,000 6,82,000 403,000 6,822.000 403,000 Additional Information: 1. When H Ltd acquired the shares of S. Ltd, the general reserve and profit and loss account of S.Ltd showed a balance of Rs. 30,000 and Rs 4,000(Dr.) respectively. 2. Creditors of S Ltd, include Rs. 10,000 for goods supplied by H Ltd at a profit of 20% on sales. Half of the goods were still in stock on 31.12.2011 3. The bills accepted by H. Ltd were all in favor of S. Ltd. 4. Fixed assets were over-valued by Rs. 20,000. Q+2: Ltd. purchased control of Ltd on 1.1.2011. The following are the Balance sheets of H Ltd ands Ltd as at 31.12.2011 Liabilities R Ltd Sud Assets RLtd SLtd Share Capital (Shares of Rs. 10 each) 12.00.000 6,00,000 Land and Building 2.20,000 280,000 General Reserve 1,20,000 1,00,000 plant and Machinery 4,00,000 3,60.000 Profit and Loss A/C 2,00,000 200,000 45,000 shares in S Ltd, at cost 6.75,000 Creditors 2,00,000 1,60,000 Stock in trade 90,000 40.000 Debtors 100.000 1,80.000 Cash at bank 2,35,000 2,00,000 17,20,000 10,60,000 17,20,000 10,60,000 On 1.1.2011 S Ltd had Rs. 1,00,000 in General Reserve and Rs. 1,20,000 (Cr) in Profit and Loss Account. In July 2011, 10% dividend was paid by S Ltd. for 2000. Dividend received form S Ltd. was credited to profit and Loss Account by H Ltd. Debtors of S Ltd, includes Rs. 25,000 due from H. Ltd. Prepare a consolidated Balance sheet as at 31.12.2011 Q73: Bengal Ltd. acquired 12,000 shares of Barakar Ltd. of the full value of Rs.10 each at a price of Rs.1,70,000 on 14.2011. The Balance Sheets of the two companies as at 31.3.2012 were as follows: Liabilities Bengal Ltd Barakar Ltd Assets Bengal Ltd Barakar Ltd Share Capital (Shares of Rs. 10 each) 10,00,000 2,00,000 Goodwill 3,00,000 70,000 General Reserve 4,20,000 1,00,000 Land and Building 4,00,000 1,00,000 Creditors 240,000 92,000 Plant and Machinery 5,00,000 1,00,000 Bills Payable 80,000 60,000 Stock in trade 2,00,000 40,500 Profit and Loss A/C (on 1.4.2011) 90,000 40,000 Debtors 3,00,000 1,34,500 Profit for the year ended 1,70,000 45,000 Investment 2,00,000 Bills Receivable 20,000 30,000 Cash and Bank 80,000 62,000 20,00,000 5,37,000 20,00,000 5,37,000 Additional Information: 1. Stock in the hand of Barakar Ltd includes goods purchased from Bengal Ltd. at Rs. 20,000 which includes profit charged by the latter company at 25% on cost. 2. Both the companies have proposed 10% dividend for 2011-12. 3. Out of the debtors and bills receivable of Bengal Ltd. Rs.50,000 and Rs. 16,000 respectively represented due from Barakar Ltd Prepare a Consolidated Balance sheet of Bengal Ltd and its subsidiary Barakar Ltd as at 31.3.2012 all parts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started