Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO NOT answer part b. Please explain step by step and in detail 12. Solve the following application problems: a) You have an outstanding balance

DO NOT answer part b.

Please explain step by step and in detail

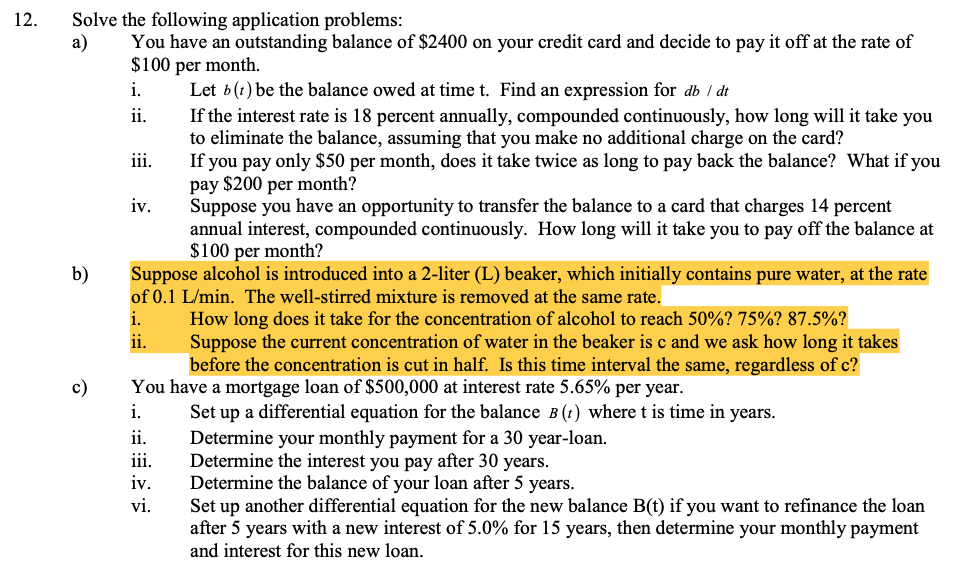

12. Solve the following application problems: a) You have an outstanding balance of $2400 on your credit card and decide to pay it off at the rate of $100 per month. i. Let b(t) be the balance owed at time t. Find an expression for db / dt ii. If the interest rate is 18 percent annually, compounded continuously, how long will it take you to eliminate the balance, assuming that you make no additional charge on the card? iii. If you pay only $50 per month, does it take twice as long to pay back the balance? What if you pay $200 per month? iv. Suppose you have an opportunity to transfer the balance to a card that charges 14 percent annual interest, compounded continuously. How long will it take you to pay off the balance at $100 per month? b) Suppose alcohol is introduced into a 2-liter (L) beaker, which initially contains pure water, at the rate of 0.1 L/min. The well-stirred mixture is removed at the same rate. i. How long does it take for the concentration of alcohol to reach 50%? 75%? 87.5%? ii. Suppose the current concentration of water in the beaker is c and we ask how long it takes before the concentration is cut in half. Is this time interval the same, regardless of c? C You have a mortgage loan of $500,000 at interest rate 5.65% per year. i. Set up a differential equation for the balance B(t) where t is time in years. ii. Determine your monthly payment for a 30 year-loan. iii. Determine the interest you pay after 30 years. iv. Determine the balance of your loan after 5 years. vi. Set up another differential equation for the new balance B(t) if you want to refinance the loan after 5 years with a new interest of 5.0% for 15 years, then determine your monthly payment and interest for this new loan. 12. Solve the following application problems: a) You have an outstanding balance of $2400 on your credit card and decide to pay it off at the rate of $100 per month. i. Let b(t) be the balance owed at time t. Find an expression for db / dt ii. If the interest rate is 18 percent annually, compounded continuously, how long will it take you to eliminate the balance, assuming that you make no additional charge on the card? iii. If you pay only $50 per month, does it take twice as long to pay back the balance? What if you pay $200 per month? iv. Suppose you have an opportunity to transfer the balance to a card that charges 14 percent annual interest, compounded continuously. How long will it take you to pay off the balance at $100 per month? b) Suppose alcohol is introduced into a 2-liter (L) beaker, which initially contains pure water, at the rate of 0.1 L/min. The well-stirred mixture is removed at the same rate. i. How long does it take for the concentration of alcohol to reach 50%? 75%? 87.5%? ii. Suppose the current concentration of water in the beaker is c and we ask how long it takes before the concentration is cut in half. Is this time interval the same, regardless of c? C You have a mortgage loan of $500,000 at interest rate 5.65% per year. i. Set up a differential equation for the balance B(t) where t is time in years. ii. Determine your monthly payment for a 30 year-loan. iii. Determine the interest you pay after 30 years. iv. Determine the balance of your loan after 5 years. vi. Set up another differential equation for the new balance B(t) if you want to refinance the loan after 5 years with a new interest of 5.0% for 15 years, then determine your monthly payment and interest for this new loanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started