Answered step by step

Verified Expert Solution

Question

1 Approved Answer

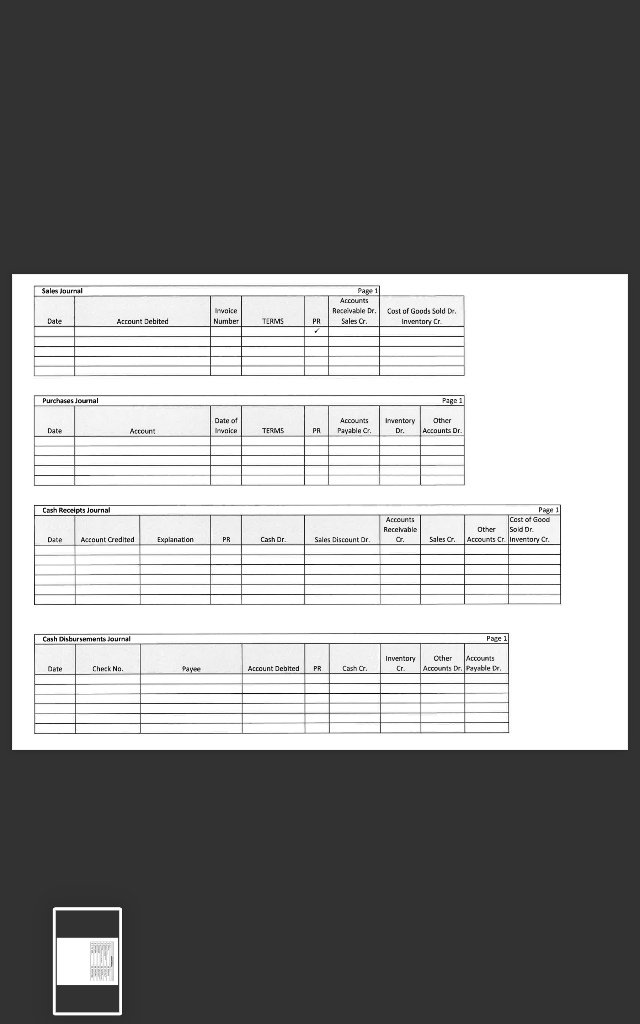

Do not show me a general journal for these transactions. Put these transactions into the corresponding journals provided on this screenshot. Thank you. Accounting Cycle

Do not show me a general journal for these transactions. Put these transactions into the corresponding journals provided on this screenshot. Thank you.

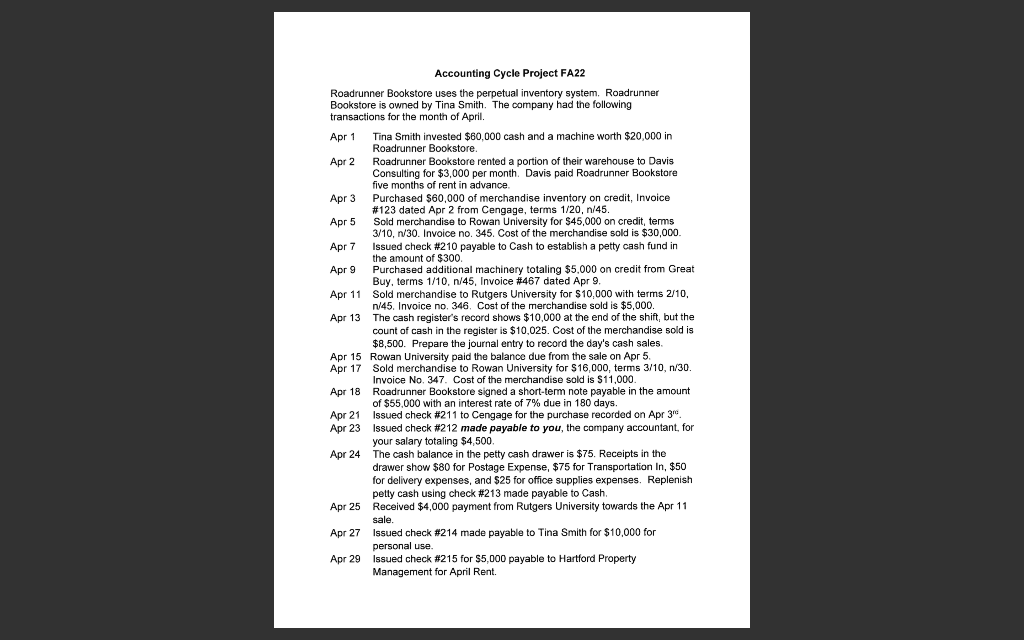

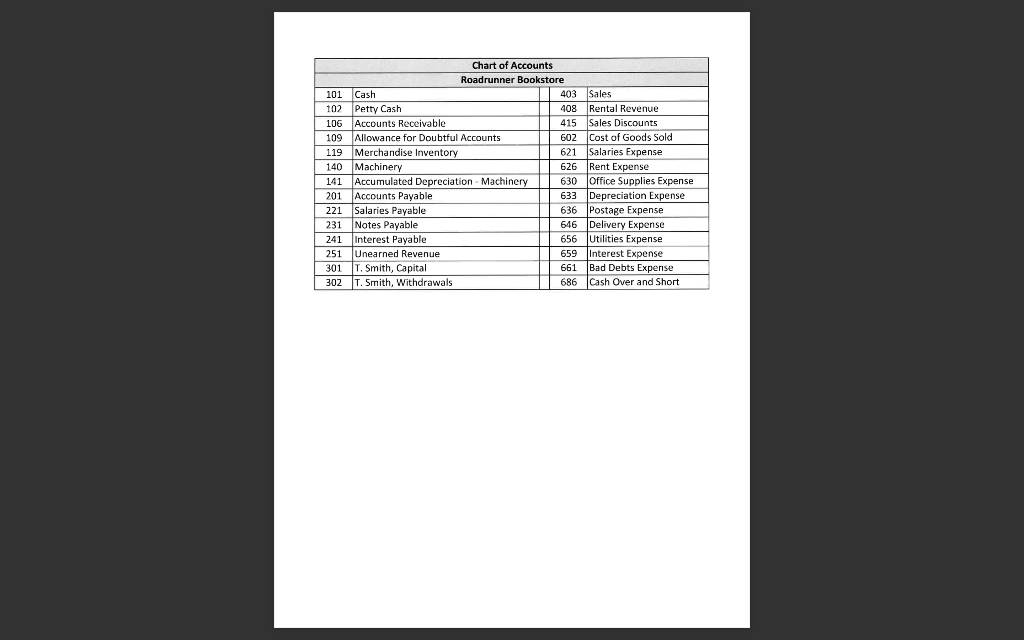

Accounting Cycle Project FA22 Roadrunner Bookstore uses the perpetual inventory system. Roadrunner Bookstore is owned by Tina Smith. The company had the following transactions for the month of April. Apr 1 Tina Smith invested $60,000 cash and a machine worth $20,000 in Roadrunner Bookstore. Apr 2 Roadrunner Bookstore rented a portion of their warehouse to Davis Consulting for $3,000 per month. Davis paid Roadrunner Bookstore five months of rent in advance. Apr 3 Purchased $60,000 of merchandise inventory on credit, Invoice \#123 dated Apr 2 from Cengage, terms 1/20, n/45. Apr 5 Sold merchandise to Rowan University for $45,000 on credit, terms 3/10,n/30. Invoice no. 345. Cost of the merchandise sold is $30,000. Apr 7 Issued check \#210 payable to Cash to establish a petty cash fund in the amount of $300. Apr 9 Purchased additional machinery totaling $5,000 on credit from Great Buy, terms 1/10,n/45, Invoice \#467 dated Apr 9 . Apr 11 Sold merchandise to Rutgers University for $10,000 with terms 2/10, n/45. Invoice no. 346 . Cost of the merchandise sold is $5,000. Apr 13 The cash register's record shows $10,000 at the end of the shift, but the count of cash in the register is $10,025. Cost of the merchandise sold is $8,500. Prepare the journal entry to record the day's cash sales. Apr 15 Rowan University paid the balance due from the sale on Apr 5. Apr 17 Sold merchandise to Rowan University for $16,000, terms 3/10,n/30. Invoice No. 347. Cost of the merchandise sold is $11,000. Apr 18 Roadrunner Bookstore signed a short-term note payable in the amount of $55,000 with an interest rate of 7% due in 180 days. Apr 21 Issued check #211 to Cengage for the purchase recorded on Apr 3m. Apr 23 Issued check $212 made payable to you, the company accountant, for your salary totaling $4,500. Apr 24 The cash balance in the petty cash drawer is $75. Receipts in the drawer show $80 for Postage Expense, $75 for Transportation In, $50 for delivery expenses, and $25 for office supplies expenses. Replenish petty cash using check \# 213 made payable to Cash. Apr 25 Received $4,000 payment from Rutgers University towards the Apr 11 sale. Apr 27 Issued check \#214 made payable to Tina Smith for $10,000 for personal use. Apr 29 Issued check \#215 for $5,000 payable to Hartford Property Management for April Rent. \begin{tabular}{|l|l|c|l|} \hline \multicolumn{4}{|c|}{ Chart of Accounts } \\ \hline \multicolumn{4}{|c|}{ Roadrunner Bookstore } \\ \hline 101 & Cash & 403 & Sales \\ \hline 102 & Petty Cash & 408 & Rental Revenue \\ \hline 106 & Accounts Receivable & 415 & Sales Discounts \\ \hline 109 & Allowance for Doubtful Accounts & 602 & Cost of Goods Sold \\ \hline 119 & Merchandise Inventory & 621 & Salaries Expense \\ \hline 140 & Machinery & 626 & Rent Expense \\ \hline 141 & Accumulated Depreciation - Machinery & 630 & Office Supplies Expense \\ \hline 201 & Accounts Payable & 633 & Depreciation Expense \\ \hline 221 & Salaries Payable & 636 & Postage Expense \\ \hline 231 & Notes Payable & 646 & Delivery Expense \\ \hline 241 & Interest Payable & 656 & Utilities Expense \\ \hline 251 & Unearned Revenue & 659 & Interest Expense \\ \hline 301 & T. Smith, Capital & 661 & Bad Debts Expense \\ \hline 302 & T. Smith, Withdrawals & 686 & Cash Over and Short \\ \hline \end{tabular} \begin{tabular}{|c|c|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Cash Disbursements Laurnal } \\ \hline Dete & Check Na. & \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started