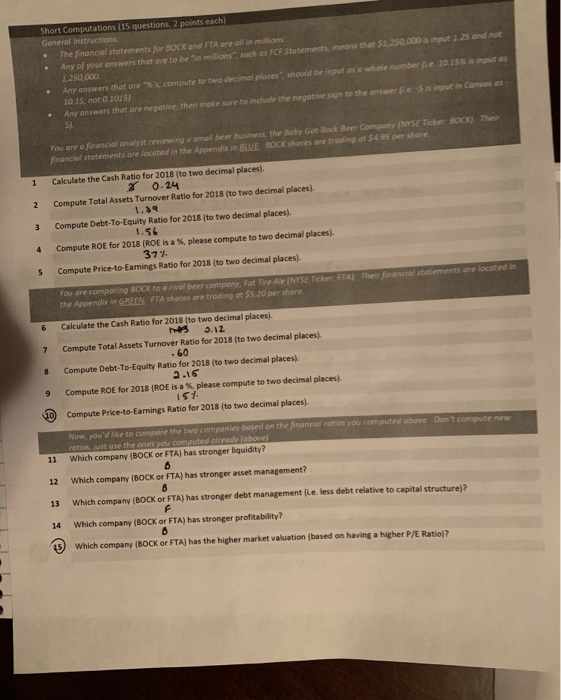

Do my answers look good? need help on 10 & 15

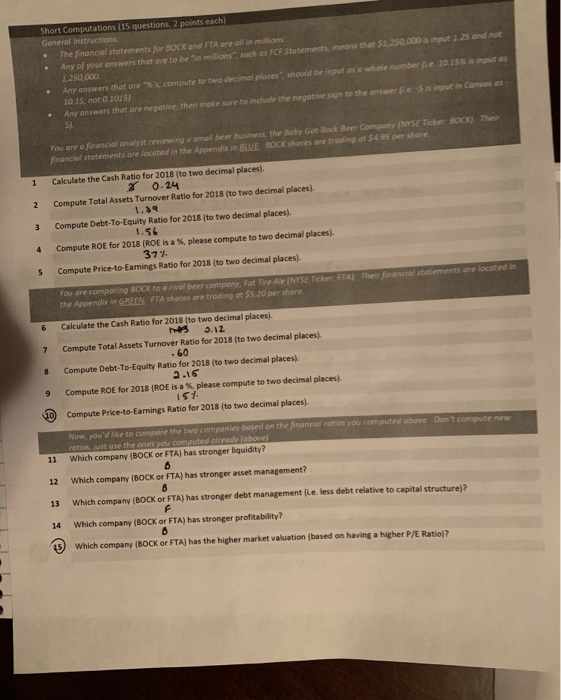

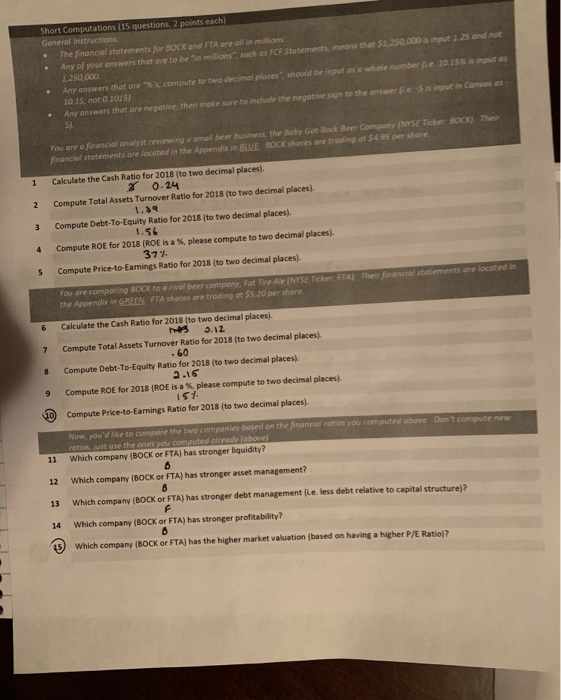

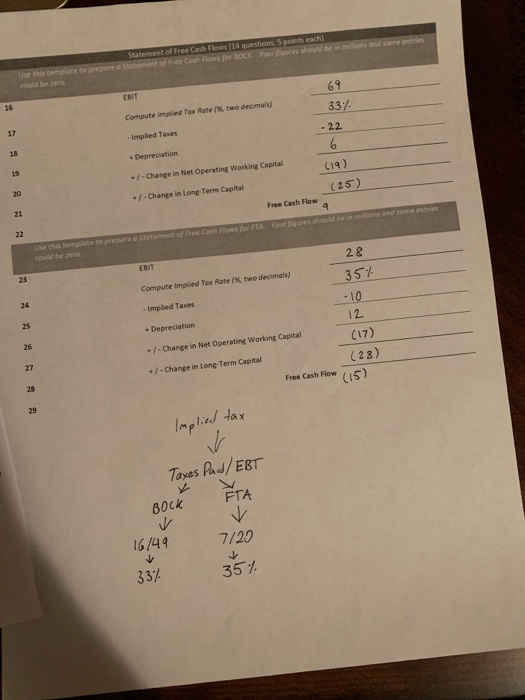

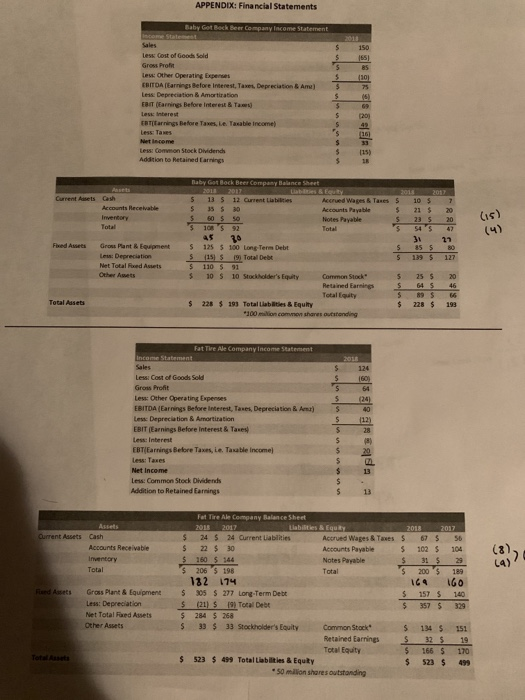

Short Computations (15 questions, 2 points cach) General Instructions The financial statements for BOCK and FTA are all in millions Any of your answers that are to be in millions, such as FCF Statements, means thor $1.250.000 sinut 125 and not 1.250,000 Any answers that one 's compute to two decimal places, should be input ose whole bere 10155 is imputes 10.15. not 0 1015) Any answers that are negative, then make sure to include the negative sign to the answer is input in conses You are e financial analyst reviewing a small beer business, the Baby Got Bock Beer Company (NYSE Ticker BOCKY Their financial statements are located in the Appendix in BLUE BOCK shores are trading of 5495 per share 2 Calculate the Cash Ratio for 2018 (to two decimal places). 0.24 Compute Total Assets Turnover Ratio for 2018 (to two decimal places). 1.39 Compute Debt-To-Equity Ratio for 2018 (to two decimal places). 1.56 Compute ROE for 2018 (ROE is a %, please compute to two decimal places). 37 Compute Price-to-Earnings Ratio for 2018 to two decimal places). The financial statements are located You are comparing BOCK to rivol beer company, Fat Tire Ale (NYSE Ticker FTA the Appendix in GREEN FTA shores are trading or $5 20 per share Calculate the Cash Ratio for 2018 (to two decimal places). Tres 0.12 Compute Total Assets Turnover Ratio for 2018 (to two decimal places) .60 8 2.16 Compute Debt-To-Equity Ratio for 2018 (to two decimal places). Compute ROE for 2018 (ROE is a please compute to two decimal places 151 Compute Price-to-Earnings Ratio for 2018 to two decimal places). D Now you'd like to compare the two companies based on the finance ratios you computed above. Dont compute new ratios, fust use the ones you computed already (above) Which company (BOCK or FTA) has stronger liquidity? 12 Which company (BOCK or FTA) has stronger asset management? 13 which company (BOCK or FTA) has stronger debt management (ie. less debt relative to capital structure? 14 Which company (BOCK or FTA) has stronger profitability? ) Which company (BOCK or FTA) has the higher market valuation based on having a higher P/E Ratio? d some entre Statement of Free Cash Flow (14 questions, 5 points each) re statement of Free Con Flows for BOCK Fourres should be in Use this template to p 69 EBIT Compute implied Tax Rate / two decimals) 33% - 22 -Implied Taxes 6 Depreciation (19) +/- Change in Net Operating Working Capital (25) +/- Change in Long Term Capital Free Cash Flow and sometres Your figures should be in Use this template to prepare a statement of free Cash Flows for FTA 28 351 Compute implied Tex Rote % two decimals) -10 - Implied Taxes 12 Depreciation +/- Change in Net Operating Working Capital +/- Change in Long-Term Capital (17) (28) Free Cash Flow (15) Implied tax v Taxes Paud/ EBT ETA BOCK 16/44 7/20 354 337 APPENDIX: Financial Statements Baby Got Back Beer Company Income Statement Less Cost of Goods Sold Gross Pro Lew: Other Operating Expenses EBITDA Earnings Before Interest, Taxes, Depreciation & Am Lens: Depreciation & Amortization EDIT (Earnings Before Interest & Tas Les interest arnings Before Taxes e Table income) E Net Income Less: Convon Stock Dividench Addition to Retained Earnings Baby Got Back Beer Company Balance Sheet 7 105 21 $ 20 20 $ 235 's S 13 S 12 Current Liabilities Accrued Wages Taxes S $ 35 $ 30 $ Notes Payable STORS 92 45 30 $ 125 $ 100 Long Term Debt $ $ 115 S 19) Total Debt $ $ 1105 91 $ 10 $ 10 Stockholder's Equity Coron Stock $ Retained Earnings $ Totality 5 $ 228 $ 193 Totallaties & Equity $ *100 million comment shares outstanding 31 85 S 139 5 22 80 127 Gross Plant & Equipment Lew: Depreciation Net Total Feed Auets Other Awets 25 $ 20 45 46 895 66 228 $ 193 Total Assets Fat Tire Ale company income Statement Sales Les Costa Good Sold Army Less: Other Operating Expenses EBITDA (Earnings Before Interest, Taxes, Depreciation Les Depreciation Amortiration EBIT (Earnings Before Interest & Taxes Les interest FBT Farnings Before Taxes, Le Taxable income Net Income Less Common Stock Dividends Addition to Retained Earnings Current Assets Cash Accounts Receivable Inventory $ $ $ $ Total Total Fled Assets Gross Plant & Equipment Les: Depreciation Net Total Faed Assets Other Assets $ $ $ s Fat Tire Ale Company Balance Sheet 2016 2017 Liabilities & Equity 2018 2017 24 $ 24 Current Liabilities Accrued Wages & Taxes $ 67 $ 56 22 $ 30 Accounts Payable $ 102 $ 104 160 5 144 Notes Payable $ 31 $ 29 206 $ 198 s 2003 189 182 174 164 160 205 $ 277 Long-Term Debt S 1575 140 (21) S 19 Total Debt $ 357 $ 329 284 $ 268 33 $ 33 Stockholder's Equity Common Stock $ 134 $ 151 Retained Earrings $ 32 $ 19 Total Equity $ 166 $ 170 523 $ 499 Total Liabilities & Equity $ 523 $ 499 50 million shares outstanding Tet $