Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do not answer part a Question 1. part b , what is adjusted lease, adjusted EBIT, adjusted assets, adjusted debt, adjusted equity, WACC and ROC

Do not answer part a

Question 1. part b, what is adjusted lease, adjusted EBIT, adjusted assets, adjusted debt, adjusted equity, WACC and ROC

please show me the working out for all the things

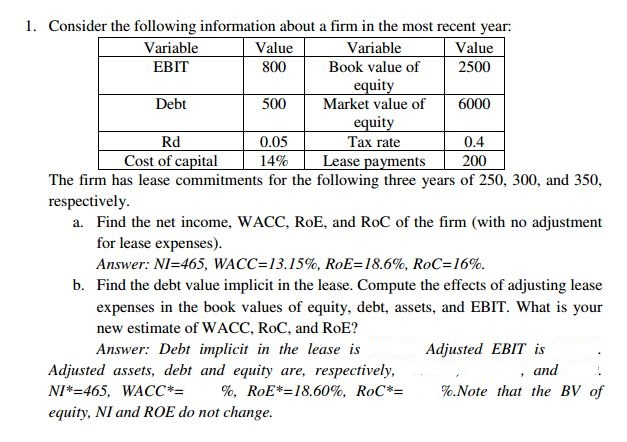

1. Consider the following information about a firm in the most recent year: Variable Value Variable Value EBIT 800 Book value of 2500 equity Debt 500 Market value of 6000 equity Red 0.05 Tax rate (0.4 Cost of capital 14% Lease payments 200 The firm has lease commitments for the following three years of 250, 300, and 350, respectively a. Find the net income, WACC, RoE, and RoC of the firm (with no adjustment for lease expenses) Answer: NI-465, WACC-13.15%, RoE-18.6%, RoC-16%. b. Find the debt value implicit in the lease. Compute the effects of adjusting lease expenses in the book values of equity, debt, assets, and EBIT. What is your new estimate of WACC, RoC, and RoE? Adjusted EBIT is Answer: Debt implicit in the lease is Adjusted assets, debt and equity are, respectively, and NI* 465, WACC RoE 18.60%. RoC* Note that the BV of equity, NI and ROE do not change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started