Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do not copy from others. (Its not full answers and I cant understand by that, please do not waste my chance to ask questions, I

Do not copy from others. (Its not full answers and I cant understand by that, please do not waste my chance to ask questions, I need to UNDERSTAND it not copying the answer for exams)

I need detailed calculations step and explanation.

I need to know how you deal with the dividend yearly rate in a six month contract, and how do understand the intersection rate 2% for any term.

Please give me detail solutions.

Many thanks in advance.

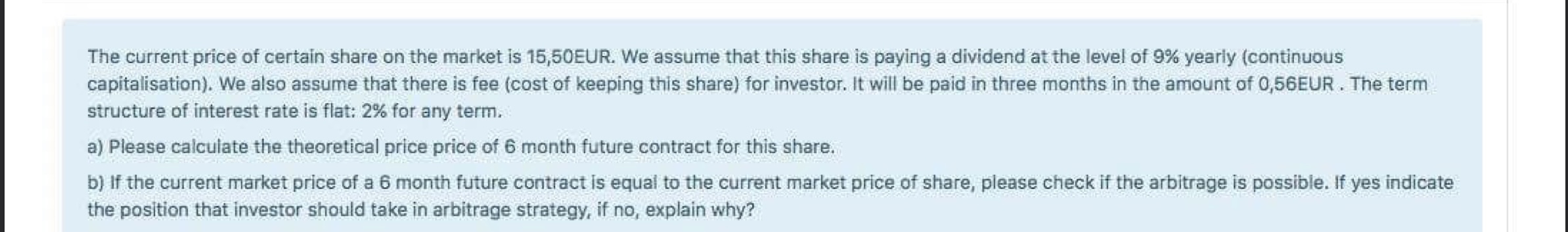

The current price of certain share on the market is 15,50EUR. We assume that this share is paying a dividend at the level of 9% yearly (continuous capitalisation). We also assume that there is fee (cost of keeping this share) for investor. It will be paid in three months in the amount of 0,56EUR. The term structure of interest rate is flat: 2% for any term. a) Please calculate the theoretical price price of 6 month future contract for this share. b) If the current market price of a 6 month future contract is equal to the current market price of share, please check if the arbitrage is possible. If yes indicate the position that investor should take in arbitrage strategy, if no, explain whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started