DO NOT ANSWER IF NOT ANSWER BOTH QUESTIONS

DO NOT ANSWER IF NOT ANSWER BOTH QUESTIONS

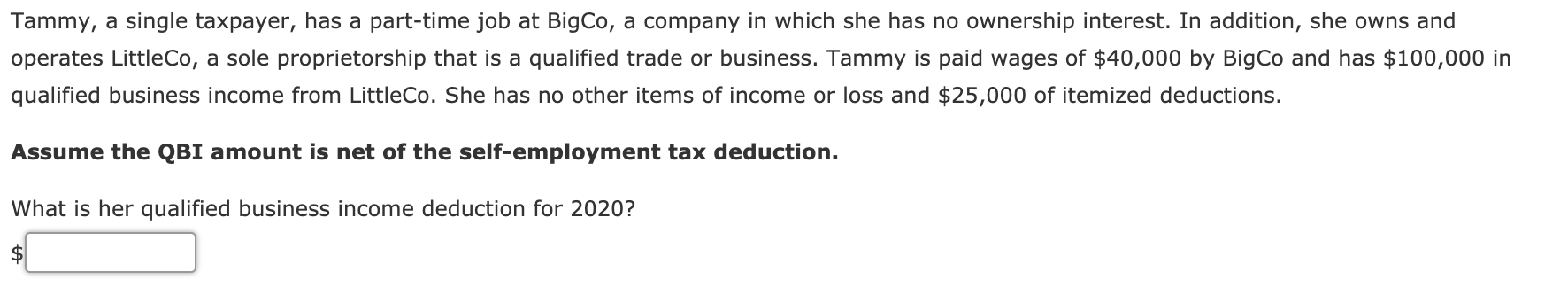

Donald (a married taxpayer filing jointly) owns a wide variety of commercial rental properties held in a single member LLC. Donald's LLC reports rental income of $1,500,000. The LLC pays no W-2 wages; rather, it pays a management fee to an S corporation Donald controls. The management company pays W-2 wages but reports no income (or loss). Donald's total unadjusted basis of the commercial rental property is $10,000,000. Donald's taxable income before the QBI deduction (and his modified taxable income) is $2,000,000. What is Donald's QBI deduction for 2020? Tammy, a single taxpayer, has a part-time job at BigCo, a company in which she has no ownership interest. In addition, she owns and operates LittleCo, a sole proprietorship that is a qualified trade or business. Tammy is paid wages of $40,000 by Bigco and has $100,000 in qualified business income from LittleCo. She has no other items of income or loss and $25,000 of itemized deductions. Assume the QBI amount is net of the self-employment tax deduction. What is her qualified business income deduction for 2020? Donald (a married taxpayer filing jointly) owns a wide variety of commercial rental properties held in a single member LLC. Donald's LLC reports rental income of $1,500,000. The LLC pays no W-2 wages; rather, it pays a management fee to an S corporation Donald controls. The management company pays W-2 wages but reports no income (or loss). Donald's total unadjusted basis of the commercial rental property is $10,000,000. Donald's taxable income before the QBI deduction (and his modified taxable income) is $2,000,000. What is Donald's QBI deduction for 2020? Tammy, a single taxpayer, has a part-time job at BigCo, a company in which she has no ownership interest. In addition, she owns and operates LittleCo, a sole proprietorship that is a qualified trade or business. Tammy is paid wages of $40,000 by Bigco and has $100,000 in qualified business income from LittleCo. She has no other items of income or loss and $25,000 of itemized deductions. Assume the QBI amount is net of the self-employment tax deduction. What is her qualified business income deduction for 2020

DO NOT ANSWER IF NOT ANSWER BOTH QUESTIONS

DO NOT ANSWER IF NOT ANSWER BOTH QUESTIONS