Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST Question 1. Answer all parts I. Consider the following three bonds Bond 1 10,000 7%

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST

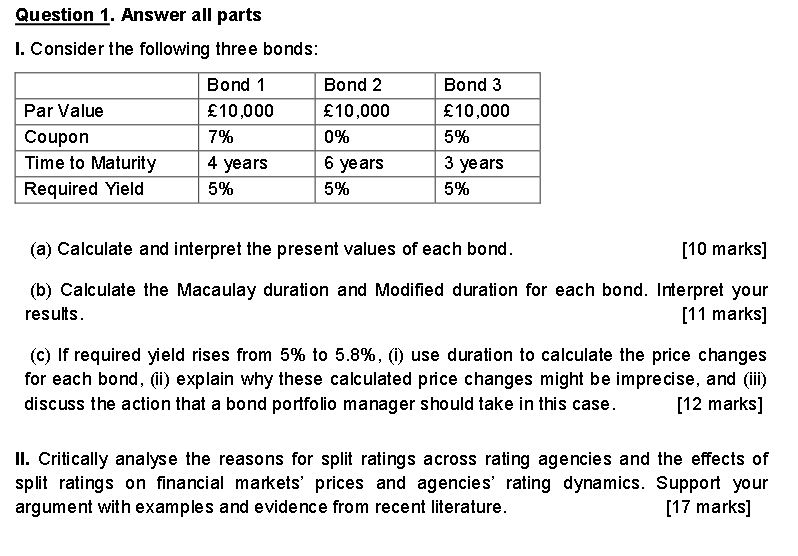

Question 1. Answer all parts I. Consider the following three bonds Bond 1 10,000 7% 4 years 5% Bond 2 10,000 0% byears 5% Bond 3 10,000 5% 3 years 5% Par Value Coupon Time to Maturity Required Yield (a) Calculate and interpret the present values of each bond [10 marks] (b) Calculate the Macaulay duration and Modified duration for each bond. Interpret your [11 marks] results (c) If required yield rises from 5% to 5.8%, (i) use duration to calculate the price changes for each bond, (i) explain why these calculated price changes might be imprecise, and (ii) [12 markS] discuss the action that a bond portfolio manager should take in this case II. Critically analyse the reasons for split ratings across rating agencies and the effects of split ratings on financial markefs prices and agencies rating dynamics. Support your argument with examples and evidence from recent literature [17 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started