Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**DO NOT NEED EXPLANATION OR WORK DONE FOR #'s 1-10, JUST GIVE ANSWER** ** ONLY SHOW WORK FOR #11** 1) What statement is true about

**DO NOT NEED EXPLANATION OR WORK DONE FOR #'s 1-10, JUST GIVE ANSWER**

** ONLY SHOW WORK FOR #11**

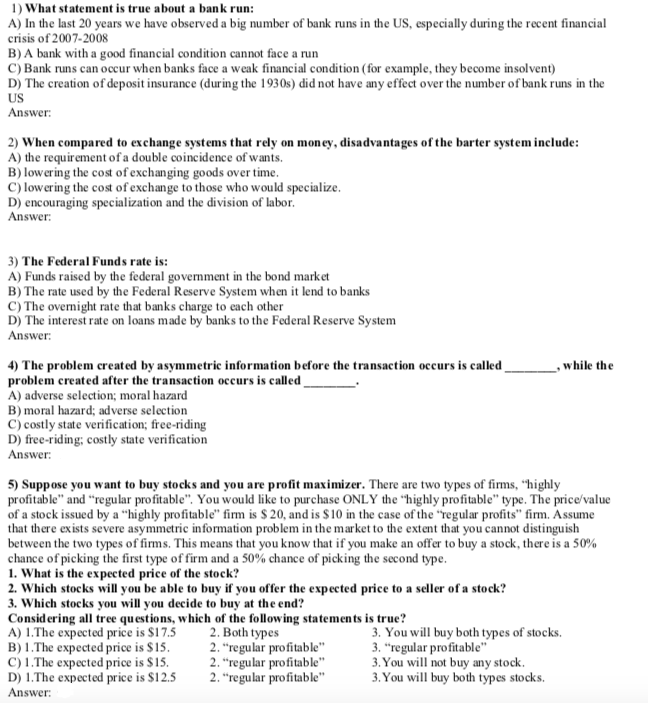

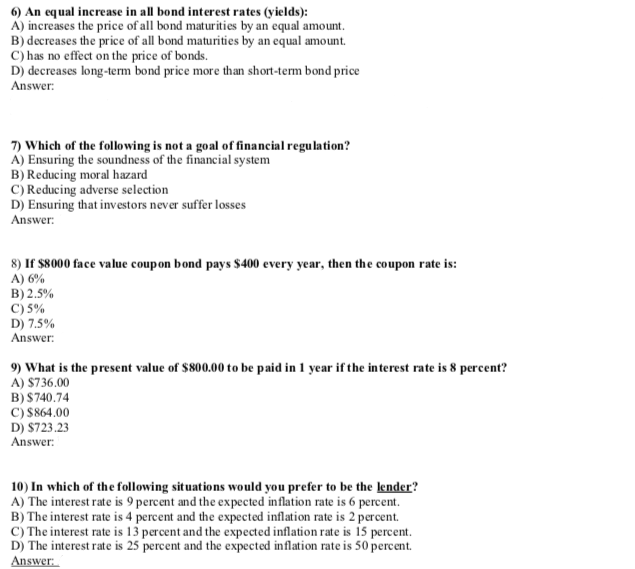

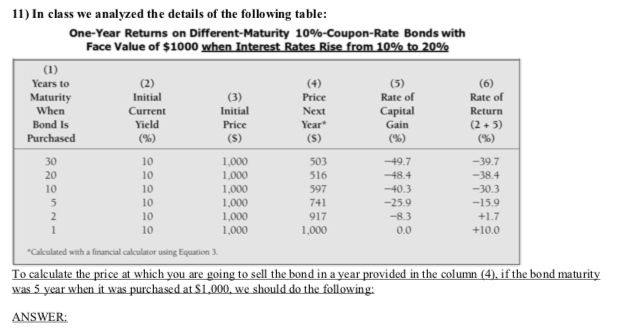

1) What statement is true about a bank run: A) In the last 20 years we have observed a big number of bank runs in the US, especially during the recent financial crisis of 2007-2008 B) A bank with a good financial condition cannot face a run C) Bank runs can occur when banks face a weak financial condition(for example, they become insolvent) D) The creation of deposit insurance (during the 1930s) did not have any effect over the number of bank runs in the US Answer: 2) When compared to exchange systems that rely on money, disadvantages ofthe barter system include A) the requirement of a double coincidence of wants. B) lowering the cost ofexchanging goods over time C) lowering the cost of exchange to those who would specialize D) encouraging specialization and the division of labor Answer: 3) The Federal Funds rate is: A) Funds raised by the federal government in the bond market B) The rate used by the Federal Reserve System when it lend to banks C) The overnight rate that banks charge to each other D) The interest rate on loans made by banks to the Federal Reserve System Answer: 4) The problem created by asymmetric information before the transaction occurs is called problem created after the transaction occurs is called A) adverse selection; moral hazared B) moral hazard; adverse selection C) costly state verification; free-riding D) free-riding; costly state verification Answer: while the 5) Suppose you want to buy stocks and you are profit maximizer. There are two types of firms, "highly profitable" and "regular profitable" You would like to purchase ONLY the "hihly profitable" type. The price/value of a stock issued by a "highly profitable" firm is $ 20, and is $10 in the case of the "regular profits" firm. Assume that there exists severe asymmetric information problem in the market to the extent that you cannot distinguish between the two types of firms. This means that you know that if you make an offer to buy a stock, there is a 50% chance of picking the first type of firm and a 50% chance of picking the second type 1. What is the expected price of the stock? 2. Which stocks will you be able to buy if you offer the expected price to a seller ofa stock? 3. Which stocks you will you decide to buy at the end? Considering all tree questions, which of the following statements is true? A) 1.The expected price is $17.5 B) 1.The expected price is $15 C) 1.The expected price is $15. D) 1.The expected price is $12. Answer: 2. Both types 2. "regular profitable" 2. "regular profitable" 2. "regular profitable" 3. You will buy both types of stocks. 3. "regular profitable" 3. You will not buy any stock 3. You buy both types stocks. 6) An equal increase in all bond interest rates (yields): A) increases the price of all bond maturities by an equal amount B) decreases the price of all bond maturities by an equal amount C) has no effect on the price of bonds. D) decreases long-term bond price more than short-term bond price Answer 7) Which of the following is not a goal of financial regu lation? A) Ensuring the soundness of the financial system B) Reducing moral hazard C) Reducing adverse selection D) Ensuring that investors never suffer losses Answer: 8) If $8000 face value coupon bond pays $400 every year, then the coupon rate is: A)6% B)2.5% C) 5% D) 7.5% Answer 9) What is the present value of $800.00 to be paid in 1 year if the interest rate is 8 percent? A) $736.00 B) S740.74 C)$864.00 D) $723.23 Answer 10) In which of the following situations would you prefer to be the lender? A) The interest rate is 9 percent and the expected inflation rate is 6 percent B) The interest rate is 4 percent and the expected inflation rate is 2 percent. C) The interest rate is 13 percent and the expected inflation rate is 15 percent D) The interest rate is 25 percent and the expected inflation rate is 50 percent Answer 11) In class we analyzed the details of the following table: One-Year Returns on Different-Maturity 10%-coupon-Rate Bonds with Years to Initial Rate of Rate of When Bond Is Initial Price Next Yield (2+5) -49.7 -48.4 40.3 -25.9 -8.3 0.0 -39.7 -38.4 -30.3 -15.9 30 20 10 1,000 1,000 1,000 1,000 1,000 1,000 503 516 597 741 917 1,000 10 10 10 +10.0 Cakculated with a financial cakculator using Equation 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started