Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do not use exel to compute answer , show all workings and formula Question 2 a) You are considering the following two mutually exclusive projects.

do not use exel to compute answer , show all workings and formula

do not use exel to compute answer , show all workings and formula

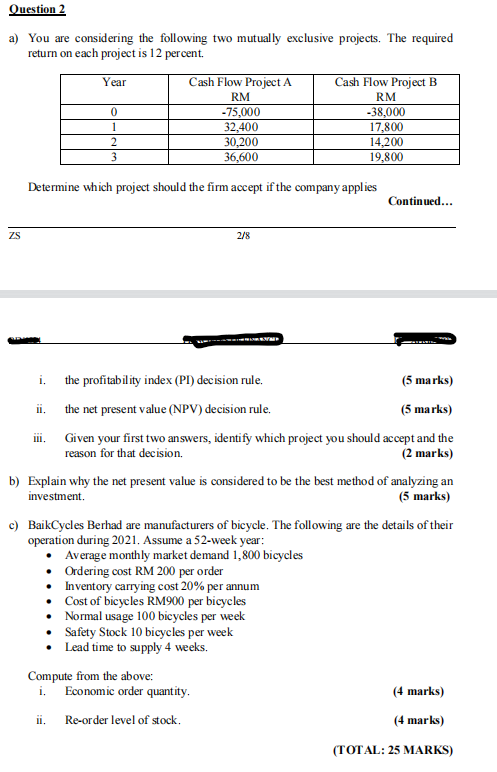

Question 2 a) You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Year 0 1 2 3 Cash Flow Project A RM -75,000 32,400 30,200 36,600 Cash Flow Project B RM -38,000 17,800 14,200 19,800 Determine which project should the firm accept if the company applies Continued... ZS 2/8 i. the profitability index (PT) decision rule. (5 marks) i. the net present value (NPV) decision rule. (5 marks) Given your first two answers, identify which project you should accept and the reason for that decision (2 marks) b) Explain why the net present value is considered to be the best method of analyzing an investment (5 marks) c) BaikCycles Berhad are manufacturers of bicycle. The following are the details of their operation during 2021. Assume a 52-week year: Average monthly market demand 1,800 bicycles Ordering cost RM 200 per order Inventory carrying cost 20% per annum Cost of bicycles RM900 per bicycles Normal usage 100 bicycles per week Safety Stock 10 bicycles per week Lead time to supply 4 weeks. Compute from the above: i. Economic order quantity, (4 marks) ii. Re-order level of stock, (4 marks) (TOTAL: 25 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started