Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do not copy other answers. THEY ARE WRONG Solve and show the workings of each Suppose that a 3-year financial investment is expected to make

Do not copy other answers. THEY ARE WRONG

Solve and show the workings of each

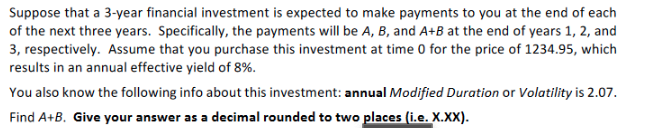

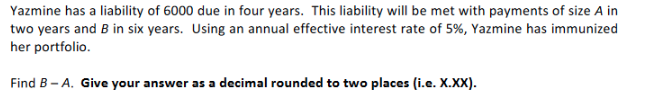

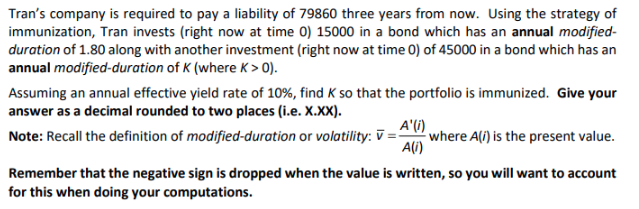

Suppose that a 3-year financial investment is expected to make payments to you at the end of each of the next three years. Specifically, the payments will be A,B, and A+B at the end of years 1,2 , and 3 , respectively. Assume that you purchase this investment at time 0 for the price of 1234.95, which results in an annual effective yield of 8%. You also know the following info about this investment: annual Modified Duration or Volatility is 2.07. Find A+B. Give your answer as a decimal rounded to two places (i.e. X.XX ). Yazmine has a liability of 6000 due in four years. This liability will be met with payments of size A in two years and B in six years. Using an annual effective interest rate of 5%, Yazmine has immunized her portfolio. Find BA. Give your answer as a decimal rounded to two places (i.e. X.XX). Tran's company is required to pay a liability of 79860 three years from now. Using the strategy of immunization, Tran invests (right now at time 0) 15000 in a bond which has annual modifiedduration of 1.80 along with another investment (right now at time 0 ) of 45000 in a bond which has an annual modified-duration of K (where K>0 ). Assuming an annual effective yield rate of 10%, find K so that the portfolio is immunized. Give your answer as a decimal rounded to two places (i.e. X.XX). Note: Recall the definition of modified-duration or volatility: v=A(i)A(i) where A(i) is the present value. Remember that the negative sign is dropped when the value is written, so you will want to account for this when doing your computations

Suppose that a 3-year financial investment is expected to make payments to you at the end of each of the next three years. Specifically, the payments will be A,B, and A+B at the end of years 1,2 , and 3 , respectively. Assume that you purchase this investment at time 0 for the price of 1234.95, which results in an annual effective yield of 8%. You also know the following info about this investment: annual Modified Duration or Volatility is 2.07. Find A+B. Give your answer as a decimal rounded to two places (i.e. X.XX ). Yazmine has a liability of 6000 due in four years. This liability will be met with payments of size A in two years and B in six years. Using an annual effective interest rate of 5%, Yazmine has immunized her portfolio. Find BA. Give your answer as a decimal rounded to two places (i.e. X.XX). Tran's company is required to pay a liability of 79860 three years from now. Using the strategy of immunization, Tran invests (right now at time 0) 15000 in a bond which has annual modifiedduration of 1.80 along with another investment (right now at time 0 ) of 45000 in a bond which has an annual modified-duration of K (where K>0 ). Assuming an annual effective yield rate of 10%, find K so that the portfolio is immunized. Give your answer as a decimal rounded to two places (i.e. X.XX). Note: Recall the definition of modified-duration or volatility: v=A(i)A(i) where A(i) is the present value. Remember that the negative sign is dropped when the value is written, so you will want to account for this when doing your computations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started