Answered step by step

Verified Expert Solution

Question

1 Approved Answer

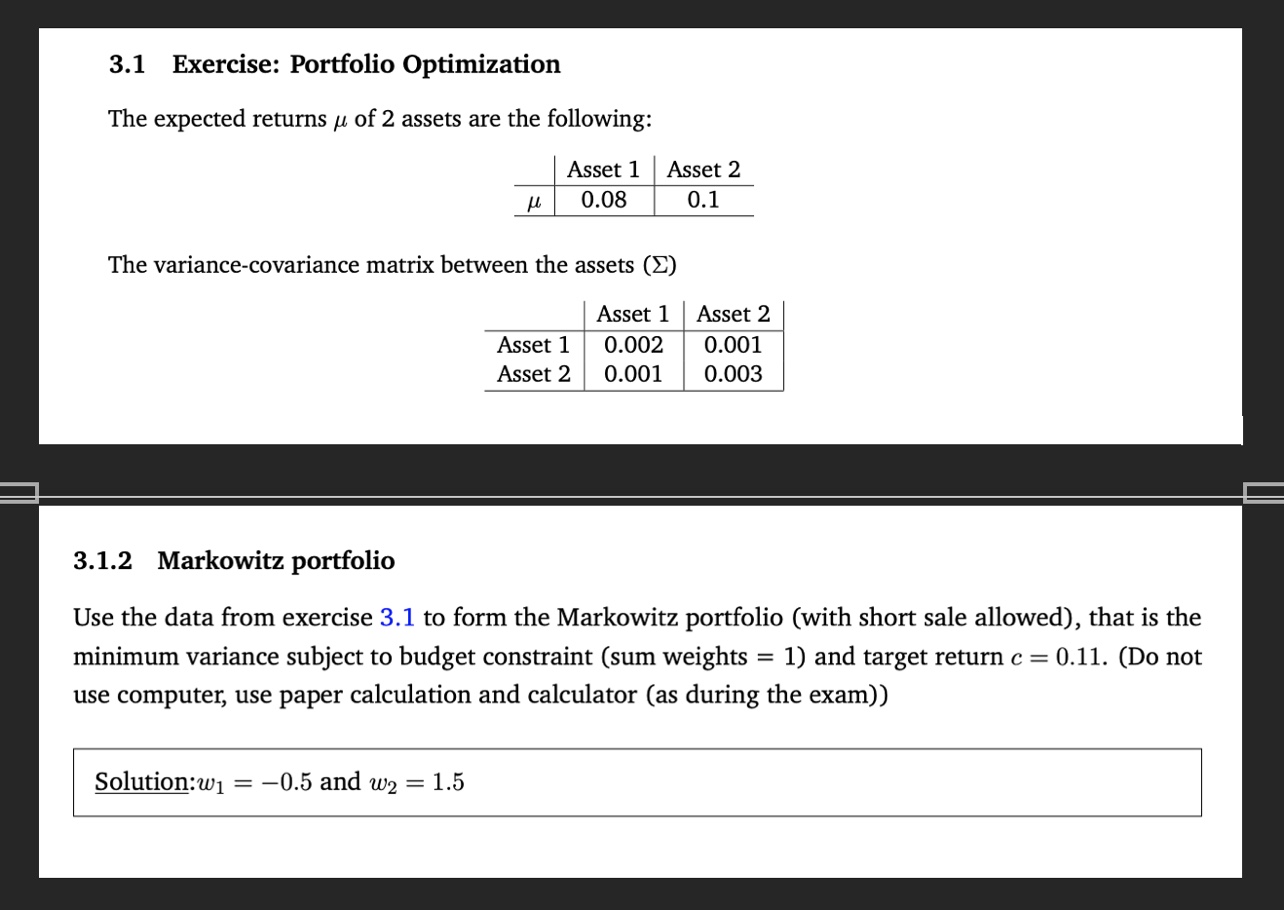

DO NOT use code 3.1 Exercise: Portfolio Optimization The expected returns of 2 assets are the following: The variance-covariance matrix between the assets () 3.1.2

DO NOT use code

3.1 Exercise: Portfolio Optimization The expected returns of 2 assets are the following: The variance-covariance matrix between the assets () 3.1.2 Markowitz portfolio Use the data from exercise 3.1 to form the Markowitz portfolio (with short sale allowed), that is the minimum variance subject to budget constraint (sum weights =1 ) and target return c=0.11. (Do not use computer, use paper calculation and calculator (as during the exam))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started