Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST Q uestion 1. Answer all partS . Consider the following three bonds Par Value Coupon

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST

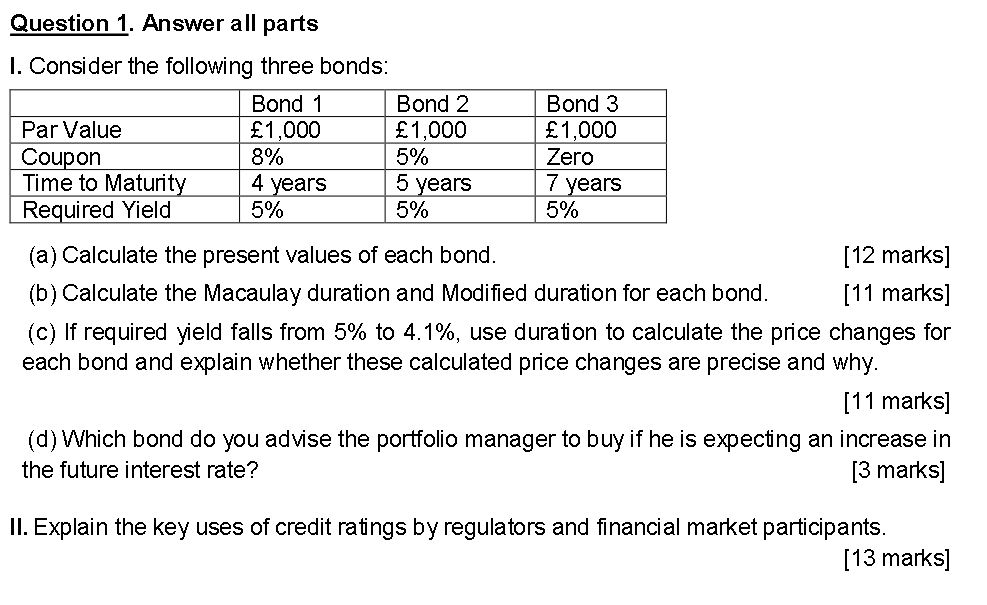

Q uestion 1. Answer all partS . Consider the following three bonds Par Value Coupon lime to Matunt Required Yield Bond 1 1.000 8% 4 years 5% Bond 2 1,000 5% 5 years 5% Bond 3 1,000 Zero 7 years 5% (a) Calculate the present values of each bond (b) Calculate the Macaulay duration and Modified duration for each bond [12 marks] [11 marks) (c) If required yield falls from 5% to 4.1%, use duration to calculate the price changes for each bond and explain whether these calculated price changes are precise and why [11 marks (d) VVnich bond do you adise the portrollo manager to buy if he is expecung an increase in the future interest rate? 3 markS II. Explain the key uses of credit ratings by regulators and financial market participants [13 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started