Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO NOT SOLVE PROBLEM 1. IT IS SOLVED HERE: https://www.chegg.com/homework-help/questions-and-answers/2-following-shows-information-government-bond-traded-secondary-market-type-bond-government-q43213276 Need excel solution for #2. 1. [4] The following shows the information of a government

DO NOT SOLVE PROBLEM 1. IT IS SOLVED HERE: https://www.chegg.com/homework-help/questions-and-answers/2-following-shows-information-government-bond-traded-secondary-market-type-bond-government-q43213276

Need excel solution for #2.

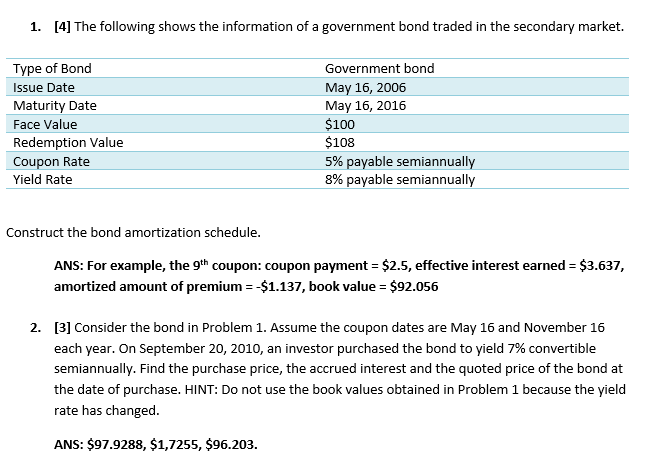

1. [4] The following shows the information of a government bond traded in the secondary market. Type of Bond Issue Date Maturity Date Face Value Redemption Value Coupon Rate Yield Rate Government bond May 16, 2006 May 16, 2016 $100 $108 5% payable semiannually 8% payable semiannually Construct the bond amortization schedule. ANS: For example, the 9th coupon: coupon payment = $2.5, effective interest earned = $3.637, amortized amount of premium =-$1.137, book value = $92.056 2. [3] Consider the bond in Problem 1. Assume the coupon dates are May 16 and November 16 each year. On September 20, 2010, an investor purchased the bond to yield 7% convertible semiannually. Find the purchase price, the accrued interest and the quoted price of the bond at the date of purchase. HINT: Do not use the book values obtained in Problem 1 because the yield rate has changed. ANS: $97.9288, $1,7255, $96.203. 1. [4] The following shows the information of a government bond traded in the secondary market. Type of Bond Issue Date Maturity Date Face Value Redemption Value Coupon Rate Yield Rate Government bond May 16, 2006 May 16, 2016 $100 $108 5% payable semiannually 8% payable semiannually Construct the bond amortization schedule. ANS: For example, the 9th coupon: coupon payment = $2.5, effective interest earned = $3.637, amortized amount of premium =-$1.137, book value = $92.056 2. [3] Consider the bond in Problem 1. Assume the coupon dates are May 16 and November 16 each year. On September 20, 2010, an investor purchased the bond to yield 7% convertible semiannually. Find the purchase price, the accrued interest and the quoted price of the bond at the date of purchase. HINT: Do not use the book values obtained in Problem 1 because the yield rate has changed. ANS: $97.9288, $1,7255, $96.203Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started