Question: Do not mention Blockbuster How strong are the competitive forces in the rapidly evolving global market for streamed video content? Do a five-forces analysis to

Do not mention Blockbuster

- How strong are the competitive forces in the rapidly evolving global market for streamed video content? Do a five-forces analysis to support your answer.

- What forces are driving change in this new global industry? Are the combined impacts of these driving forces likely to be favorable or unfavorable in term of their effects on competitive intensity and future industry profitability?

- What does your strategic group map of this industry look like? How attractively is Netflix positioned on the map? Why?

- What key factors will determine a companys success in this industry in the next 3-5 years?

- What is Netflixs strategy? Which of the five generic competitive strategies discussed in Chapter 5 most closely fit the competitive approach that Netflix is taking? What type of competitive advantage is Netflix trying to achieve?

- What does a SWOT analysis of Netflix reveal about the overall attractiveness of its situation?

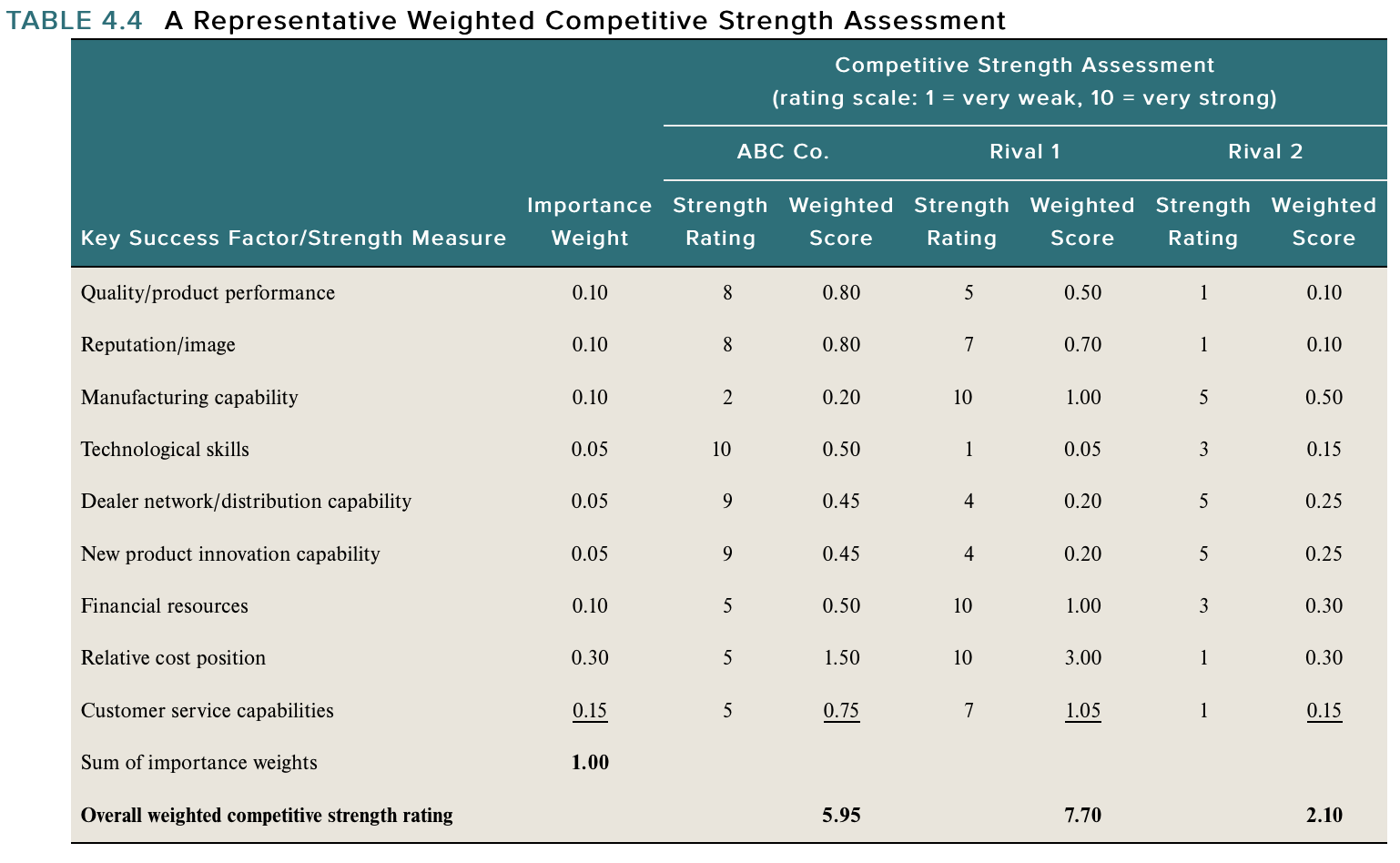

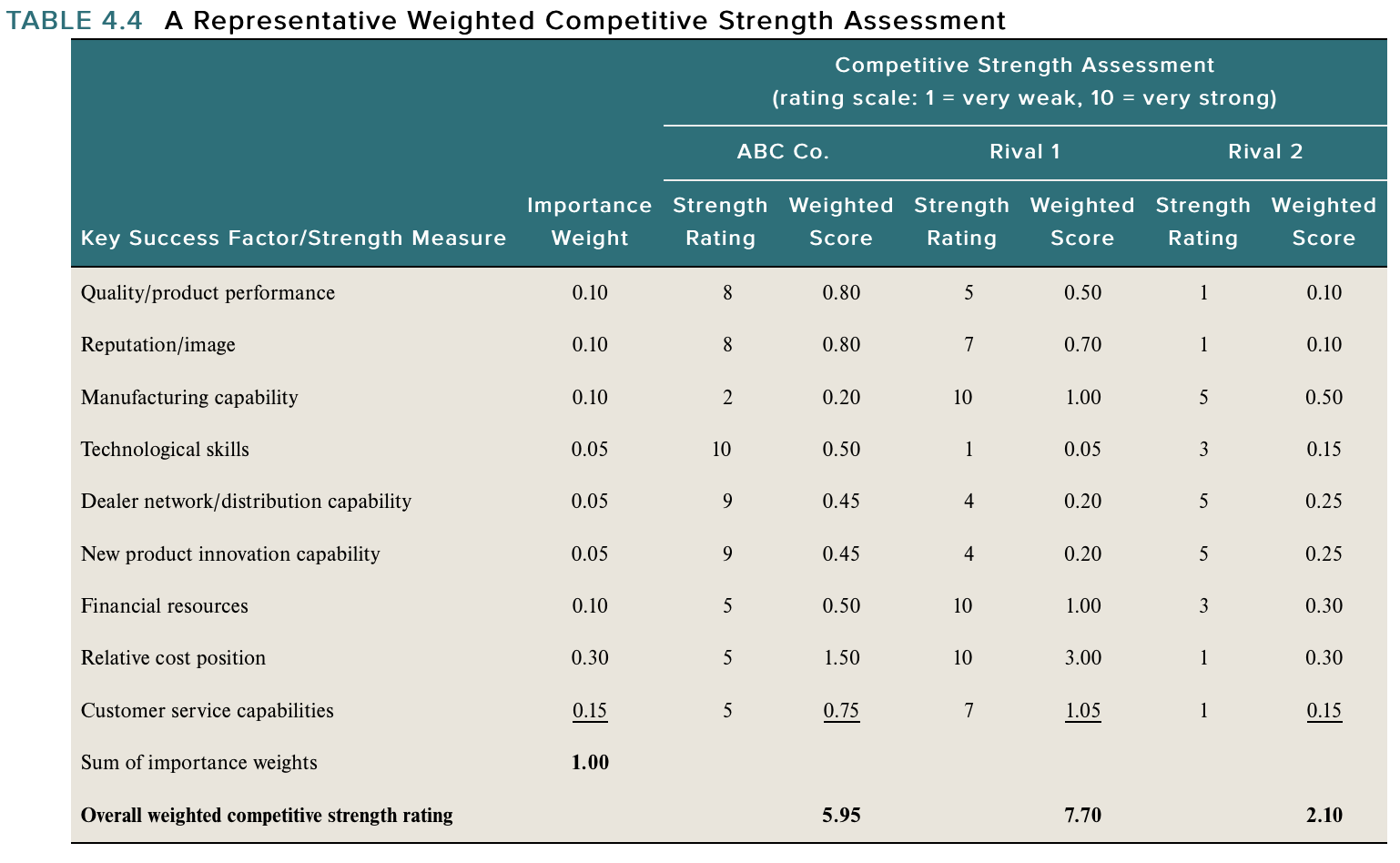

- How does Netflixs competitive strength compare against that of its primary rivals as of 2018? Do a weighted competitive strength assessment using the methodology presented in Table 4.4 in Chapter 4 to support your answer. Based on your assessment and calculations, does Netflix have a net competitive advantage over some/all of these rivals?

- What recommendations would you make to Netflix CEO Reed Hastings? At a minimum, your recommendations should cover what to do about each of the top priority issues you identified.

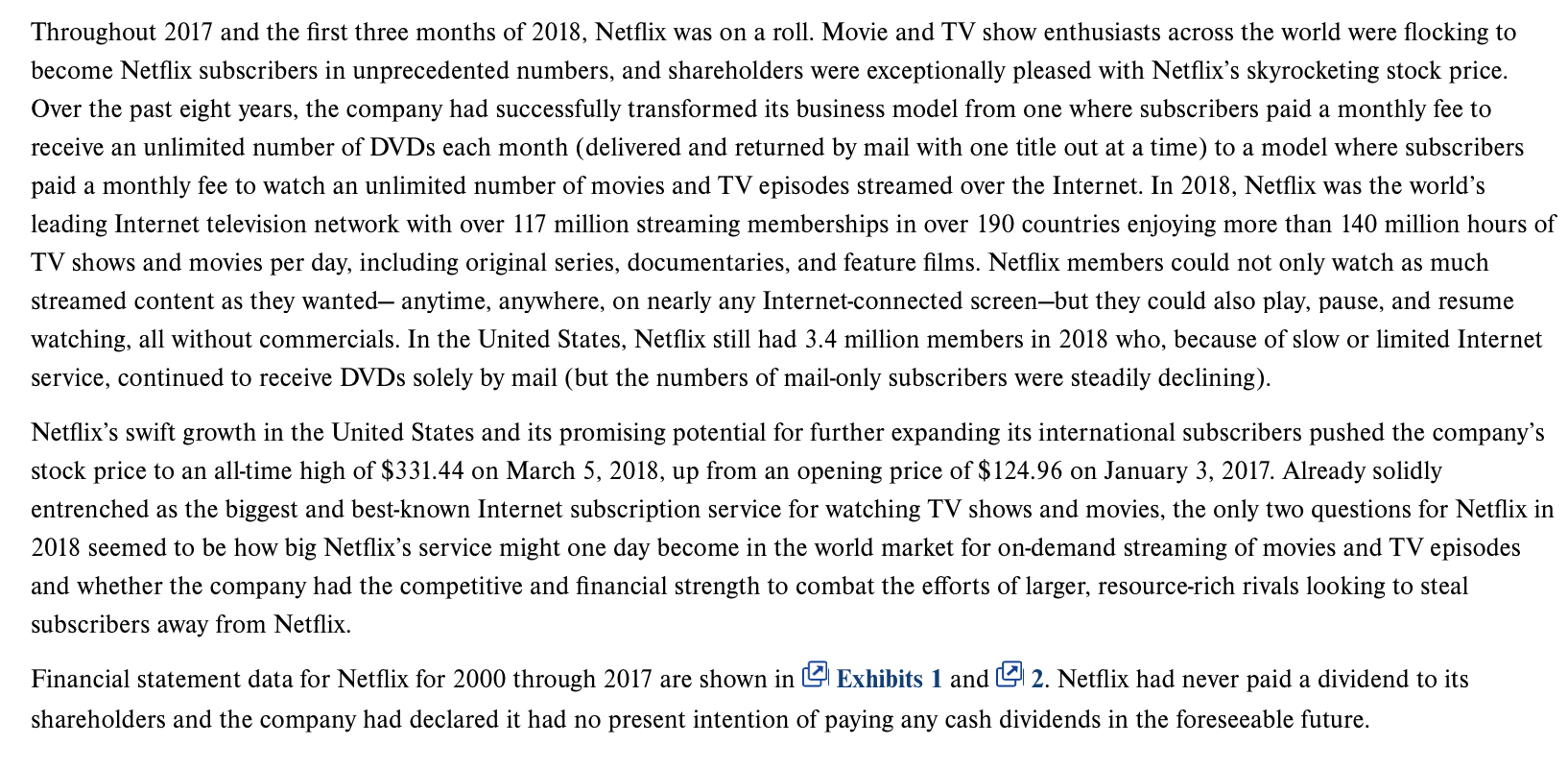

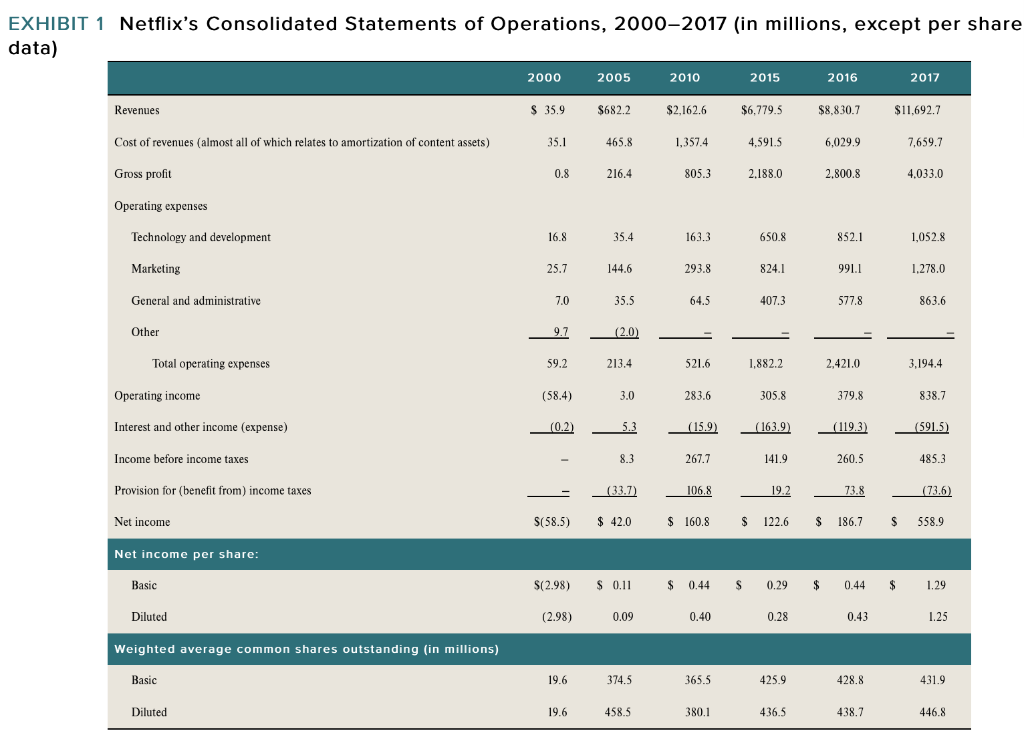

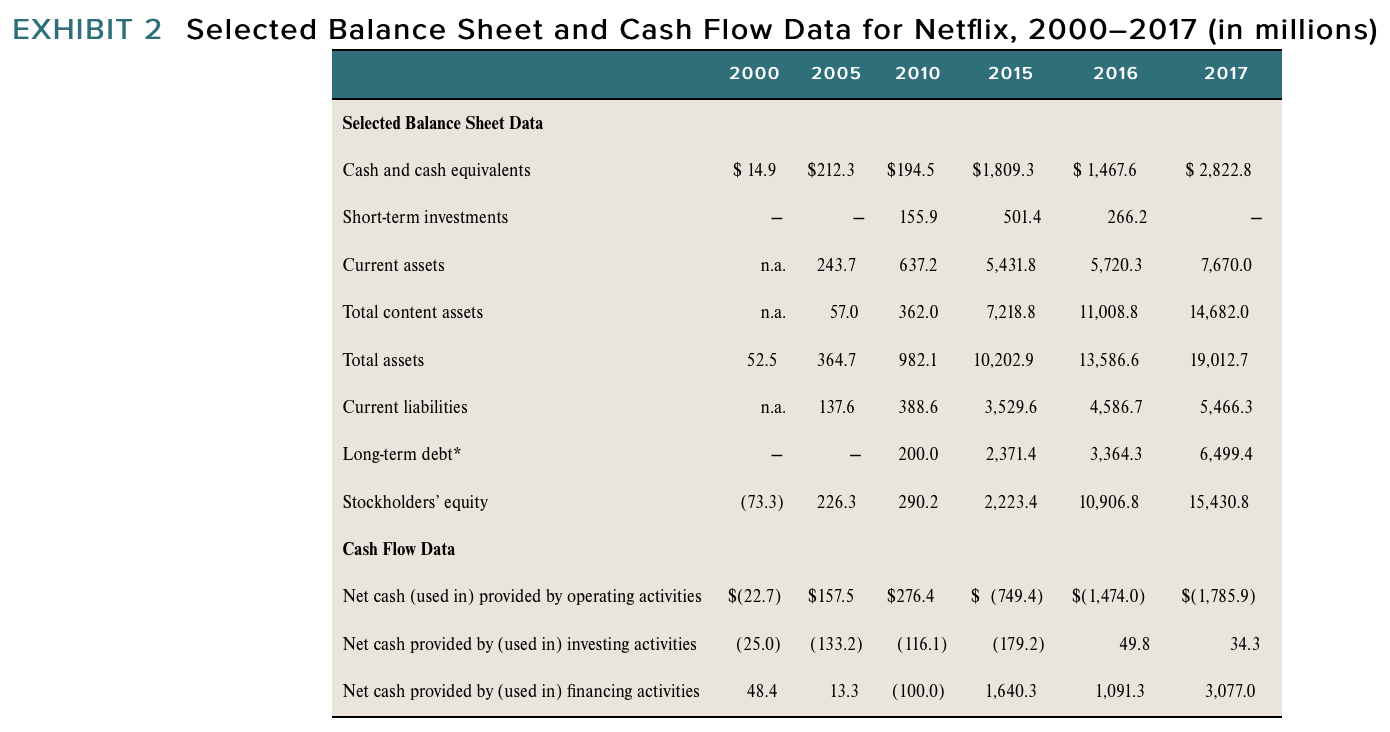

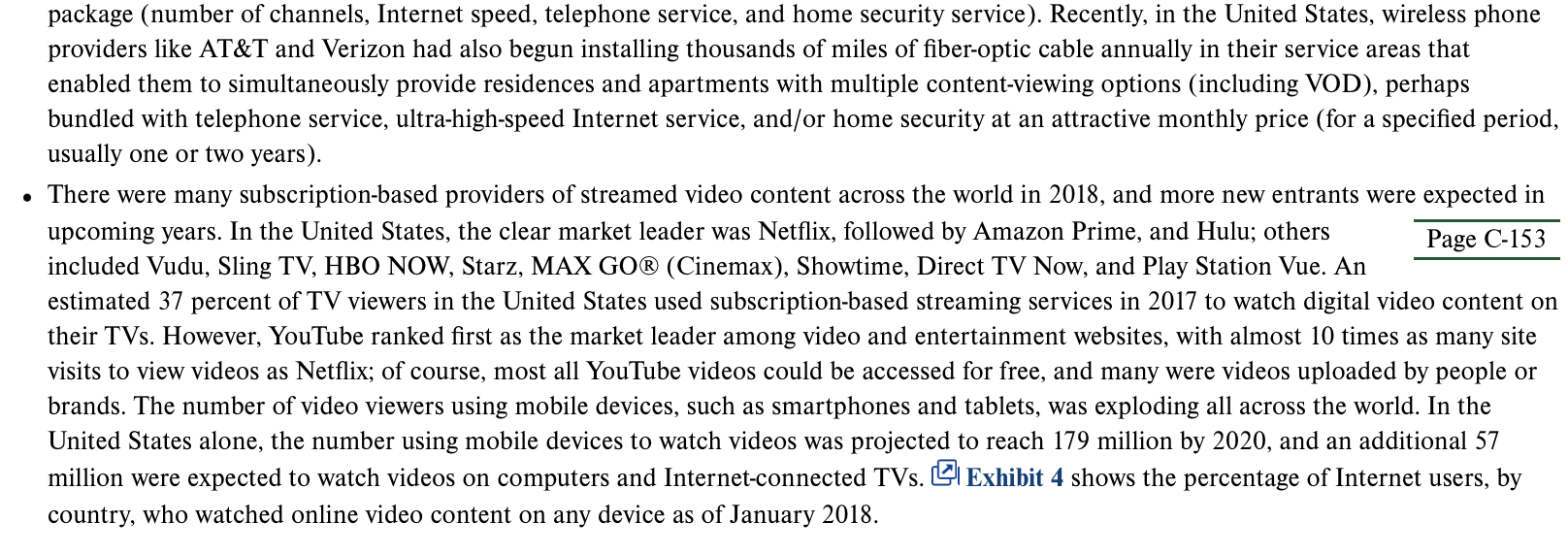

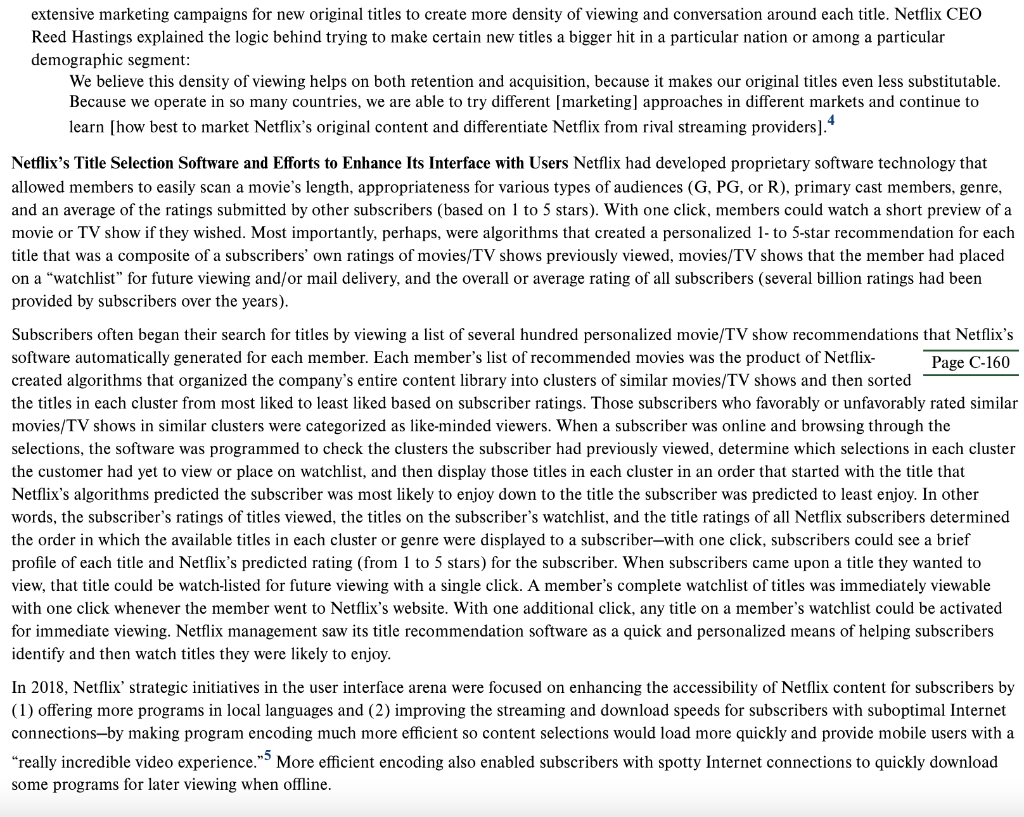

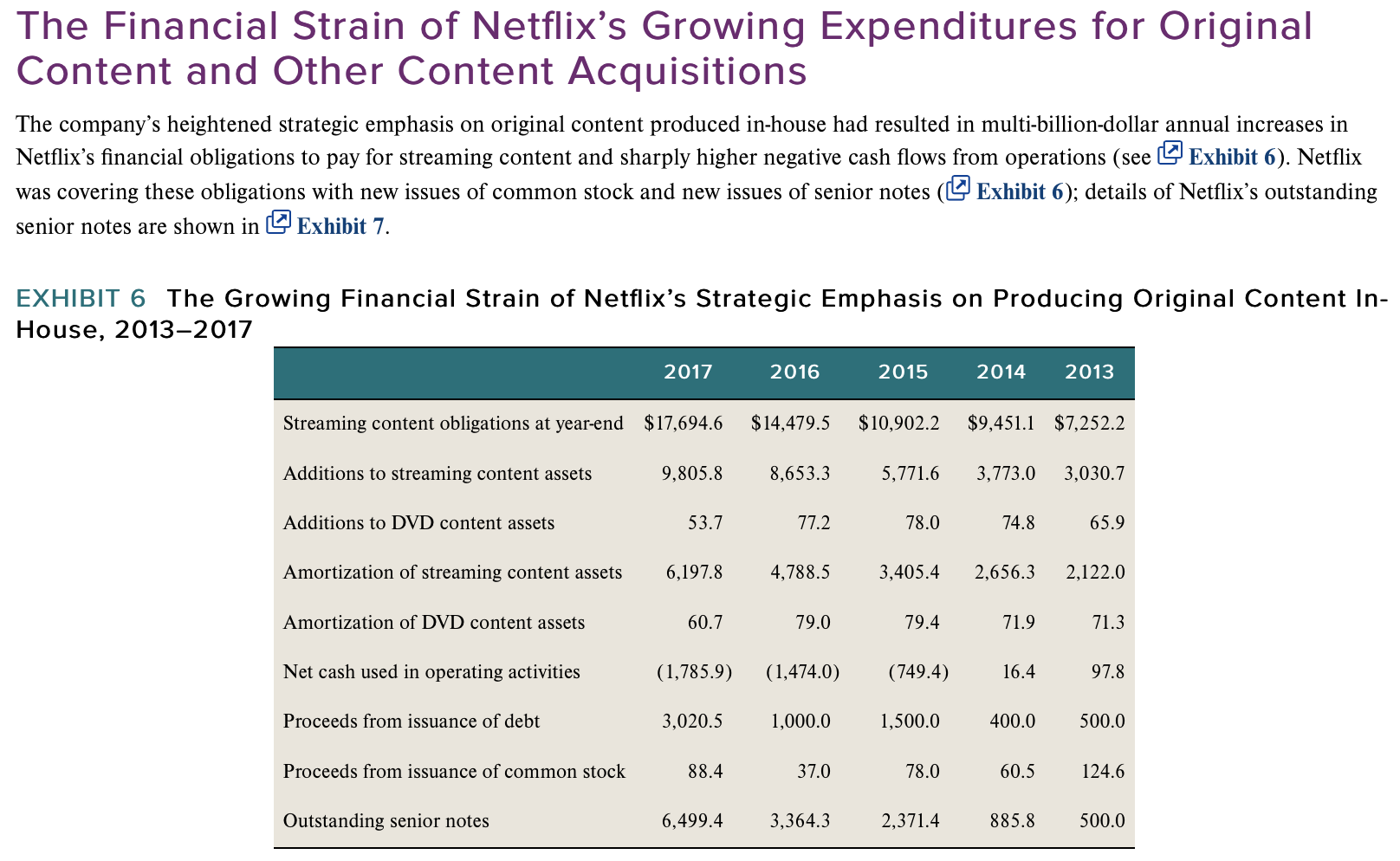

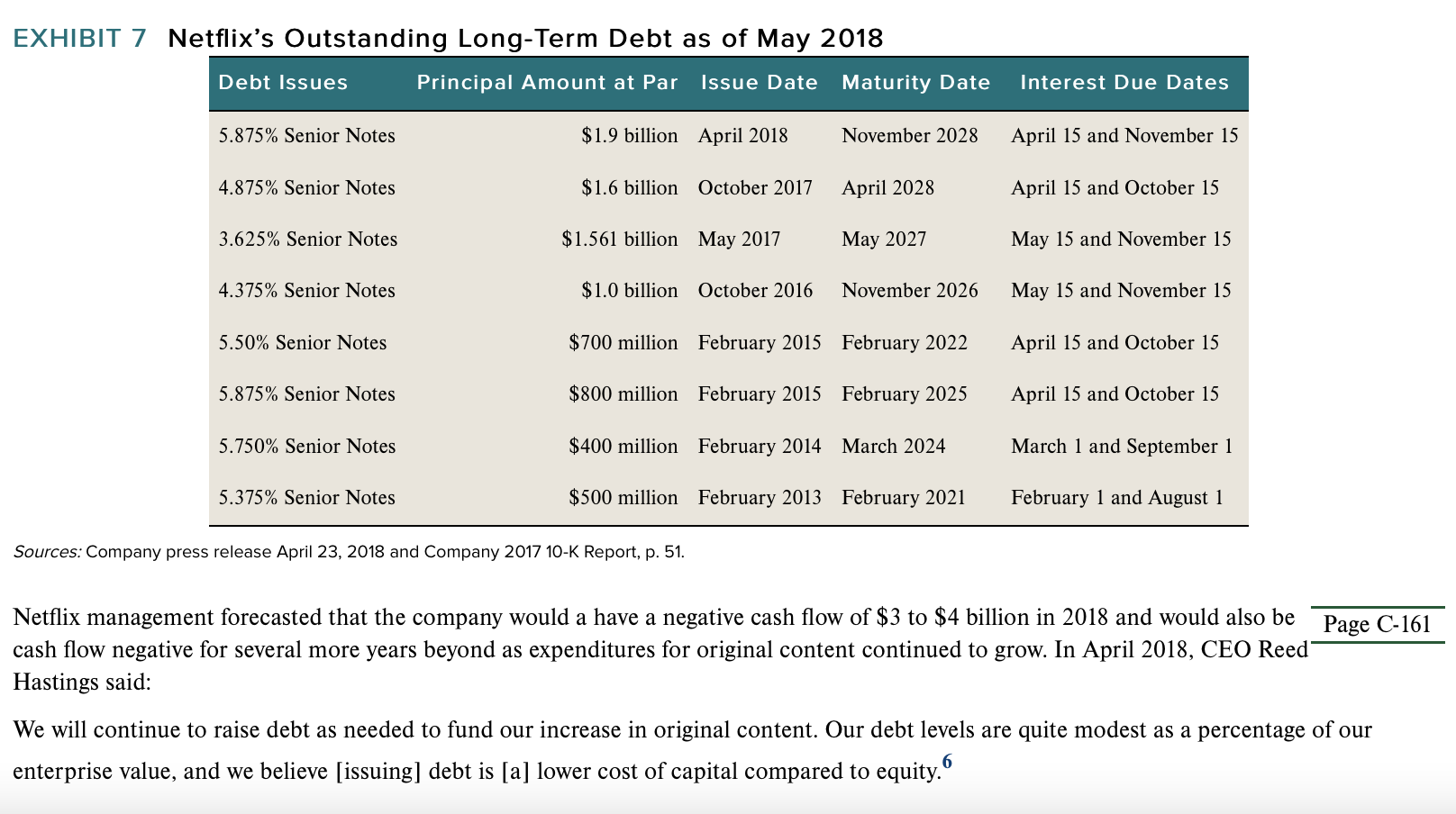

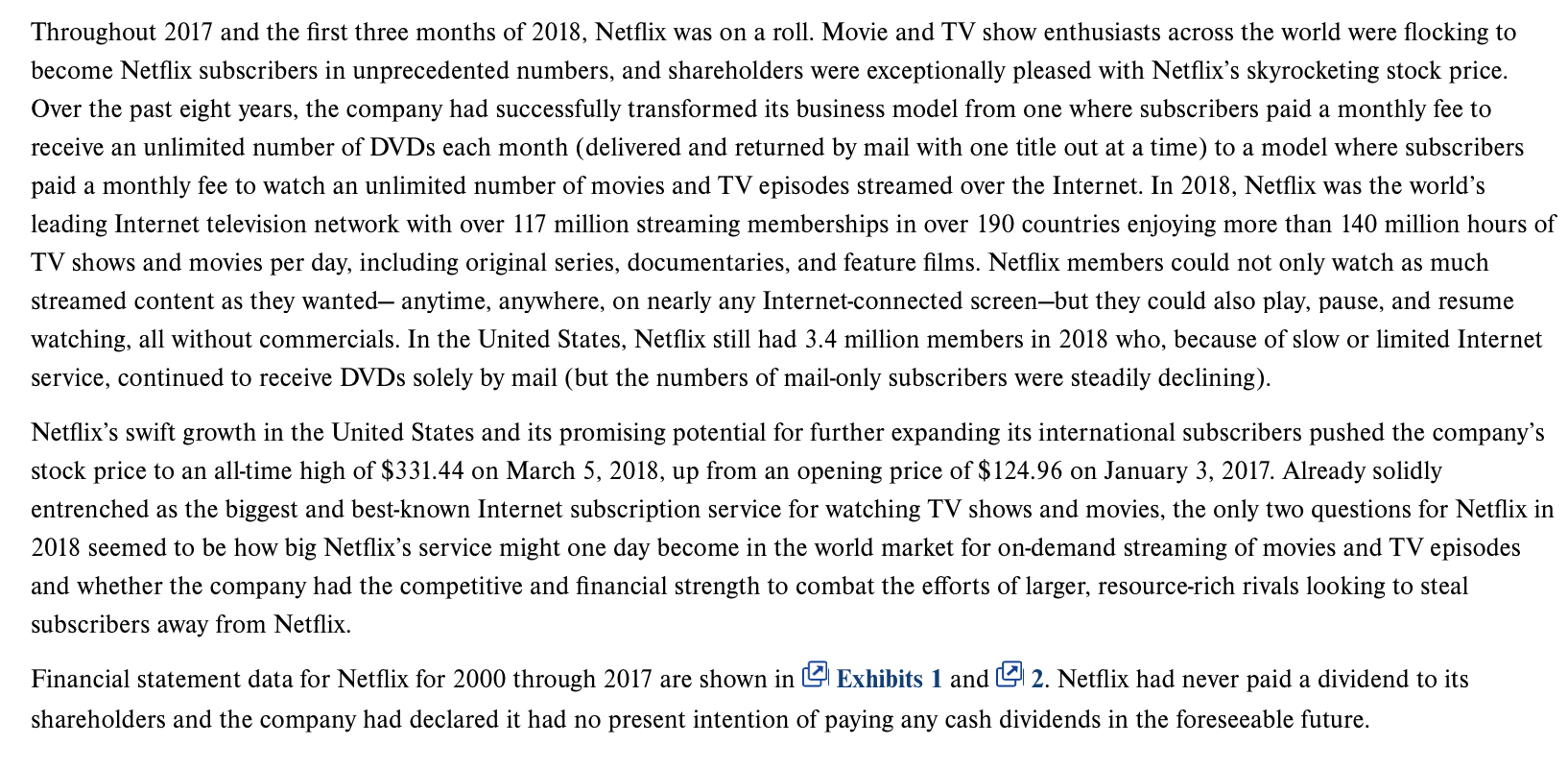

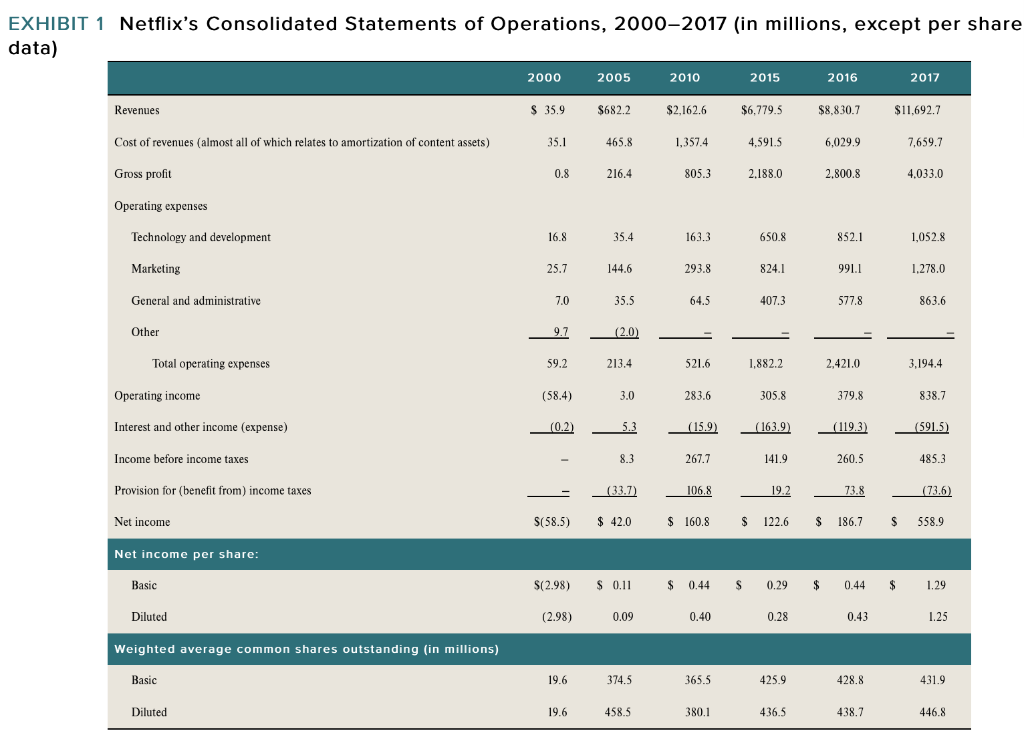

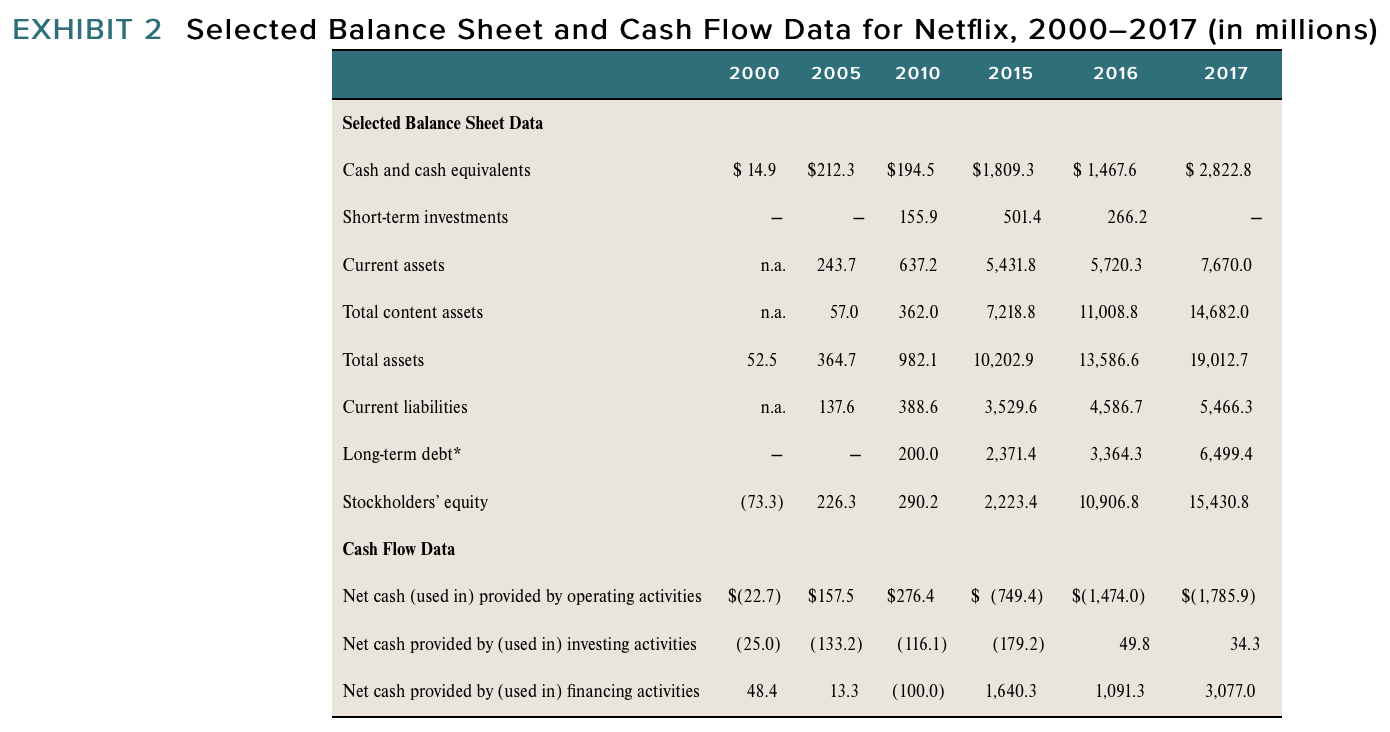

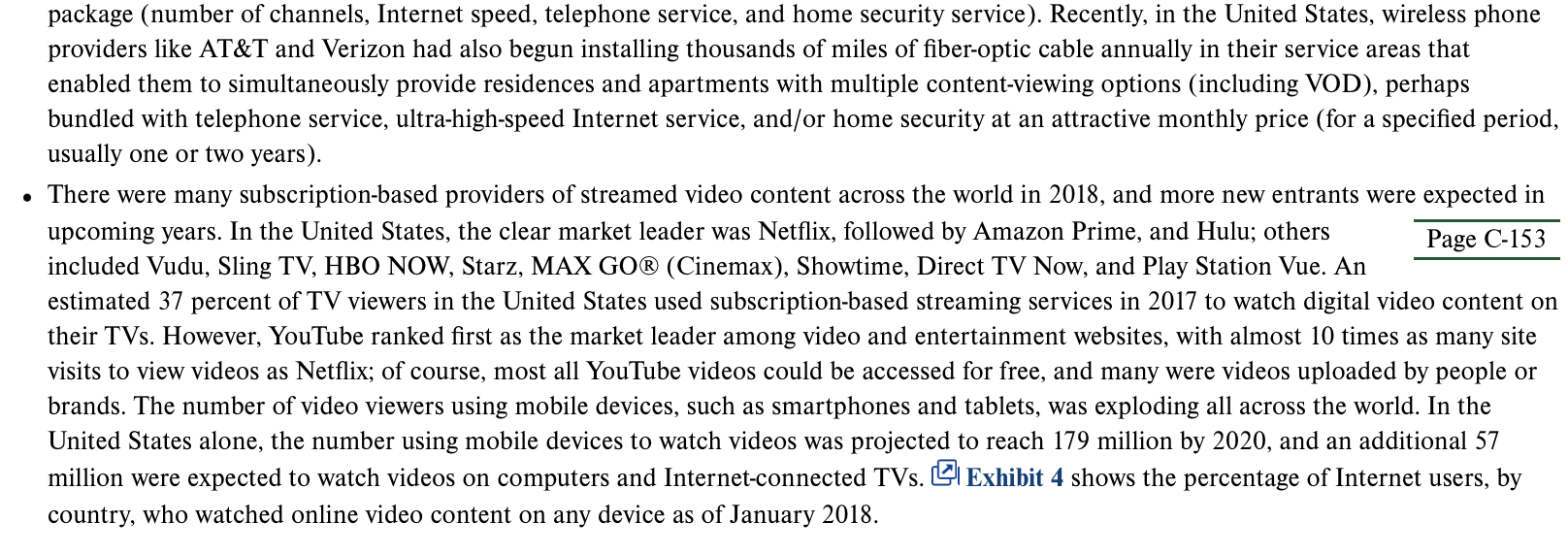

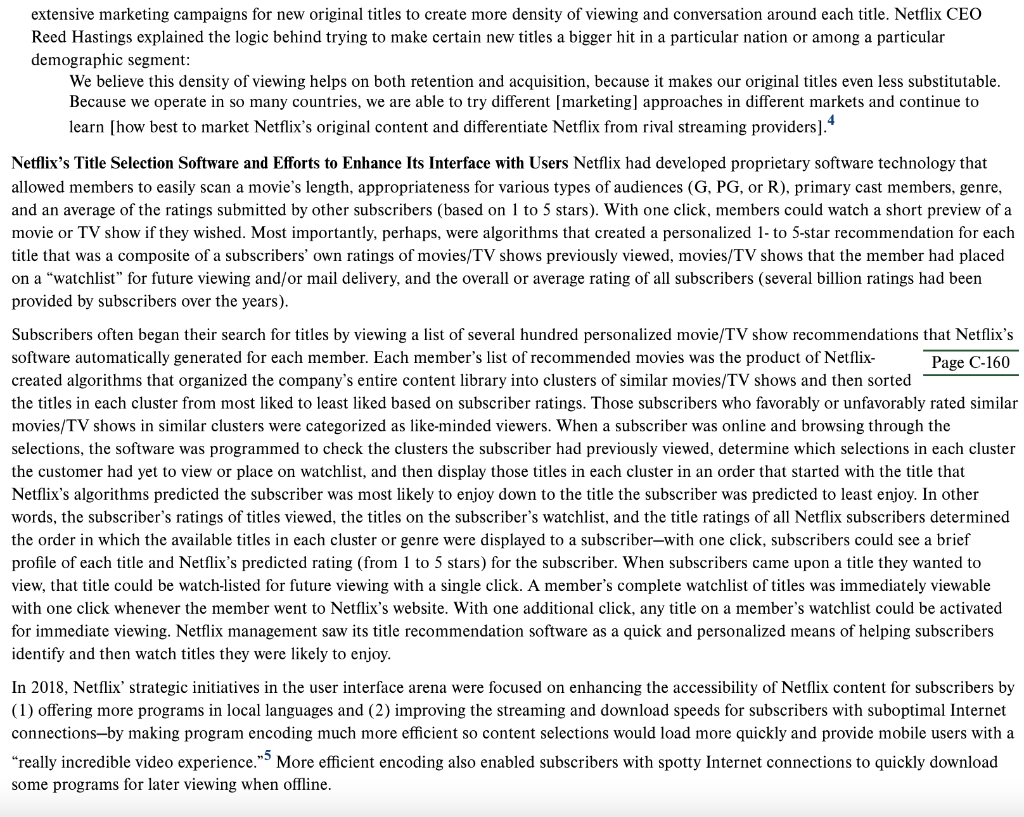

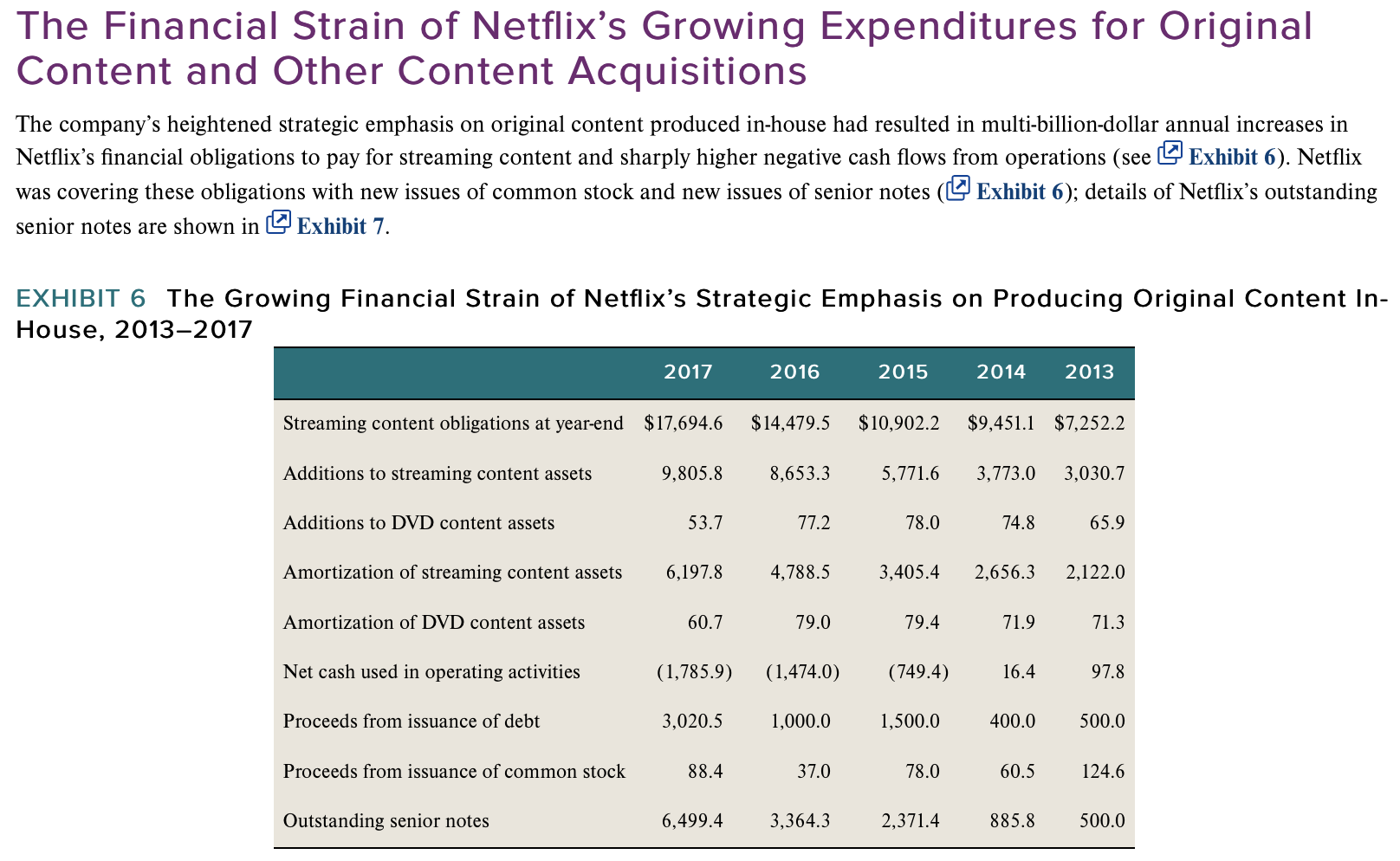

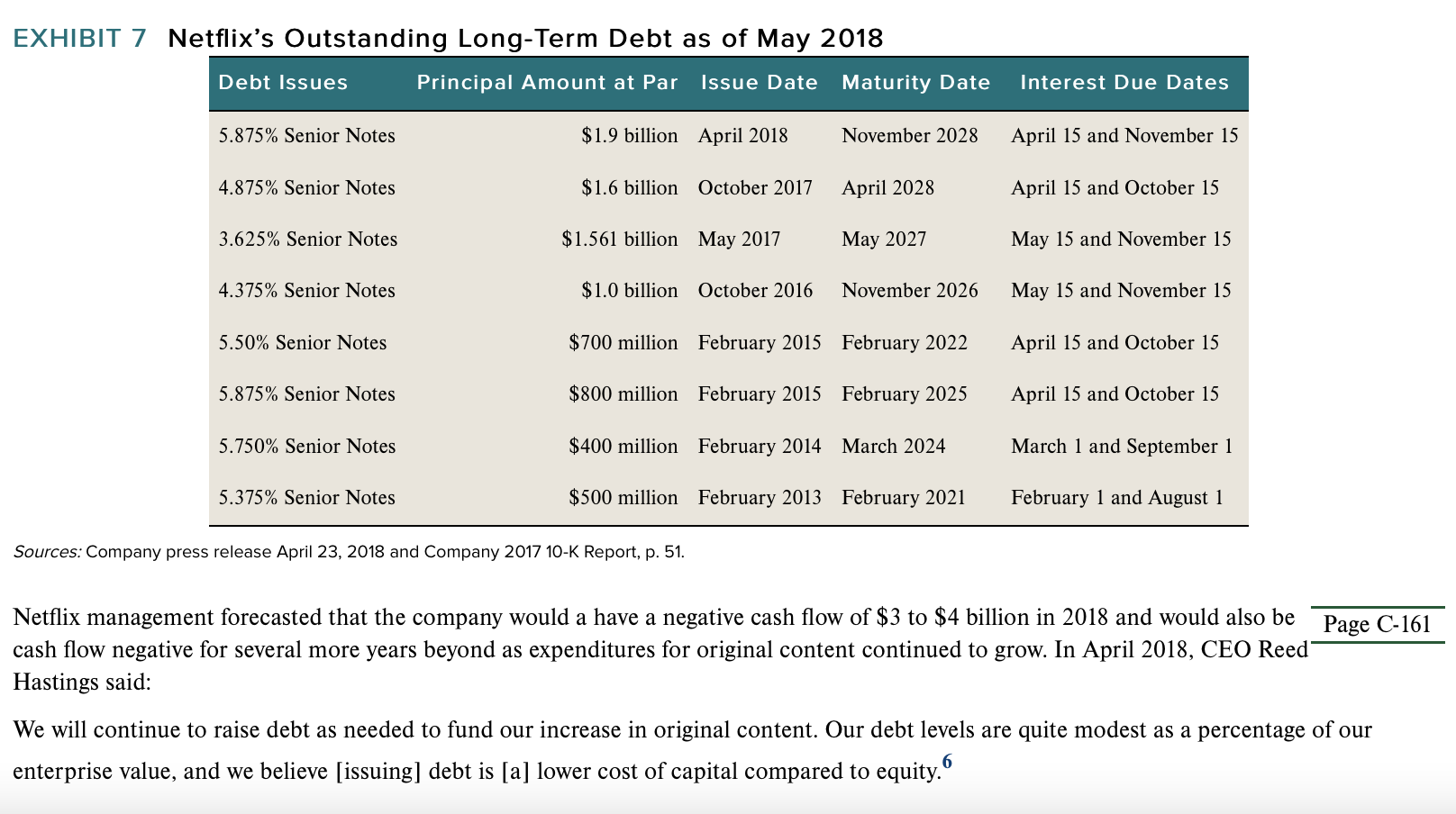

Throughout 2017 and the first three months of 2018 , Netflix was on a roll. Movie and TV show enthusiasts across the world were flocking to become Netflix subscribers in unprecedented numbers, and shareholders were exceptionally pleased with Netflix's skyrocketing stock price. Over the past eight years, the company had successfully transformed its business model from one where subscribers paid a monthly fee to receive an unlimited number of DVDs each month (delivered and returned by mail with one title out at a time) to a model where subscribers paid a monthly fee to watch an unlimited number of movies and TV episodes streamed over the Internet. In 2018, Netflix was the world's leading Internet television network with over 117 million streaming memberships in over 190 countries enjoying more than 140 million hours of TV shows and movies per day, including original series, documentaries, and feature films. Netflix members could not only watch as much streamed content as they wanted- anytime, anywhere, on nearly any Internet-connected screen-but they could also play, pause, and resume watching, all without commercials. In the United States, Netflix still had 3.4 million members in 2018 who, because of slow or limited Internet service, continued to receive DVDs solely by mail (but the numbers of mail-only subscribers were steadily declining). Netflix's swift growth in the United States and its promising potential for further expanding its international subscribers pushed the company's stock price to an all-time high of $331.44 on March 5, 2018, up from an opening price of $124.96 on January 3, 2017. Already solidly entrenched as the biggest and best-known Internet subscription service for watching TV shows and movies, the only two questions for Netflix in 2018 seemed to be how big Netflix's service might one day become in the world market for on-demand streaming of movies and TV episodes and whether the company had the competitive and financial strength to combat the efforts of larger, resource-rich rivals looking to steal subscribers away from Netflix. Financial statement data for Netflix for 2000 through 2017 are shown in \ Exhibits 1 and 2. Netflix had never paid a dividend to its shareholders and the company had declared it had no present intention of paying any cash dividends in the foreseeable future. EXHIBIT 1 Netflix's Consolidated Statements of Operations, 2000-2017 (in millions, except per sha data) EXHIBIT 2 Selected Balance Sheet and Cash Flow Data for Netflix, 2000-2017 (in millions) Netflix's Drive to Globalize Its Operations (\) Exhibit 3 shows the remarkably short time frame it took for Netflix to expand its operations from a U.S.-only subscriber base to a global subscriber base. As of 2018, Netflix had, for the time being, shelved efforts to overcome the government-erected barriers to entering the People's Republic of China, the world's most massive market for entertainment. The Chinese government had for several years refused to issue Netflix a license to operate in China, preferring instead to control the content its citizens were allowed to seegovernment censors required that an entire series of a TV show had to be approved before it could begin to be shown on an online platform. Aside from the censorship issue, most observers believed the Chinese government also wished to protect aspiring local providers of Internetbased entertainment content from foreign competitors. As a consequence of its nonexistent prospects for getting an operating license from the Chinese government any time soon, in 2017 Netflix negotiated a licensing arrangement to exclusively provide some of its original content to a fast-growing Chinese company named iQiyi (pronounced Q wee), the leading provider of online entertainment services in China with some 60 million subscribers (as of early 2018). Use of a licensing strategy was attractive to Netflix because it provided a means of gaining content distribution in China and building awareness of the Netflix brand and Netflix content, but the licensing arrangement was expected to generate only small revenues. The U.S. government had instituted restrictions precluding all U.S.-based companies from having operations in North Korea, Syria, and Crimea. Netflix estimated that it usually took about two years after the initial launch in a new country or geographic region to attract sufficient subscribers to generate a positive "contribution profit"-Netflix defined "contribution profit (loss)" as revenues less cost of revenues (which consisted of amortization of content assets and expenses directly related to the acquisition, licensing, and production/delivery of such content and marketing expenses associated with its domestic streaming and international streaming business segments (the company had ceased all marketing activities related to its domestic DVD business). In 2018, the world market for entertainment video (movies, TV episodes, and live-streamed events) was undergoing rapid and disruptive change being driven by (1) increasingly pervasive consumer access to high-speed Internet connections, (2) the variety of devices and downloadable apps that consumers could use to access both broadcast and streamed entertainment programs, and (3) the mounting intensity with which well-known, resource-rich companies were competing for viewers of entertainment programs. Close to half of the world's population of 7.6 billion people in 2018 used the Internet and, of these, somewhere around 700 million currently had access to broadband high-speed Internet connections. The number of people with broadband Internet access was forecast to move rapidly toward 1 billion-a number that Netflix viewed as its near-term market opportunity. 1 YouTube and Facebook already had two billion monthly active users, a number that Netflix viewed as its long-term market opportunity for accessing and attracting more subscribers. People could watch streamed entertainment on smartphones, all types of computers (tablets, laptops, and desktops), in-home TVs with either built-in Internet connections or connected to a digital video disc (DVD) player with built-in Internet access, and recent versions of video game consoles. During the past five to eight years, most households with high-speed Internet service and/or Internet-connected TVs or DVD players had shifted from renting or buying physical DVDs with the desired content to almost exclusively watching streamed movies and TV episodes. This was because streaming had the advantage of allowing household members to order and instantly watch the movies and TV programs they wanted to see and was much more convenient than patronizing a nearby rent-or-purchase location. This shift had permanently undercut the once-thriving businesses of selling movie and music DVDs and/or renting DVDs at local brick-and-mortar locations and standalone rental kiosks (like Redbox in the United States) or delivering/returning DVDs by mail (as at Netflix) and unleashed a fierce battle among the providers of streamed content in countries across the world to become the preferred streamed content provider (or, at worst, a frequently used content provider). Consumers could view streamed entertainment from growing numbers and types of providers and the options included: - Using a TV remote to order movies and popular TV shows instantly streamed directly to a TV (or other connected device) on a pay-per-view basis (generally referred to as "video-on-demand" or VOD). Most all traditional cable and satellite providers of multichannel TV packages were promoting a library of several hundred movie titles (and often prior episodes of top TV shows, as well as other content) available ondemand to regular subscribers having a cable or satellite box; the rental prices for pay-per-view and VOD movies from such providers ranged from $1 to $6, but the rental price for popular recently released movies was usually $3.99 to $5.99. However, most every traditional cable and satellite provider had recently begun offering a growing variety of content-viewing options that were streamed directly to a single location (and viewable simultaneously on up to as many as eight compatible WiFi enabled devices) via a special downloadable streaming application that eliminated the need for a cable/satellite box. These streaming options allowed subscribers to customize their own service package (number of channels, Internet speed, telephone service, and home security service). Recently, in the United States, wireless phone package (number of channels, Internet speed, telephone service, and home security service). Recently, in the United States, wireless phone providers like AT\&T and Verizon had also begun installing thousands of miles of fiber-optic cable annually in their service areas that enabled them to simultaneously provide residences and apartments with multiple content-viewing options (including VOD), perhaps bundled with telephone service, ultra-high-speed Internet service, and/or home security at an attractive monthly price (for a specified period, usually one or two years). - There were many subscription-based providers of streamed video content across the world in 2018, and more new entrants were expected in upcoming years. In the United States, the clear market leader was Netflix, followed by Amazon Prime, and Hulu; others included Vudu, Sling TV, HBO NOW, Starz, MAX GO (Cinemax), Showtime, Direct TV Now, and Play Station Vue. An estimated 37 percent of TV viewers in the United States used subscription-based streaming services in 2017 to watch digital video content on their TVs. However, YouTube ranked first as the market leader among video and entertainment websites, with almost 10 times as many site visits to view videos as Netflix; of course, most all YouTube videos could be accessed for free, and many were videos uploaded by people or brands. The number of video viewers using mobile devices, such as smartphones and tablets, was exploding all across the world. In the United States alone, the number using mobile devices to watch videos was projected to reach 179 million by 2020 , and an additional 57 million were expected to watch videos on computers and Internet-connected TVs. Exhibit 4 shows the percentage of Internet users, by country, who watched online video content on any device as of January 2018. EXHIBIT 4 The Percentage of Internet Users in Selected Countries Who Watched Online Video Content on Any Device a or maybe twice per month), since the rental costs tended to be less than the monthly subscription prices for unlimited streaming from the various streaming providers. However, competitors offering unlimited Internet streaming plans tended to be the most economical and convenient choice for individuals and households who watched an average of three or more titles per month and for individuals who wanted to be able to watch movies or TV shows or special live event streaming on mobile devices. Netflix was by far the global leader in Internet streaming. It faced numerous competitors of varying competitive strength, geographic coverage, and content offerings; currently, none could match Netflix's global scope or the size of its content library. In North America, Netflix's three biggest Internet streaming competitors were Amazon Prime, Hulu, and HBO (with its HBO NOW and HBO GO service options): - Amazon Prime Video-Amazon competed with Netflix via its Amazon Prime membership service. Individuals and households could become an Amazon Prime member for a fee of $119 per year or $11.99 per month (after a one-month free trial); there was a discounted price for students. In April 2018, Amazon announced that it had over 100 million Amazon Prime members globally. While Amazon had originally created its Amazon Prime membership program as a means of providing unlimited two-day shipping to customers who frequently ordered merchandise from Amazon and liked to receive their orders quickly, in 2012 Amazon began including movie and music streaming as a standard benefit of Prime membership-Amazon's video streaming service was called "Prime Video." Amazon's Prime Video content library contained thousands of movies that could be streamed to members, over 40 original series and movies, and some two million songs. In 2017 and 2018, Amazon made Prime Video more attractive to Prime members by (1) adding Prime Originals to its offerings, like The Marvelous Mrs. Maisel and the Oscar-nominated movie The Big Sick, (2) debuting NFL Thursday Night Football on Prime Video (which attracted more than 18 million total viewers over 11 games), and (3) expanding its slate of programming across the globe- launching new seasons of Bosch, Sneaky Pete, and The Man in the High Castle from the United States, The Grand Tour from the United Kingdom, You Are Wanted from Germany, while adding new Sentosha shows from Japan, along with Breathe and the award-winning Inside Edge from India. In April 2018, Amazon announced it had agreed to pay the National Football League $65 million a year to stream NFL Thursday Night Football globally to its Amazon Prime members in 2018 and 2019. Also in 2018, Prime Channels offerings were expanded to include CBS All Access in the United States and newly launched channels in the United Kingdom and Germany. In 2017, Prime Video Direct secured subscription video rights for more than 3,000 feature films and committed over $18 million in royalties to independent filmmakers and other rights holders. Going forward, the Prime original series pipeline included Tom Clancy's Jack Ryan, starring John Krasinski; King Lear, starring Anthony Hopkins and Emma Thompson; The Romanoffs, starring Aaron Eckhart and Diane Lane ; Carnival Row, starring Orlando Bloom and Cara Delevingne; Good Omens, starring Jon Hamm; and Homecoming, starring Julia Roberts in her first television series. In addition, Prime Video had acquired the global television rights for a multi-season production of The Lord of the Rings, as well as Corts, a miniseries based on the epic saga of Hernn Corts from executive producer Steven Spielberg and starring Javier Bardem. Amazon's 2018 budget for Prime Video original content additions and enhancement was reportedly $5 billion. Other 2018 benefits of becoming an Amazon Prime member included discounted prices on Kindle eBooks, free reading of designated digital editions of books and magazines, special deals/coupons on purchases of selected products that Amazon sold, one-click ordering via a "dash button," shopping with Alexa, cloud storage and sharing of personal photos and videos, and an opt-in DVD rental service (for an extra fee). button," shopping with Alexa, cloud storage and sharing of personal photos and videos, and an opt-in DVD rental service (for an extra fee). In addition, Amazon competed with Netflix's DVDs-by-mail subscription service by allowing people to rent any streamed or downloadable movie, TV program, or other digital content for a limited time (for viewing on a personal computer, portable media player or other compatible device) or to purchase such content in the form of a downloadable file. - Hulu-Hulu had 20 million subscribers as of May 2018, up from 12 million in May 2017. The subscription fee for Hulu was $8 per month for regular streaming and $12 per month for commercial-free streaming, and new subscribers got a one-week free trial. The regular streaming option included advertisements as a means of helping keep the monthly subscription price low. Hulu also offered plans that included not only its video streaming service, but also packages that included 50 or more live TV and cable channels (that included sports, news, and entertainment) and options to add on HBO, Showtime , and Cinemax . The Hulu library of offerings included all current season episodes of popular TV shows, over 15,000 back season episodes of 380+ TV shows, over 425 movies, most in high-definition, and a growing selection of Hulu-produced original content. Hulu was a joint venture co-owned by Walt Disney (30 percent), Fox ( 30 percent), Comcast (30 percent), and Time Warner (10 percent) - HBO NOW and HBO GO-HBO NOW was an option to receive unlimited streaming of content in HBO's library that included movies, documentaries, sports programs, and original series (Silicon Valley, Game of Thrones, True Detective, Big Little Lies, Sharp Objects) for a cancel-anytime monthly subscription price of $14.99 (as of 2018). HBO NOW content was viewable on mobile phones, tablets, computers and Internet-connected TVs. HBO NOW, offered only in the United States and a few territories had over two million subscribers as of February 2017. HBO GO was a bonus offering only for people who subscribed to HBO through a cable or satellite provider; such subscribers used a downloadable app to access the HBO GO website, entered their user name and password of their cable provider to authenticate their subscription and then clicked on the desired HBO content that was viewable on mobile phones, laptops, and computers. HBO had no interest in offering its HBO GO option to people who were not cable subscribers because its principal revenue source was a percentage of the monthly fees that nearly 140 million cable subscribers across the world paid their cable company for HBO as part of their cable package HBO was typically the most expensive of the premium cable channels offered by cable/satellite providers. However, as of 2018, HBO was offering a direct streaming service akin to HBO NOW in several countries that had low cable subscriber rates (namely Spain, Page C-155 Columbia, and the four Nordic countries-Norway, Denmark, Sweden, and Finland). HBO was a division of Time Warner, which had agreed to merge with AT\&T, pending government approval. In April 2018, Comcast, one of the largest cable operators in the United States, announced it had expanded its partnership with Netflix and would begin including a Netflix subscription in new and existing packages offered to its cable subscribers. In July 2018, The Wall Street Journal reported that Walmart was likely to enter the video streaming market and establish a subscription service with programming that targeted "Middle America" and that would likely involve a subscription price below what Netflix charged. 2 Walmart was working with a veteran television executive with experience in pay-television on plans for the service. Since launching the company's online movie rental service in 1999, Reed Hastings, founder and CEO of Netflix, had been the chief architect of Netflix's subscription-based business model and strategy that had transformed Netflix into the world's largest online entertainment subscription service. Hastings's goals for Netflix were simplebuild the world's best Internet service for entertainment content, keep improving Netflix's content offerings and services faster than rivals, attract growing numbers of subscribers every year, and grow long-term earnings per share. Hastings was a strong believer in moving early and fast to initiate strategic changes that would help Netflix outcompete rivals, strengthen its brand image and reputation, and fortify its position as the industry leader. Netflix's Subscription-Based Business Model Netflix employed a subscription-based business model. Members could choose from a variety of subscription plans whose prices and terms had varied over the years. Originally, all of the subscription plans were based on obtaining and returning DVDs by mail, with monthly prices dependent on the number of titles out at a time. But as more and more households began to have high-speed Internet connections, Netflix began bundling unlimited streaming with each of its DVD-by-mail subscription options, with the long-term intent of encouraging subscribers to switch to watching instantly streamed content rather than using DVD discs delivered and returned by mail. The DVDs-by-mail part of the business had order fulfillment costs and postage costs that were bypassed when members opted for instant streaming. In 2018, Netflix offered three types of streaming membership plans. Its basic plan, currently priced at $7.99 per month in the United States, included access to standard definition quality streaming on a single screen at a time. Its standard plan, currently priced at $10.99 per month, was the most popular streaming plan and included access to high-definition quality streaming on two screens concurrently. The company's premium plan, currently priced at $13.99 per month, included access to high definition and ultra-high definition quality content on four screens concurrently. As of December 31, 2017, international pricing for the three plans ranged from approximately $4 to $20 per month per U.S. dollar equivalent. Top management expected that the prices of the membership plans in each country would likely rise over time. Netflix had organized its operations into three business segments: domestic streaming, international streaming, and domestic DVD. The domestic streaming segment derived revenues from monthly membership fees for services consisting solely of streaming content to members in the United States. The international streaming segment derived revenues from monthly membership fees for services consisting solely of streaming content to members outside the United States. The domestic DVD segment derived revenues from monthly membership fees for services consisting solely of DVD-by-mail. Recent performance of Netflix's three business segments is shown in The DVD-by-Mail Option Subscribers who opted to receive movie and TV episode DVDs by mail went to Netflix's website, selected one or more movies from its DVD library, and received the movie DVDs by first-class mail generally within one business day. Subscribers could keep a DVD for as long as they wished, with no due dates, no late fees, no shipping fees, and no pay-per-view fees. Subscribers returned DVDs via the U.S. Postal Service in a prepaid return envelope that came with each movie order. The Domestic and International Streaming Options Netflix launched its Internet streaming service in January 2007, with instantwatching capability for 2,000 titles on personal computers. Very quickly, Netflix invested aggressively to enable its software to instantly stream content to a growing number of "Netflix-ready" devices, including video game consoles (made by Sony, Microsoft, and Nintendo), Internet-connected DVD and Blu-ray players, Internet-connected TVs, TiVo DVRs, and special Netflix players made by Roku and several other electronics manufacturers. At the same time, it began licensing increasing amounts of digital content that could be instantly streamed to subscribers. Initially, Netflix took a "metered" approach to streaming, in essence offering an hour per month of instant watching on a PC for every dollar of a subscriber's monthly subscription plan. In 2010, Netflix switched to an unlimited streaming option on all of its monthly subscription plans. According to one source, Netflix had an estimated 6,800 movie titles and 530 TV shows available for streaming as of 201003 In recent years, however, Netflix had gradually shrunk the number of movie titles in its streaming library to approximately 4,000 as of early 2018 and dramatically increased the number of TV shows to an estimated 1,570 in 2018. Netflix had increased the number of new original content offerings in each of the past five years. There were two reasons for the shift in the makeup of Netflix's streaming content. One reason was internal data showing that subscribers spent only about one-third of their time on Netflix watching movies; the second reason was a conviction on the part of Netflix's content executives that if viewers were passionate about a movie, they would have already seen it in theaters by the time it ended up on Netflix. To make the company's movie library more valuable for its subscribers, Netflix had begun releasing a progressively larger number of original movies ( 80 movies were scheduled for release in 2018) and creating more multi-episode original TV series like past hits House of Cards, The Crown, Orange Is the New Black, and Stranger Things. Going forward, Netflix was expected to continue to place greater emphasis on its own original content-both movies and original TV series-chiefly as a way to more strongly differentiate itself from competitors; top management had announced its intention to spend $7 to $8 billion on original content in 2018 , up from $6 billion in 2017. Netflix's Strategy Netflix's strategy in 2018 was focused squarely on: - Growing the number of domestic and international streaming subscribers. - Enhancing the appeal of its library of streaming content, with an increasing emphasis on exclusive original movies and TV series produced in-house. - Spending aggressively on marketing and advertising in all of the countries and geographic regions the company had recently entered to broaden awareness of the Netflix brand and service and thereby support the company's strategic objective to rapidly grow its base of streaming subscribers. - Expanding the number of titles that members could download for offline viewing. - Continuously enhancing its user interface. Subscriber Growth Netflix executives were keenly aware that rapid subscriber growth was the key to boosting the company's profitability and justifying the company's lofty stock price of $330 (as of late April 2018), which was an astonishing 264 times the company's 2017 earnings per share and 71 times the consensus EPS of $4.65 that Wall Street analysts and Netflix investors were anticipating the company would earn in 2019. Netflix executives expected that close to 75 percent of the gains in subscriber growth in 2018 and over 80 percent of the gains in 2019 and beyond would come in the international arena. New Content Acquisition Over the years, Netflix had spent considerable time and energy establishing strong ties with various entertainment video providers to both expand its content library and gain access to new releases as soon as possible after they were released for first-run showing in movie theaters. Prior to the recent push by Amazon Prime and Hulu to attract streaming subscribers, Netflix had successfully negotiated exclusive rights to show titles produced by a few studios. In August 2011, Netflix introduced a new "Just for Kids" section on its website that contained a large selection of kid-friendly movies and TV shows. By March 2012, over one billion hours of Just for Kids programming had been streamed to Netflix members. New content was acquired from movie studios and distributors through direct purchases, revenue-sharing agreements, and licensing agreements to stream content. Netflix acquired many of its new-release movie DVDs from studios for a low upfront fee in exchange for a commitment for a defined period of time either to share a percentage of subscription revenues or to pay a fee based on content utilization. After the revenuesharing period expired for a title, Netflix generally had the option of returning the title to the studio, purchasing the title, or destroying its copies of the title. On occasion, Netflix also purchased DVDs for a fixed fee per disc from various studios, distributors, and other suppliers. In the case of movie titles and TV episodes that were streamed to subscribers via the Internet for instant viewing, Netflix generally paid a fee to license the content for a defined period of time, with the total fees spread out over the term of the license agreement (so as to match up content payments with the stream of subscription revenues coming in for that content). Following the expiration of the license term, Netflix either removed the content from its library of streamed offerings or negotiated an extension or renewal of the license agreement when management believed there was still enough subscriber interest in the content to justify the renewal fees. Over the past five years, Netflix's rapidly growing subscriber base (as well as the streaming subscriber growth at Amazon Prime Video, Hulu, and other providers) gave movie studios and the network broadcasters of popular TV shows considerably more bargaining power to command higher prices for their content. Netflix management was acutely aware of its diminishing bargaining power in acquiring content that would be especially appealing to subscribers, and the substantial negative impact that paying higher prices for streaming content had on the company's current and future profit margins. Nonetheless, Netflix executives believed there was still room for the company to earn attractive profits on streaming if it could grow its subscriber base fast enough to more than cover the rising costs of content acquisition. As indicated earlier, Netflix had recently begun devoting the majority of its new content acquisition budget to producing its own original movies and TV series in-house. Several of these shows were being launched in local languages with local producers to appeal directly, if not exclusively, to subscribers in a particular country or region. A new 2017 Brazilian science-fiction show had scored well with audiences around the world, even though it had been produced in Portuguese for Brazil-Netflix's first instance of a local-language program working well in locations where other languages dominated. In the second half of 2018, Netflix introduced a new original series produced in Denmark, called The Rain, that Netflix executives believed would have broad global appeal, along with the second season of the Brazilian program (called 3% ). Other new original content scheduled for 2018 included the second season of 13 Reasons Why (one of Netflix's most watched television shows around the world in 2017), returning seasons of hits like Luke Cage, GLOW, Dear White People, Unbreakable Kimmy Schmidt, Santa Clarita Diet, Series of Unfortunate Events, and a comedy feature film with Adam Sandler and Chris Rock, called The Week Of. Marketing and Advertising Netflix used multiple marketing approaches to attract subscribers, but especially online advertising (paid search listings, banner ads on social media sites, and permission-based e-mails), and ads on regional and national television. To spur subscriber growth, Netflix had boosted marketing expenditures of all kinds from $25.7 million in 2000 ( 16.8 percent of revenues) to $142.0 million in 2005 (20.8 percent of revenues) to \$298.8 million in 2010 (13.8 percent of revenues) to $991.1 million in 2016 ( 11.2 percent of revenues), and to $1.278.0 billion in 2017 (10.9 percent of revenues). These expenditures related to: - Online and television advertising in the United States and newly entered countries. Advertising campaigns of one type or another were underway more or less continuously, with the lure of one-month free trials and announcements of new and forthcoming original titles usually being the prominent ad features. Netflix's expenditures for digital and television advertising were $1,091.1 million in 2017 , $842.4 million in 2016, and $714.3 million in 2015, several multiples higher than the \$205.9 million spent in 2009 . - Costs pertaining to free trial subscriptions. - Payments to the company's partners. These partners consisted mainly of (1) consumer products manufacturers who produced and distributed devices (particularly remote controls) that facilitated connecting TVs and other media equipment to Netflix, and (2) certain cable providers and other multichannel video programming distributors, mobile operators, and Internet service providers who had begun collaborating with Netflix to make it easy for their customers to connect to Netflix. For example, most all brands of Internet-connected TVs now came with a preinstalled Netflix app that was easily accessed via the TV remote; some TV remotes even had Netflix buttons that provided Netflix subscribers with a one-click connection to their watchlist. In 2018, multi-channel TV providers like Comcast and Sky were offering customers the option to bundle a subscription to Netflix in with their preferred channel packages. Netflix believed collaboration with a host of cable and mobile phone operators across all geographic markets would likely become common practice very quickly. Management was particularly interested in partnering with mobile operators to create quick and easy-to-use procedures for mobile phone users across the world to access Netflix streamed or downloadable programming. Netflix believed it was particularly important to make mobile streaming from Netflix instantly accessible to those people who basically only wanted to have their relationship with Netflix on a mobile device. In 2018, Netflix expected its growth in marketing expenditures to outpace revenue growth, partly because it had started investing in more extensive marketing campaigns for new original titles to create more density of viewing and conversation around each title. Netflix CEO extensive marketing campaigns for new original titles to create more density of viewing and conversation around each title. Netflix CEO Reed Hastings explained the logic behind trying to make certain new titles a bigger hit in a particular nation or among a particular demographic segment: We believe this density of viewing helps on both retention and acquisition, because it makes our original titles even less substitutable. Because we operate in so many countries, we are able to try different [marketing] approaches in different markets and continue to learn [how best to market Netflix's original content and differentiate Netflix from rival streaming providers]. 4 Netflix's Title Selection Software and Efforts to Enhance Its Interface with Users Netflix had developed proprietary software technology that allowed members to easily scan a movie's length, appropriateness for various types of audiences (G, PG, or R), primary cast members, genre, and an average of the ratings submitted by other subscribers (based on 1 to 5 stars). With one click, members could watch a short preview of a movie or TV show if they wished. Most importantly, perhaps, were algorithms that created a personalized 1- to 5 -star recommendation for each title that was a composite of a subscribers' own ratings of movies/TV shows previously viewed, movies/TV shows that the member had placed on a "watchlist" for future viewing and/or mail delivery, and the overall or average rating of all subscribers (several billion ratings had been provided by subscribers over the years). Subscribers often began their search for titles by viewing a list of several hundred personalized movie/TV show recommendations that Netflix's software automatically generated for each member. Each member's list of recommended movies was the product of Netflix- Page C-160 created algorithms that organized the company's entire content library into clusters of similar movies/TV shows and then sorted the titles in each cluster from most liked to least liked based on subscriber ratings. Those subscribers who favorably or unfavorably rate selections, the software was programmed to check the clusters the subscriber had previously viewed, determine which selections in each cluster the customer had yet to view or place on watchlist, and then display those titles in each cluster in an order that started with the title that Netflix's algorithms predicted the subscriber was most likely to enjoy down to the title the subscriber was predicted to least enjoy. In other words, the subscriber's ratings of titles viewed, the titles on the subscriber's watchlist, and the title ratings of all Netflix subscribers determined the order in which the available titles in each cluster or genre were displayed to a subscriber-with one click, subscribers could see a brief profile of each title and Netflix's predicted rating (from 1 to 5 stars) for the subscriber. When subscribers came upon a title they wanted to view, that title could be watch-listed for future viewing with a single click. A member's complete watchlist of titles was immediately viewable with one click whenever the member went to Netflix's website. With one additional click, any title on a member's watchlist could be activated for immediate viewing. Netflix management saw its title recommendation software as a quick and personalized means of helping subscribers identify and then watch titles they were likely to enjoy. In 2018, Netflix' strategic initiatives in the user interface arena were focused on enhancing the accessibility of Netflix content for subscribers by (1) offering more programs in local languages and (2) improving the streaming and download speeds for subscribers with suboptimal Internet connections-by making program encoding much more efficient so content selections would load more quickly and provide mobile users with a "really incredible video experience."5 More efficient encoding also enabled subscribers with spotty Internet connections to quickly download some programs for later viewing when offline. The Financial Strain of Netflix's Growing Expenditures for Original Content and Other Content Acquisitions The company's heightened strategic emphasis on original content produced in-house had resulted in multi-billion-dollar annual increases in Netflix's financial obligations to pay for streaming content and sharply higher negative cash flows from operations (see 6 ). Netflix was covering these obligations with new issues of common stock and new issues of senior notes ( senior notes are shown in Exhibit 7. EXHIBIT 7 Netflix's Outstanding Long-Term Debt as of May 2018 Sources: Company press release April 23, 2018 and Company 201710K Report, p. 51. Netflix management forecasted that the company would a have a negative cash flow of $3 to $4 billion in 2018 and would also be Page C-161 cash flow negative for several more years beyond as expenditures for original content continued to grow. In April 2018, CEO Reed Hastings said: We will continue to raise debt as needed to fund our increase in original content. Our debt levels are quite modest as a percentage of our enterprise value, and we believe [issuing] debt is [a] lower cost of capital compared to equity. 6 TABLE 4.4 A Representative Weighted Competitive Strength Assessment