Answered step by step

Verified Expert Solution

Question

1 Approved Answer

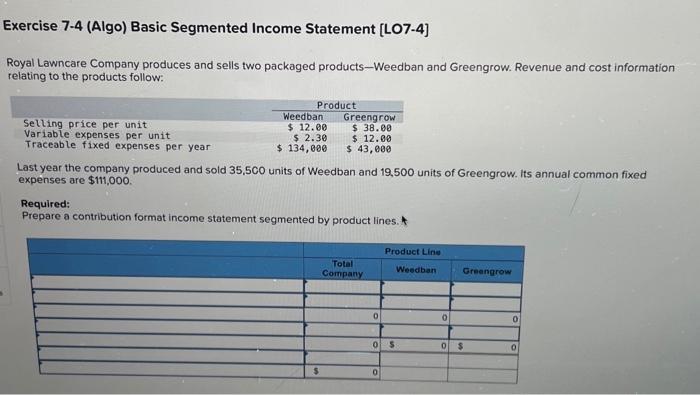

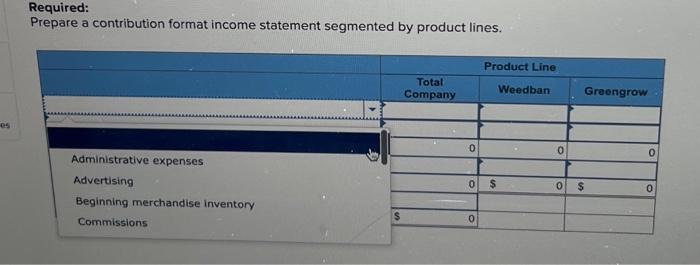

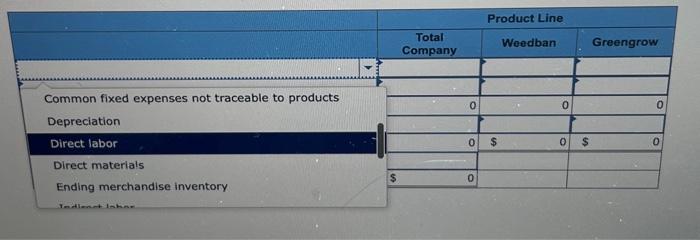

DO NOT ANSWER IF YOU ARE NOT GOING TO COMPLETE ALL SECTIONS!!! plZ provide answers in excel like format. i included what goes in the

DO NOT ANSWER IF YOU ARE NOT GOING TO COMPLETE ALL SECTIONS!!! plZ provide answers in excel like format. i included what goes in the blanks in pictures 2-4

i think all info is there

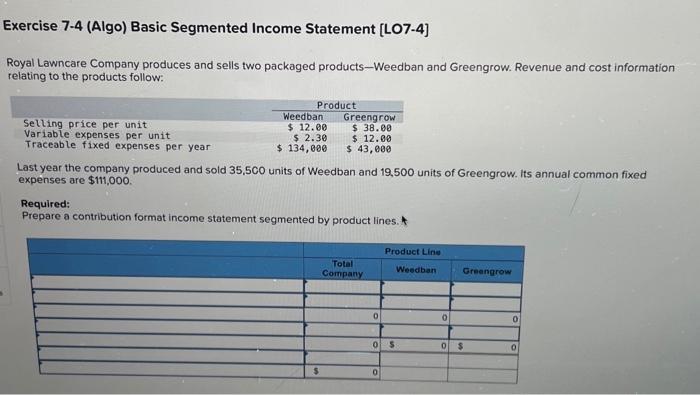

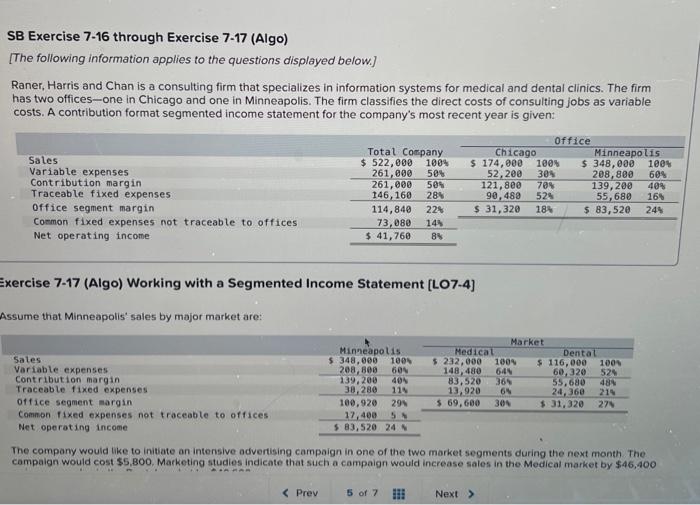

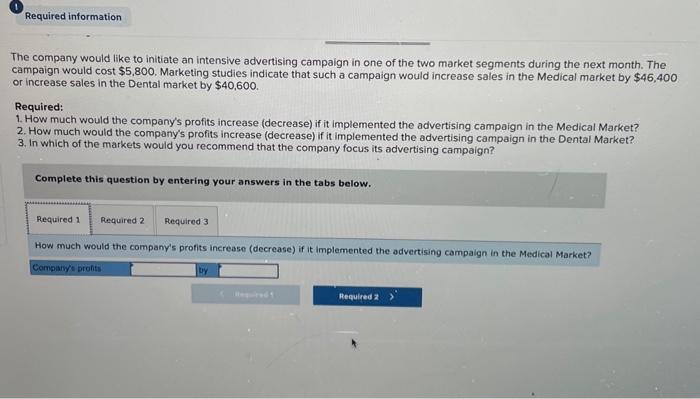

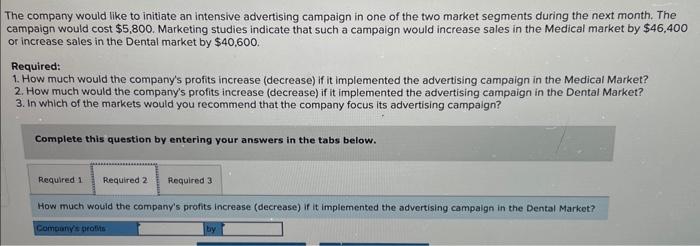

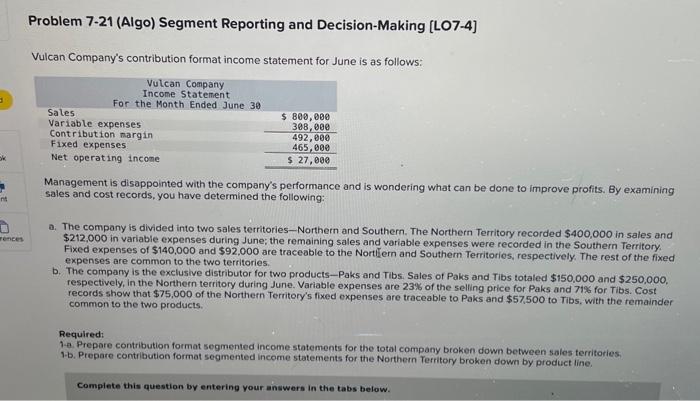

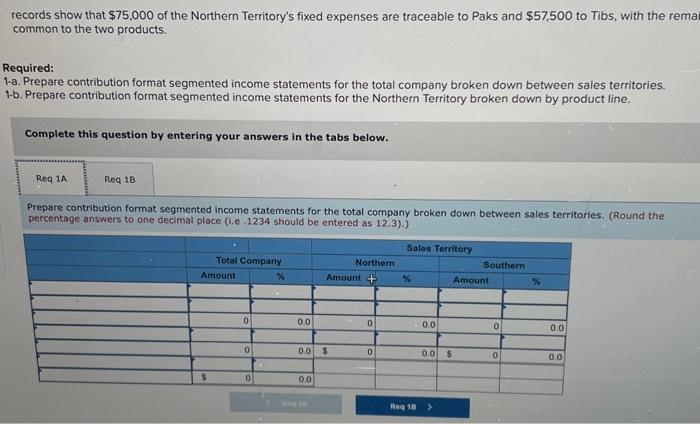

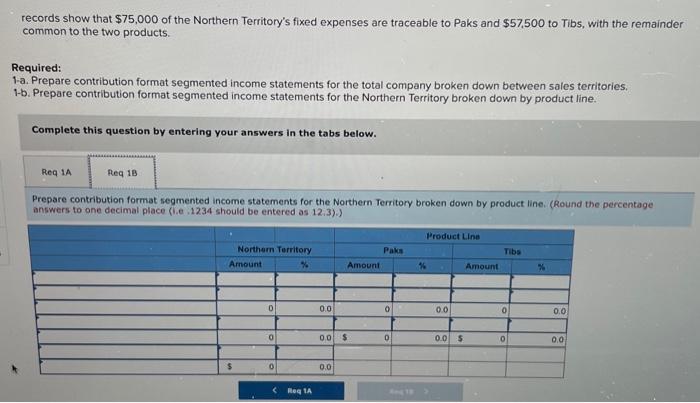

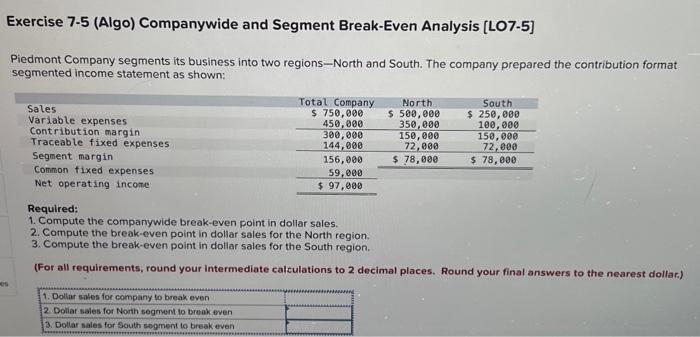

Exercise 7-4 (Algo) Basic Segmented Income Statement [LO7-4] Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Last year the company produced and sold 35,500 units of Weedban and 19,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Required: Prepare a contribution format income statement segmented by product lines. SB Exercise 7-16 through Exercise 7-17 (Algo) [The following information applies to the questions displayed below] Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Exercise 7-17 (Algo) Working with a Segmented Income Statement [LO7-4] Assume that Minneapolis' sales by major market are: The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,800. Marketing studies indicate that such a campaign would increase sales in the Medical market by $46,400 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,800. Marketing studies indicate that such a campaign would increase sales in the Medical market by $46,400 or increase sales in the Dental market by $40,600. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,800. Marketing studies indicate that such a campaign would increase sales in the Medical market by $46,400 or increase sales in the Dental market by $40,600. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? Problem 7-21 (Algo) Segment Reporting and Decision-Making [LO7-4] Vulcan Company's contribution format income statement for June is as follows: Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $212,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $140,000 and $92,000 are traceable to the Nortilern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $150,000 and $250,000. respectively, in the Northern territory during June. Variable expenses are 23% of the selling price for Paks and 71% for Tibs. Cost records show that $75,000 of the Northern Territory's fixed expenses are traceable to Paks and $57,500 to Tibs, with the remainder common to the two products. records show that $75,000 of the Northern Territory's fixed expenses are traceable to Paks and $57,500 to Tibs, with the reme common to the two products. Required: a. Prepare contribution format segmented income statements for the total company broken down between sales territories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. Prepare contribution format segmented income statements for the total company broken down between sales territories. (Round the percentage answers to one decimal place (1.e .1234 should be entered as 12.3).) records show that $75,000 of the Northern Territory's fixed expenses are traceable to Paks and $57,500 to Tibs, with the remainder common to the two products. Required: 1-a. Prepare contribution format segmented income statements for the total company broken down between sales territories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. (Round the percentage answers to one decimal place (1.e .1234 should be entered as 12.3 ). ) Exercise 7-5 (Algo) Companywide and Segment Break-Even Analysis [LO7-5] Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. (For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started